Investment banking is a highly competitive field that attracts many aspiring finance professionals. Understanding the application timeline for investment banking roles is crucial for candidates aiming to secure internships or full-time positions. Typically, investment banking applications open in waves, with significant variations depending on the region and specific firm. This article provides a comprehensive overview of when applications open, the current trends in investment banking recruitment, and strategic insights for prospective applicants.

| Key Concept | Description/Impact |

|---|---|

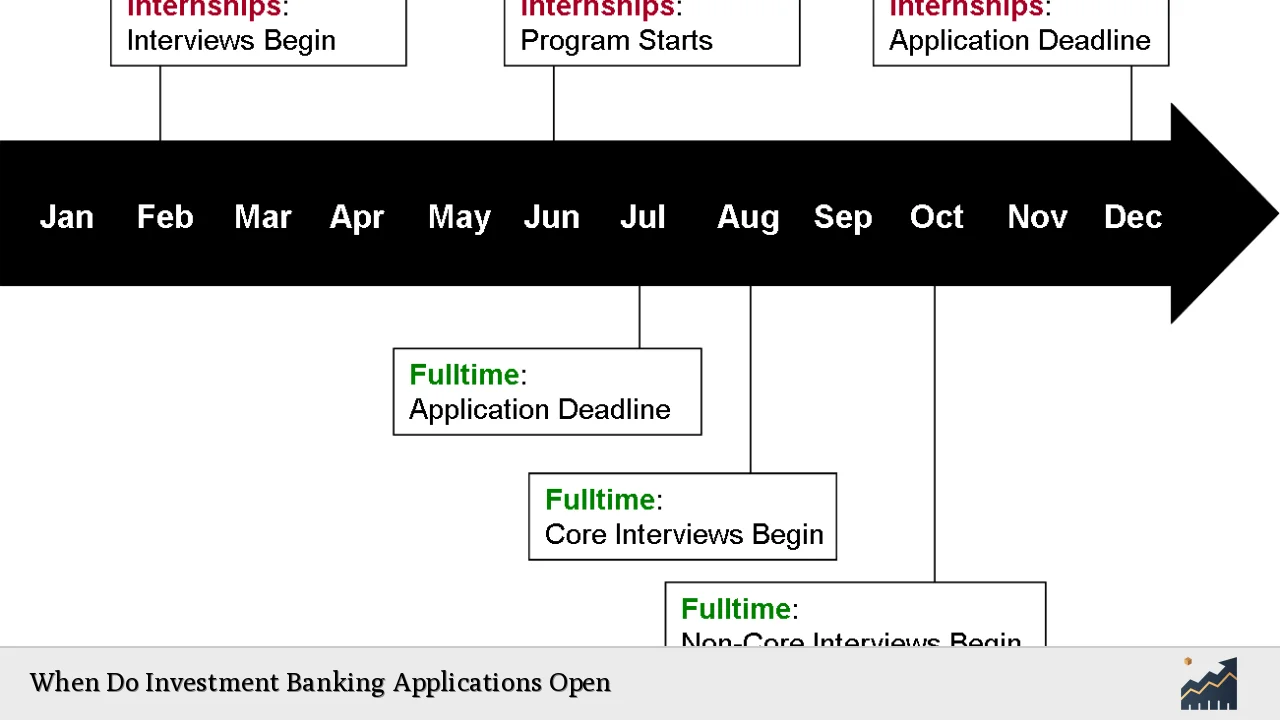

| Application Timelines | Most investment banks begin recruiting for summer internships in July, with deadlines often extending through October and November. |

| Regional Variations | Application timelines vary by region; U.S. banks typically open applications earlier than European firms. |

| Early Applications Advantage | Applying early can significantly increase chances of securing interviews and offers, as many banks operate on a rolling admissions basis. |

| Off-cycle Opportunities | Some firms offer off-cycle internships throughout the year, providing additional opportunities for candidates who miss the main recruitment cycle. |

| Market Trends | The investment banking sector is evolving with increased demand for digital transformation and sustainable finance, influencing recruitment strategies. |

Market Analysis and Trends

The investment banking landscape has been experiencing significant changes, influenced by various market dynamics and economic conditions. As of 2024, the global investment banking market is projected to grow from $131.25 billion in 2023 to $142.16 billion in 2024, reflecting a compound annual growth rate (CAGR) of 8.3%. This growth is driven by several factors:

- Mergers and Acquisitions (M&A): M&A activity is expected to rebound in 2024 after a decline in previous years. High levels of dry powder—approximately $2.5 trillion—held by financial sponsors are likely to drive transaction volumes as firms seek to deploy capital amid stabilizing market conditions.

- Technological Advancements: Investment banks are increasingly adopting digital solutions and artificial intelligence (AI) to enhance operational efficiency and decision-making processes. The integration of technology is not only transforming internal operations but also shaping client interactions and service delivery.

- Sustainable Finance: There is a growing emphasis on environmental, social, and governance (ESG) factors in investment decisions. Banks are adapting their strategies to incorporate sustainable finance principles, responding to investor demand for responsible investing options.

Implementation Strategies

To effectively navigate the investment banking application process, candidates should consider the following strategies:

- Start Early: Begin researching firms and preparing application materials well before the official opening dates. Many banks open applications as early as July, so having your resume and cover letter ready can give you an edge.

- Networking: Engage with professionals in the industry through informational interviews or networking events. Building relationships can provide insights into specific firms’ cultures and expectations.

- Tailored Applications: Customize your application for each firm. Highlight relevant experiences that align with the firm’s values and focus areas, especially regarding their approach to technology or sustainability.

- Practice Assessment Tests: Many banks use online assessments as part of their recruitment process. Familiarize yourself with common formats and practice extensively to improve your performance.

Risk Considerations

While pursuing a career in investment banking can be rewarding, it is essential to be aware of potential risks:

- High Competition: The field is extremely competitive, with thousands of applicants vying for a limited number of positions each year. This necessitates a strong academic background and relevant internship experience.

- Market Volatility: Economic downturns can affect hiring practices within investment banks. Candidates should remain adaptable and consider alternative roles within finance if necessary.

- Work-Life Balance: Investment banking is known for demanding hours and high-pressure environments. Prospective applicants should assess their readiness for this lifestyle before committing to a career path.

Regulatory Aspects

Investment banks operate under stringent regulatory frameworks that vary by region:

- U.S. Regulations: The Securities and Exchange Commission (SEC) oversees investment banking activities in the United States, ensuring compliance with securities laws that govern capital raising and advisory services.

- European Regulations: In Europe, regulations such as MiFID II (Markets in Financial Instruments Directive) impose transparency requirements on financial services firms, impacting how investment banks conduct business.

Understanding these regulatory requirements is crucial for candidates as they prepare for interviews; knowledge of compliance issues can demonstrate a candidate’s seriousness about the profession.

Future Outlook

The future of investment banking appears promising but will require firms to adapt continuously to changing market conditions:

- Continued Growth: The global investment banking market is expected to reach $194.05 billion by 2028, driven by ongoing demand for M&A advisory services, sustainable finance initiatives, and technological innovations.

- Evolving Skill Sets: As technology plays an increasingly central role in finance, candidates will need to develop skills in data analytics, AI applications, and regulatory technology (RegTech) to remain competitive.

- Global Opportunities: Emerging markets are becoming more significant players in global finance, offering new opportunities for investment banks that can navigate these complex environments effectively.

Frequently Asked Questions About When Do Investment Banking Applications Open

- When do most investment banks open their applications?

Most investment banks begin opening applications for summer internships around July each year. - What are typical deadlines for these applications?

Deadlines usually range from mid-November to December, but many banks operate on a rolling admissions basis. - Are there off-cycle internship opportunities?

Yes, many firms offer off-cycle internships throughout the year aside from the main recruitment cycle. - How important is networking in securing an investment banking position?

Networking is crucial; it can provide valuable insights into firm culture and enhance your chances of getting an interview. - What qualifications do I need to apply?

A strong academic background in finance or related fields is essential, along with relevant internship experience. - How competitive is the application process?

The application process is highly competitive; thousands apply for limited positions each year. - What should I focus on when preparing my application?

You should tailor your resume and cover letter to each firm while highlighting relevant experiences that align with their values. - What are some common challenges faced during recruitment?

Candidates often face challenges such as high competition and rigorous interview processes that require extensive preparation.

In conclusion, understanding when investment banking applications open is vital for aspiring professionals seeking entry into this competitive field. By staying informed about market trends, preparing strategically, and being aware of regulatory landscapes, candidates can enhance their prospects of securing desirable positions within leading financial institutions.