Investing is a crucial aspect of personal finance that allows individuals to grow their wealth over time. With various investment options available, it can be challenging to determine which ones are suitable for your financial goals. A good investment typically offers the potential for returns that exceed inflation, while also aligning with your risk tolerance and investment horizon. This article explores several investment opportunities, strategies, and considerations to help you make informed decisions.

| Investment Type | Description |

|---|---|

| Stocks | Equity ownership in a company, offering potential for high returns. |

| Bonds | Debt instruments providing fixed interest over time. |

| Mutual Funds | Pooled investments managed by professionals. |

| Real Estate | Property investments for rental income and appreciation. |

| ETFs | Funds traded like stocks, offering diversification. |

Understanding Different Investment Types

Investors have a variety of options when it comes to choosing where to allocate their funds. Each type of investment has its unique characteristics, risks, and potential rewards.

- Stocks: Investing in stocks means buying shares of a company. Stocks can offer high returns, especially if the company grows significantly. However, they also come with higher volatility and risk.

- Bonds: Bonds are loans made to corporations or governments in exchange for periodic interest payments and the return of principal at maturity. They are generally considered safer than stocks but offer lower returns.

- Mutual Funds: These are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Managed by professionals, mutual funds can provide diversification and professional management.

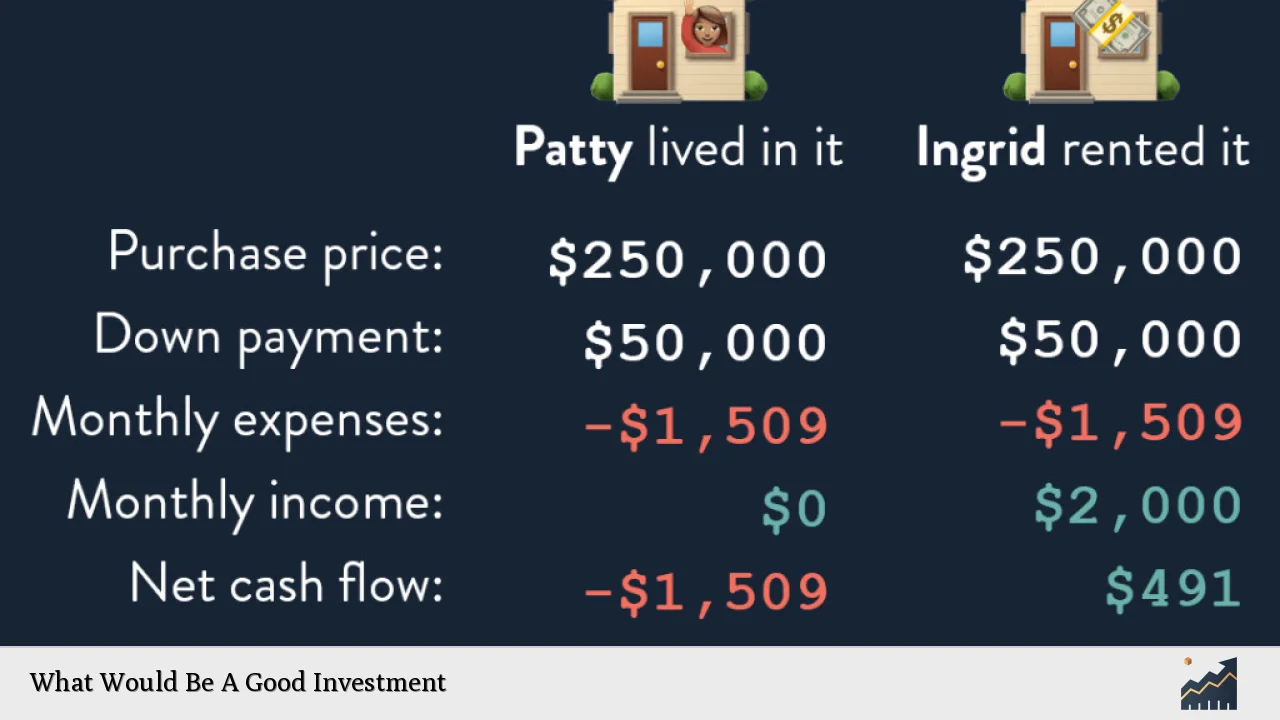

- Real Estate: Investing in real estate involves purchasing properties for rental income or capital appreciation. Real estate can provide steady cash flow but requires significant capital and ongoing management.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and typically have lower fees compared to mutual funds.

Investment Strategies for Beginners

When starting your investment journey, it’s essential to adopt strategies that match your financial goals and risk appetite. Here are some effective strategies:

- Buy and Hold: This long-term strategy involves purchasing stocks or funds and holding them for several years. It allows you to benefit from compounding returns without frequent trading.

- Index Fund Investing: Investing in index funds involves buying funds that track specific market indices, such as the S&P 500. This strategy provides broad market exposure with lower fees.

- Dollar-Cost Averaging: This approach entails regularly investing a fixed amount of money into a particular investment over time. It helps mitigate the impact of market volatility by spreading out your purchase points.

- Income Investing: Focus on investments that generate regular income through dividends or interest payments. This strategy is ideal for those seeking cash flow alongside capital appreciation.

- Diversification: Spread your investments across different asset classes to reduce risk. A well-diversified portfolio can help protect against market downturns.

Assessing Risk Tolerance

Understanding your risk tolerance is critical when selecting investments. Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. Factors influencing risk tolerance include:

- Time Horizon: The length of time you plan to hold an investment affects your risk tolerance. Longer time horizons typically allow for more aggressive investments since you have time to recover from market downturns.

- Financial Situation: Your current financial status, including income, expenses, and savings, plays a role in determining how much risk you can take on without jeopardizing your financial stability.

- Investment Goals: Clearly defined goals help shape your investment strategy. For instance, saving for retirement may allow for more risk than saving for a short-term purchase.

The Importance of Research

Conducting thorough research before making any investment decisions is essential. Here are some key aspects to consider:

- Company Fundamentals: When investing in individual stocks, analyze the company’s financial health, management team, competitive position, and growth potential.

- Market Trends: Stay informed about economic indicators and market trends that could impact your investments. Understanding macroeconomic factors can help you make better decisions.

- Investment Vehicles: Familiarize yourself with different types of investment vehicles available in the market. Each has its own set of rules, fees, and tax implications that could affect your returns.

Setting Clear Investment Goals

Establishing clear financial goals is vital for successful investing. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Consider the following when setting goals:

- Short-Term vs Long-Term Goals: Differentiate between short-term goals (e.g., saving for a vacation) and long-term goals (e.g., retirement). Your investment strategy will vary based on the timeline for each goal.

- Amount Needed: Determine how much money you need to achieve each goal. This will guide how much you need to invest regularly.

- Review Regularly: Periodically review your goals and adjust them as necessary based on changes in your life circumstances or market conditions.

Tax Considerations in Investing

Understanding the tax implications of your investments is crucial for maximizing returns. Different types of investments are taxed differently:

- Capital Gains Tax: Profits from selling investments may be subject to capital gains tax. Long-term capital gains (for assets held over one year) are usually taxed at a lower rate than short-term gains.

- Dividends Taxation: Dividend income may also be taxed at different rates depending on whether they are qualified or non-qualified dividends.

- Tax-Advantaged Accounts: Consider using tax-advantaged accounts like IRAs or 401(k)s for retirement savings to defer taxes on earnings until withdrawal.

Building an Investment Portfolio

Creating a well-balanced investment portfolio involves selecting a mix of assets that align with your risk tolerance and investment goals:

1. Determine Asset Allocation: Decide how much of your portfolio will be allocated to different asset classes such as stocks, bonds, real estate, etc., based on your risk profile.

2. Select Investments Within Each Asset Class: Choose specific investments within each asset class that align with your overall strategy.

3. Regular Rebalancing: Over time, some investments may outperform others leading to an unbalanced portfolio. Regularly rebalance your portfolio to maintain your desired asset allocation.

4. Monitor Performance: Keep track of how your investments perform against benchmarks and adjust as necessary based on changes in market conditions or personal circumstances.

5. Stay Disciplined: Avoid making impulsive decisions based on short-term market fluctuations; stick to your long-term strategy unless there is a significant reason to change course.

FAQs About Good Investments

- What is the best type of investment for beginners?

Index funds are often recommended as they provide diversification with lower costs. - How much should I invest initially?

Start with an amount you can afford without impacting your daily expenses or emergency savings. - What is diversification?

Diversification involves spreading investments across various asset classes to reduce risk. - How do I assess my risk tolerance?

Your risk tolerance can be assessed by considering factors like age, financial situation, and investment goals. - What are tax-efficient investing strategies?

Utilizing tax-advantaged accounts like IRAs or focusing on long-term capital gains can enhance tax efficiency.

In conclusion, identifying good investments requires understanding various options available while considering personal financial goals and risk tolerance. By employing sound strategies such as diversification and research while setting clear objectives and monitoring performance regularly, investors can build portfolios that align with their aspirations effectively.