Investing in the S&P 500 is a popular choice for many investors looking to gain exposure to the U.S. stock market. The S&P 500 index tracks the performance of 500 of the largest publicly traded companies in the United States, making it a reliable indicator of market trends and economic health. By investing in S&P 500 index funds or ETFs, investors can achieve diversification and potentially benefit from long-term capital appreciation.

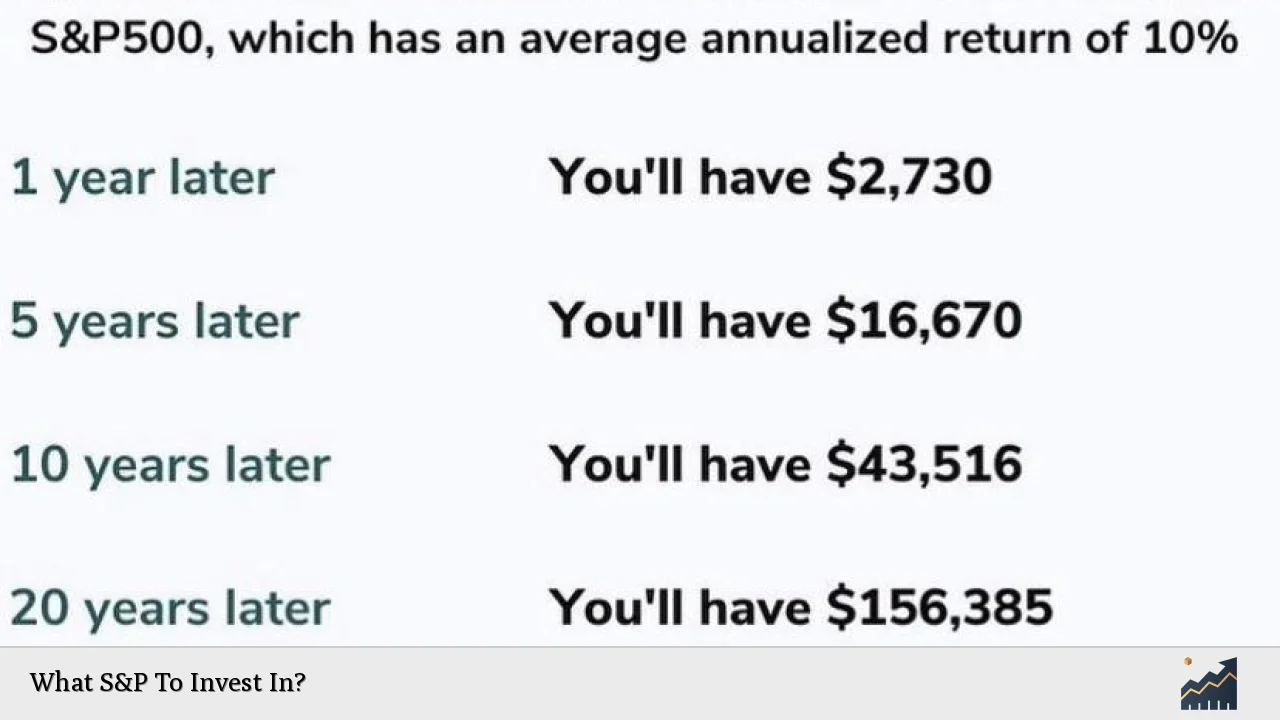

The S&P 500 has historically provided an average annual return of about 10%, making it an attractive option for those with a long-term investment horizon. This index includes major companies across various sectors, such as technology, healthcare, and consumer goods, allowing investors to own a piece of many leading firms without needing to buy individual stocks.

Investors can choose between various S&P 500 index funds and ETFs based on factors like expense ratios, historical performance, and management style. Below is a concise overview of key considerations when selecting an S&P 500 investment.

| Investment Type | Description |

|---|---|

| Index Funds | Mutual funds that aim to replicate the performance of the S&P 500. |

| ETFs | Exchange-traded funds that track the S&P 500 and trade like stocks. |

Types of S&P 500 Investments

When considering investments in the S&P 500, you have two primary options: index funds and ETFs. Each has its own advantages and characteristics that may appeal to different types of investors.

Index Funds

Index funds are mutual funds designed to mirror the performance of the S&P 500. They are typically passively managed, meaning they automatically adjust their holdings to reflect changes in the index. Here are some important features:

- Low Expense Ratios: Many index funds have low fees compared to actively managed funds.

- Long-Term Growth: Historically, these funds have provided solid returns over extended periods.

- Minimum Investment Requirements: Some index funds may require a minimum investment, which varies by fund.

ETFs

Exchange-Traded Funds (ETFs) also track the performance of the S&P 500 but trade like stocks on an exchange. This allows for more flexibility in buying and selling throughout the trading day. Key features include:

- Liquidity: ETFs can be bought or sold at any time during market hours.

- Tax Efficiency: Generally, ETFs are more tax-efficient than mutual funds due to their structure.

- No Minimum Investment: Most ETFs do not have minimum investment requirements beyond the price of one share.

Both investment types provide exposure to the same underlying assets but cater to different trading strategies and preferences.

Best S&P 500 Funds for Investment

Choosing the right fund is crucial for achieving your investment goals. Here are some of the top-rated S&P 500 index funds and ETFs you might consider:

Vanguard S&P 500 ETF (VOO)

- Expense Ratio: 0.03%

- 5-Year Annualized Return: 14.7%

- Overview: This ETF is one of the largest in the market and is known for its low costs and strong performance history.

Schwab S&P 500 Index Fund (SWPPX)

- Expense Ratio: 0.02%

- 5-Year Annualized Return: 14.7%

- Overview: Sponsored by Charles Schwab, this fund has a solid reputation for investor-friendly practices and low fees.

Fidelity Zero Large Cap Index (FNILX)

- Expense Ratio: 0.00%

- 5-Year Annualized Return: Not specified

- Overview: This fund has no expense ratio, making it an attractive option for cost-conscious investors.

These funds are well-regarded for their performance and low costs, making them suitable choices for both novice and experienced investors.

Factors to Consider When Investing

When deciding where to invest within the S&P 500, several factors should be taken into account:

Expense Ratios

The expense ratio represents the annual fee charged by a fund manager as a percentage of your investment. Lower expense ratios mean more of your money stays invested, which can significantly impact your returns over time.

Performance History

While past performance does not guarantee future results, reviewing a fund’s historical returns can provide insight into how it has reacted in different market conditions.

Fund Size and Management

Larger funds often have more resources for research and management but may also come with higher fees. Consider whether you prefer a larger fund with established performance or a smaller fund that may offer unique opportunities.

How to Invest in S&P 500 Funds

Investing in S&P 500 index funds or ETFs can be straightforward if you follow these steps:

1. Open a Brokerage Account: Choose a reputable brokerage that offers access to index funds or ETFs.

2. Research Funds: Compare different options based on expense ratios, historical performance, and your investment goals.

3. Decide on Investment Amount: Determine how much you want to invest based on your financial situation.

4. Place Your Order: For ETFs, you can buy shares during market hours; for mutual funds, purchases occur at the end of the trading day at net asset value (NAV).

5. Monitor Your Investment: Regularly review your portfolio to ensure it aligns with your financial goals.

By following these steps, you can effectively invest in an S&P 500 fund that meets your needs.

Advantages of Investing in the S&P 500

Investing in an S&P 500 index fund or ETF comes with several advantages:

- Diversification: By investing in one fund, you gain exposure to hundreds of companies across various sectors.

- Lower Risk: The broad diversification typically reduces risk compared to investing in individual stocks.

- Historical Performance: The long-term average return of around 10% annually makes it a reliable choice for growth-oriented investors.

These benefits make investing in the S&P 500 appealing for both new and seasoned investors seeking long-term growth potential.

Disadvantages of Investing in the S&P 500

While there are many advantages to investing in the S&P 500, there are also some drawbacks:

- Market Volatility: The stock market can be unpredictable; even diversified investments can experience significant fluctuations.

- Limited Exposure to Small-Cap Stocks: The focus on large-cap companies means limited exposure to potentially high-growth small-cap stocks.

- U.S.-Centric Investments: The S&P 500 only includes U.S.-based companies, limiting international diversification opportunities.

Understanding these disadvantages can help investors make informed decisions regarding their portfolios.

FAQs About What S&P To Invest In

- What is an S&P 500 index fund?

An S&P 500 index fund is a type of mutual fund or ETF that aims to replicate the performance of the S&P 500 index. - How do I choose an S&P 500 fund?

Consider factors like expense ratios, historical performance, and management style when selecting an S&P 500 fund. - Are ETFs better than index funds?

ETFs offer greater liquidity as they trade like stocks throughout the day, while index funds are only priced at day’s end. - What are some top-rated S&P 500 funds?

Popular options include Vanguard’s VOO, Schwab’s SWPPX, and Fidelity’s FNILX. - Is investing in the S&P 500 safe?

While generally lower risk than individual stocks due to diversification, investing still carries inherent market risks.

Investing in an S&P 500 index fund or ETF can be a strategic move for those looking to build wealth over time while minimizing risks associated with individual stock selection. By understanding your options and following sound investment principles, you can effectively participate in one of the most established indices in financial markets today.