Investing your money wisely is crucial to achieving financial growth and security. As we enter 2025, various investment options are available that cater to different risk appetites and financial goals. Understanding the current market trends and identifying the best places to allocate your funds can significantly impact your financial future. This article will explore the most promising investment avenues for 2025, providing insights into stocks, bonds, real estate, and alternative investments.

| Investment Type | Description |

|---|---|

| Stocks | Equities that can provide high returns but come with higher risk. |

| Bonds | Fixed-income securities that offer stability and lower risk. |

| Real Estate | Property investments that can yield rental income and appreciate in value. |

| Alternative Investments | Niche assets like cryptocurrencies and private equity. |

Understanding Your Investment Goals

Before diving into specific investment options, it’s essential to clarify your investment goals. Are you looking for short-term gains or long-term growth? Your objectives will influence your choices significantly.

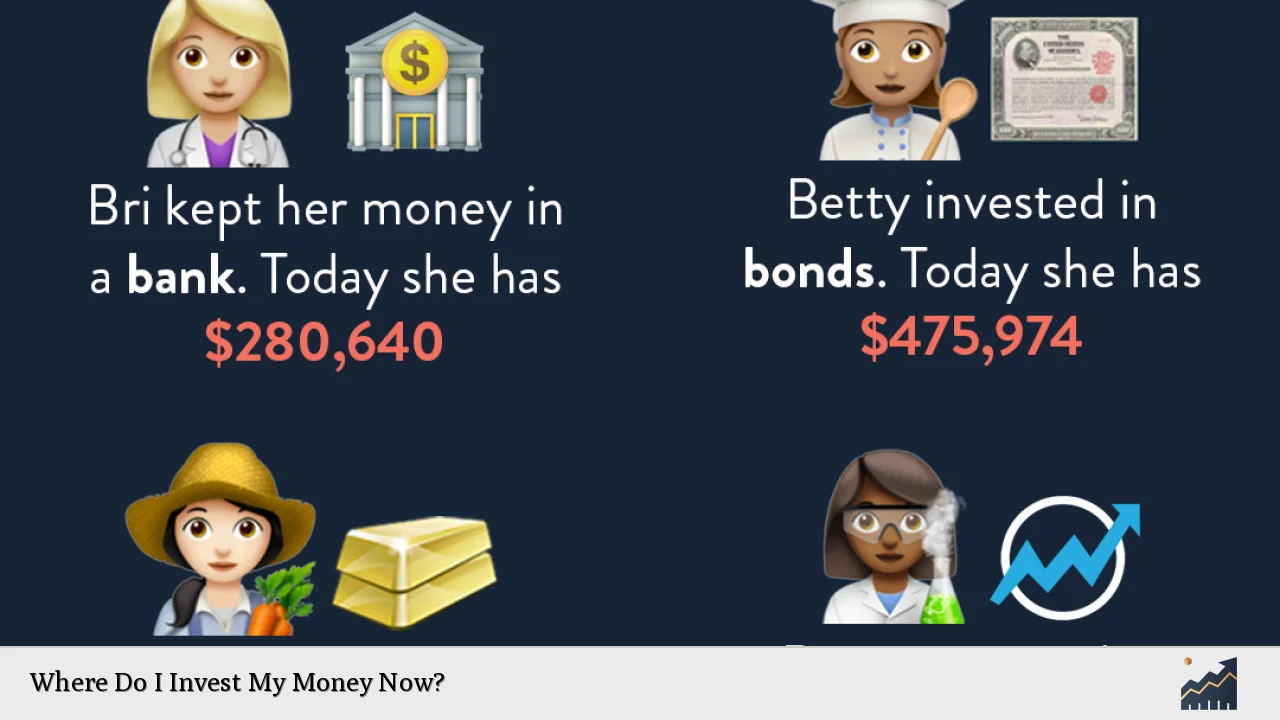

If you aim for long-term growth, consider investing in stocks or real estate. These options typically offer higher returns over extended periods but come with increased volatility. Conversely, if you need immediate access to funds or prefer lower risk, fixed-income investments like bonds or high-yield savings accounts may be more suitable.

Additionally, understanding your risk tolerance is vital. Higher-risk investments can lead to substantial gains but also significant losses. Assessing your comfort level with risk will help you create a balanced portfolio that aligns with your financial situation.

Promising Investment Avenues for 2025

As we look ahead to 2025, several investment categories stand out due to their potential for growth and stability:

- Stocks: The stock market has shown remarkable resilience, with expectations for continued growth driven by technological advancements and economic recovery. Focus on sectors like technology, especially companies involved in artificial intelligence (AI), which are projected to thrive.

- Bonds: With interest rates expected to stabilize, investment-grade bonds can provide steady income while mitigating risk. Look for opportunities in government bonds and corporate bonds from financially sound companies.

- Real Estate: Despite rising interest rates cooling some markets, areas with high demand remain lucrative. Investing in rental properties or real estate investment trusts (REITs) can generate passive income while benefiting from property appreciation.

- Alternative Investments: Cryptocurrencies and other alternative assets are gaining traction as investors seek higher returns. While they carry higher risks, they can diversify your portfolio effectively.

Key Sectors to Watch

In addition to general categories of investments, certain sectors are poised for significant growth in 2025:

Technology Sector

The technology sector continues to lead the charge in innovation and growth. Companies focusing on AI, cloud computing, and cybersecurity are particularly attractive. As businesses increasingly rely on digital solutions, investing in tech stocks could yield substantial returns.

Renewable Energy

With a global shift towards sustainability, renewable energy sources like solar and wind power present exciting investment opportunities. Government incentives and corporate commitments to reduce carbon footprints will likely drive growth in this sector.

Healthcare

The aging population worldwide creates a growing demand for healthcare services and products. Investing in pharmaceutical companies or biotech firms that focus on innovative treatments can be a wise choice.

Financial Services

The financial sector is expected to benefit from deregulation and economic recovery. Investing in banks and financial institutions could provide solid returns as they capitalize on increased lending activity.

Diversification Strategies

To mitigate risk while maximizing potential returns, consider employing diversification strategies:

- Asset Allocation: Spread your investments across various asset classes—stocks, bonds, real estate, and alternatives—to reduce exposure to any single market downturn.

- Sector Diversification: Within equities, diversify across sectors such as technology, healthcare, consumer goods, and energy. This approach helps cushion against sector-specific volatility.

- Geographic Diversification: Explore international markets by investing in foreign stocks or global mutual funds. This strategy allows you to tap into growth opportunities outside your home country.

Monitoring Economic Indicators

Staying informed about economic indicators is critical for making informed investment decisions:

- Interest Rates: Monitor central bank policies regarding interest rates as they significantly impact bond yields and stock valuations.

- Inflation Rates: Rising inflation can erode purchasing power; thus, consider investments that historically perform well during inflationary periods—like commodities or real estate.

- Market Trends: Keep an eye on market trends and sentiments that could influence investor behavior. Understanding these dynamics will help you adjust your portfolio accordingly.

FAQs About Where Do I Invest My Money Now

- What are the safest investments right now?

High-yield savings accounts and government bonds are considered safe investments. - Is it a good time to invest in stocks?

Yes, especially in sectors like technology and healthcare that show strong growth potential. - What should I know about investing in real estate?

Focus on locations with high demand; rental properties can provide steady income. - How do I diversify my investment portfolio?

Spread investments across different asset classes and sectors to minimize risk. - Are alternative investments worth it?

They can offer high returns but come with higher risks; research thoroughly before investing.

Conclusion

Determining where to invest your money now involves careful consideration of your goals, risk tolerance, and market conditions. As we move into 2025, opportunities abound across various sectors such as technology, renewable energy, healthcare, and financial services. By diversifying your portfolio and staying informed about economic trends, you can position yourself for success in the evolving investment landscape.

Investing is not just about choosing the right assets; it’s also about creating a strategy that aligns with your personal financial goals while managing risks effectively. Whether you’re a seasoned investor or just starting out, the key is to remain adaptable and informed as you navigate the complexities of the financial markets.