Wise, formerly known as TransferWise, is a prominent fintech company specializing in international money transfers and multi-currency accounts. Despite its banking-like functionalities, it is crucial to clarify that Wise is not a bank itself but operates as a Money Services Business (MSB). This distinction is significant when considering which banks Wise collaborates with to provide its services.

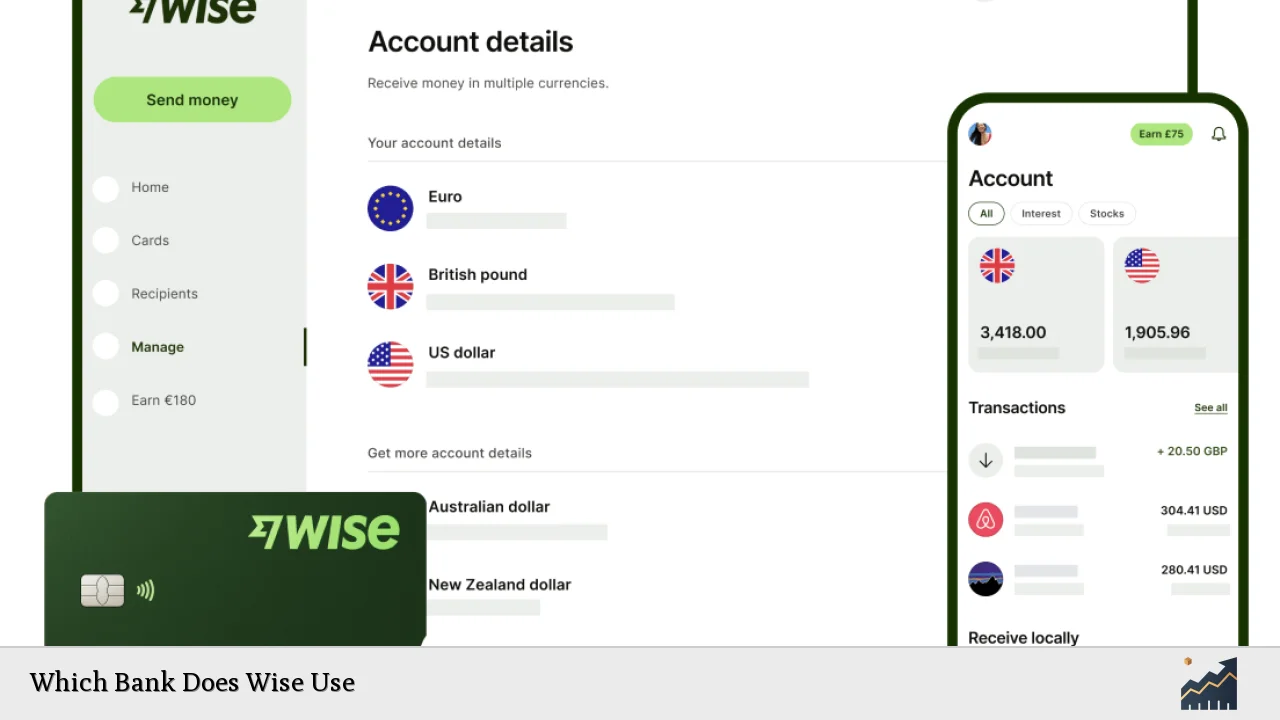

Wise partners with various banks globally to facilitate its operations. These partnerships enable Wise to offer customers features such as local bank details for receiving payments in multiple currencies, competitive exchange rates, and the ability to hold and manage funds across different currencies. The company has established a robust network of over 90 banking partners and holds licenses in multiple jurisdictions, allowing it to operate effectively across borders.

| Key Concept | Description/Impact |

|---|---|

| Partnerships with Banks | Wise collaborates with traditional banks like Bank Mandiri in Indonesia and Nubank in Brazil. These partnerships enhance Wise’s ability to provide efficient cross-border payment solutions. |

| Licensing and Regulation | Wise operates under various regulatory frameworks, holding licenses in 48 U.S. states and other countries, ensuring compliance with local laws. |

| Banking Features | Through partnerships, Wise offers features like local bank account details for receiving payments in different currencies, making it easier for users to conduct international transactions. |

| Security Measures | Wise implements industry-standard security protocols, including two-factor authentication and 24/7 fraud monitoring, ensuring customer funds are protected. |

| Market Positioning | Wise positions itself as a cost-effective alternative to traditional banks for international money transfers, leveraging its technology to provide lower fees and better exchange rates. |

Market Analysis and Trends

The financial technology sector has seen significant growth over the past decade, particularly in cross-border payment solutions. Wise has capitalized on this trend by offering services that cater to both individual consumers and businesses. As of 2024, Wise reported a 29% year-over-year increase in active customers, totaling approximately 12.8 million users. This growth reflects a broader trend where consumers are increasingly seeking alternatives to traditional banking services for international transactions.

Current Market Statistics

- Active Customers: 12.8 million

- Transaction Volume: £118.5 billion processed in FY2024

- Revenue Growth: 24% increase year-over-year

- Customer Funds Held: £18.5 billion

These statistics indicate that Wise is not only growing its customer base but also enhancing the volume of transactions processed through its platform. The company’s focus on transparency and low fees has resonated well with users, further solidifying its market position.

Implementation Strategies

To maintain its competitive edge, Wise employs several strategies:

- Technological Innovation: Continuous investment in technology ensures that Wise can offer faster transaction times and lower fees compared to traditional banks.

- Global Partnerships: Collaborating with banks worldwide allows Wise to expand its reach and offer localized services that meet the needs of diverse markets.

- User-Centric Design: The Wise app is designed for ease of use, enabling customers to manage their finances seamlessly across multiple currencies.

- Regulatory Compliance: By adhering to local regulations and obtaining necessary licenses, Wise builds trust with customers while ensuring operational viability.

Risk Considerations

While Wise presents numerous advantages over traditional banking options, potential risks exist:

- Regulatory Risks: As a non-bank entity operating across multiple jurisdictions, changes in regulations could impact Wise’s ability to operate or expand.

- Market Competition: The fintech space is highly competitive, with numerous players emerging that could challenge Wise’s market share.

- Currency Fluctuations: As an international money transfer service, fluctuations in currency values can affect transaction costs and profitability.

Regulatory Aspects

Wise operates under stringent regulatory frameworks globally. In the U.S., it holds licenses as a money transmitter in all 48 states where it operates. Additionally, it partners with established banks to ensure compliance with local laws regarding financial transactions. This regulatory adherence not only protects consumers but also enhances the credibility of Wise as a financial service provider.

Future Outlook

Looking ahead, Wise aims to continue expanding its services and market presence. The company’s strategic focus includes:

- Enhancing Product Offerings: Introducing new features such as investment options and savings accounts through partnerships with banks like BlackRock will attract more users.

- Expanding Global Reach: Increasing partnerships with banks in emerging markets will allow Wise to tap into new customer bases.

- Sustainability Initiatives: As consumer awareness around sustainability grows, Wise may incorporate environmentally friendly practices into its operations.

The future of Wise appears promising as it continues to innovate and adapt within the rapidly evolving fintech landscape.

Frequently Asked Questions About Which Bank Does Wise Use

- Is Wise a bank?

No, Wise is not a bank; it operates as a Money Services Business (MSB) offering international money transfer services. - Which banks does Wise partner with?

Wise partners with various banks globally, including Bank Mandiri in Indonesia and Nubank in Brazil, among others. - How does Wise ensure my money is safe?

Wise employs industry-standard security measures such as two-factor authentication and continuous fraud monitoring. - Can I earn interest on my funds with Wise?

Yes, through partnerships like the one with BlackRock, customers can earn interest on certain balances held within their accounts. - What currencies can I hold in my Wise account?

Users can hold over 40 currencies in their Wise accounts. - How does Wise compare to traditional banks?

Wise generally offers lower fees and better exchange rates for international transactions compared to traditional banks. - What are the fees associated with using Wise?

Fees vary based on the transaction type but are typically lower than those charged by conventional banks for international transfers. - Is my money insured when using Wise?

Yes, funds held up to $250,000 are insured through partnerships with regulated banking institutions.

This comprehensive analysis highlights how Wise operates within the financial ecosystem through strategic partnerships while addressing the needs of modern consumers seeking efficient international payment solutions.