Investing your 401(k) is a crucial step in securing your financial future for retirement. A 401(k) plan is an employer-sponsored retirement savings account that allows you to contribute a portion of your paycheck before taxes are taken out. These contributions can then be invested in various options provided by your plan, typically including a mix of mutual funds, index funds, and sometimes individual stocks or bonds. The key to successful 401(k) investing lies in understanding your options, assessing your risk tolerance, and making informed decisions that align with your long-term financial goals.

When deciding where to invest your 401(k), it’s important to consider factors such as your age, retirement timeline, and financial objectives. Generally, younger investors can afford to take on more risk, while those closer to retirement may want to focus on preserving their capital. Your 401(k) investment strategy should evolve over time, becoming more conservative as you approach retirement age.

| Investment Type | Risk Level |

|---|---|

| Stock Funds | Higher |

| Bond Funds | Moderate |

| Target-Date Funds | Varies (becomes more conservative over time) |

| Money Market Funds | Lower |

Understanding Your 401(k) Investment Options

Most 401(k) plans offer a variety of investment options to choose from. These typically include mutual funds, which are professionally managed portfolios of stocks, bonds, or other securities. Within the category of mutual funds, you may find several types:

- Stock funds: These invest primarily in company stocks and can be further categorized into large-cap, mid-cap, and small-cap funds, depending on the size of the companies they invest in. Stock funds generally offer higher potential returns but come with higher risk.

- Bond funds: These invest in corporate or government bonds and are generally considered less risky than stock funds. They typically provide more stable, albeit lower, returns.

- Index funds: These are designed to track the performance of a specific market index, such as the S&P 500. They offer broad market exposure and typically have lower fees than actively managed funds.

- Target-date funds: These funds automatically adjust their asset allocation to become more conservative as you approach your target retirement date. They can be a good option for investors who prefer a “set it and forget it” approach.

- Money market funds: These invest in short-term, low-risk securities and are considered one of the safest investment options, though they typically offer lower returns.

It’s important to diversify your investments across different asset classes to spread risk. Many financial advisors recommend a mix of stock and bond funds, with the exact proportion depending on your risk tolerance and time horizon.

Assessing Your Risk Tolerance

Understanding your risk tolerance is crucial when deciding where to invest your 401(k). Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. Several factors influence risk tolerance:

- Age: Generally, younger investors can afford to take on more risk because they have more time to recover from market downturns.

- Time until retirement: The closer you are to retirement, the less risk you may want to take on to protect your savings.

- Financial goals: Your specific retirement goals and desired lifestyle can impact how much risk you’re willing to take.

- Personal comfort level: Some people are naturally more comfortable with financial risk than others.

To assess your risk tolerance, consider how you would react to a significant drop in your 401(k) balance. Would you panic and sell, or stay the course? Your answer can help guide your investment choices. Many 401(k) plans offer risk assessment tools or questionnaires to help you determine your risk profile.

Remember that while higher-risk investments like stock funds have the potential for greater returns, they also come with a higher chance of short-term losses. Conversely, lower-risk investments like bond funds offer more stability but may not provide the growth needed to outpace inflation over the long term.

Strategies for 401(k) Investing

Once you understand your investment options and risk tolerance, you can develop a strategy for investing your 401(k). Here are some key strategies to consider:

Diversification

Diversification is a fundamental principle of investing that involves spreading your money across different types of investments to reduce risk. In the context of a 401(k), this might mean investing in a mix of stock funds, bond funds, and possibly other options like real estate investment trusts (REITs) if available in your plan.

Asset Allocation

Asset allocation refers to how you divide your investments among different asset classes. A common approach is to use the “100 minus your age” rule. This suggests that the percentage of your portfolio invested in stocks should be 100 minus your current age. For example, if you’re 30, you might consider investing 70% in stocks and 30% in bonds. However, this is just a general guideline, and your specific allocation should be based on your individual circumstances and risk tolerance.

Regular Rebalancing

Over time, some investments in your portfolio may perform better than others, causing your asset allocation to shift. Rebalancing involves periodically adjusting your investments to maintain your desired asset allocation. Many 401(k) plans offer automatic rebalancing features, which can help keep your investments on track without requiring constant monitoring.

Maximizing Employer Match

If your employer offers a matching contribution, it’s generally advisable to contribute at least enough to take full advantage of this match. This is essentially free money that can significantly boost your retirement savings.

Considering Target-Date Funds

For those who prefer a hands-off approach, target-date funds can be an attractive option. These funds automatically adjust their asset allocation to become more conservative as you approach retirement. While convenient, it’s important to understand the specific strategy and fees associated with these funds.

Common Mistakes to Avoid

When investing your 401(k), be aware of these common pitfalls:

- Failing to contribute: Not participating in your 401(k) or contributing too little can significantly impact your retirement savings.

- Overinvesting in company stock: While it may seem loyal to invest heavily in your employer’s stock, this can lead to a lack of diversification.

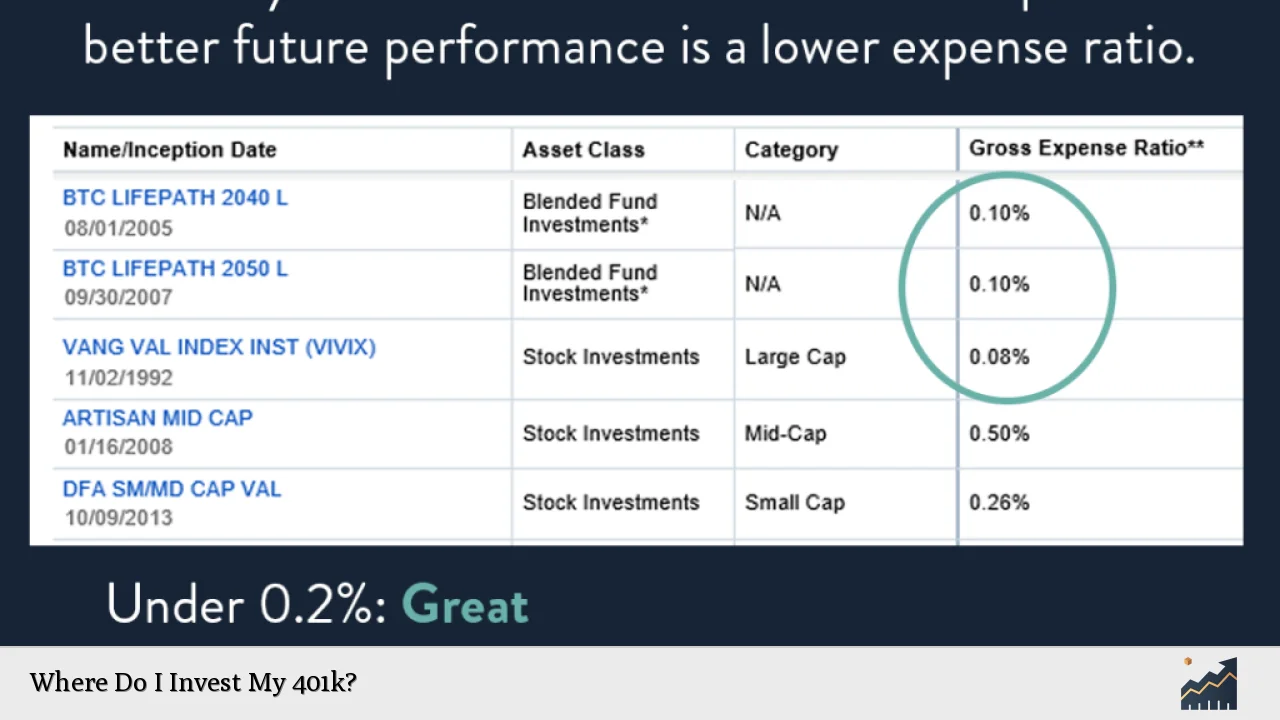

- Ignoring fees: High fees can eat into your returns over time. Pay attention to the expense ratios of the funds you choose.

- Frequent trading: Trying to time the market or making frequent changes to your investments can lead to poor performance and higher fees.

- Cashing out early: Withdrawing money from your 401(k) before retirement can result in significant penalties and lost growth potential.

By avoiding these mistakes and following a well-thought-out investment strategy, you can maximize the potential of your 401(k) and work towards a secure retirement.

FAQs About Where Do I Invest My 401k

- How much should I contribute to my 401(k)?

Aim to contribute at least enough to get your full employer match, ideally 10-15% of your salary if possible. - Can I lose money in my 401(k)?

Yes, investments can lose value, but historically, the stock market has trended upward over long periods. - Should I choose a Roth or traditional 401(k)?

This depends on your current tax bracket and expected future income; consult a financial advisor for personalized advice. - How often should I review my 401(k) investments?

Review your investments at least annually or when experiencing major life changes. - What if my 401(k) doesn’t offer good investment options?

Focus on low-cost index funds if available, or consider supplementing with an IRA for more options.