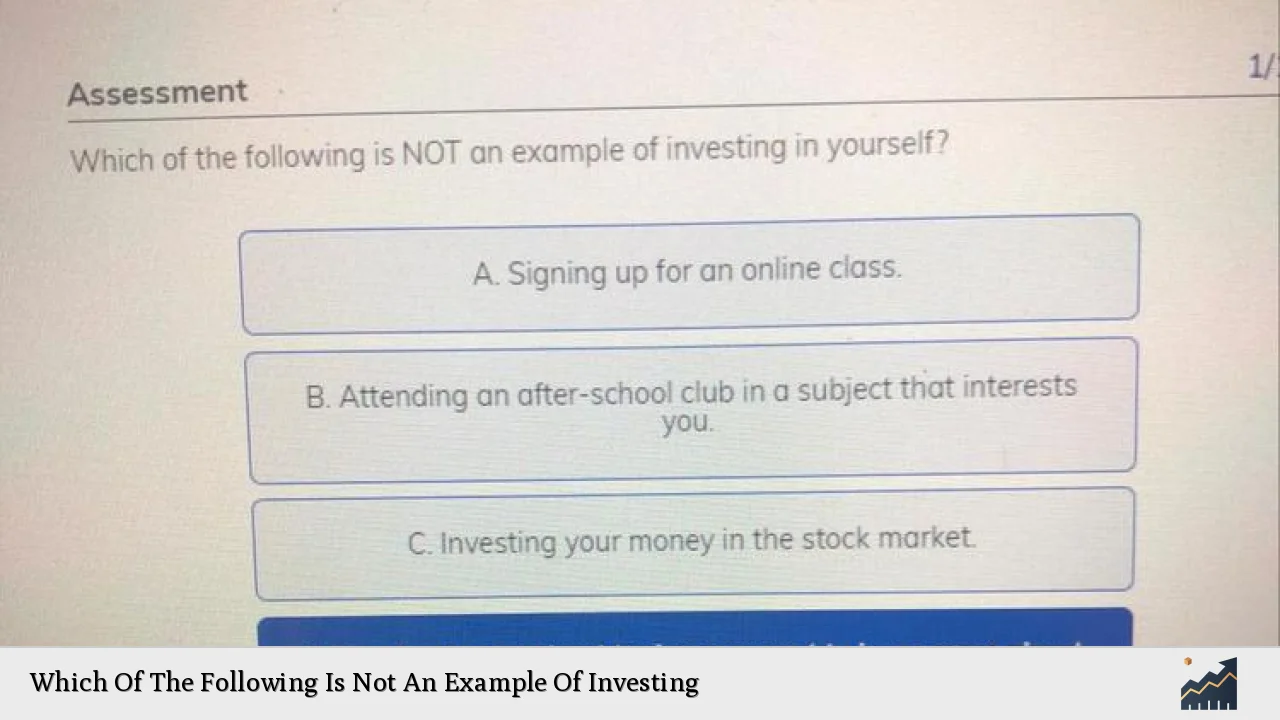

Investing is a critical aspect of personal finance that involves allocating resources, usually money, in order to generate an income or profit. However, not all financial activities qualify as investing. Understanding the distinctions between saving, investing, and other financial actions is essential for individual investors and finance professionals alike. This article explores the nuances of investing, identifies common misconceptions, and clarifies which activities do not constitute investment.

| Key Concept | Description/Impact |

|---|---|

| Direct Investment | Involves purchasing assets directly, such as stocks or real estate, with the expectation of generating returns. |

| Indirect Investment | Involves investing through intermediaries like mutual funds or ETFs, where the investor does not directly manage the assets. |

| Savings Deposits | Placing money in a savings account is a form of saving rather than investing, as it typically generates lower returns with minimal risk. |

| Speculative Activities | Engaging in high-risk trades or gambling does not constitute investing as it lacks a structured approach to generating returns. |

| Insurance Policies | While they can accumulate cash value, life insurance is primarily a risk management tool rather than an investment vehicle. |

Market Analysis and Trends

The current investment landscape is shaped by several key trends that individual investors should be aware of:

- Rise of Technology Stocks: As of mid-2024, technology companies have dominated market performance, particularly those involved in artificial intelligence (AI). The global equity market reached an all-time high of $78.4 trillion, with technology stocks significantly contributing to this growth.

- IPO Market Dynamics: The initial public offering (IPO) market has seen fluctuations, with a notable decline in activity in early 2024 compared to previous years. Companies are increasingly cautious about going public amidst economic uncertainties.

- Private Equity Growth: Despite challenges, private equity markets have shown resilience with an estimated value of $8.7 trillion at the end of 2023. This sector continues to attract investment but faces pressure from rising interest rates and economic volatility.

These trends indicate that while certain sectors are thriving, others are experiencing significant challenges. Investors must adapt their strategies accordingly.

Implementation Strategies

To effectively navigate the investment landscape, consider the following strategies:

- Diversification: Spread investments across various asset classes (stocks, bonds, real estate) to mitigate risks associated with market volatility.

- Long-term Focus: Adopt a long-term perspective when investing. Short-term market fluctuations should not deter investors from their overall goals.

- Regular Contributions: Utilize dollar-cost averaging by making regular contributions to investment accounts regardless of market conditions. This strategy can reduce the impact of volatility.

- Research and Education: Stay informed about market trends and investment opportunities through continuous education and analysis of financial reports.

Risk Considerations

Investing inherently involves risks that must be managed effectively:

- Market Risk: The potential for loss due to fluctuations in market prices. Diversification can help mitigate this risk.

- Credit Risk: The risk that a bond issuer will default on payments. Investors should assess the creditworthiness of issuers before purchasing bonds.

- Inflation Risk: The risk that inflation will erode purchasing power over time. Investments in assets that historically outpace inflation (like equities) may be beneficial.

- Liquidity Risk: The risk of being unable to sell an investment quickly without incurring significant losses. Consider liquidity needs when selecting investments.

Regulatory Aspects

Understanding regulatory frameworks is crucial for compliance and informed decision-making:

- Securities and Exchange Commission (SEC): The SEC oversees securities transactions and protects investors against fraudulent practices. Compliance with SEC regulations is essential for investment firms.

- Investment Advisers Act: This act requires investment advisers to register with the SEC or state regulators and adhere to fiduciary standards when managing client assets.

- Dodd-Frank Act: Implemented post-financial crisis, this act enhances regulation of financial markets and aims to reduce systemic risks within the banking system.

Staying updated on regulatory changes can help investors avoid penalties and ensure their strategies align with legal requirements.

Future Outlook

Looking ahead, several factors will shape the investment landscape:

- Technological Advancements: Innovations in fintech will continue to transform how individuals invest. Technologies such as robo-advisors and AI-driven analytics are making investing more accessible.

- Sustainable Investing: There is a growing trend towards environmental, social, and governance (ESG) investing as investors seek to align their portfolios with their values while pursuing returns.

- Global Economic Conditions: Ongoing geopolitical tensions and economic policies will influence market dynamics. Investors should remain vigilant about international developments that could impact their portfolios.

By understanding these factors, investors can make informed decisions that align with their financial goals.

Frequently Asked Questions About Which Of The Following Is Not An Example Of Investing

- What activities are considered saving instead of investing?

Savings accounts, certificates of deposit (CDs), and keeping cash under a mattress are examples of saving rather than investing. - Is buying life insurance considered an investment?

No, life insurance primarily serves as a risk management tool rather than an investment vehicle. - Can you provide examples of indirect investments?

Indirect investments include purchasing shares in mutual funds or exchange-traded funds (ETFs), where the investor does not directly manage the underlying assets. - What is the difference between direct and indirect investments?

Direct investments involve purchasing assets directly (e.g., stocks), while indirect investments involve using intermediaries (e.g., mutual funds). - Why is it important to differentiate between saving and investing?

Differentiating helps individuals allocate their resources effectively based on their financial goals and risk tolerance. - What role does diversification play in investing?

Diversification reduces risk by spreading investments across various asset classes, minimizing the impact of poor performance in any single investment. - How can I stay compliant with investment regulations?

Regularly review regulatory updates from bodies like the SEC and consult with financial advisors to ensure compliance with applicable laws. - What should I consider when choosing investments?

Consider your financial goals, risk tolerance, time horizon, and market conditions when selecting investments.

This comprehensive analysis clarifies what constitutes investing versus other financial activities. By understanding these distinctions and staying informed about market trends and regulations, individual investors can make more educated decisions that align with their financial objectives.