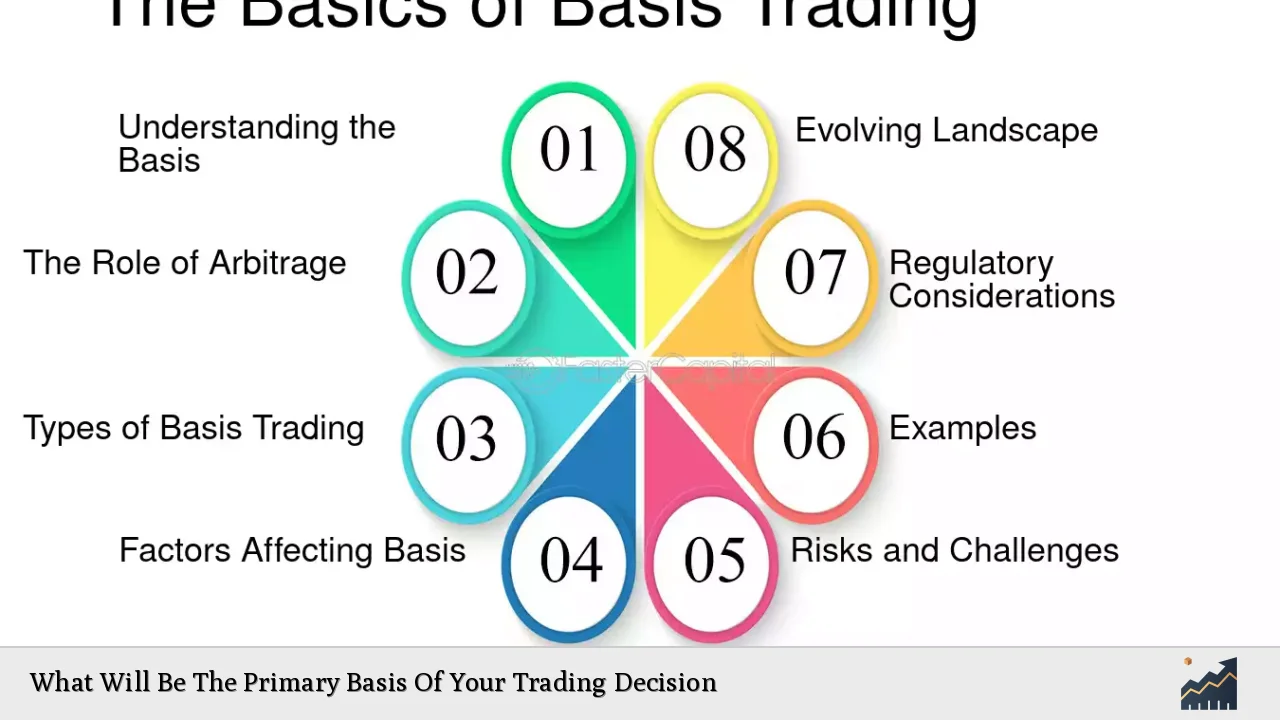

In the dynamic world of trading, the foundation of successful decision-making hinges on a multitude of factors that influence market behavior and individual investor psychology. Understanding these factors is crucial for both novice and experienced traders aiming to navigate the complexities of financial markets. The primary basis of trading decisions typically revolves around a blend of market analysis, strategic implementation, risk management, and regulatory awareness. This comprehensive guide delves into these critical components, providing insights into how they shape trading decisions and strategies.

| Key Concept | Description/Impact |

|---|---|

| Market Analysis | Involves assessing economic indicators, market trends, and technical analysis to make informed trading decisions. |

| Trading Strategy | A defined approach that outlines when to enter or exit trades based on specific criteria such as technical signals or fundamental analysis. |

| Risk Management | Strategies to minimize potential losses through diversification, stop-loss orders, and position sizing. |

| Regulatory Environment | Understanding regulations that govern trading practices, which can impact market behavior and investor confidence. |

| Market Sentiment | The overall attitude of investors toward a particular market or asset class, often driven by news events and economic data. |

| Psychological Factors | Cognitive biases and emotional responses that can influence decision-making processes in trading. |

Market Analysis and Trends

Effective trading decisions begin with thorough market analysis, which encompasses both fundamental and technical aspects.

- Fundamental Analysis: This involves evaluating economic indicators such as GDP growth rates, unemployment figures, inflation rates, and central bank policies. For instance, the recent increase in U.S. inflation to 2.6% in October 2024 has implications for Federal Reserve policies and interest rates, impacting equity markets significantly.

- Technical Analysis: Traders utilize charts and historical data to identify patterns and trends that may indicate future price movements. Tools such as moving averages, relative strength index (RSI), and Fibonacci retracements are commonly employed to forecast potential entry and exit points.

- Current Market Trends: As of December 2024, major indices like the S&P 500 have shown a remarkable increase of 32.01% over the past year despite market volatilities. This growth reflects broader economic recovery trends and investor optimism regarding fiscal policies under the new U.S. administration.

Implementation Strategies

Once traders have conducted their analyses, the next step is to formulate implementation strategies that guide their trading actions.

- Defining Goals: Traders should clearly outline their short-term and long-term objectives. This includes establishing risk-reward ratios that align with their investment philosophy.

- Developing a Trading Plan: A structured plan detailing entry and exit strategies is essential. For example, day traders may focus on high-volatility stocks to capitalize on intraday price movements, while swing traders might look for stocks poised for medium-term gains based on technical indicators.

- Adhering to a Strategy: Emotional discipline is vital; traders must stick to their predetermined plans even amidst market fluctuations. This helps mitigate impulsive decisions driven by fear or greed.

Risk Considerations

Risk management is a cornerstone of successful trading. It involves identifying potential risks associated with trading activities and implementing measures to mitigate them.

- Diversification: Spreading investments across various asset classes can reduce exposure to any single investment’s volatility.

- Stop-Loss Orders: These orders automatically sell a security when it reaches a certain price, helping limit potential losses.

- Position Sizing: Determining the appropriate amount of capital to allocate to each trade based on risk tolerance can prevent significant financial setbacks.

Regulatory Aspects

Understanding the regulatory environment is crucial for compliance and informed decision-making.

- Market Regulations: Traders must be aware of regulations set forth by bodies like the SEC in the U.S., which govern trading practices to ensure fair markets. Non-compliance can lead to severe penalties.

- Impact of Regulations on Trading Strategies: Changes in regulations can affect market dynamics; for instance, new tax laws or changes in margin requirements can influence trader behavior significantly.

Future Outlook

Looking ahead, several factors will shape the future landscape of trading decisions:

- Economic Indicators: Continued monitoring of key economic indicators such as inflation rates, employment statistics, and GDP growth will be essential for anticipating market movements.

- Technological Advancements: The rise of AI-driven analytics tools is transforming how traders analyze data and make decisions. These technologies provide deeper insights into market trends and investor sentiment.

- Geopolitical Events: Global events such as elections or international trade negotiations can create volatility in markets. Traders must remain vigilant about how these developments could impact their positions.

Frequently Asked Questions About What Will Be The Primary Basis Of Your Trading Decision

- What is the most important factor in making trading decisions?

The most crucial factor varies by trader but typically includes market analysis combined with personal risk tolerance and investment goals. - How do I develop a successful trading strategy?

A successful strategy involves thorough research, clear goal-setting, backtesting against historical data, and ongoing adjustments based on market conditions. - What role does psychology play in trading?

Psychological factors such as fear and greed can significantly impact decision-making; maintaining emotional discipline is essential for success. - How can I manage risk effectively?

Effective risk management includes diversification, using stop-loss orders, position sizing according to risk tolerance, and regular portfolio reviews. - What are some common mistakes traders make?

Common mistakes include over-leveraging positions, failing to adhere to a trading plan, neglecting research, and allowing emotions to dictate trades. - How often should I evaluate my trading performance?

Traders should regularly evaluate their performance—ideally after each trade or at least weekly—to identify areas for improvement. - What resources are available for improving my trading skills?

A variety of resources are available including online courses, webinars, books on trading psychology and strategies, as well as mentorship programs. - How do regulatory changes affect my trading decisions?

Regulatory changes can impact margin requirements, tax implications on profits/losses, and overall market accessibility; staying informed is crucial.

This comprehensive overview emphasizes that effective trading decisions are multi-faceted processes influenced by various analytical approaches, strategic planning, risk management practices, regulatory knowledge, psychological awareness, and future outlook considerations. By integrating these elements into their decision-making framework, traders can enhance their potential for success in the ever-evolving financial markets.