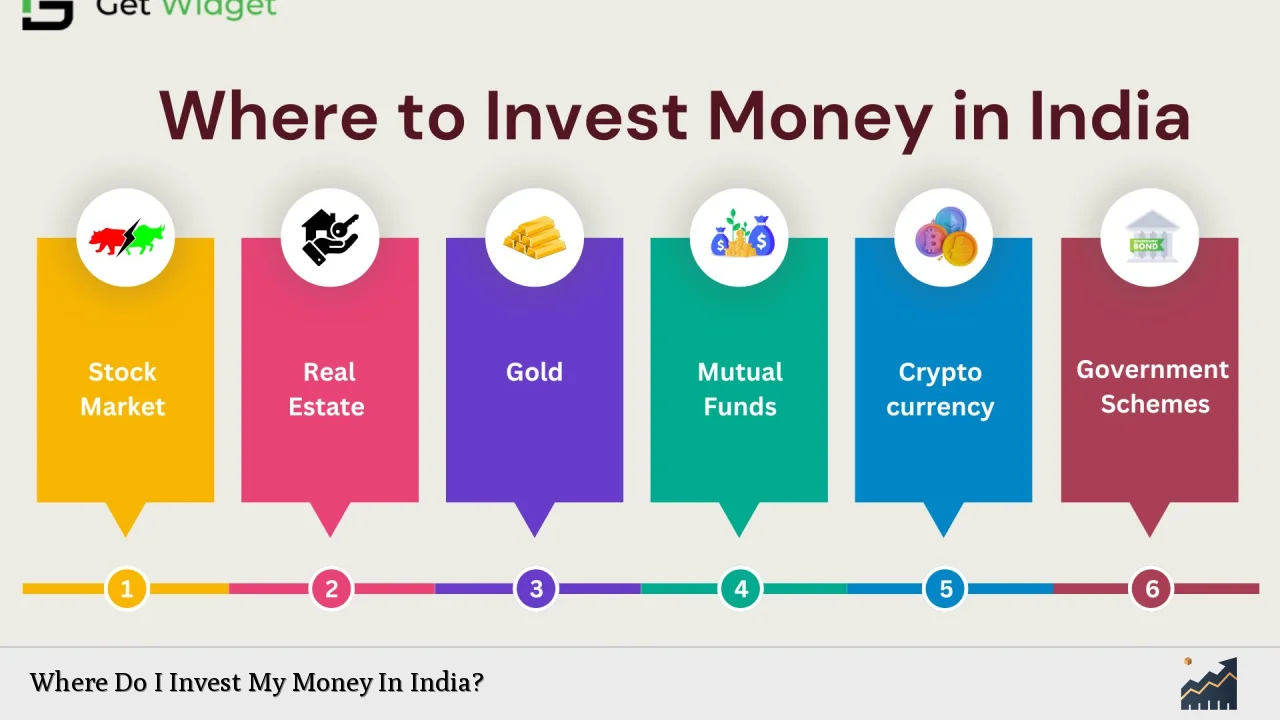

Investing your money wisely is crucial for building wealth and securing your financial future. In India, a diverse range of investment options is available, each catering to different risk appetites, investment horizons, and financial goals. Understanding where to invest can help you maximize returns while minimizing risks. This guide will explore various investment avenues in India, highlighting their features, benefits, and potential returns.

| Investment Type | Key Features |

|---|---|

| Stocks | Ownership in companies with potential for high returns |

| Mutual Funds | Pooled investments managed by professionals |

| Fixed Deposits | Safe investment with guaranteed returns |

| Gold | Hedge against inflation and economic uncertainty |

| Real Estate | Tangible asset with rental income potential |

| Bonds | Debt instruments offering fixed interest returns |

| Savings Schemes | Government-backed options with tax benefits |

Understanding Investment Options

Investors in India have access to a variety of investment options, each with unique characteristics. The most common types include:

- Stocks: Investing in stocks means buying shares of publicly traded companies. Stocks can offer high returns but come with higher risks due to market volatility.

- Mutual Funds: These are professionally managed investment funds that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are suitable for investors looking for diversification without managing individual stocks.

- Fixed Deposits (FDs): FDs are one of the safest investment options. You deposit a lump sum with a bank for a fixed tenure and earn interest at a predetermined rate. They are ideal for risk-averse investors seeking guaranteed returns.

- Gold: Investing in gold can be done through physical gold, gold ETFs, or sovereign gold bonds. Gold acts as a hedge against inflation and economic downturns.

- Real Estate: Real estate investments involve purchasing properties for rental income or capital appreciation. It requires significant capital but can yield substantial returns over time.

- Bonds: Bonds are debt securities issued by governments or corporations to raise capital. They pay fixed interest over time and return the principal at maturity, making them less risky than stocks.

- Savings Schemes: Government-backed schemes like the Public Provident Fund (PPF) and National Savings Certificate (NSC) offer fixed returns and tax benefits under Section 80C of the Income Tax Act.

Risk Assessment and Investment Strategy

Before investing, it is essential to assess your risk tolerance and financial goals.

- Risk Tolerance: Understand how much risk you can handle emotionally and financially. Higher potential returns typically come with higher risks.

- Investment Goals: Define your investment objectives—whether they are short-term gains, long-term wealth accumulation, or retirement savings.

Creating a balanced portfolio that aligns with your risk profile is crucial. A diversified portfolio minimizes risks while maximizing potential returns by spreading investments across various asset classes.

High-Growth Sectors in India

Investing in specific sectors can enhance your chances of achieving higher returns. Here are some promising sectors in India:

- Banking & Financial Services: The Indian banking sector is experiencing robust growth due to rising credit demand and digital banking adoption. Mid-sized private banks show strong loan growth rates between 15% to 20%.

- Information Technology (IT): India’s IT sector is booming due to increasing global demand for digital services. Companies in cloud computing and AI-driven analytics are particularly well-positioned for growth.

- Consumer Goods (FMCG): With rising disposable incomes, the FMCG sector is expected to grow significantly. This sector caters to the needs of India’s expanding middle class.

- Healthcare & Pharmaceuticals: Innovations in biotechnology and telemedicine are driving growth in this sector. India’s position as a global leader in generic drugs further enhances its potential.

- Infrastructure & Capital Goods: The government’s ambitious infrastructure plans promise significant investments in construction and engineering firms, offering stability and growth opportunities.

Investment Vehicles for Beginners

For those new to investing, starting small with manageable options can be beneficial:

- Systematic Investment Plans (SIPs): SIPs allow you to invest small amounts regularly in mutual funds. This approach reduces market timing risks and promotes disciplined investing.

- Public Provident Fund (PPF): PPF is a long-term savings scheme backed by the government, offering attractive interest rates with tax benefits.

- National Pension System (NPS): NPS is designed for retirement savings and offers tax deductions on contributions while providing market-linked returns.

Tax Implications on Investments

Understanding the tax implications of your investments is essential for maximizing returns:

- Long-Term Capital Gains (LTCG): Gains from assets held for more than one year are taxed at lower rates compared to short-term gains.

- Tax Deductions: Investments in certain schemes like PPF, NPS, and ELSS (Equity Linked Savings Scheme) qualify for tax deductions under Section 80C.

Being aware of these implications can help you make informed decisions about where to invest your money effectively while minimizing tax liabilities.

Choosing the Right Investment Platform

Selecting the right platform for investing is crucial:

- Online Brokers: Many online brokerage platforms offer user-friendly interfaces and low fees. They provide access to stocks, mutual funds, ETFs, and more.

- Robo-Advisors: These automated platforms create personalized investment portfolios based on your risk profile and goals at minimal costs.

- Traditional Financial Advisors: For personalized guidance, consider consulting a certified financial advisor who can help tailor an investment strategy suited to your needs.

FAQs About Where Do I Invest My Money In India

- What are the best investment options for beginners?

SIP mutual funds, PPF, and fixed deposits are excellent choices for beginners. - How much should I invest monthly?

A monthly investment depends on your financial goals; starting small with SIPs is advisable. - Are stocks safe investments?

Stocks carry risks but can offer high returns; diversification helps mitigate risks. - What is the minimum amount required to start investing?

You can start investing with as little as ₹500 in mutual funds through SIPs. - How do I choose between stocks and mutual funds?

If you prefer hands-on management, stocks may suit you; if you want professional management and diversification, choose mutual funds.

Investing wisely requires careful consideration of various factors including risk tolerance, market conditions, and personal financial goals. By exploring different avenues available in India—such as stocks, mutual funds, fixed deposits, gold, real estate, bonds, and government savings schemes—you can build a robust investment portfolio that aligns with your aspirations while managing risks effectively.