Investment banking recruiting is a critical process for both aspiring professionals and financial institutions. Understanding the timeline and nuances of this recruitment cycle is essential for candidates looking to secure coveted positions in this competitive field. The recruitment process typically begins with summer internships, which serve as a gateway to full-time roles. Given the high stakes and the rigorous nature of the selection process, candidates must be well-prepared and informed about the latest trends and timelines in investment banking recruiting.

| Key Concept | Description/Impact |

|---|---|

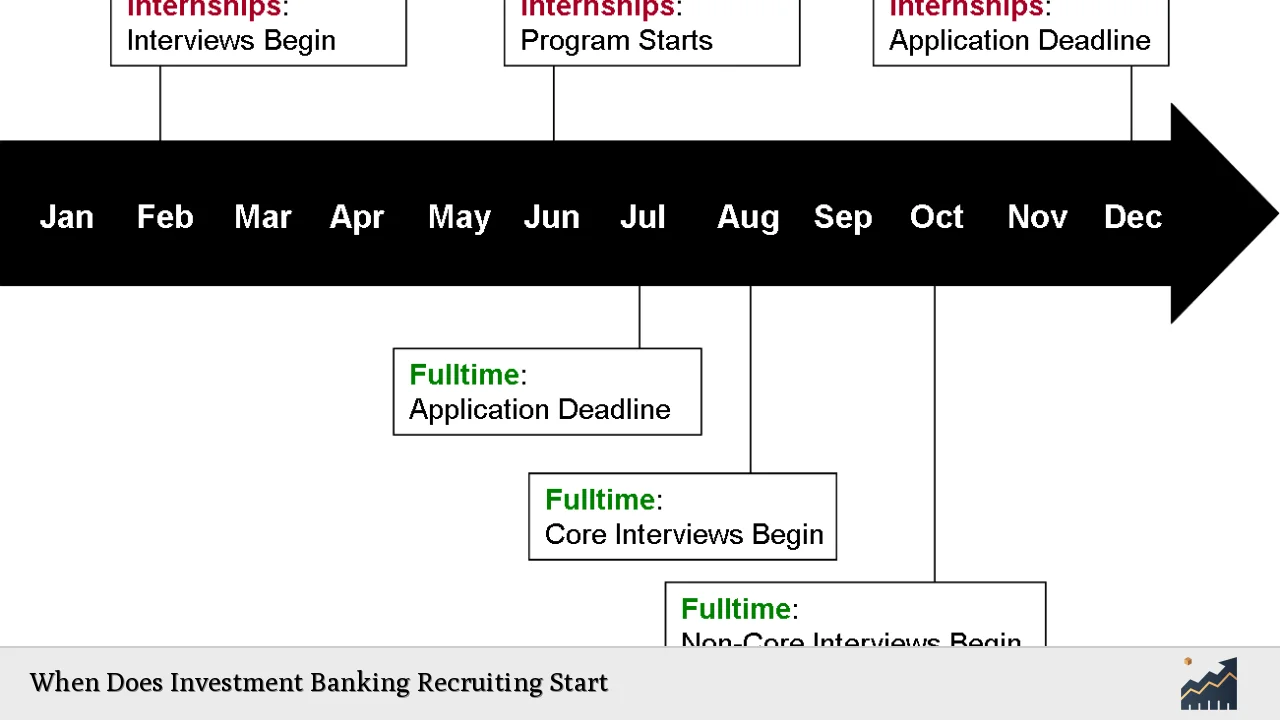

| Recruitment Timeline | Investment banks generally start recruiting for internships in early fall (August-September) for positions that begin the following summer. |

| Internship Importance | Internships are crucial as they often lead to full-time job offers; banks prefer hiring from their intern pool. |

| Application Deadlines | Internship applications typically close between November and December, while full-time applications may extend into October for U.S. firms. |

| Off-Cycle Recruiting | Some smaller banks hire on an ad-hoc basis throughout the year, providing opportunities outside the typical recruitment cycles. |

| Networking | Building connections is vital; candidates should start networking early to enhance their chances of securing interviews. |

| Market Trends | The demand for investment banking roles has increased, particularly in sectors like technology and renewable energy, influencing recruitment strategies. |

| Diversity Initiatives | Banks are increasingly focusing on diversity, equity, and inclusion (DEI) in their recruitment processes, impacting candidate selection. |

Market Analysis and Trends

The investment banking sector is currently experiencing significant changes due to various economic factors and evolving market demands. As of 2024, the global investment banking market is projected to grow from approximately $131.25 billion in 2023 to $142.16 billion, reflecting a compound annual growth rate (CAGR) of 8.3%. This growth is driven by:

- Technological Advancements: The integration of artificial intelligence (AI) and fintech innovations is reshaping how banks operate, influencing recruitment needs.

- Sector Focus: There is a noticeable shift towards sectors such as technology, healthcare, and renewable energy, which are attracting substantial investments. This trend necessitates a workforce skilled in these areas.

- Diversity Initiatives: Increasing emphasis on DEI has led banks to broaden their candidate pools, ensuring that recruitment processes are inclusive.

The competition for talent remains fierce, with firms vying for candidates who can navigate complex financial landscapes while embracing technological advancements.

Implementation Strategies

To effectively navigate the investment banking recruiting landscape, candidates should consider the following strategies:

- Start Early: Begin networking and researching potential employers well before application deadlines. Engaging with alumni networks or attending industry events can provide valuable insights.

- Tailor Applications: Customize resumes and cover letters to highlight relevant experiences and skills that align with specific roles within investment banks.

- Prepare for Interviews: Given the rigorous nature of interviews in this sector, candidates should practice technical questions and behavioral interview techniques extensively.

- Leverage Internships: Securing an internship not only provides practical experience but also significantly increases the likelihood of receiving a full-time offer post-graduation.

- Stay Informed: Keep abreast of market trends and developments within the investment banking industry to demonstrate knowledge during interviews.

Risk Considerations

While pursuing a career in investment banking can be lucrative, there are inherent risks involved:

- Job Market Volatility: Economic downturns can lead to hiring freezes or layoffs within investment banks. Candidates should be prepared for fluctuations in job availability.

- High Competition: With thousands of applicants vying for limited positions, candidates must differentiate themselves through unique experiences or specialized skills.

- Work-Life Balance: The demanding nature of investment banking often leads to long hours and high stress levels. Candidates should consider their capacity for managing such pressures before committing to this career path.

Regulatory Aspects

The regulatory environment surrounding investment banking continues to evolve, impacting recruitment strategies:

- Compliance Requirements: Investment banks must adhere to stringent regulations set forth by entities like the SEC and other global regulatory bodies. This necessitates hiring individuals who are knowledgeable about compliance issues.

- Changes in Legislation: Upcoming regulations may alter how banks operate and recruit talent. Staying informed about these changes is crucial for both candidates and firms.

- Impact of Technology on Regulation: The rise of fintech solutions is prompting regulatory adaptations that could influence hiring practices within investment banks.

Future Outlook

Looking ahead, several trends are likely to shape the future of investment banking recruiting:

- Increased Demand for Tech-Savvy Professionals: As digital transformation accelerates within financial services, there will be a growing need for professionals who can leverage technology effectively.

- Focus on Sustainable Finance: With an increasing emphasis on environmental sustainability, candidates with expertise in sustainable finance will become more sought after.

- Global Recruitment Strategies: Firms may expand their search beyond traditional markets to tap into diverse talent pools worldwide, reflecting a more globalized approach to hiring.

As we move further into 2024, investment banks will need to adapt their recruiting strategies to align with these emerging trends while continuing to attract top talent in an increasingly competitive landscape.

Frequently Asked Questions About When Does Investment Banking Recruiting Start

- What is the typical timeline for investment banking recruiting?

The recruiting process usually starts in August or September for internships that take place the following summer. Full-time recruiting often begins shortly after internship offers are extended. - When do applications for internships typically open?

Internship applications generally open around July or August and close by mid-November to December. - How important are internships in securing a full-time position?

Internships are crucial as most full-time positions are filled by former interns; success during an internship significantly boosts chances of receiving a job offer. - Are there off-cycle recruiting opportunities?

Yes, smaller firms often hire on an ad-hoc basis throughout the year, allowing candidates additional chances outside traditional timelines. - What role does networking play in the recruiting process?

Networking is vital; it helps candidates gain insights into firms and increases visibility among recruiters. - How has diversity impacted investment banking recruiting?

Diversity initiatives have led firms to broaden their candidate pools, making recruitment more inclusive and focused on varied backgrounds. - What skills are most sought after in candidates?

Candidates with strong analytical skills, proficiency in financial modeling, knowledge of compliance regulations, and tech-savviness are highly valued. - How can candidates prepare effectively for interviews?

Candidates should practice both technical questions related to finance as well as behavioral questions that assess cultural fit within a firm.

In conclusion, understanding when investment banking recruiting starts—and how to navigate its complexities—is essential for aspiring finance professionals. By staying informed about market trends and preparing strategically, candidates can enhance their chances of success in this competitive field.