Investing is a critical component of personal finance that allows individuals to grow their wealth over time. Whether you’re saving for retirement, a major purchase, or simply looking to increase your net worth, understanding where to invest is essential. The investment landscape is vast, encompassing various asset classes, strategies, and platforms suited to different financial goals and risk appetites.

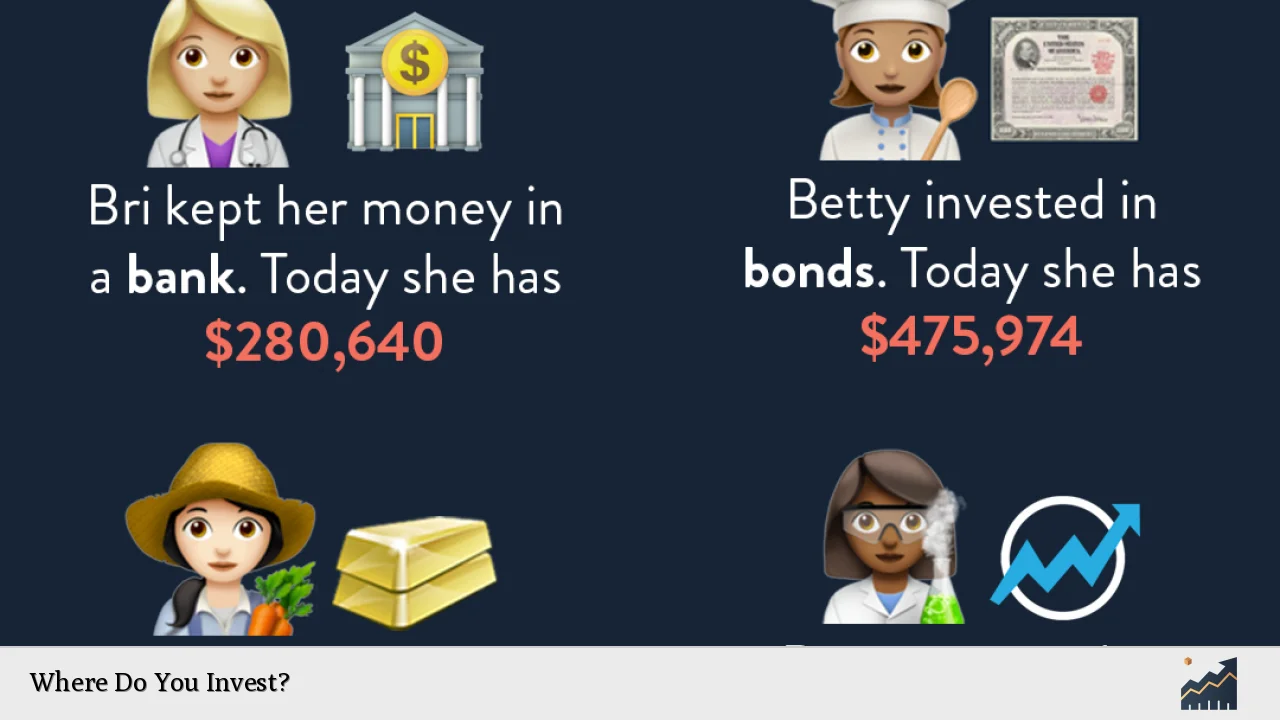

Investors can choose from several avenues including stocks, bonds, mutual funds, real estate, and alternative investments. Each option has its unique characteristics and potential returns. The choice of investment depends on individual financial situations, risk tolerance, and investment objectives.

In this article, we will explore the various types of investments available, the strategies you can employ, and practical steps to get started on your investment journey.

| Investment Type | Description |

|---|---|

| Stocks | Ownership in a company, offering potential for high returns. |

| Bonds | Loans to governments or corporations that pay interest over time. |

| Mutual Funds | Pools of money from multiple investors to buy diversified assets. |

| Real Estate | Property investments that can generate rental income and appreciation. |

| ETFs | Funds that trade on stock exchanges like individual stocks. |

Understanding Different Investment Types

Investing can be categorized into several types based on the asset class. Each type has its own risk profile and potential for returns.

- Stocks: When you buy stocks, you are purchasing a share of ownership in a company. Stocks have the potential for high returns but come with higher volatility. Long-term investors often benefit from capital appreciation and dividends.

- Bonds: Bonds are fixed-income securities where you lend money to an issuer (government or corporation) in exchange for periodic interest payments plus the return of principal at maturity. They are generally considered safer than stocks but offer lower returns.

- Mutual Funds: These are investment vehicles that pool money from many investors to purchase a diversified portfolio of stocks and/or bonds. Mutual funds are managed by professionals, making them a good choice for those who prefer a hands-off approach.

- Real Estate: Investing in real estate involves purchasing property for rental income or capital appreciation. Real estate can provide steady cash flow and tax benefits but requires significant capital and management effort.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks. ETFs typically have lower fees than mutual funds and offer flexibility in trading.

Investment Strategies for Beginners

For those new to investing, having a strategy is crucial. Here are some common strategies that beginners can consider:

- Buy and Hold: This long-term strategy involves purchasing assets and holding onto them regardless of market fluctuations. It requires patience but can yield substantial returns over time.

- Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount of money into an asset regardless of its price. This approach reduces the impact of volatility by averaging out the purchase price over time.

- Index Investing: Instead of picking individual stocks, investors can buy index funds or ETFs that track a specific market index (like the S&P 500). This method provides diversification and reduces risk.

- Value Investing: This strategy focuses on identifying undervalued stocks with strong fundamentals. Investors buy these stocks at a lower price with the expectation that their value will increase over time.

- Growth Investing: Growth investors look for companies expected to grow at an above-average rate compared to their industry or the overall market. These investments may not pay dividends but offer significant capital appreciation potential.

How to Start Investing

To begin your investing journey, follow these practical steps:

1. Set Clear Goals: Determine what you are investing for—retirement, education, wealth accumulation—and set specific financial goals.

2. Establish a Budget: Decide how much money you can afford to invest regularly without affecting your essential expenses.

3. Choose an Investment Account: Open an investment account through a brokerage firm or financial institution. Consider whether you want a standard brokerage account or tax-advantaged accounts like IRAs or TFSAs.

4. Research Investments: Take the time to research different investment options based on your risk tolerance and goals. Understand how each investment works before committing your money.

5. Diversify Your Portfolio: Avoid putting all your eggs in one basket by diversifying across different asset classes and sectors. This strategy helps mitigate risk.

6. Monitor Your Investments: Regularly review your portfolio’s performance and make adjustments as needed based on market conditions or changes in your personal circumstances.

7. Stay Informed: Keep yourself updated with market trends and economic news that may impact your investments.

Risk Management in Investing

Understanding risk is vital when investing. Different investments carry varying levels of risk, which can affect your overall portfolio performance.

- Market Risk: The risk of losing money due to market fluctuations affects all types of investments but is particularly relevant for stocks.

- Credit Risk: This pertains to bonds; if the issuer defaults on payments, investors may lose their principal investment.

- Liquidity Risk: This refers to the difficulty of selling an asset quickly without incurring significant losses. Real estate often has higher liquidity risk compared to stocks or ETFs.

- Interest Rate Risk: Changes in interest rates can affect bond prices inversely; when rates rise, bond prices typically fall.

To manage these risks effectively:

- Diversify across various asset classes.

- Regularly rebalance your portfolio.

- Set stop-loss orders on stocks.

- Invest according to your risk tolerance and time horizon.

FAQs About Where Do You Invest

- What is the best investment for beginners?

Index funds or ETFs are often recommended as they provide diversification with lower fees. - How much money do I need to start investing?

You can start investing with any amount; many platforms allow fractional shares. - Is it better to invest in stocks or bonds?

It depends on your risk tolerance; stocks offer higher potential returns while bonds provide stability. - How often should I review my investments?

You should review your investments at least annually or whenever there’s a significant market change. - What is dollar-cost averaging?

This strategy involves regularly investing a fixed amount regardless of market conditions.

Investing is not just about making money; it’s about building wealth over time through informed decisions and strategic planning. By understanding different investment types, employing effective strategies, and managing risks wisely, anyone can embark on a successful investment journey tailored to their financial goals.