Short-term investments are financial instruments designed to provide liquidity, safety, and modest returns over a brief period, typically less than three years. These investments play a crucial role in cash management strategies for both individuals and corporations. While the Brainly platform often discusses various investment options, it’s essential to understand the broader context of short-term investments in today’s financial landscape.

| Key Concept | Description/Impact |

|---|---|

| Liquidity | High accessibility to funds with minimal value impact |

| Risk Level | Generally low, prioritizing capital preservation |

| Time Horizon | Typically less than 3 years, often 3-12 months |

| Return Potential | Lower than long-term investments, but higher than holding cash |

Market Analysis and Trends

The short-term investment landscape has undergone significant changes in recent years, particularly in response to global economic shifts and monetary policies. As of December 2024, several key trends are shaping the market:

Rising Interest Rates: Following a period of near-zero interest rates, central banks worldwide have implemented rate hikes to combat inflation. This has led to increased yields on many short-term investment vehicles, making them more attractive to investors seeking to preserve capital while earning a return.

Technological Integration: The rise of fintech has democratized access to short-term investment options. Mobile apps and online platforms now offer easy access to money market funds, high-yield savings accounts, and even short-term bond ETFs, allowing investors to manage their short-term portfolios with greater efficiency.

ESG Considerations: Even in short-term investments, there’s a growing trend towards considering environmental, social, and governance (ESG) factors. Some money market funds and short-term bond funds now incorporate ESG criteria in their investment selection process.

Cryptocurrency Integration: While not traditionally considered a short-term investment due to volatility, some investors are using stablecoins and crypto savings accounts as alternatives to traditional short-term investments, seeking higher yields in the crypto ecosystem.

Implementation Strategies

Implementing an effective short-term investment strategy requires careful consideration of several factors:

1. Cash Flow Analysis: Before investing, conduct a thorough analysis of your cash flow needs. This will help determine how much liquidity you require and the appropriate time horizon for your investments.

2. Diversification: Even within short-term investments, diversification is crucial. Consider spreading investments across different types of short-term vehicles to balance risk and return.

3. Laddering: For Certificates of Deposit (CDs) and short-term bonds, consider a laddering strategy. This involves purchasing securities with staggered maturity dates, providing regular access to funds while potentially capturing higher yields on longer-term investments.

4. Regular Monitoring: Keep a close eye on interest rates and economic indicators. Short-term investment yields can change rapidly, and being proactive can help maximize returns.

5. Tax Considerations: Be aware of the tax implications of your short-term investments. Some options, like municipal money market funds, may offer tax advantages depending on your situation.

Risk Considerations

While short-term investments are generally considered low-risk, they are not without potential pitfalls:

Inflation Risk: In periods of high inflation, the returns on short-term investments may not keep pace with the rising cost of living, leading to a loss of purchasing power.

Interest Rate Risk: When interest rates rise, the value of existing fixed-rate investments may decline. This is particularly relevant for short-term bond funds.

Credit Risk: Even highly-rated short-term corporate bonds or commercial paper carry some risk of default. Diversification and careful issuer selection are crucial.

Liquidity Risk: Some short-term investments, like CDs, may impose penalties for early withdrawal. Ensure you understand any restrictions on accessing your funds.

Opportunity Cost: While prioritizing safety and liquidity, short-term investments typically offer lower returns compared to longer-term options, potentially leading to missed growth opportunities.

Regulatory Aspects

Short-term investments are subject to various regulations designed to protect investors and maintain market stability:

SEC Regulations: In the United States, the Securities and Exchange Commission (SEC) regulates money market funds, imposing strict requirements on portfolio composition, liquidity, and disclosure.

Basel III Accords: These international banking regulations impact how financial institutions manage their short-term investments, potentially affecting the availability and terms of certain investment products.

FDIC Insurance: Many short-term investment options, such as savings accounts and CDs, are protected by FDIC insurance up to $250,000 per depositor, per insured bank.

MiFID II: In Europe, the Markets in Financial Instruments Directive II (MiFID II) impacts how short-term investment products are marketed and sold to investors.

Future Outlook

The future of short-term investments is likely to be shaped by several emerging trends:

Continued Digitalization: Expect further integration of AI and machine learning in short-term investment management, potentially offering more personalized and efficient investment strategies.

Sustainable Short-Term Options: The growth of ESG investing is likely to extend further into the short-term investment space, with more products aligning with sustainability goals.

Central Bank Digital Currencies (CBDCs): As CBDCs develop, they could introduce new short-term investment opportunities and potentially reshape traditional money market instruments.

Geopolitical Influences: Increasing global tensions and economic uncertainties may drive more investors towards safe-haven short-term investments, potentially impacting yields and availability.

Regulatory Evolution: Expect ongoing regulatory changes, particularly in response to new financial technologies and changing market dynamics.

Frequently Asked Questions About Which Is An Example Of A Short Term Investment Brainly 2

- What are the most common examples of short-term investments?

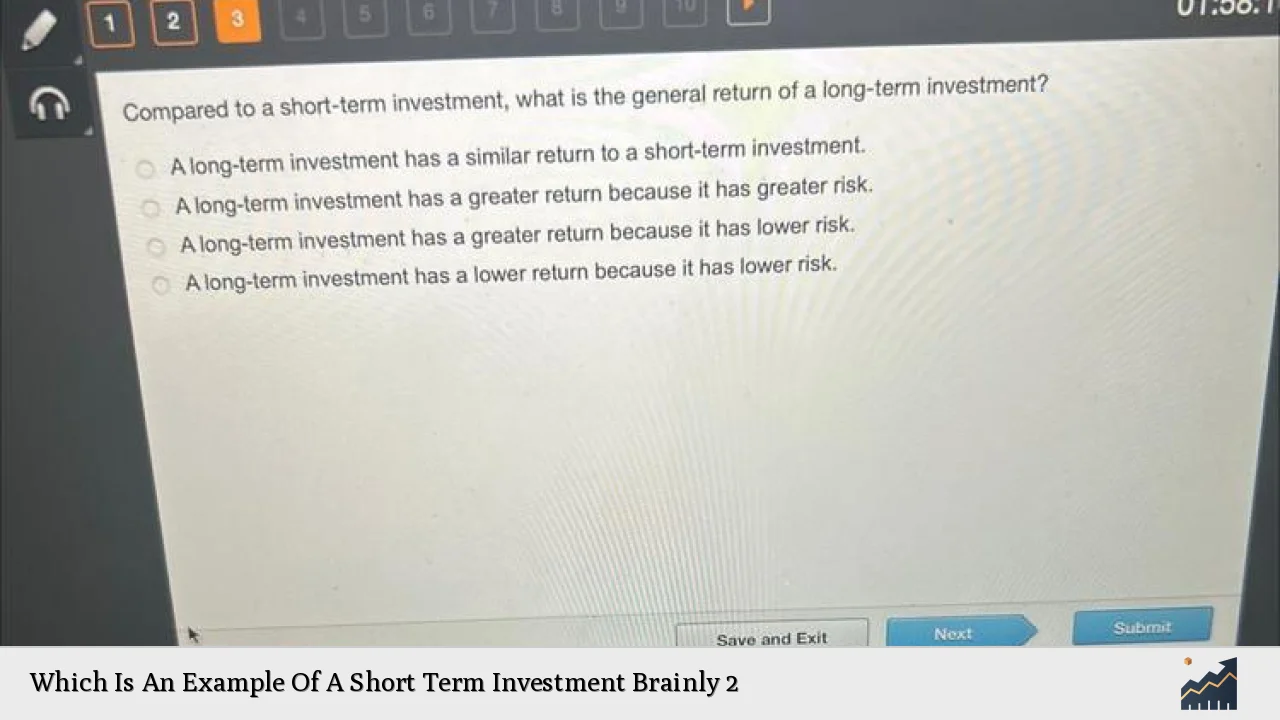

Common short-term investments include high-yield savings accounts, money market accounts, short-term government bonds (T-bills), certificates of deposit (CDs), and short-term corporate bonds. - How do short-term investments differ from long-term investments?

Short-term investments typically have lower risk and lower returns compared to long-term investments. They are more liquid and are held for shorter periods, usually less than three years. - Are short-term investments safe?

While generally considered safer than long-term investments, short-term investments still carry some risk. However, options like FDIC-insured savings accounts and government bonds are among the safest investments available. - What is the typical return on short-term investments?

Returns vary based on the specific investment and market conditions. As of 2024, high-yield savings accounts and short-term government bonds typically offer annual returns ranging from 3% to 5%. - Can cryptocurrencies be considered short-term investments?

While some investors use cryptocurrencies for short-term trading, they are generally not considered traditional short-term investments due to their high volatility and risk. - How do I choose the best short-term investment for my needs?

Consider factors such as your risk tolerance, liquidity needs, investment timeline, and current market conditions. It’s often beneficial to consult with a financial advisor to determine the best strategy for your specific situation. - Are there any tax advantages to short-term investments?

Some short-term investments, like municipal bonds or certain savings accounts, may offer tax advantages. However, gains from short-term investments held for less than a year are typically taxed as ordinary income.