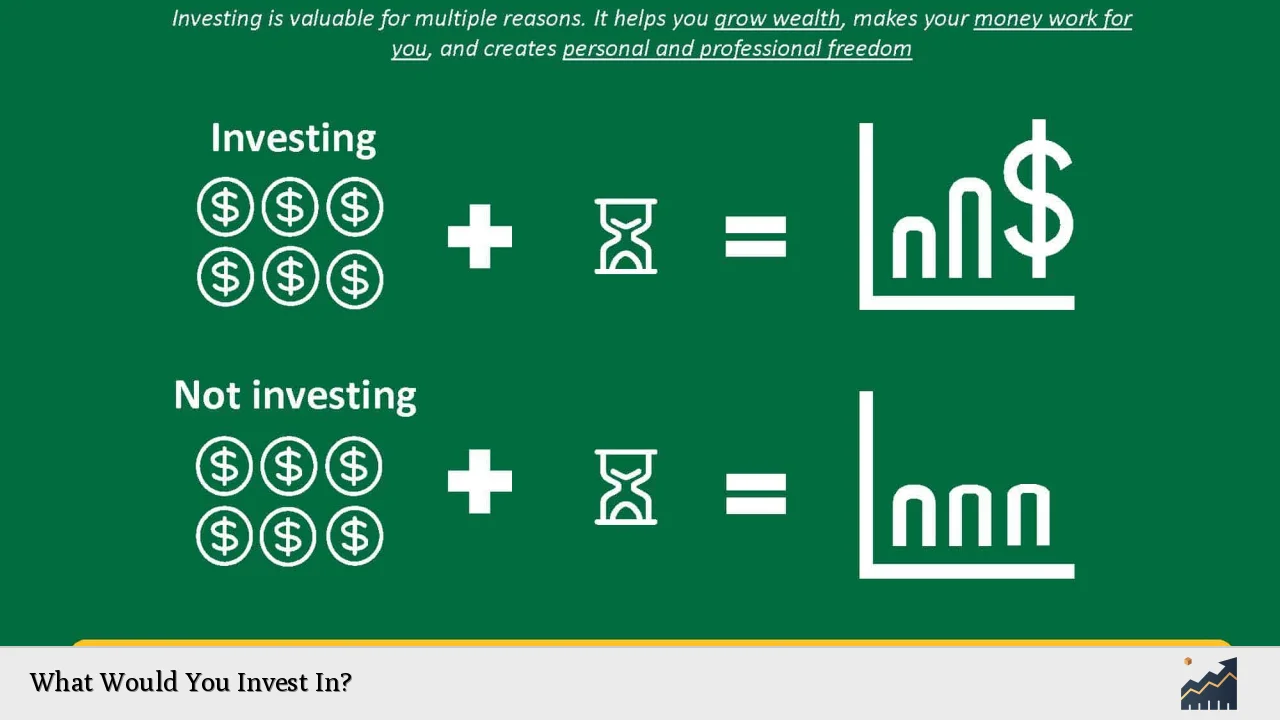

Investing is a crucial aspect of financial planning that allows individuals to grow their wealth over time. The decision of where to invest can be overwhelming due to the plethora of options available. This article aims to guide you through various investment avenues, strategies, and considerations to help you make informed decisions. Whether you’re a novice investor or looking to diversify your portfolio, understanding the fundamentals of investing is essential for achieving your financial goals.

Investing can take many forms, including stocks, bonds, mutual funds, real estate, and alternative investments. Each option has its own risk and return profile, making it vital to assess your financial situation, investment objectives, and risk tolerance before diving in. The right investment strategy will depend on various factors such as your age, income level, and long-term financial goals.

To provide a clearer understanding of the investment landscape, here’s a brief overview of common investment types:

| Investment Type | Description |

|---|---|

| Stocks | Ownership in a company; potential for high returns but higher risk. |

| Bonds | Loans to governments or corporations; generally lower risk with fixed returns. |

| Mutual Funds | Pools of funds from multiple investors to buy diversified assets. |

| Real Estate | Investment in property; can generate rental income and appreciate over time. |

| Alternative Investments | Includes commodities, hedge funds, and private equity; often less liquid. |

Understanding Your Investment Goals

Before investing, it’s crucial to define your investment goals. Are you saving for retirement, a home purchase, or your child’s education? Your objectives will significantly influence your investment choices.

- Short-term goals: If you need access to your money within a few years, consider safer investments like savings accounts or short-term bonds.

- Long-term goals: For goals that are decades away, such as retirement, you can afford to take more risks with stocks or mutual funds that have the potential for higher returns.

Understanding your timeline is critical. The longer you can keep your money invested, the more risk you can typically take on since you have time to recover from market fluctuations.

Assessing Your Risk Tolerance

Your risk tolerance is another key factor in determining what to invest in. It reflects how much risk you’re willing to take with your investments based on your personality and financial situation.

- Conservative investors: Prefer low-risk investments like bonds or dividend-paying stocks that provide steady income with minimal volatility.

- Moderate investors: May choose a mix of stocks and bonds to balance potential growth with some level of safety.

- Aggressive investors: Are willing to take on higher risks for the chance of substantial returns through investments in growth stocks or emerging markets.

It’s essential to be honest about your comfort level with risk; this will help you avoid panic selling during market downturns.

Popular Investment Strategies

There are several effective strategies that investors use based on their goals and risk tolerance. Here are some popular options:

- Buy and Hold: This strategy involves purchasing stocks or funds and holding them for an extended period regardless of market fluctuations. It capitalizes on long-term growth trends.

- Dollar-Cost Averaging: This method entails investing a fixed amount regularly (e.g., monthly) regardless of market conditions. It helps mitigate the impact of volatility by averaging out purchase prices.

- Index Fund Investing: Investing in index funds allows you to buy a broad market index like the S&P 500. This strategy offers diversification at a low cost and is suitable for passive investors.

- Value Investing: This strategy focuses on finding undervalued stocks that have strong fundamentals but are trading below their intrinsic value. Investors aim for long-term gains as the market corrects itself.

- Growth Investing: Investors look for companies expected to grow at an above-average rate compared to their industry. This often involves higher risk but can lead to significant rewards.

Each strategy has its advantages and disadvantages. Consider which aligns best with your investment philosophy and objectives.

Types of Investments

When deciding what to invest in, it’s important to understand the different types of assets available:

Stocks

Investing in stocks means buying shares of companies. Stocks can provide high returns but come with high volatility. It’s essential to research companies thoroughly before investing.

Bonds

Bonds are considered safer than stocks. They offer fixed interest payments over time and return the principal at maturity. Government bonds are typically less risky compared to corporate bonds.

Mutual Funds

Mutual funds pool money from multiple investors to buy diversified portfolios of stocks or bonds. They are managed by professionals but come with management fees that can eat into returns.

Real Estate

Investing in real estate involves purchasing property for rental income or appreciation. Real estate can provide cash flow but requires significant capital and ongoing management.

Alternative Investments

These include commodities like gold or oil, hedge funds, private equity, and collectibles like art or antiques. They often require specialized knowledge and may not be as liquid as traditional investments.

Diversification: A Key Strategy

One of the most critical principles in investing is diversification. By spreading your investments across various asset classes and sectors, you reduce the risk associated with any single investment performing poorly.

- Asset Allocation: Determine what percentage of your portfolio should be allocated to stocks, bonds, real estate, etc., based on your risk tolerance and investment goals.

- Sector Diversification: Invest across different sectors (technology, healthcare, finance) so that downturns in one area do not significantly impact your overall portfolio.

Diversification does not guarantee profits or protect against losses but can help manage overall portfolio risk more effectively.

Staying Informed About Market Trends

Keeping an eye on market trends is vital for making informed investment decisions. Economic indicators such as inflation rates, employment figures, and interest rates can influence market performance significantly.

- Research Sources: Utilize reputable financial news outlets, economic reports, and analysis from experts to stay updated on market conditions.

- Continuous Learning: The investment landscape is always changing; consider taking courses or reading books about investing strategies and market analysis techniques.

Staying informed will empower you to make timely adjustments to your portfolio as needed based on changing economic conditions or personal circumstances.

FAQs About What Would You Invest In

- What is the best investment for beginners?

Index funds are often recommended due to their diversification and lower fees. - How much should I invest initially?

Start with an amount you’re comfortable with; even small amounts can grow over time. - Is real estate a good investment?

Yes, it can provide rental income and appreciation but requires significant capital. - What is dollar-cost averaging?

This strategy involves regularly investing a fixed amount regardless of market conditions. - How do I assess my risk tolerance?

Consider factors like age, financial situation, and comfort level with market fluctuations.

In conclusion, choosing where to invest requires careful consideration of your financial goals, risk tolerance, and market conditions. By understanding different investment types and strategies while staying informed about economic trends, you can build a robust portfolio that aligns with your aspirations. Remember that investing is a long-term commitment; patience and discipline are key components for success in this endeavor.