Diversification is a fundamental principle in investment strategy, aimed at reducing risk while maximizing potential returns. It involves spreading investments across various asset classes, sectors, and geographic regions to mitigate the impact of poor performance in any single investment. In this analysis, we will explore different investment plans, evaluate their levels of diversification, and provide insights into current market trends that influence these strategies.

| Key Concept | Description/Impact |

|---|---|

| Asset Allocation | Allocating investments among different asset classes (stocks, bonds, real estate) to balance risk and return. |

| Sector Diversification | Investing in various sectors (technology, healthcare, energy) to reduce exposure to sector-specific risks. |

| Geographic Diversification | Diversifying investments across different countries and regions to mitigate country-specific risks and currency fluctuations. |

| Time Horizon Diversification | Adjusting investment strategies based on the investor’s time frame (short-term vs. long-term) to optimize returns. |

| Risk Tolerance Consideration | Aligning investment choices with the investor’s risk appetite to ensure comfort with potential losses. |

Market Analysis and Trends

The investment landscape is continually evolving, influenced by economic indicators, market sentiments, and global events. As of late 2024, several key trends have emerged:

- Interest Rates: Rising interest rates have prompted investors to reassess their portfolios. Fixed-income investments are becoming more attractive as yields increase, leading many to diversify into bonds and other fixed-income securities.

- Inflation Concerns: Persistent inflation has led investors to seek assets that can provide a hedge against inflation, such as commodities and real estate. Real Estate Investment Trusts (REITs) have gained popularity for their potential to offer both income and capital appreciation.

- Technological Innovations: Sectors such as technology and healthcare are experiencing rapid growth due to advancements in artificial intelligence and biotechnology. Investors are increasingly looking to diversify into these high-growth areas while balancing their portfolios with more stable investments.

- Global Economic Shifts: Geopolitical tensions and economic shifts are prompting investors to consider geographic diversification more seriously. Investing in emerging markets can provide growth opportunities that are less correlated with developed markets.

Implementation Strategies

To achieve a well-diversified portfolio, investors can adopt several strategies:

- Asset-Class Diversification: This involves spreading investments across various asset classes such as stocks, bonds, real estate, and cash equivalents. For instance, a balanced portfolio might include 60% equities (both domestic and international), 30% bonds, and 10% cash or cash equivalents.

- Sector Diversification: Investors should allocate funds across different sectors of the economy. For example:

- Technology

- Healthcare

- Consumer Goods

- Financial Services

- Geographic Diversification: By investing in both domestic and international markets, investors can reduce exposure to local economic downturns. This can be achieved through mutual funds or ETFs that focus on international markets.

- Utilizing Mutual Funds or ETFs: These investment vehicles inherently provide diversification by pooling money from multiple investors to purchase a broad range of securities. This allows individual investors access to diversified portfolios without needing substantial capital.

Risk Considerations

While diversification is a powerful tool for risk management, it is not without its challenges:

- Over-Diversification: Holding too many investments can dilute returns and complicate portfolio management. Investors should aim for a balance that allows for adequate diversification without excess complexity.

- Correlation of Assets: During market downturns, many asset classes may become highly correlated. For example, during the COVID-19 pandemic, both stocks and bonds experienced significant declines simultaneously.

- Market Volatility: Investors must remain aware that while diversification can reduce risk, it does not eliminate it entirely. Market conditions can change rapidly, impacting diversified portfolios unexpectedly.

Regulatory Aspects

Investors should be aware of regulatory frameworks that govern investment practices:

- Securities Regulations: Regulatory bodies like the SEC impose rules designed to protect investors from fraud while ensuring transparency in financial markets.

- Tax Implications: Different investment vehicles have varying tax implications which can affect overall returns. Understanding capital gains taxes on stocks versus interest income from bonds is crucial for effective portfolio management.

Future Outlook

Looking ahead into 2025 and beyond:

- Continued Importance of Diversification: As market conditions evolve with technological advancements and geopolitical shifts, maintaining a diversified portfolio will remain critical for managing risk while seeking growth opportunities.

- Emerging Asset Classes: Investors may increasingly look towards alternative investments such as private equity or cryptocurrency as part of their diversification strategy.

- Sustainable Investing Trends: There is a growing emphasis on Environmental, Social, and Governance (ESG) criteria in investment decisions. This trend is likely to influence how portfolios are constructed moving forward.

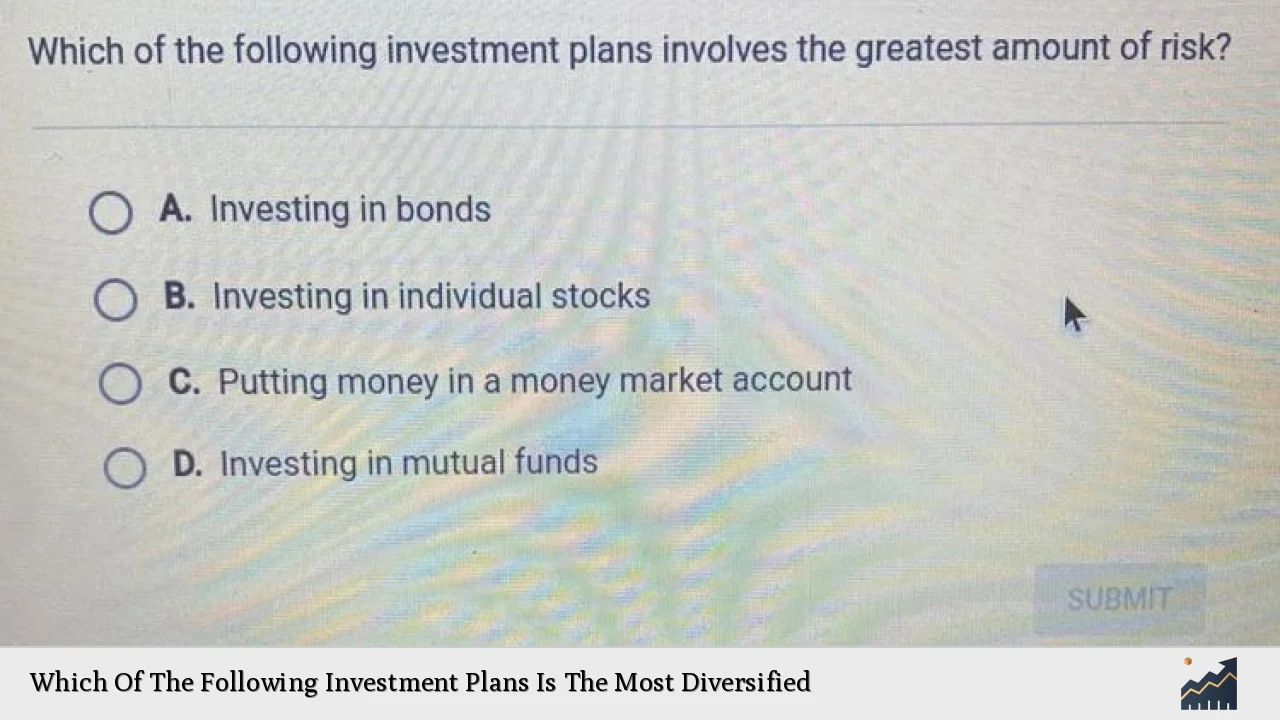

Frequently Asked Questions About Which Of The Following Investment Plans Is The Most Diversified

- What is diversification?

Diversification is the practice of spreading investments across various asset classes and sectors to reduce risk. - Which investment plan is considered most diversified?

An investment plan that includes a mix of stocks, bonds, mutual funds, real estate, and possibly commodities would be considered highly diversified. - How does geographic diversification work?

Geographic diversification involves investing in different countries or regions to mitigate risks associated with local economic downturns. - Can mutual funds provide adequate diversification?

Yes, mutual funds typically invest in a wide range of securities which inherently provides diversification. - What are the risks associated with over-diversification?

Over-diversification can lead to diluted returns and increased complexity in managing your portfolio. - How often should I rebalance my diversified portfolio?

It’s recommended to review your portfolio at least annually or after significant market movements to ensure it aligns with your investment goals. - What role do alternative investments play in diversification?

Alternative investments can provide uncorrelated returns compared to traditional asset classes like stocks and bonds, enhancing overall portfolio diversification. - Is there a perfect level of diversification?

No single level of diversification fits all; it depends on individual risk tolerance and investment goals.

In conclusion, understanding which investment plans offer the most diversification requires careful consideration of various factors including asset allocation strategies, current market trends, regulatory environments, and individual investor goals. By adopting a comprehensive approach that encompasses these elements, investors can better position themselves for long-term success while managing risk effectively.