Investing $25,000 can be a significant step towards building your financial future. With various options available, it’s essential to understand your goals, risk tolerance, and the potential returns of different investment avenues. This guide will explore several investment strategies suitable for a $25,000 investment, helping you make informed decisions.

| Investment Option | Description |

|---|---|

| High-Yield Savings Account | Low-risk account with higher interest rates than traditional savings. |

| Certificates of Deposit (CDs) | Time-bound deposits with fixed interest rates. |

| Real Estate | Property investment for rental income and appreciation. |

| Index Funds | Funds that track a market index, offering diversification. |

| Exchange-Traded Funds (ETFs) | Marketable securities that track an index, commodity, or basket of assets. |

Understanding Your Investment Goals

Before investing your $25,000, it’s crucial to define your investment goals. Are you looking for short-term gains or long-term growth? Do you need quick access to your funds, or can you afford to lock them away for several years?

Your risk tolerance is another vital factor. If you prefer safer investments with guaranteed returns, options like high-yield savings accounts or CDs may suit you. Conversely, if you are willing to accept higher risks for potentially greater rewards, consider stocks or real estate.

Diversification is key to managing risk. Spreading your investments across various asset classes can help mitigate losses in any single area.

High-Yield Savings Accounts (HYSA)

A high-yield savings account is an excellent option for those prioritizing safety and liquidity. These accounts offer significantly higher interest rates compared to traditional savings accounts—often around 4-5% APY—and are typically FDIC-insured up to $250,000.

- Pros: Low risk, easy access to funds, and interest accrual.

- Cons: Lower returns compared to other investment options.

Using a HYSA allows you to keep your emergency fund intact while earning interest on your savings. This is particularly beneficial if you anticipate needing access to these funds in the near future.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are another low-risk investment option. They require you to lock in your money for a specified period—ranging from a few months to several years—in exchange for a fixed interest rate.

- Pros: Higher interest rates than traditional savings accounts and guaranteed returns.

- Cons: Limited access to funds until maturity; early withdrawal penalties apply.

For example, if you invest $25,000 in a 12-month CD at an interest rate of 3%, you would earn approximately $750 by the end of the term. CDs are ideal for those who can afford to set aside their money for a while without needing immediate access.

Real Estate Investments

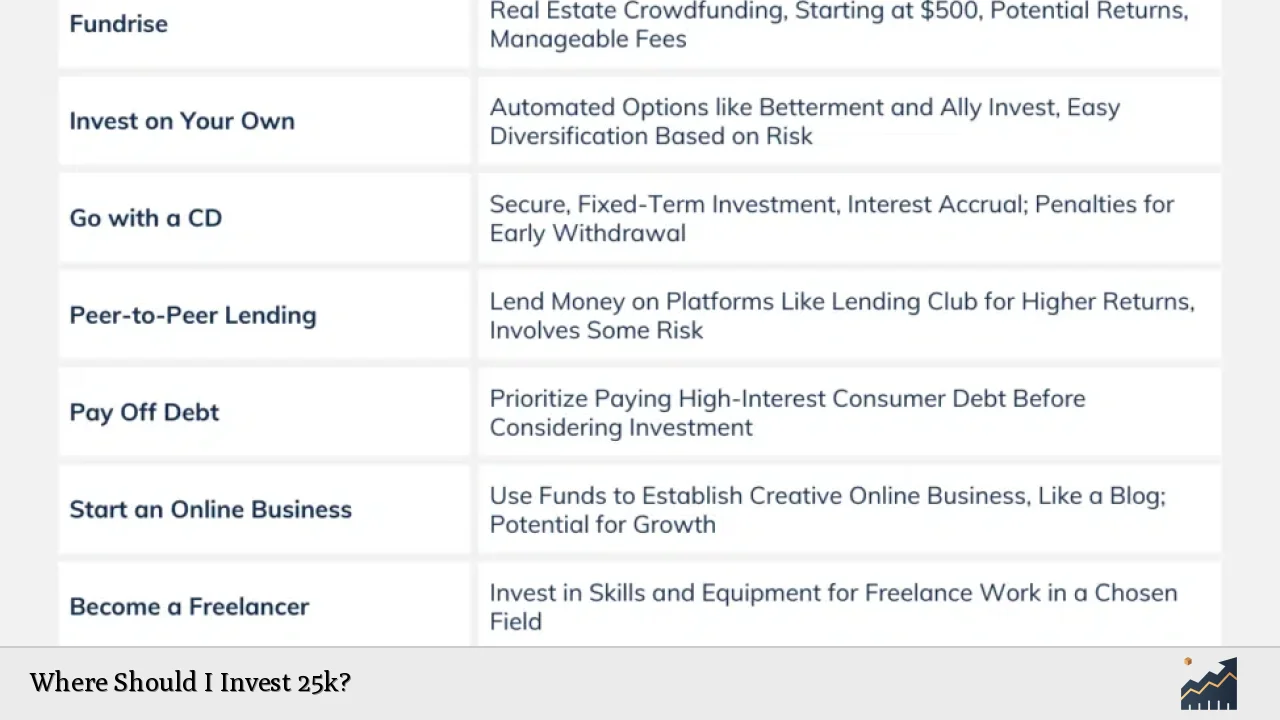

Investing in real estate can be a lucrative option if you’re looking for long-term growth and passive income. With $25,000, you can make a down payment on a rental property or invest in real estate crowdfunding platforms.

- Pros: Potential for significant appreciation and rental income.

- Cons: Illiquidity and the need for ongoing management and maintenance.

Real estate investments often require substantial upfront costs but can yield high returns over time. If you’re considering this route, research local markets and property management options thoroughly.

Index Funds

Index funds are mutual funds or ETFs designed to replicate the performance of a specific index—such as the S&P 500. They offer instant diversification across multiple stocks at a low cost.

- Pros: Low fees and broad market exposure.

- Cons: Market volatility affects performance; not suitable for short-term investing.

Investing in an index fund with your $25,000 allows you to benefit from overall market growth without having to pick individual stocks. This strategy is particularly effective for long-term investors looking to build wealth over time.

Exchange-Traded Funds (ETFs)

Similar to index funds, ETFs are collections of stocks or bonds that trade on stock exchanges. They provide flexibility and ease of trading throughout the day at market prices.

- Pros: Diversification and lower expense ratios compared to mutual funds.

- Cons: Brokerage fees may apply; prices fluctuate throughout the trading day.

With $25,000, you can create a diversified portfolio by investing in multiple ETFs across different sectors or asset classes. This approach helps spread risk while allowing participation in various market segments.

Alternative Investments

If you’re open to exploring non-traditional avenues, consider alternative investments such as peer-to-peer lending, commodities like gold or silver, or even art and collectibles.

- Pros: Potentially high returns and diversification benefits.

- Cons: Higher risk and less liquidity; requires more research and understanding of the market.

Alternative investments can enhance your portfolio’s diversity but come with their own set of risks. Ensure that you conduct thorough research before venturing into these areas.

Paying Off Debt

While it may not seem like an investment in the traditional sense, paying off high-interest debt can yield significant returns by saving on future interest payments. If you have credit card debt or loans with high rates, consider using part of your $25,000 to eliminate these liabilities.

- Pros: Immediate financial relief and improved credit score.

- Cons: Reduces available cash for other investments; opportunity cost if invested elsewhere could yield higher returns.

By prioritizing debt repayment, you effectively earn a “return” equal to the interest rate on that debt—often much higher than what you’d earn through traditional investments.

Creating a Balanced Portfolio

A balanced portfolio is crucial for managing risk while aiming for growth. Here’s how you might allocate your $25,000:

| Investment Type | Allocation (%) |

|---|---|

| High-Yield Savings Account | 20% |

| Certificates of Deposit | 20% |

| Real Estate Investment | 30% |

| Index Funds/ETFs | 30% |

This allocation allows for liquidity through savings accounts while also pursuing growth through real estate and stock market investments. Adjust these percentages based on your risk tolerance and financial goals.

FAQs About Investing $25k

FAQs About Where Should I Invest 25k?

- What is the safest way to invest $25k?

The safest way is typically through high-yield savings accounts or CDs. - Can I invest in stocks with $25k?

Yes, with $25k you can diversify across multiple stocks or invest in index funds. - Is real estate worth investing in with $25k?

Yes, it can be used as a down payment on rental properties or through crowdfunding platforms. - How much should I keep liquid when investing?

A good rule is to keep at least three to six months’ worth of expenses liquid. - What are some alternative investments?

Alternative investments include peer-to-peer lending, commodities like gold, and collectibles.

In conclusion, investing $25k offers numerous opportunities tailored to different financial goals and risk tolerances. Consider diversifying across various asset classes while keeping liquidity needs in mind. Always remember that investing involves risks; therefore, thorough research and possibly consulting with a financial advisor may enhance your decision-making process.