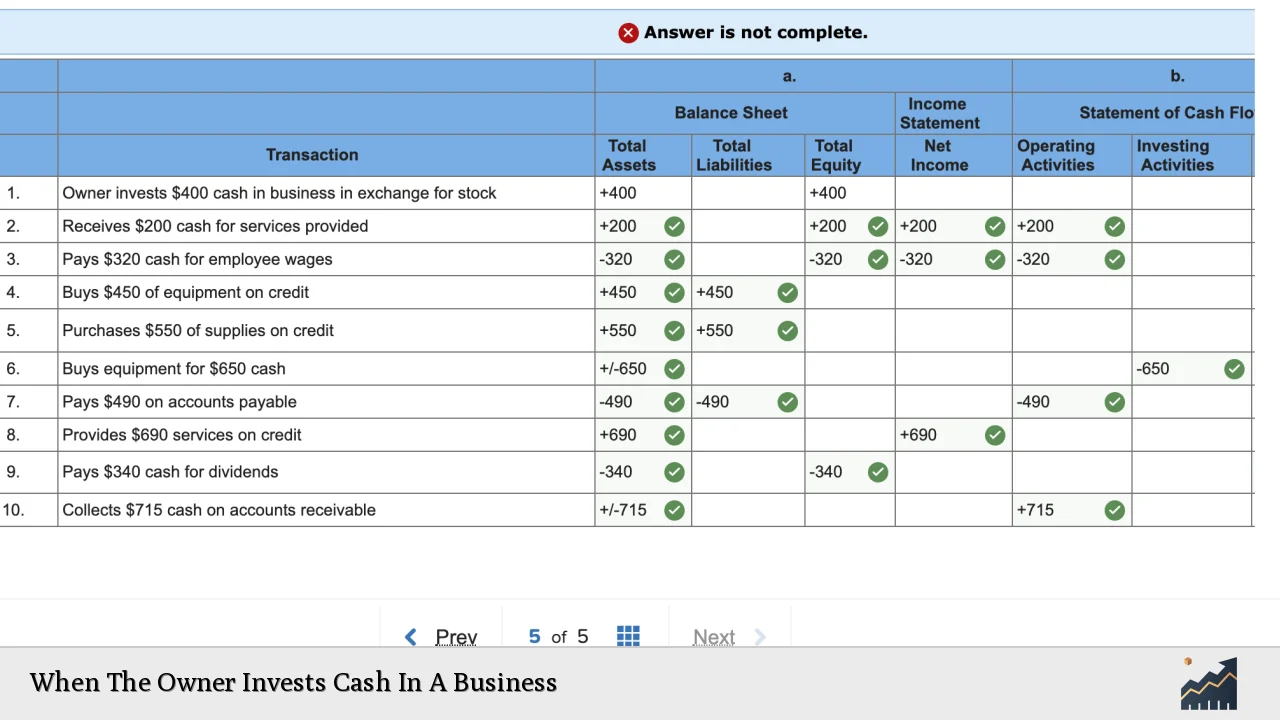

Investing cash into a business is a fundamental action that can significantly impact its financial structure and operational capabilities. When an owner invests cash, the immediate effects are reflected in the company’s balance sheet, specifically in the assets and owner’s equity. Understanding these implications is crucial for business owners, investors, and finance professionals alike, as it lays the groundwork for strategic planning and financial management.

| Key Concept | Description/Impact |

|---|---|

| Owner’s Equity Increase | The owner’s equity increases by the amount of cash invested, reflecting a higher stake in the business. |

| Asset Growth | Cash assets increase, enhancing liquidity and operational flexibility. |

| Liabilities Stability | Liabilities remain unchanged since the investment does not involve borrowing or incurring new debts. |

| Financial Health Indicator | A rise in owner’s equity indicates improved financial health and can attract additional investments or loans. |

| Investment Opportunities | The additional cash allows for reinvestment in growth opportunities, such as expanding operations or acquiring new assets. |

Market Analysis and Trends

The current landscape of business investment is shaped by several factors, including post-pandemic recovery dynamics, evolving consumer preferences, and technological advancements.

- Post-COVID Recovery: U.S. businesses have shown resilience with real non-residential fixed investment growing at a rate of 4-6% annually since 2021. This growth has exceeded historical benchmarks despite rising interest rates that typically dampen investment activities.

- Technology Integration: Small businesses are increasingly leveraging technology to enhance operational efficiency. For instance, many are adopting digital payment solutions and self-service technologies to streamline processes and reduce costs.

- Sustainability Focus: There is a notable trend towards sustainable business practices. Companies that integrate sustainability into their operations are likely to attract a growing base of environmentally conscious consumers.

- Investment in Startups: The surge in new business applications post-pandemic indicates a robust entrepreneurial spirit. Many founders are optimistic about their potential returns on investment, driving a wave of new ventures.

Implementation Strategies

When an owner decides to invest cash into their business, several strategies can be employed to maximize the benefits of this investment:

- Reinvestment in Operations: Owners should consider using the cash to improve operational efficiencies or expand product lines. This could involve upgrading technology or investing in employee training.

- Debt Reduction: If applicable, using invested cash to pay down existing debts can strengthen the balance sheet by reducing liabilities and interest expenses.

- Market Expansion: Cash investments can be directed towards marketing efforts to increase brand visibility or enter new markets.

- Asset Acquisition: Investing in tangible assets such as equipment or property can enhance production capabilities and potentially lead to increased revenue streams.

Risk Considerations

Investing cash into a business also carries inherent risks that must be carefully managed:

- Liquidity Risk: While investing cash can enhance operational capabilities, it may also reduce liquidity if not managed properly. Owners should ensure they maintain sufficient working capital for day-to-day operations.

- Market Volatility: Economic downturns or shifts in consumer behavior can impact the return on investment. It’s essential for owners to remain adaptable and responsive to market changes.

- Overextension: There is a risk of overextending financially if investments are made without thorough market analysis or strategic planning. Owners should conduct due diligence before committing significant funds.

Regulatory Aspects

Understanding regulatory requirements is crucial when making cash investments into a business:

- Securities Regulations: If the investment involves issuing stock or other securities, compliance with SEC regulations is necessary to avoid legal repercussions.

- Tax Implications: Cash investments may have tax consequences that affect both the business and the owner personally. Consulting with tax professionals can help navigate these complexities.

- Financial Reporting Standards: Adhering to GAAP (Generally Accepted Accounting Principles) ensures that all transactions related to owner investments are accurately reported in financial statements.

Future Outlook

The outlook for owner investments in businesses remains positive, driven by several key factors:

- High Returns on Capital: Current estimates suggest that returns on private capital remain historically high, encouraging further investments by owners.

- Increased Entrepreneurial Activity: The trend of rising new business applications indicates a robust entrepreneurial environment where owners feel confident about their investment prospects.

- Evolving Consumer Trends: As consumer preferences shift towards sustainability and technology-driven solutions, businesses that adapt quickly will likely see substantial benefits from owner investments aimed at innovation and efficiency.

Frequently Asked Questions About When The Owner Invests Cash In A Business

- What happens to the balance sheet when an owner invests cash?

The balance sheet reflects an increase in both assets (cash) and owner’s equity by the amount invested, while liabilities remain unchanged. - How does an owner’s cash investment affect business growth?

An owner’s cash investment can provide necessary capital for expansion projects, marketing initiatives, or asset acquisitions that drive growth. - Are there tax implications for owners investing cash?

Yes, there may be tax implications depending on how the investment is structured; consulting with a tax advisor is recommended. - What risks should owners consider when investing cash?

Owners should consider liquidity risk, market volatility, and potential overextension when making cash investments. - Can an owner’s investment impact future financing options?

An increase in owner’s equity can improve the company’s financial health profile, potentially making it easier to secure loans or attract investors. - What role does market analysis play in making cash investments?

Market analysis helps identify opportunities for growth and assess risks associated with investing cash into specific projects or areas within the business. - How can owners ensure their investment decisions are sound?

Conducting thorough market research, consulting financial advisors, and developing strategic plans can help ensure sound investment decisions. - Is it advisable to invest personal funds into a business?

This depends on individual circumstances; however, personal funds can signal confidence to other investors but should be approached cautiously to avoid personal financial strain.

Investing cash into a business is not only a critical step for operational success but also serves as a reflection of an owner’s commitment to long-term growth. By understanding the implications of such investments—ranging from immediate impacts on financial statements to broader market trends—owners can make informed decisions that position their businesses for success.