Investing in the S&P 500 is a popular choice for many individuals looking to grow their wealth over time. The S&P 500 index comprises 500 of the largest publicly traded companies in the United States, providing investors with broad exposure to the U.S. stock market. This diversification helps mitigate risk, as the performance of individual stocks can vary significantly. Investors often choose to invest in S&P 500 index funds or exchange-traded funds (ETFs) that track the index, allowing them to benefit from the overall growth of these companies without needing to pick individual stocks.

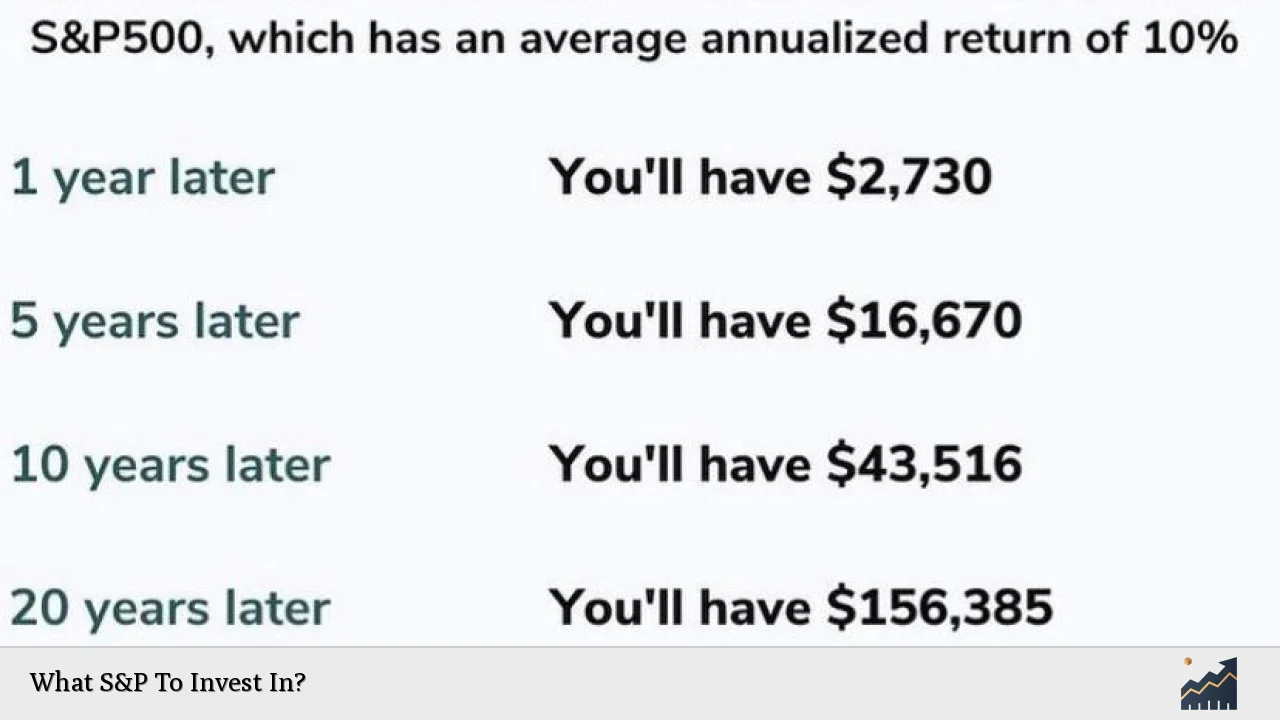

The S&P 500 has historically provided an average annual return of about 10%, making it an attractive option for long-term investors. With many funds available, it’s essential to consider factors such as expense ratios, performance history, and management style when selecting an S&P 500 investment.

| Fund Name | Expense Ratio |

|---|---|

| Vanguard S&P 500 ETF (VOO) | 0.03% |

| Schwab S&P 500 Index Fund (SWPPX) | 0.02% |

| Fidelity Zero Large Cap Index (FNILX) | 0.00% |

Investors should also be aware of the potential risks associated with investing in the S&P 500. While the index provides exposure to large-cap companies, it does not include smaller companies that may offer higher growth potential. Additionally, market fluctuations can impact the index’s performance, so a long-term investment horizon is typically recommended.

Understanding S&P 500 Index Funds

S&P 500 index funds are designed to replicate the performance of the S&P 500 index by holding shares of the companies included in that index. These funds can be structured as mutual funds or ETFs, each with its advantages and disadvantages.

Mutual Funds are typically bought directly from a fund company and are priced at the end of the trading day based on their net asset value (NAV). They may have minimum investment requirements and could charge fees known as “loads.”

ETFs, on the other hand, trade on stock exchanges like individual stocks and can be bought or sold throughout the trading day at market prices. They generally have lower expense ratios compared to mutual funds, making them more cost-effective for many investors.

Investors should consider their investment goals and preferences when choosing between mutual funds and ETFs.

Benefits of Investing in S&P 500 Funds

Investing in S&P 500 funds offers several key benefits:

- Diversification: By investing in an S&P 500 fund, you gain exposure to 500 different companies, reducing your risk compared to investing in individual stocks.

- Cost-Effectiveness: Many S&P 500 funds have very low expense ratios, which means you keep more of your investment returns.

- Historical Performance: The S&P 500 has shown consistent long-term growth, making it a reliable choice for investors looking for capital appreciation.

- Ease of Access: These funds are widely available through various brokerage platforms, making it easy for investors to get started.

Despite these advantages, it’s essential to remember that all investments carry risks. The value of your investment can fluctuate based on market conditions.

Top Choices for S&P 500 Investments

When considering which S&P 500 fund to invest in, several options stand out due to their low costs and strong performance history:

- Vanguard S&P 500 ETF (VOO): With an expense ratio of 0.03%, VOO is one of the largest ETFs tracking the S&P 500. It provides excellent liquidity and has a strong track record of performance.

- Schwab S&P 500 Index Fund (SWPPX): This mutual fund boasts an expense ratio of just 0.02%, making it one of the cheapest options available. It has a solid performance history and is suitable for long-term investors.

- Fidelity Zero Large Cap Index (FNILX): This fund has no expense ratio at all, allowing investors to keep all their returns. It tracks large-cap U.S. stocks effectively, including those in the S&P 500.

These options cater to different investor preferences, whether you prefer ETFs or mutual funds.

Factors to Consider When Investing

Before investing in an S&P 500 fund, consider these important factors:

- Expense Ratios: Lower expense ratios mean more money stays invested rather than going towards fees.

- Performance History: Look at how long the fund has been operating and its historical returns compared to its benchmark.

- Investment Strategy: Understand whether you prefer passive management through index tracking or active management strategies that attempt to outperform the index.

- Minimum Investment Requirements: Some mutual funds may have minimum investment thresholds that could impact your ability to invest.

By taking these factors into account, you can make a more informed decision about which fund aligns best with your financial goals.

Risks Associated with Investing in the S&P 500

While investing in an S&P 500 fund can be beneficial, there are inherent risks involved:

- Market Volatility: The stock market can be unpredictable; prices may fluctuate significantly over short periods.

- Concentration Risk: The largest companies dominate the index; therefore, if these firms underperform, it could negatively affect your investment’s overall performance.

- Limited Exposure: The index primarily includes large-cap U.S. companies; smaller companies may offer higher growth potential but are not represented in this index.

Understanding these risks will help you manage your expectations and build a balanced investment portfolio that aligns with your risk tolerance.

How to Invest in an S&P 500 Fund

Investing in an S&P 500 fund is straightforward:

1. Choose a Brokerage Account: Open a brokerage account if you don’t already have one; many offer commission-free trading on ETFs.

2. Select Your Fund: Research and choose an appropriate fund based on expense ratios, performance history, and your investment strategy.

3. Decide on Your Investment Amount: Determine how much money you want to invest initially.

4. Place Your Order: Execute your trade through your brokerage account by entering the ticker symbol for your chosen fund.

5. Monitor Your Investment: Regularly review your investment’s performance and make adjustments as necessary based on your financial goals.

By following these steps, you can effectively invest in an S&P 500 fund and start building your portfolio today.

FAQs About What S&P To Invest In

- What is an S&P 500 index fund?

An S&P 500 index fund tracks the performance of the S&P 500 by holding shares of its constituent companies. - How do I buy an S&P 500 ETF?

You can purchase an S&P 500 ETF through a brokerage account like any other stock. - What are some popular S&P 500 funds?

Popular options include Vanguard S&P 500 ETF (VOO), Schwab S&P 500 Index Fund (SWPPX), and Fidelity Zero Large Cap Index (FNILX). - Are there risks associated with investing in these funds?

Yes, market volatility and concentration risk are significant factors to consider when investing. - How much does it cost to invest in an S&P 500 fund?

Costs vary by fund but often include low expense ratios; some funds even have no fees.

Investing in an S&P 500 fund can be a smart strategy for building wealth over time while managing risk through diversification. By understanding your options and carefully selecting a fund that aligns with your financial goals, you can take advantage of this powerful investment vehicle effectively.