Investing is a crucial aspect of personal finance that allows individuals to grow their wealth over time. With various options available, knowing where to invest can be overwhelming. This guide aims to provide clarity on investment avenues, helping both novice and experienced investors make informed decisions.

Investments can range from traditional stocks and bonds to alternative assets like real estate and cryptocurrencies. Each type of investment comes with its own set of risks and rewards, making it essential for investors to understand their financial goals and risk tolerance before diving in.

The investment landscape is continually evolving, influenced by market trends, economic conditions, and technological advancements. Therefore, staying informed about these changes is vital for making sound investment choices.

| Investment Type | Description |

|---|---|

| Stocks | Ownership in a company, offering potential for high returns. |

| Bonds | Loans to governments or corporations, providing fixed interest payments. |

| Real Estate | Property investments that can generate rental income and appreciation. |

| Cryptocurrencies | Digital currencies that offer high volatility and potential returns. |

Understanding Different Investment Types

Investors have a wide array of options when it comes to choosing where to invest their money. Understanding the characteristics of each investment type is crucial for making informed decisions.

- Stocks: Investing in stocks means purchasing shares of a company. This ownership can lead to capital gains if the company performs well, but it also carries the risk of losses if the company underperforms. Stocks are known for their potential high returns but also come with higher volatility.

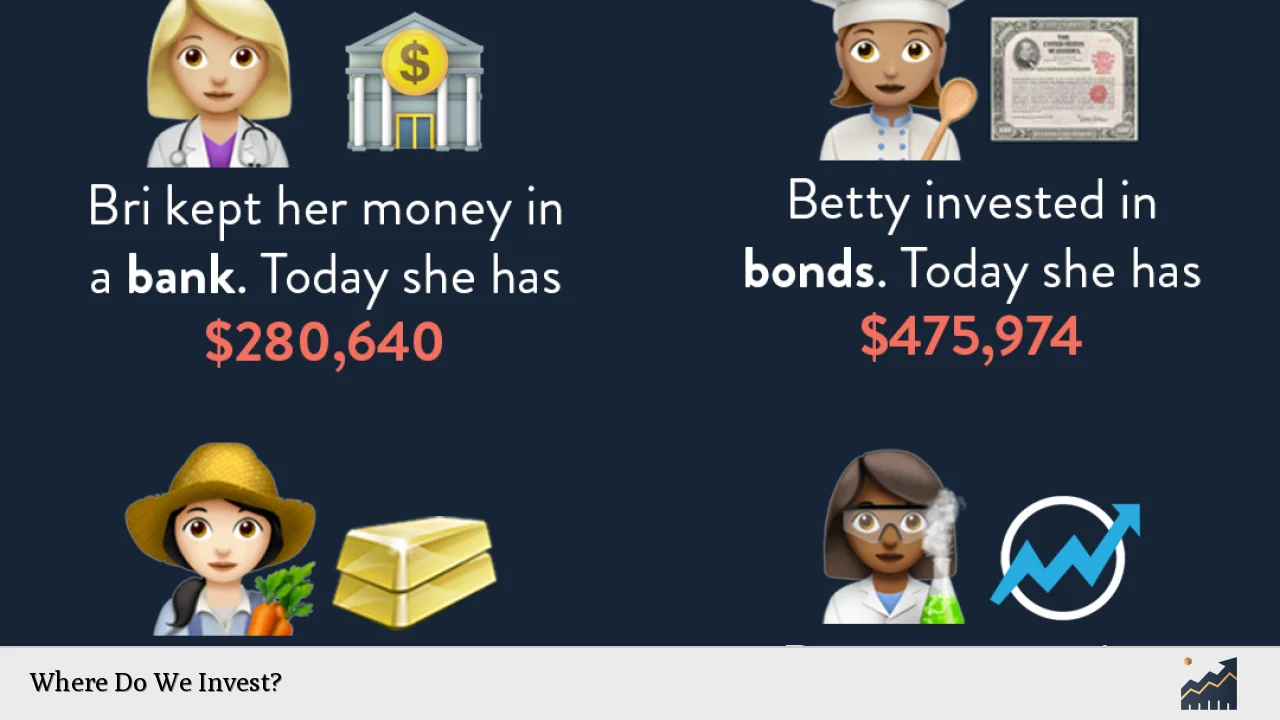

- Bonds: Bonds are a more stable investment compared to stocks. When you buy a bond, you are essentially lending money to the issuer (government or corporation) in exchange for periodic interest payments plus the return of the bond’s face value at maturity. While bonds generally offer lower returns than stocks, they are considered safer and can provide a steady income stream.

- Real Estate: Investing in real estate involves purchasing properties with the expectation that they will appreciate over time or generate rental income. Real estate can be a tangible asset and often serves as a hedge against inflation. However, it requires significant capital upfront and ongoing maintenance costs.

- Cryptocurrencies: Digital currencies like Bitcoin and Ethereum have gained popularity as alternative investments. They are known for their extreme volatility, which can lead to substantial gains or losses. Cryptocurrencies are decentralized and operate on blockchain technology, attracting tech-savvy investors looking for high-risk opportunities.

Understanding these investment types enables investors to align their choices with their financial goals and risk tolerance.

Assessing Your Financial Goals

Before investing, it is essential to assess your financial goals. This assessment will guide your investment strategy and help determine which assets align with your objectives.

- Short-term vs. Long-term Goals: Identify whether your goals are short-term (e.g., saving for a vacation) or long-term (e.g., retirement savings). Short-term investments may prioritize liquidity, while long-term investments can focus on growth potential.

- Risk Tolerance: Understanding your risk tolerance is crucial in selecting appropriate investments. Risk tolerance varies based on factors such as age, financial situation, and investment knowledge. Younger investors may afford to take on more risk due to a longer time horizon for recovery.

- Income Needs: Assess whether you need regular income from your investments or if you can afford to reinvest earnings for growth. Income-focused investments may include dividend-paying stocks or bonds.

By clearly defining your financial goals, you can create an investment strategy tailored to your unique needs.

Diversification Strategies

Diversification is a critical strategy in investing that helps mitigate risk by spreading investments across various asset classes. This approach reduces the impact of poor performance from any single investment on your overall portfolio.

- Asset Allocation: Determine the percentage of your portfolio allocated to different asset classes (stocks, bonds, real estate). A balanced approach often involves investing in both equities for growth and fixed-income securities for stability.

- Geographic Diversification: Consider investing in international markets alongside domestic assets. This strategy can provide exposure to different economies and reduce dependence on local market performance.

- Sector Diversification: Within stock investments, diversify across various sectors (technology, healthcare, finance). This reduces risk associated with sector-specific downturns.

Implementing diversification strategies helps create a more resilient portfolio capable of weathering market fluctuations.

Investment Vehicles

Choosing the right investment vehicle is essential for achieving your financial goals efficiently. Various vehicles cater to different needs and preferences:

- Mutual Funds: These funds pool money from multiple investors to purchase a diversified portfolio of stocks or bonds managed by professionals. They offer diversification but may come with management fees.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks. ETFs typically have lower fees than mutual funds and offer flexibility in trading.

- Retirement Accounts: Accounts such as 401(k)s or IRAs provide tax advantages for retirement savings. Contributions may be tax-deductible, and earnings grow tax-deferred until withdrawal.

- Robo-Advisors: Automated platforms that create and manage investment portfolios based on individual risk profiles and goals. They offer low-cost solutions without requiring extensive investment knowledge.

Selecting the right vehicle depends on factors such as fees, management style, and tax implications.

Staying Informed About Market Trends

Keeping abreast of market trends is vital for successful investing. Changes in economic conditions can significantly impact asset performance:

- Economic Indicators: Monitor indicators such as GDP growth rates, unemployment rates, inflation rates, and consumer confidence indexes. These metrics provide insights into economic health and potential market direction.

- Market Sentiment: Pay attention to investor sentiment reflected in stock market trends or consumer behavior studies. Positive sentiment often drives market growth while negative sentiment can lead to declines.

- Technological Advancements: Stay informed about innovations that could disrupt industries or create new opportunities (e.g., renewable energy technologies). Understanding these trends helps identify potential investment opportunities early.

By staying informed about market trends, investors can make timely decisions that align with evolving economic conditions.

The Role of Professional Advisors

For many investors, working with professional advisors can enhance investment strategies:

- Financial Planning: Advisors help create comprehensive financial plans that encompass budgeting, saving, investing, and retirement planning tailored to individual circumstances.

- Investment Management: Professionals manage portfolios based on established strategies aligned with clients’ goals while providing ongoing monitoring and adjustments as needed.

- Education: Advisors often educate clients about investment options and strategies, empowering them to make informed decisions about their finances.

While professional advice comes at a cost, it can provide valuable insights that enhance overall investment success.

FAQs About Where Do We Invest?

- What are the best types of investments for beginners?

Stocks and ETFs are often recommended due to their potential for growth and ease of access. - How much should I invest initially?

Start with an amount you are comfortable losing; even small amounts can grow over time. - Is it better to invest in individual stocks or mutual funds?

Mutual funds offer diversification while individual stocks may provide higher returns; choose based on your risk tolerance. - What is the importance of diversification?

Diversification reduces risk by spreading investments across different asset classes. - How often should I review my investment portfolio?

Review your portfolio at least annually or after significant life changes or market shifts.

Investing wisely requires knowledge about various asset classes, understanding personal financial goals, employing diversification strategies, selecting suitable vehicles, staying informed about market trends, and considering professional advice when necessary. By following these guidelines, investors can navigate the complex world of investing effectively.