Investors often seek to minimize risk while still aiming for reasonable returns. Understanding which investment choices carry the least risk is crucial for developing a sound investment strategy. This article explores various investment options, analyzing their risk levels, potential returns, and suitability for different investor profiles.

| Key Concept | Description/Impact |

|---|---|

| Cash Equivalents | Includes money market funds and Treasury bills; these are the safest investments, offering low returns but high liquidity and principal protection. |

| Bonds | Generally considered lower risk than stocks; government bonds are the safest, while corporate bonds carry more risk depending on the issuer’s creditworthiness. |

| High-Yield Savings Accounts | Safe and liquid, these accounts offer modest interest rates and are FDIC insured up to $250,000, making them a secure choice for cash preservation. |

| Certificates of Deposit (CDs) | Offer higher interest rates than savings accounts but require locking in funds for a set period; insured by the FDIC, making them low-risk. |

| Mutual Funds and ETFs | Diversification reduces risk; however, the level of risk varies based on the underlying assets. Bond funds typically carry lower risk than stock funds. |

| Real Estate Investment Trusts (REITs) | Provide exposure to real estate markets with moderate risk; they offer dividends but can be affected by market fluctuations and property values. |

Market Analysis and Trends

The investment landscape has evolved significantly due to various economic factors, including interest rate changes, inflation trends, and geopolitical events. As of 2024, several key trends are influencing low-risk investment choices:

- Interest Rates: With central banks maintaining higher interest rates to combat inflation, cash equivalents like Treasury bills and high-yield savings accounts have become more attractive. Investors are seeking safe havens that provide liquidity without significant capital loss.

- Inflation Protection: Investments such as Treasury Inflation-Protected Securities (TIPS) have gained popularity as they adjust with inflation, ensuring that investors do not lose purchasing power over time.

- Market Volatility: The current geopolitical climate has led to increased market volatility. Consequently, investors are gravitating towards safer asset classes that can withstand economic shocks.

- Diversification Strategies: Investors are increasingly aware of the importance of diversification in reducing portfolio risk. Mutual funds and ETFs that focus on bonds or stable sectors are being favored for their ability to spread risk across multiple assets.

Implementation Strategies

To effectively implement a low-risk investment strategy, consider the following approaches:

- Asset Allocation: Determine an appropriate mix of cash equivalents, bonds, and other low-risk investments based on your financial goals and risk tolerance. A typical conservative portfolio might consist of 50% cash equivalents, 30% bonds, and 20% equities.

- Regular Monitoring: Keep track of market conditions and adjust your portfolio as necessary. Economic indicators such as inflation rates and interest rates should inform your decisions on when to shift assets.

- Utilizing Professional Advice: Engaging with financial advisors can provide personalized strategies tailored to individual circumstances. Advisors can help navigate complex markets and identify suitable low-risk options.

- Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount into low-risk assets over time. It helps mitigate the impact of market volatility by averaging out purchase prices.

Risk Considerations

While low-risk investments generally offer stability, they are not without their own risks:

- Inflation Risk: Cash equivalents may not keep pace with inflation over time, eroding purchasing power. This is a significant concern for conservative investors relying solely on these assets.

- Interest Rate Risk: Bonds are sensitive to interest rate changes; when rates rise, bond prices typically fall. Therefore, investing in longer-term bonds can expose investors to greater volatility.

- Liquidity Risk: Some low-risk investments like CDs may impose penalties for early withdrawal. Understanding the terms before investing is crucial to avoid unexpected costs.

- Credit Risk: Corporate bonds carry varying degrees of credit risk based on the issuer’s financial health. Investing in high-quality bonds or diversified bond funds can mitigate this risk.

Regulatory Aspects

Understanding regulatory frameworks is essential for any investor:

- Securities Regulation: Investments such as stocks and bonds are regulated by bodies like the SEC in the United States. Compliance with these regulations ensures investor protection against fraud.

- Insurance Protections: Many low-risk investments come with insurance protections (e.g., FDIC insurance for savings accounts and CDs) that safeguard against bank failures.

- Tax Implications: Different investment types have varying tax treatments. For example, municipal bonds may offer tax-exempt interest income, making them attractive for investors in higher tax brackets.

Future Outlook

The future of low-risk investments will likely be shaped by ongoing economic developments:

- Continued Interest Rate Adjustments: As central banks respond to inflationary pressures, interest rates may fluctuate significantly in the coming years. This will impact bond yields and cash equivalent returns.

- Geopolitical Stability: Global events will continue to influence market conditions. Investors may need to remain agile in their strategies to adapt to sudden changes in geopolitical landscapes.

- Technological Advancements: The rise of fintech platforms is making it easier for individual investors to access low-cost investment options such as robo-advisors that can create diversified portfolios tailored to specific risk tolerances.

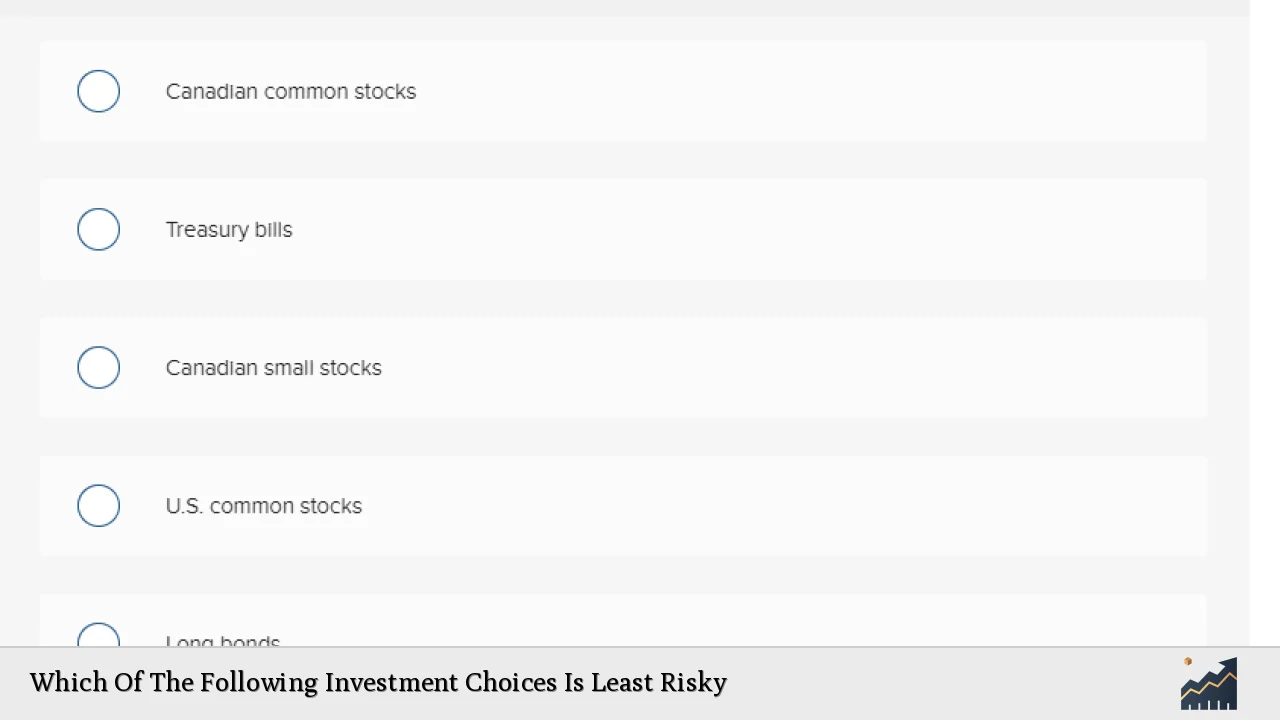

Frequently Asked Questions About Which Of The Following Investment Choices Is Least Risky

- What is the safest type of investment?

The safest types of investments include cash equivalents like money market funds and U.S. Treasury securities due to their stability and government backing. - Are bonds considered a safe investment?

Bonds generally carry lower risk compared to stocks; government bonds are particularly safe while corporate bonds vary in risk based on issuer creditworthiness. - How does inflation affect my investments?

Inflation can erode purchasing power; thus, investments like TIPS or real estate may be better suited for protecting against inflation compared to cash equivalents. - What role does diversification play in reducing investment risk?

Diversification spreads out exposure across different asset classes or sectors, which can reduce overall portfolio volatility and potential losses. - Can I lose money in a high-yield savings account?

No, high-yield savings accounts are typically insured by the FDIC up to certain limits; however, inflation may reduce your real returns. - What should I consider before investing in CDs?

Consider interest rates and penalties for early withdrawal; CDs lock your funds for a specified term which could be disadvantageous if rates rise. - Is real estate a low-risk investment?

Real estate can provide moderate returns with some risks related to market fluctuations; REITs offer a way to invest with lower capital but still carry market risks. - How often should I review my investment portfolio?

A regular review at least annually or during significant market changes is advisable to ensure your portfolio aligns with your financial goals and risk tolerance.

In conclusion, understanding which investment choices are least risky involves evaluating various options based on individual circumstances and market conditions. By focusing on cash equivalents, government bonds, high-yield savings accounts, and diversified portfolios, investors can create strategies that align with their financial goals while minimizing exposure to potential losses.