Deciding when to sell an investment property is a critical decision for real estate investors, significantly impacting overall returns. The right timing can maximize profits, while poor timing may lead to losses or missed opportunities. This comprehensive guide explores the key factors influencing the decision to sell, current market trends, and strategic considerations for investors.

| Key Concept | Description/Impact |

|---|---|

| Market Conditions | Understanding local real estate trends, including price peaks and buyer demand, is crucial for timing a sale effectively. |

| Maintenance Costs | Rising maintenance costs can erode profits; if expenses exceed rental income, selling may be more beneficial. |

| Investment Goals | Changes in personal or financial goals can necessitate selling a property that no longer aligns with the investor’s strategy. |

| Tenant Stability | High tenant turnover can indicate issues with the property, suggesting it may be time to sell. |

| Economic Indicators | Monitoring interest rates, inflation, and housing supply helps gauge the optimal time for selling. |

| Tax Implications | Understanding capital gains tax and other selling costs is essential for calculating net profit from a sale. |

Market Analysis and Trends

The real estate market is influenced by various factors including economic conditions, interest rates, and local market dynamics. As of late 2024, several trends are shaping the landscape:

- Home Price Growth: The median home price in the U.S. reached approximately $404,500 as of September 2024, reflecting a year-over-year increase of about 5.7%. This growth indicates a continuing seller’s market where prices are favorable for sellers.

- Interest Rates: Mortgage rates have stabilized around 6.88% as of October 2024. While high rates have slowed sales activity, anticipated cuts in mid-2024 could rejuvenate the market.

- Supply and Demand: The housing inventory remains low at about a 4.3-month supply, which is below the balanced market threshold of 5-6 months. This scarcity typically favors sellers.

- Emerging Trends: Factors such as increased reliance on rentals over home purchases are emerging due to economic pressures. This shift creates unique opportunities for investors focusing on rental properties.

Implementation Strategies

To effectively decide when to sell an investment property, consider implementing the following strategies:

- Conduct Regular Market Assessments: Stay informed about local real estate trends and broader economic indicators that might affect property values.

- Evaluate Financial Performance: Regularly calculate metrics like Internal Rate of Return (IRR) and cash flow to assess whether holding or selling is more advantageous. A healthy IRR typically ranges from 18% to 20%.

- Set Clear Investment Goals: Define your investment strategy clearly—whether it’s long-term appreciation or short-term cash flow—and adjust your portfolio accordingly.

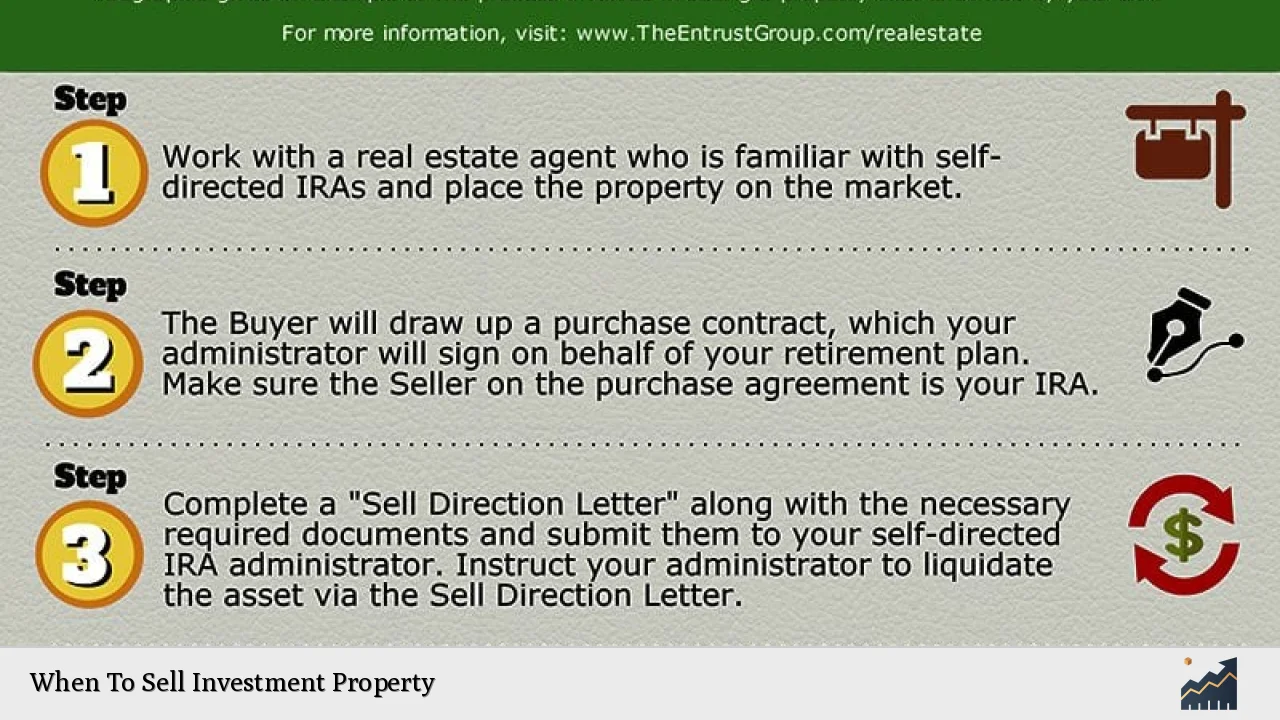

- Utilize Professional Advice: Engage with real estate agents or financial advisors who can provide insights into market conditions and help strategize your sale.

Risk Considerations

Selling an investment property comes with inherent risks that need careful consideration:

- Market Volatility: Real estate markets can fluctuate due to economic conditions. Selling during a downturn could result in lower profits.

- Emotional Decision-Making: Investors often become attached to their properties. Decisions should be based on financial analysis rather than emotional factors.

- Potential Tax Liabilities: Capital gains taxes can significantly impact net proceeds from a sale. Understanding these implications beforehand is crucial.

- Market Timing Risks: Attempting to time the market perfectly can lead to missed opportunities. It’s often better to sell based on personal circumstances rather than trying to predict market movements.

Regulatory Aspects

Understanding the regulatory environment surrounding real estate transactions is essential:

- Disclosure Requirements: Sellers must disclose known issues with a property that could affect its value or desirability.

- Tax Regulations: Familiarize yourself with capital gains tax laws applicable in your jurisdiction. In many cases, holding a property for over a year can reduce tax liabilities.

- Local Real Estate Laws: Compliance with local laws regarding tenant rights and eviction processes is vital when preparing to sell an occupied rental property.

Future Outlook

Looking ahead, several factors will influence the timing of selling investment properties:

- Economic Recovery: As interest rates are expected to decrease by mid-2024, this could stimulate buyer activity and increase property values.

- Technological Advancements: The integration of technology in real estate transactions (e.g., AI for property valuation) will streamline processes and potentially enhance profitability for sellers.

- Shift Towards Rentals: With more individuals opting for rentals over home purchases due to high mortgage rates, properties that cater to this demand may become more valuable.

Frequently Asked Questions About When To Sell Investment Property

- What are the signs that it’s time to sell my investment property?

Key indicators include rising maintenance costs, changing personal circumstances, poor cash flow performance, and unfavorable market conditions. - How do I calculate my property’s value?

You can assess your property’s value by comparing it with similar properties in your area (comparative market analysis) and considering recent sales data. - What costs should I consider when selling?

Costs include agent commissions, legal fees, repair costs before sale, and potential capital gains taxes. - Is there an ideal time of year to sell?

The spring and fall months often see higher buyer activity; however, local market conditions should also guide your timing. - Should I sell if my property is not appreciating?

If your investment no longer meets your financial goals or incurs high maintenance costs without appreciation potential, it may be wise to sell. - What role does tenant stability play in my decision?

Persistent tenant turnover or vacancy may indicate underlying issues with the property, suggesting it might be time to divest. - How do interest rates affect my decision to sell?

Higher interest rates generally reduce buyer affordability; thus, understanding current rates can help you gauge optimal selling times. - Should I consult a professional before selling?

Yes, consulting real estate professionals can provide valuable insights into market conditions and help you make informed decisions.

In conclusion, deciding when to sell an investment property requires careful analysis of market trends, personal goals, financial performance, and regulatory considerations. By staying informed and strategically planning your exit strategy, you can maximize returns on your investment while minimizing risks associated with the sale process.