Investing is a crucial aspect of personal finance that allows individuals to grow their wealth over time. The decision of where to invest can be overwhelming due to the multitude of options available, including stocks, bonds, mutual funds, real estate, and more. Each investment type comes with its own set of risks and potential returns, making it essential for investors to carefully consider their financial goals, risk tolerance, and investment horizon before making decisions.

Understanding the various investment vehicles is vital for anyone looking to build a portfolio that aligns with their financial objectives. Whether you are a novice investor or someone with more experience, knowing where to invest can significantly impact your financial future. This article will explore different investment options, strategies for beginners, and key considerations to help you navigate the investment landscape effectively.

| Investment Type | Description |

|---|---|

| Stocks | Ownership in a company, offering potential for high returns. |

| Bonds | Loans to governments or corporations with fixed interest payments. |

| Mutual Funds | Pools of money from multiple investors to buy a diversified portfolio. |

| Real Estate | Investment in property for rental income or appreciation. |

| ETFs | Funds that track indexes and trade like stocks on exchanges. |

Understanding Investment Options

When considering where to invest, it’s crucial to understand the different types of investment options available. Each type has unique characteristics that can affect your overall investment strategy.

- Stocks: Investing in stocks means purchasing shares of ownership in a company. Stocks can offer high returns but also come with higher risk due to market volatility. Investors should research companies thoroughly before investing.

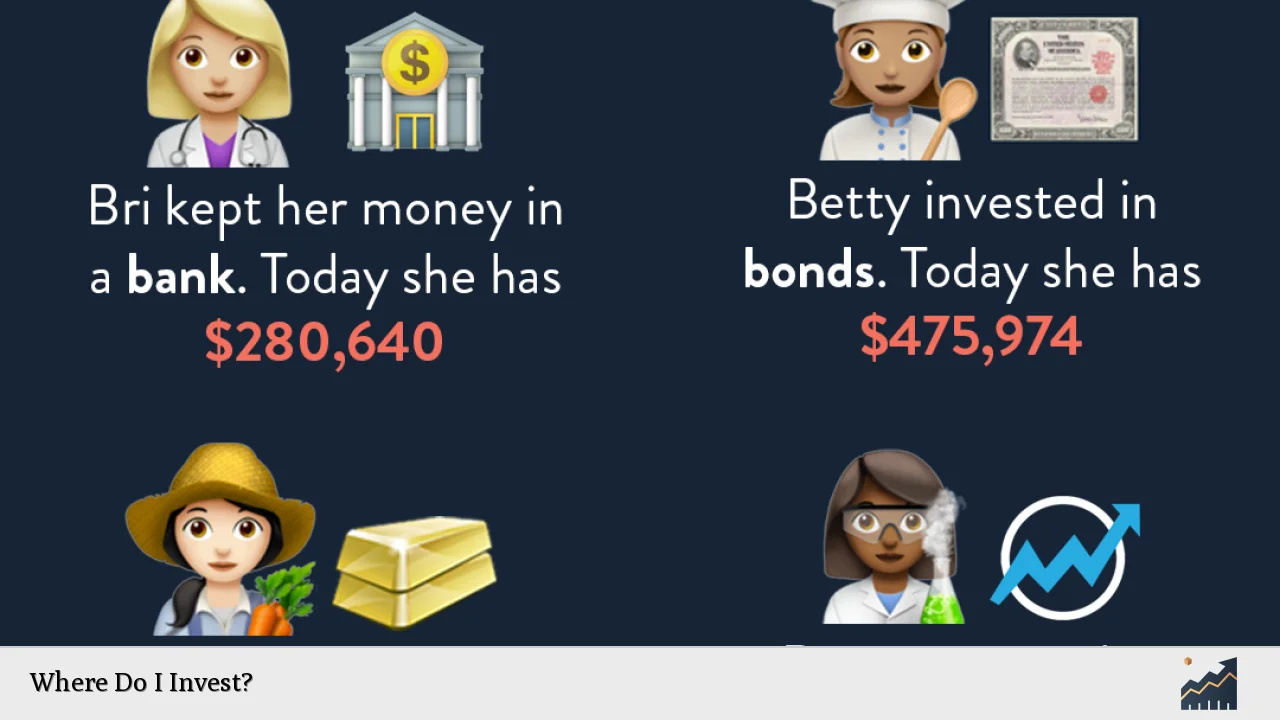

- Bonds: Bonds are fixed-income investments where you lend money to an entity (government or corporation) in exchange for periodic interest payments and the return of principal at maturity. They are generally considered safer than stocks but offer lower potential returns.

- Mutual Funds: These are professionally managed investment funds that pool money from many investors to purchase securities. They provide diversification but come with management fees that can eat into returns.

- Real Estate: Investing in real estate involves purchasing property for rental income or capital appreciation. Real estate can provide steady cash flow but requires significant capital and management effort.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and typically have lower fees than mutual funds.

Each option has its own advantages and disadvantages, making it essential for investors to align their choices with their financial goals and risk tolerance.

Investment Strategies for Beginners

For those new to investing, adopting a strategy can simplify the process and enhance success rates. Here are some popular strategies:

- Buy and Hold: This long-term strategy involves purchasing investments and holding them for an extended period, regardless of market fluctuations. It relies on the idea that markets will rise over time.

- Dollar-Cost Averaging: This technique involves regularly investing a fixed amount of money regardless of market conditions. It helps mitigate the impact of volatility by averaging out purchase prices over time.

- Index Fund Investing: Investing in index funds allows you to buy a broad market index (like the S&P 500) instead of individual stocks. This strategy offers diversification and typically lower fees.

- Income Investing: This approach focuses on generating regular income through dividends or interest payments from investments like dividend-paying stocks or bonds.

- Growth Investing: Growth investors seek companies expected to grow at an above-average rate compared to their industry or the overall market. This strategy often involves higher risk but can yield substantial rewards.

By understanding these strategies, beginners can make informed decisions that align with their financial objectives while managing risk effectively.

Assessing Your Risk Tolerance

Before investing, it’s vital to assess your risk tolerance, which refers to your ability and willingness to endure fluctuations in your investment value. Factors influencing risk tolerance include:

- Investment Goals: What do you want to achieve? Long-term growth may justify higher risk compared to short-term savings goals.

- Time Horizon: The length of time you plan to hold an investment affects how much risk you can take. Longer horizons typically allow for more aggressive investments since there is time to recover from downturns.

- Financial Situation: Your current financial status plays a significant role in determining how much risk you can afford. If you have substantial savings or other income sources, you may be more comfortable taking risks.

- Emotional Factors: Your psychological response to market volatility is crucial. Some investors panic during downturns while others remain calm; understanding your emotional reactions can guide your investment choices.

By evaluating these factors, you can better determine an appropriate asset allocation that matches your risk tolerance and investment goals.

Building a Diversified Portfolio

Diversification is a fundamental principle in investing that helps reduce risk by spreading investments across various asset classes. A well-diversified portfolio includes:

- Equities (Stocks): Consider allocating a portion of your portfolio to stocks for growth potential.

- Fixed Income (Bonds): Including bonds can provide stability and income during market fluctuations.

- Real Assets (Real Estate): Real estate investments can offer inflation protection and diversification benefits.

- Cash or Cash Equivalents: Maintaining some liquidity allows you to take advantage of opportunities as they arise without needing to sell other investments at an unfavorable time.

The specific allocation depends on your individual risk tolerance, goals, and investment horizon. Regularly reviewing and rebalancing your portfolio ensures it remains aligned with your objectives as market conditions change.

Utilizing Investment Accounts

Selecting the right type of investment account is essential for optimizing your returns while minimizing tax liabilities. Common account types include:

- Taxable Accounts: These accounts do not offer tax advantages but provide flexibility in terms of withdrawals and contributions. Capital gains taxes apply when investments are sold at a profit.

- Retirement Accounts (e.g., IRAs, 401(k)s): These accounts offer tax benefits for retirement savings. Contributions may be tax-deductible, and investments grow tax-deferred until withdrawal during retirement.

- Education Savings Accounts (e.g., 529 Plans): Designed for education expenses, these accounts allow tax-free growth when used for qualified educational costs.

Choosing the right account type based on your financial goals can significantly impact your overall investment strategy and returns over time.

Staying Informed About Market Trends

Staying updated on market trends is vital for making informed investment decisions. Investors should:

- Follow financial news outlets for updates on economic indicators that could affect markets.

- Monitor changes in interest rates as they directly impact bond prices and stock valuations.

- Understand sector performance trends; certain sectors may outperform others based on economic conditions.

- Consider global events that could influence markets; geopolitical tensions or changes in trade policies can have significant effects on investments.

By keeping abreast of these factors, investors can adapt their strategies accordingly and make timely adjustments when necessary.

Seeking Professional Guidance

For many individuals, navigating the complexities of investing can be daunting. Seeking professional guidance from financial advisors or planners can provide valuable insights tailored to your specific situation. When choosing an advisor:

- Ensure they have appropriate credentials and experience in managing investments.

- Discuss their fee structure upfront; some advisors charge commissions while others have flat fees.

- Clarify their investment philosophy; ensure it aligns with your goals and values.

- Ask about their approach towards risk management; understanding how they handle downturns is crucial for peace of mind.

Professional guidance can help demystify investing while providing personalized strategies that fit your unique circumstances.

FAQs About Where Do I Invest?

- What should I consider before investing?

You should evaluate your financial goals, risk tolerance, time horizon, and current financial situation. - How do I start investing as a beginner?

Begin by educating yourself about different investment types, setting clear goals, and considering starting with low-cost index funds. - What is diversification?

Diversification involves spreading investments across various asset classes to reduce risk. - Should I use a financial advisor?

A financial advisor can provide personalized advice tailored to your situation if you’re unsure about managing investments yourself. - What are common mistakes new investors make?

New investors often overlook research, fail to diversify adequately, or react emotionally during market fluctuations.

Investing wisely requires careful planning and consideration of various factors impacting potential returns. By understanding different options available, assessing personal circumstances accurately, diversifying effectively, staying informed about market trends, and seeking professional advice when necessary, individuals can build successful investment portfolios tailored to their specific needs and goals.