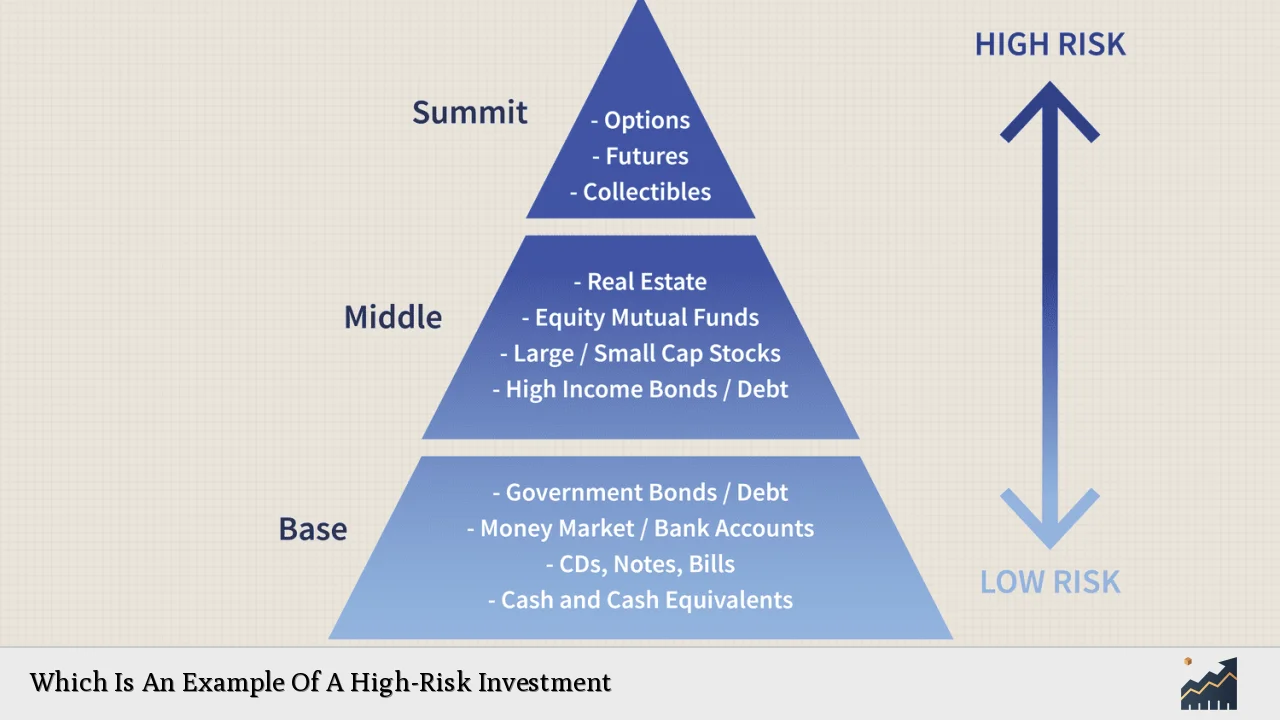

High-risk investments are financial opportunities that carry a significant likelihood of loss or failure, but they also offer the potential for substantial returns. Understanding these investments is crucial for individual investors, finance professionals, and anyone interested in the dynamics of risk and reward in the investment landscape. This article explores various high-risk investment examples, market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Start-Up Company Stocks | Investing in stocks of newly established companies can yield high returns but comes with a high risk of failure due to lack of market history and volatility. |

| Cryptocurrencies | Digital currencies like Bitcoin and Ethereum are known for their extreme price fluctuations and regulatory uncertainties, representing both high risk and potential high reward. |

| Foreign Exchange (Forex) Trading | Forex trading involves buying and selling currencies, which can be highly volatile and risky due to geopolitical events and market sentiment. |

| Venture Capital | Investing in early-stage companies through venture capital can lead to significant gains if the company succeeds but carries a high failure rate. |

| High-Yield Bonds | Bonds rated below investment grade offer higher returns but come with increased default risk, especially in volatile economic conditions. |

| Options Trading | Options allow investors to speculate on price movements within a set timeframe, presenting opportunities for high returns but also significant losses. |

| Real Estate Investment Trusts (REITs) | REITs can provide high dividends but are subject to real estate market fluctuations and economic downturns. |

| Initial Public Offerings (IPOs) | Investing in companies during their IPO can be lucrative but is risky due to the uncertainty surrounding new stock performance. |

Market Analysis and Trends

The landscape for high-risk investments is shaped by various market dynamics, including economic indicators, investor sentiment, and regulatory changes. Recent trends indicate a growing interest in alternative investments such as cryptocurrencies and venture capital, driven by technological advancements and a search for higher yields amid low-interest rates.

- Cryptocurrency Market: The cryptocurrency market has seen explosive growth over the past few years. As of late 2023, Bitcoin’s price fluctuated around $30,000 after reaching highs above $60,000 earlier. This volatility attracts speculative investors seeking quick gains but also poses risks of significant losses.

- Venture Capital: Investment in venture capital reached record levels in 2023, with global funding exceeding $300 billion. Investors are increasingly looking at tech startups in sectors like artificial intelligence and biotechnology as potential high-reward opportunities.

- Forex Trading: The forex market remains one of the largest financial markets globally, with daily trading volumes exceeding $6 trillion. The volatility caused by geopolitical tensions and economic policies continues to attract traders looking for profit opportunities.

Implementation Strategies

Investing in high-risk assets requires careful planning and strategic execution. Here are some effective strategies:

- Diversification: Spread investments across various asset classes to mitigate risks associated with any single investment.

- Due Diligence: Conduct thorough research on investment opportunities. This includes analyzing financial statements, understanding market conditions, and evaluating management teams.

- Risk Management: Implement stop-loss orders to limit potential losses on trades. Setting clear investment goals and exit strategies can help manage risk effectively.

- Investment Horizon: Consider the time frame for holding investments. Longer horizons can allow more time for recovery from volatility.

Risk Considerations

High-risk investments come with inherent uncertainties that investors must be prepared to navigate:

- Market Volatility: Prices of high-risk assets can fluctuate dramatically based on market conditions. Investors should be ready for rapid changes that could affect their portfolios.

- Liquidity Risks: Some high-risk investments may not be easily liquidated without incurring significant losses. Understanding the liquidity profile of an investment is crucial.

- Regulatory Risks: Changes in regulations can impact the viability of certain investments. For instance, stricter regulations on cryptocurrencies could affect their market value.

- Psychological Factors: High-stakes investing can evoke strong emotions such as fear and greed. Maintaining a disciplined approach is essential to avoid impulsive decisions.

Regulatory Aspects

Regulatory bodies play a significant role in overseeing high-risk investments to protect investors from fraud and excessive risk exposure:

- Securities Exchange Commission (SEC): The SEC regulates securities markets in the U.S., ensuring transparency and fairness in trading practices. Recent initiatives have focused on enhancing disclosures related to high-risk investments.

- Financial Conduct Authority (FCA): In the UK, the FCA has implemented rules aimed at improving consumer protection regarding high-risk investments. These include mandatory risk warnings before consumers engage with such products.

- Global Regulations: Different countries have varying regulations governing high-risk investments. Investors should be aware of local laws when considering international opportunities.

Future Outlook

The future of high-risk investing will likely be influenced by several factors:

- Technological Advancements: Innovations such as blockchain technology could reshape how we view traditional investments like stocks and bonds.

- Economic Conditions: Interest rates are expected to remain volatile as central banks navigate inflationary pressures. This environment may lead investors to seek higher returns in riskier assets.

- Investor Education: As more retail investors enter the market, there will be a growing emphasis on education regarding risks associated with high-yield investments. Improved financial literacy can help mitigate some risks associated with these types of investments.

Frequently Asked Questions About Which Is An Example Of A High-Risk Investment

- What qualifies as a high-risk investment?

High-risk investments typically include assets that have a significant chance of loss or failure but offer potentially higher returns. Examples include stocks in start-ups, cryptocurrencies, forex trading, and venture capital. - How do I evaluate the risk of an investment?

To evaluate an investment’s risk, consider its historical performance, market volatility, liquidity issues, regulatory environment, and overall economic conditions. - Can I reduce my exposure to high-risk investments?

Diversifying your portfolio across different asset classes can help mitigate risks associated with any single investment. - What should I know before investing in cryptocurrencies?

Understand the volatility associated with cryptocurrencies, regulatory implications, technological vulnerabilities, and ensure you only invest what you can afford to lose. - Are there regulations protecting investors from high-risk products?

Yes, regulatory bodies like the SEC in the U.S. enforce rules designed to protect investors from fraud and ensure transparency when dealing with high-risk products. - How often should I review my investment portfolio?

Regularly reviewing your portfolio—at least quarterly—can help you make informed decisions based on changing market conditions or personal financial goals. - What are common mistakes made by investors in high-risk markets?

Common mistakes include failing to conduct proper research, allowing emotions to drive decisions, neglecting diversification strategies, and not having clear exit strategies. - Is it advisable for beginners to invest in high-risk assets?

Beginners should approach high-risk investments cautiously; it is advisable to build foundational knowledge first or consult with financial advisors before diving into these markets.

In conclusion, understanding high-risk investments is essential for navigating today’s complex financial landscape. By recognizing potential rewards alongside inherent risks, investors can make informed decisions that align with their financial goals while managing exposure effectively.