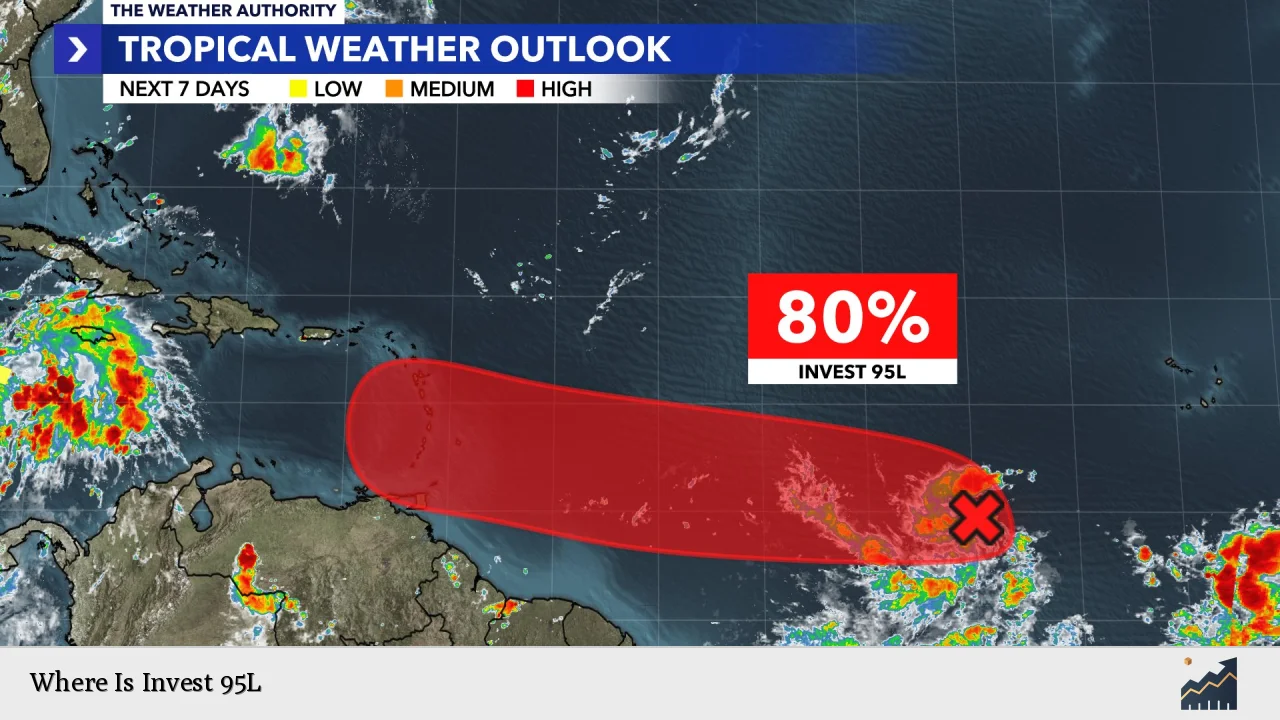

Invest 95L, a tropical disturbance being closely monitored by meteorologists and hurricane specialists, is currently located in the western Caribbean Sea. As of the latest reports, the system is positioned off the coasts of Belize and Honduras, showing signs of potential development. This area of low pressure has been under scrutiny due to its potential to evolve into a more significant tropical system, prompting interest from weather forecasters, emergency management officials, and residents in the affected regions.

| Key Concept | Description/Impact |

|---|---|

| Current Location | Western Caribbean Sea, near the coasts of Belize and Honduras |

| Development Potential | Medium chance (50%) of tropical cyclone formation within 48 hours |

| Expected Movement | Westward towards Central America |

| Primary Threat | Heavy rainfall and potential flooding in Central America |

Market Analysis and Trends

The presence and potential development of Invest 95L have significant implications for various sectors, particularly those sensitive to weather conditions in the Caribbean and Central American regions.

Energy Sector Impact: The oil and gas industry in the Gulf of Mexico region is closely monitoring the system’s progress. While Invest 95L is not currently projected to enter the Gulf, its development could influence energy prices and production schedules. Investors in energy commodities and related stocks should stay informed about the system’s evolution.

Insurance Industry Considerations: Property and casualty insurers with exposure in the potentially affected areas are assessing their risk profiles. The possibility of a tropical system making landfall could lead to increased demand for insurance products and potentially impact claim frequencies.

Agricultural Commodities: Central American countries in the path of Invest 95L are significant producers of coffee, bananas, and other tropical fruits. Heavy rainfall associated with the system could affect crop yields and quality, potentially influencing futures prices for these commodities.

Implementation Strategies

For investors and financial professionals, the presence of Invest 95L necessitates strategic planning and risk management:

- Portfolio Diversification: Ensure investments are spread across various sectors and geographical regions to mitigate potential losses from localized weather events.

- Hedging Strategies: Consider implementing weather derivatives or catastrophe bonds to protect against potential losses in weather-sensitive investments.

- Real-Time Monitoring: Utilize advanced weather tracking tools and financial market data to make informed decisions as the situation evolves.

- Supply Chain Analysis: For businesses with interests in the region, assess and fortify supply chains that could be disrupted by severe weather events.

Risk Considerations

The development of Invest 95L presents several risk factors that investors and businesses should consider:

- Operational Disruptions: Companies with operations in Central America may face temporary shutdowns or logistical challenges.

- Market Volatility: Uncertainty surrounding the system’s development could lead to short-term volatility in affected sectors.

- Currency Fluctuations: Local currencies in potentially impacted countries may experience fluctuations based on the economic implications of the weather system.

- Insurance Claims: A significant weather event could trigger an increase in insurance claims, affecting the profitability of insurers in the region.

Regulatory Aspects

Financial institutions and publicly traded companies operating in areas potentially affected by Invest 95L must adhere to specific regulatory requirements:

- Disclosure Requirements: Public companies may need to disclose potential material impacts of the weather system on their operations in SEC filings.

- Insurance Regulations: Insurers may face regulatory scrutiny regarding their risk management practices and capital adequacy in light of potential weather-related claims.

- Emergency Preparedness: Local regulations may require businesses to have contingency plans in place for severe weather events.

Future Outlook

The future development of Invest 95L remains uncertain, but its potential impact on regional economies and global markets warrants continued attention. Meteorological models suggest the system has a limited window for development before it moves inland over Central America.

Short-term Projections:

- Invest 95L is expected to bring heavy rainfall to parts of Central America, regardless of its tropical cyclone status.

- The system has approximately 24 hours over water before moving inland, limiting its potential for significant strengthening.

Long-term Implications:

- The remnants of Invest 95L could potentially merge with another Pacific disturbance, forming a new system off the coast of Mexico.

- This hurricane season has shown increased activity, aligning with long-term climate trends that suggest potentially more frequent and intense tropical systems in the future.

Investors and financial professionals should remain vigilant and adaptable as the Atlantic hurricane season progresses. The development and tracking of systems like Invest 95L serve as reminders of the interconnectedness of weather events and global markets, underscoring the importance of comprehensive risk management strategies in investment portfolios.

Frequently Asked Questions About Where Is Invest 95L

- What is an “Invest” in meteorological terms?

An “Invest” is a designated area of weather disturbance that has potential for tropical development. It allows for specialized data gathering and model runs to forecast possible formation and movement. - How likely is Invest 95L to develop into a tropical storm?

As of the latest reports, Invest 95L has a medium (50%) chance of developing into a tropical cyclone within the next 48 hours. However, its window for development is limited due to its proximity to land. - What areas are most likely to be affected by Invest 95L?

The system is expected to primarily impact parts of Central America, including Belize, Honduras, and potentially southern Mexico, with heavy rainfall being the main concern. - How does the tracking of systems like Invest 95L impact financial markets?

Tracking these systems can influence commodity prices, insurance stocks, and tourism-related investments in potentially affected regions. It also informs risk management strategies for businesses with operations in these areas. - Are there any long-term investment implications from increased tropical activity?

Increased tropical activity may lead to growing demand for climate-resilient infrastructure, advanced weather forecasting technologies, and specialized insurance products, potentially creating new investment opportunities in these sectors. - How can investors protect their portfolios from weather-related risks?

Investors can protect their portfolios through diversification, using weather derivatives, investing in companies with strong disaster preparedness, and staying informed about climate trends and their potential economic impacts.