Investing today requires a keen understanding of market trends, economic indicators, and individual financial goals. With the financial landscape continually evolving, investors must navigate various asset classes and investment strategies to optimize their portfolios. Whether you are a seasoned investor or just starting, knowing where to invest can significantly impact your financial future.

The current investment climate is shaped by several factors, including technological advancements, demographic shifts, and global economic conditions. As we enter 2025, certain sectors are emerging as promising opportunities for investment. This article will explore various avenues for investment today, providing insights into potential strategies and asset classes to consider.

| Investment Avenues | Key Features |

|---|---|

| Stocks | Potential for high returns, volatility risk |

| Bonds | Stable income, lower risk compared to stocks |

| Real Estate | Tangible asset, potential for rental income |

| Cryptocurrencies | High volatility, potential for significant gains |

| Mutual Funds | Diversification, managed by professionals |

Understanding Market Trends

The first step in making informed investment decisions is understanding current market trends. In 2025, several sectors are expected to perform well due to various economic and social factors.

- Artificial Intelligence (AI): The rise of AI technology continues to attract significant investment interest. Companies specializing in AI solutions are experiencing robust growth as businesses seek to leverage automation and data analytics.

- Renewable Energy: As global awareness of climate change increases, investments in renewable energy sources such as solar and wind power are gaining traction. Government incentives and technological advancements are making these investments more attractive.

- Healthcare: The aging population is driving demand for healthcare services and products. Pharmaceutical companies focusing on innovative treatments are likely to see substantial growth.

- Financial Sector: With recent economic changes, the financial sector is poised for growth. Investments in banks and financial institutions may yield positive returns as they adapt to new regulations and market conditions.

Understanding these trends allows investors to align their portfolios with sectors that show promise for growth.

Evaluating Investment Options

When considering where to invest today, it’s essential to evaluate different asset classes based on your financial goals and risk tolerance. Here are some popular options:

- Stocks: Investing in stocks offers the potential for high returns but comes with increased volatility. Investors should consider diversifying their stock portfolios across different sectors to mitigate risk.

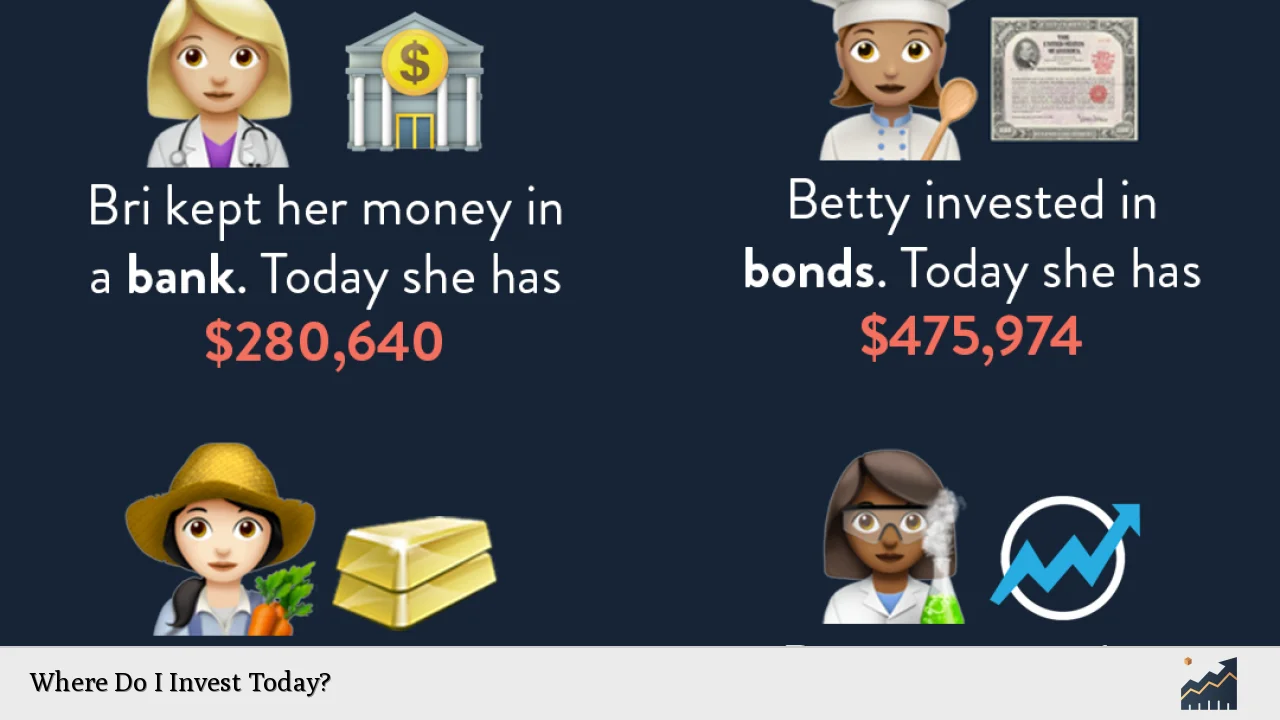

- Bonds: Bonds provide a more stable investment option with lower risk compared to stocks. They can offer consistent income through interest payments, making them suitable for conservative investors.

- Real Estate: Real estate investments can provide rental income and long-term appreciation. However, they require more capital upfront and involve ongoing management responsibilities.

- Cryptocurrencies: Cryptocurrencies have gained popularity due to their potential for high returns. However, they are highly volatile and should be approached with caution.

- Mutual Funds: Mutual funds allow investors to pool their money with others to invest in a diversified portfolio managed by professionals. This option is ideal for those seeking diversification without the need for extensive market knowledge.

Each investment option has its advantages and disadvantages; therefore, it’s crucial to assess your financial situation before making decisions.

Risk Management Strategies

Investing inherently involves risk; thus, implementing effective risk management strategies is vital. Here are some strategies investors can adopt:

- Diversification: Spread investments across various asset classes and sectors to reduce risk exposure. This strategy helps mitigate losses when one sector underperforms.

- Asset Allocation: Determine the right mix of stocks, bonds, real estate, and other assets based on your risk tolerance and investment goals. Regularly review and adjust your allocation as needed.

- Regular Monitoring: Keep an eye on market trends and economic indicators that may affect your investments. Staying informed allows you to make timely adjustments to your portfolio.

- Setting Stop-Loss Orders: For stock investments, consider setting stop-loss orders to limit potential losses. This strategy automatically sells a stock when it reaches a predetermined price.

Implementing these strategies can help protect your investments from unforeseen market fluctuations while maximizing potential returns.

The Role of Technology in Investing

Technology has transformed the investing landscape significantly in recent years. Online trading platforms and mobile apps have made investing more accessible than ever before. Here’s how technology impacts investing:

- Accessibility: Investors can now access financial markets from anywhere using online platforms. This accessibility empowers individuals to manage their investments actively.

- Data Analysis Tools: Advanced data analytics tools help investors analyze market trends and make informed decisions based on real-time data.

- Robo-Advisors: These automated platforms provide personalized investment advice based on individual financial goals and risk tolerance. They offer a cost-effective solution for those seeking professional guidance without high fees.

- Social Media Influence: Social media platforms have become significant sources of investment information. While they can provide valuable insights, investors should be cautious of misinformation that may lead to poor decisions.

Embracing technology can enhance your investing experience while providing valuable resources for decision-making.

Long-Term vs Short-Term Investing

When deciding where to invest today, consider whether you prefer a long-term or short-term strategy:

- Long-Term Investing: This approach focuses on holding investments for several years or decades. It typically involves less frequent trading and aims for gradual growth over time through compounding returns.

- Short-Term Trading: Short-term investing involves buying and selling assets within shorter time frames—ranging from days to months. While it can yield quick profits, it also carries higher risks due to market volatility.

Choosing between these strategies depends on your financial goals, risk tolerance, and investment knowledge. Long-term investing is generally less stressful and allows you to ride out market fluctuations more effectively.

Investment Trends in 2025

As we look ahead into 2025, several key trends are emerging that could shape investment decisions:

- Sustainable Investing: There is a growing emphasis on environmental sustainability among investors. Companies with strong sustainability practices may attract more capital as consumers demand responsible business practices.

- Digital Assets: The rise of digital currencies continues to gain momentum. Investors are increasingly looking at blockchain technology’s potential beyond cryptocurrencies—such as decentralized finance (DeFi) applications.

- Global Diversification: Investors are exploring opportunities beyond domestic markets as globalization continues. Emerging markets may offer attractive growth prospects compared to developed economies.

Staying abreast of these trends can help you position your portfolio for success in the coming years.

FAQs About Where Do I Invest Today?

- What are the best sectors to invest in today?

The best sectors include technology (especially AI), renewable energy, healthcare, and finance. - Should I invest in stocks or bonds?

This depends on your risk tolerance; stocks offer higher returns but come with more volatility than bonds. - How important is diversification?

Diversification is crucial as it helps mitigate risks by spreading investments across various asset classes. - What role does technology play in investing?

Technology enhances accessibility, provides data analysis tools, and enables automated investing through robo-advisors. - Is short-term trading advisable?

Short-term trading can be profitable but carries higher risks; it requires careful monitoring of market fluctuations.

Investing today requires careful consideration of various factors including market trends, personal financial goals, and risk tolerance levels. By staying informed about emerging opportunities and employing effective strategies such as diversification and technology utilization, you can position yourself for success in the ever-evolving financial landscape of 2025.