London continues to be a global hub for investment, attracting both domestic and international investors across various sectors. The city’s diverse economy, robust infrastructure, and cultural richness make it an appealing destination for those looking to invest. This comprehensive guide explores the current market landscape, identifies key investment areas, and discusses strategies for successful investment in London.

| Key Concept | Description/Impact |

|---|---|

| Real Estate | London’s real estate market is robust, with high demand driving rental prices up to an average of £2,121 per month. Areas like Battersea and Richmond are particularly attractive for property investment due to ongoing developments and strong rental yields. |

| Financial Services | London remains Europe’s leading destination for financial services investment, attracting 81 projects in 2023 alone. The sector is bolstered by a strong regulatory framework and a skilled workforce. |

| Tech Sector | The fintech and AI industries are booming in London, with significant investments fueling innovation. The fintech sector alone saw £17.7 billion invested in the first half of 2021. |

| Regeneration Projects | Major regeneration projects across London, such as the Brent Cross Cricklewood Masterplan and the Camden Film Quarter, present unique opportunities for investors looking to capitalize on urban development. |

| Sustainability Initiatives | Investment in low-carbon projects is on the rise, with over US$12 billion earmarked for sustainable developments in London, reflecting a global shift towards environmentally friendly investments. |

Market Analysis and Trends

Current Landscape

The London investment landscape is characterized by a mix of traditional sectors such as real estate and emerging industries like technology and sustainability. The city’s economy is projected to grow steadily, with an emphasis on innovation and infrastructure development.

- Real Estate: London’s real estate market remains resilient despite economic fluctuations. High demand has led to an increase in rental prices, with notable areas for investment including Battersea, Richmond, and Westminster.

- Financial Services: According to recent reports, London attracted 108 financial services projects in 2023, indicating its strong position as a financial center. The UK continues to lead Europe in foreign direct investment (FDI) within this sector.

- Technology: The fintech sector is thriving, supported by a favorable regulatory environment and access to talent. Investment in AI also shows promise, with substantial funding directed towards innovative startups.

Investment Hotspots

Recent analyses have identified several key areas in London that offer promising investment opportunities:

- Battersea: Known for its regeneration efforts and proximity to the Thames, Battersea is becoming increasingly attractive to both residential and commercial investors.

- Richmond: This area benefits from excellent schools and amenities, making it popular among families and young professionals.

- Camden: With its vibrant culture and nightlife, Camden appeals to younger demographics seeking rental properties.

- Brent Cross: The ongoing redevelopment here promises significant growth potential with new homes and retail spaces.

Implementation Strategies

Investment Approaches

Investors should consider various strategies when entering the London market:

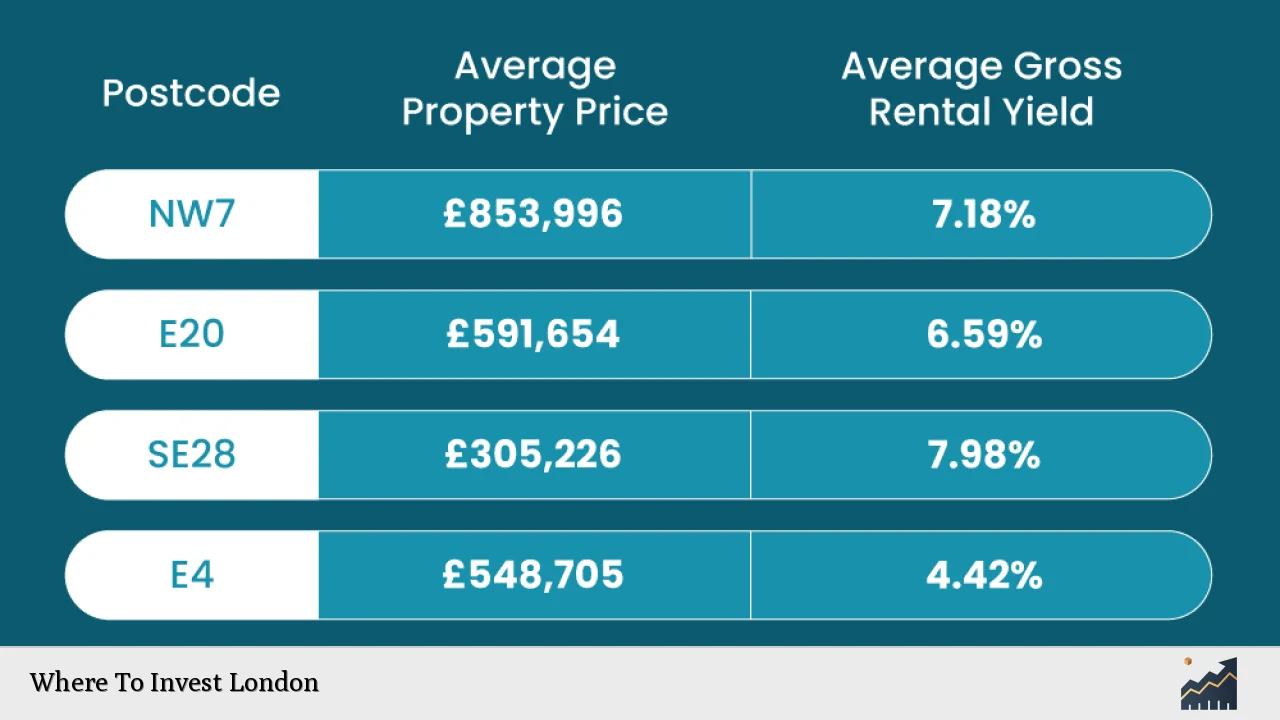

- Buy-to-Let: Purchasing residential properties for rental income remains a popular strategy. Investors should focus on high-demand areas with strong rental yields.

- Commercial Real Estate: Investing in commercial properties can provide stable returns. Areas undergoing redevelopment or gentrification often yield higher returns.

- Equity Investments: For those interested in the tech sector, equity investments in startups or established companies can offer high growth potential.

Diversification

Diversifying investments across different sectors can mitigate risks associated with market volatility. Investors should consider combining real estate investments with equities in technology or sustainable initiatives.

Risk Considerations

Market Volatility

Investors should be aware of potential risks associated with investing in London:

- Economic Uncertainty: Fluctuations in the economy can impact property values and rental income. Investors should remain informed about macroeconomic indicators.

- Regulatory Changes: Changes in government policies regarding taxation or property regulations can affect investment returns. Staying updated on regulatory developments is crucial.

- Geopolitical Risks: The ongoing geopolitical landscape may influence investor confidence. Diversifying investments can help manage these risks effectively.

Regulatory Aspects

Compliance Requirements

Investors must navigate various regulatory frameworks when investing in London:

- Property Regulations: Understanding local property laws, including landlord responsibilities and tenant rights, is essential for real estate investors.

- Financial Regulations: For those investing in financial services or technology sectors, compliance with regulations set by bodies like the Financial Conduct Authority (FCA) is mandatory.

Tax Implications

Investors should consult with tax professionals to understand the implications of property taxes, capital gains taxes, and any changes resulting from government policy shifts.

Future Outlook

Growth Projections

The outlook for investment in London remains positive:

- Sustainable Development: With increasing emphasis on sustainability, investments in low-carbon initiatives are expected to grow significantly over the next decade.

- Technological Innovation: Continued growth in fintech and AI sectors will likely attract further investments as London solidifies its position as a tech hub.

- Urban Regeneration: Ongoing regeneration projects will enhance property values and create new opportunities for investors seeking long-term gains.

Frequently Asked Questions About Where To Invest London

- What are the best areas to invest in London?

Areas like Battersea, Richmond, Camden, and Westminster are currently considered prime locations due to their growth potential and demand. - Is real estate still a good investment in London?

Yes, despite economic fluctuations, London’s real estate market shows resilience with strong rental yields. - What sectors are growing in London?

The fintech and AI sectors are experiencing significant growth alongside sustainable development initiatives. - How can I mitigate risks when investing?

Diversifying your portfolio across different asset classes can help reduce exposure to market volatility. - What regulatory considerations should I be aware of?

Investors must comply with local property laws and financial regulations set by authorities like the FCA. - Are there opportunities for foreign investors?

Yes, London remains attractive for foreign investors due to its stable economy and diverse investment options. - What is the future outlook for London’s economy?

The outlook remains positive with projected growth driven by technological innovation and urban regeneration projects. - How do I start investing in London?

Researching market trends, consulting with financial advisors, and identifying suitable investment opportunities are essential first steps.

In conclusion, London’s dynamic investment landscape offers numerous opportunities across various sectors. By understanding market trends, implementing effective strategies, considering risks carefully, and staying compliant with regulations, investors can position themselves for success in this vibrant city.