Investing your Health Savings Account (HSA) can be a strategic way to grow your savings for future medical expenses while enjoying significant tax benefits. HSAs are unique financial tools that allow you to save money tax-free for qualified medical expenses. The funds in an HSA can be invested similarly to other retirement accounts, such as IRAs or 401(k)s, making them a powerful addition to your financial planning. Understanding where and how to invest your HSA can maximize its potential and help you achieve your long-term financial goals.

When considering investments for your HSA, it’s essential to evaluate your current and future medical expenses, risk tolerance, and investment horizon. Many account holders overlook the investment aspect of HSAs, with only a small percentage actively investing their funds. However, those who do can benefit from the triple tax advantage that HSAs offer: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free.

| Investment Type | Description |

|---|---|

| Money Market Funds | Low-risk options ideal for short-term needs. |

| Stocks and Funds | Higher potential returns suitable for long-term growth. |

| Fixed Income | Stable returns with lower risk, suitable for conservative investors. |

Understanding Your HSA Investment Options

Before diving into specific investment strategies, it’s crucial to understand the various options available for investing your HSA funds. Generally, HSAs allow you to invest in:

- Money Market Funds: These are low-risk investments that provide liquidity and stability. They are suitable for individuals who anticipate needing their funds in the near term.

- Stocks and Stock-Based Funds: Investing in stocks or stock-based funds can yield higher returns over time. This option is ideal for those who do not expect significant medical expenses in the near future.

- Fixed Income Investments: These include bonds and other debt securities that offer stable returns with lower risk compared to stocks. They are appropriate for conservative investors or those nearing retirement.

Choosing the right investment type depends on your financial situation, health care needs, and how long you plan to keep the funds in the account.

Setting Investment Goals

Establishing clear investment goals is essential when deciding where to invest your HSA. Consider the following factors:

- Time Horizon: Determine when you expect to use the funds. If you plan to use them within a few years, focusing on more liquid investments like money market funds may be wise. For long-term growth, consider stocks or mutual funds.

- Risk Tolerance: Assess how comfortable you are with market fluctuations. If you prefer stability and lower risk, fixed-income investments or money market funds may suit you better.

- Healthcare Needs: Consider your anticipated medical expenses. If you foresee significant costs soon, ensure enough cash is available while investing excess funds for growth.

By aligning your investment strategy with these goals, you can optimize your HSA’s potential while ensuring access to necessary funds when needed.

Choosing the Right HSA Provider

Selecting an appropriate HSA provider is critical as it influences your investment options and fees associated with managing your account. Here are some factors to consider when evaluating providers:

- Investment Options: Look for providers that offer a diverse range of investment choices, including mutual funds, ETFs, and individual stocks.

- Fees: Be aware of any maintenance fees or transaction costs that could erode your investment returns over time.

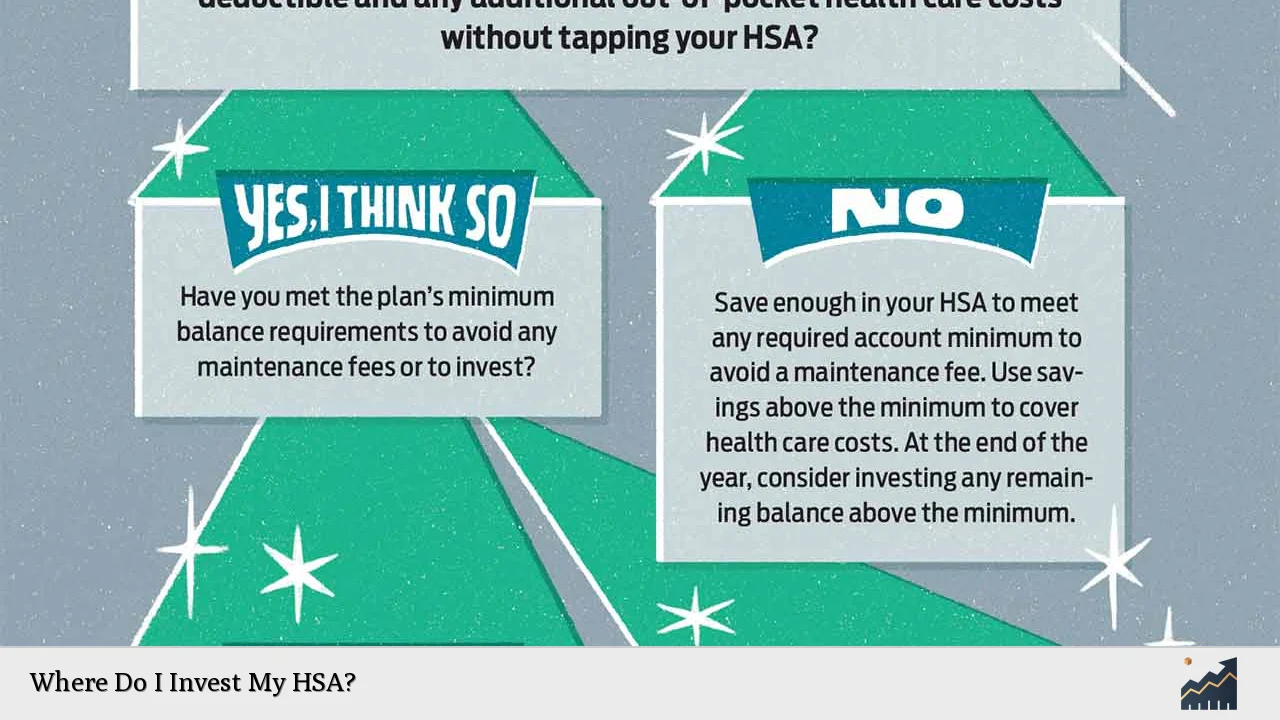

- Minimum Balance Requirements: Some providers require a minimum balance before allowing investments. Ensure you’re comfortable meeting these thresholds.

- User Experience: Consider the ease of use of the provider’s platform for managing investments and accessing account information.

By carefully evaluating these factors, you can choose an HSA provider that aligns with your investment strategy and financial goals.

Investment Strategies for Your HSA

Once you’ve chosen an HSA provider and established your investment goals, it’s time to implement a strategy tailored to your needs. Here are some effective strategies:

- Diversification: Spread your investments across various asset classes (stocks, bonds, cash equivalents) to reduce risk while maximizing potential returns.

- Regular Contributions: Consistently contribute to your HSA to take advantage of dollar-cost averaging. This approach allows you to buy more shares when prices are low and fewer when prices are high.

- Rebalancing: Periodically review and adjust your portfolio to maintain alignment with your risk tolerance and investment goals. This may involve selling some assets that have performed well and buying others that have underperformed.

- Utilize Target-Date Funds: If you’re unsure about managing investments yourself, consider target-date funds that automatically adjust asset allocation based on your expected withdrawal date.

By employing these strategies, you can effectively manage your HSA investments while working towards achieving long-term financial health.

Tax Advantages of Investing Your HSA

One of the most compelling reasons to invest through an HSA is its unique tax advantages:

- Tax-Deductible Contributions: Contributions made to an HSA reduce your taxable income for the year, providing immediate tax relief.

- Tax-Free Growth: Any interest or investment earnings generated within the account grow tax-free, allowing compounding without tax implications until withdrawal.

- Tax-Free Withdrawals: When used for qualified medical expenses, withdrawals from an HSA are entirely tax-free. This feature makes HSAs particularly beneficial for individuals planning for retirement healthcare costs.

Understanding these advantages can help motivate individuals to maximize their contributions and invest their HSAs effectively.

Managing Withdrawals from Your HSA

As you approach retirement or anticipate medical expenses, managing withdrawals from your HSA becomes crucial:

- Plan Withdrawals Strategically: If possible, pay out-of-pocket for medical expenses while allowing your HSA investments to continue growing tax-free. This strategy maximizes long-term growth potential while preserving cash reserves in the account.

- Consider Timing: Avoid withdrawing during market downturns if possible; selling investments at a loss can diminish overall returns. Instead, maintain sufficient cash reserves in the account for immediate needs.

- Use Funds Wisely: Withdraw only what is necessary for qualified medical expenses to preserve as much capital as possible within the account for future growth.

By adopting a thoughtful approach to withdrawals, you can enhance the longevity of your HSA while ensuring access to necessary funds when needed.

FAQs About Where Do I Invest My HSA

- What types of investments can I hold in my HSA?

You can typically invest in stocks, bonds, mutual funds, ETFs, and money market accounts. - How do I choose an HSA provider?

Consider factors like investment options offered, fees charged, minimum balance requirements, and user experience. - What is the best strategy for investing my HSA?

Diversification across asset classes combined with regular contributions is often considered a strong strategy. - Are there penalties for withdrawing from my HSA?

No penalties apply if withdrawals are used for qualified medical expenses; otherwise, taxes may apply. - Can I use my HSA funds after retirement?

Yes, after age 65 you can use HSA funds for non-medical expenses without penalties; regular income tax will apply.

By understanding where to invest your HSA and implementing effective strategies tailored to your financial situation and healthcare needs, you can maximize this valuable account’s potential benefits. Whether you’re saving for current medical expenses or planning ahead for retirement healthcare costs, investing wisely within an HSA can significantly enhance your financial security over time.