Investing is a crucial aspect of financial planning and wealth building. With a multitude of options available, it can be overwhelming to determine the best places to invest your money. Understanding the various investment avenues is essential for making informed decisions that align with your financial goals. This article explores different investment options, their characteristics, and how to choose the right one for you.

| Investment Type | Description |

|---|---|

| Stocks | Ownership in a company, potential for high returns but with higher risk. |

| Bonds | Loans to governments or corporations, generally lower risk than stocks. |

| Real Estate | Property investment, can provide rental income and appreciation. |

| Mutual Funds | Pools of funds from multiple investors to buy diversified assets. |

| ETFs | Exchange-traded funds that track indexes, offering diversification and liquidity. |

Investors can choose from various options, including stocks, bonds, real estate, mutual funds, and exchange-traded funds (ETFs). Each investment type has its own set of characteristics, risks, and potential returns. The key is to find a balance that suits your financial situation, risk tolerance, and investment goals.

Understanding Investment Options

Investing is not a one-size-fits-all approach; different types of investments cater to varying risk tolerances and financial objectives. Here’s a closer look at the most popular investment options:

Stocks

Investing in stocks means buying shares of ownership in a company. Stocks can offer substantial returns over time, especially if the company performs well. However, they also come with higher volatility and risk, as stock prices can fluctuate significantly based on market conditions.

- Advantages: Potential for high returns, dividends from profitable companies.

- Disadvantages: Higher risk of loss, requires market knowledge.

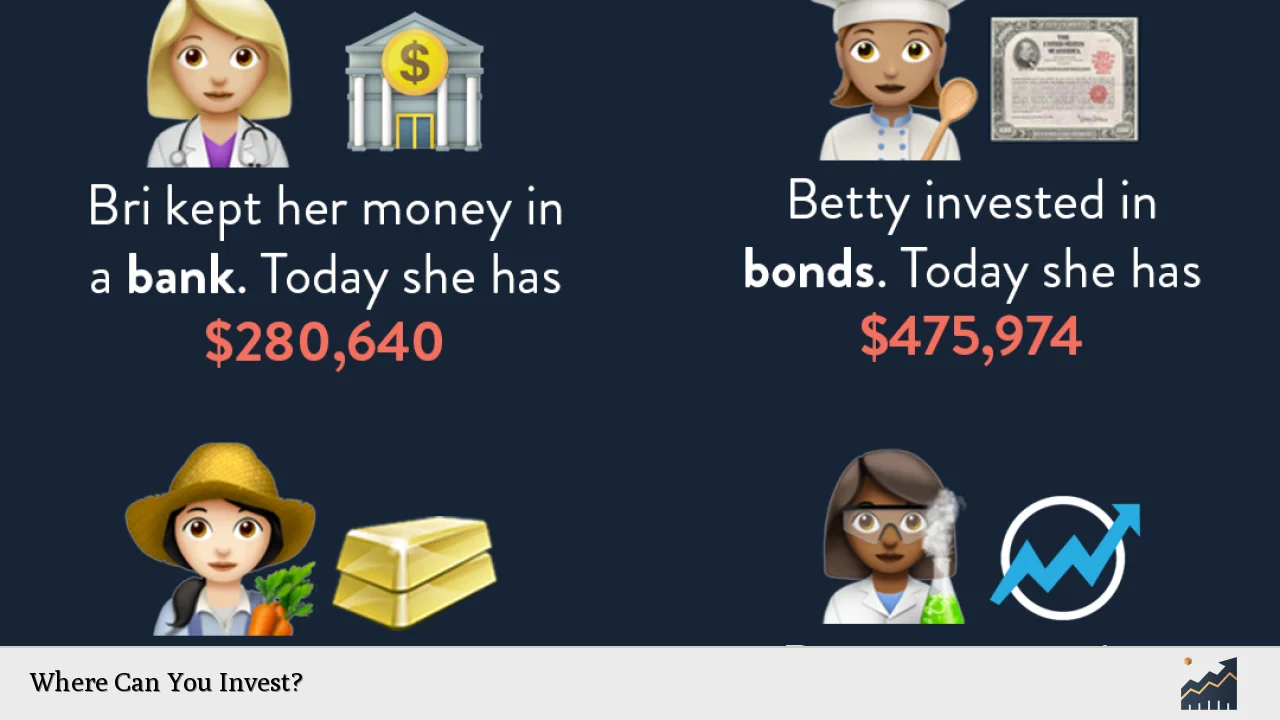

Bonds

Bonds are fixed-income securities where you lend money to governments or corporations in exchange for periodic interest payments and the return of principal at maturity. They are generally considered safer than stocks but offer lower returns.

- Advantages: Steady income through interest payments, lower risk compared to stocks.

- Disadvantages: Lower potential returns, interest rate risk.

Real Estate

Investing in real estate involves purchasing property for rental income or capital appreciation. Real estate can be a tangible asset that provides both income and long-term value growth.

- Advantages: Potential for rental income and property appreciation.

- Disadvantages: Requires significant capital upfront, ongoing maintenance costs.

Mutual Funds

Mutual funds pool money from multiple investors to buy a diversified portfolio of stocks or bonds managed by professionals. This option allows investors to gain exposure to various assets without needing extensive market knowledge.

- Advantages: Diversification reduces risk, professionally managed.

- Disadvantages: Management fees can eat into returns, less control over individual investments.

Exchange-Traded Funds (ETFs)

Similar to mutual funds, ETFs are collections of assets but trade on exchanges like individual stocks. They offer diversification and typically have lower fees than mutual funds.

- Advantages: Flexibility in trading, lower fees than mutual funds.

- Disadvantages: Market fluctuations affect prices throughout the day.

Choosing the Right Investment Strategy

Selecting the right investment strategy depends on several factors including your financial goals, risk tolerance, and investment horizon. Here are some strategies to consider:

Risk Assessment

Before investing, assess your risk tolerance. Are you comfortable with high volatility for potentially higher returns? Or do you prefer stable investments with lower returns? Understanding your comfort level with risk will guide your choices.

Time Horizon

Your investment time frame plays a critical role in determining suitable investments. Generally:

- Short-term (less than 3 years): Consider safer investments like bonds or savings accounts.

- Medium-term (3-10 years): A mix of stocks and bonds may be appropriate.

- Long-term (10+ years): You might lean towards stocks or real estate for growth potential.

Diversification

Diversifying your investments across different asset classes helps mitigate risk. A well-diversified portfolio can withstand market fluctuations better than one concentrated in a single asset type.

Financial Goals

Define your financial objectives clearly. Are you saving for retirement, a home purchase, or education? Different goals may require different strategies and asset allocations.

Investment Platforms

Investing today is more accessible than ever thanks to various platforms available for individuals:

Online Brokerage Accounts

Online brokerages allow you to buy and sell stocks, bonds, ETFs, and mutual funds easily. Many platforms offer educational resources for beginners.

Robo-Advisors

Robo-advisors provide automated investment management services based on your financial goals and risk tolerance. They create diversified portfolios tailored to your needs at relatively low costs.

Retirement Accounts

Consider tax-advantaged accounts like IRAs or 401(k)s for retirement savings. These accounts often come with tax benefits that can enhance your investment growth over time.

Common Investment Mistakes

Avoiding common pitfalls is essential for successful investing:

Timing the Market

Many investors try to time their purchases based on market predictions. This strategy often leads to losses as it’s challenging to predict market movements accurately.

Lack of Research

Investing without adequate research can lead to poor decisions. Always understand what you’re investing in before committing your money.

Emotional Investing

Emotions can cloud judgment; fear during market downturns or greed during booms may lead to impulsive decisions. Stick to your strategy regardless of market fluctuations.

FAQs About Where Can You Invest?

- What are the safest types of investments?

Bonds and savings accounts are generally considered safer investments. - How much should I invest as a beginner?

Start small; even $50-$100 per month can help you build confidence. - What is dollar-cost averaging?

This strategy involves investing a fixed amount regularly regardless of market conditions. - Are real estate investments worth it?

Yes, they can provide rental income and long-term appreciation but require significant capital. - How do I choose between stocks and bonds?

Your choice should depend on your risk tolerance and investment goals.

Investing is an essential part of achieving financial independence and building wealth over time. By understanding the various options available—stocks, bonds, real estate, mutual funds, ETFs—and developing a clear strategy based on your goals and risk tolerance, you can make informed decisions that will benefit you financially in the long run.