Investing with a Roth IRA can be one of the most effective ways to grow your retirement savings. A Roth IRA allows your investments to grow tax-free, and withdrawals in retirement are also tax-free, given certain conditions are met. This account is particularly beneficial for those who expect to be in a higher tax bracket during retirement than they are currently. Understanding how to invest within a Roth IRA can help you maximize your returns and secure your financial future.

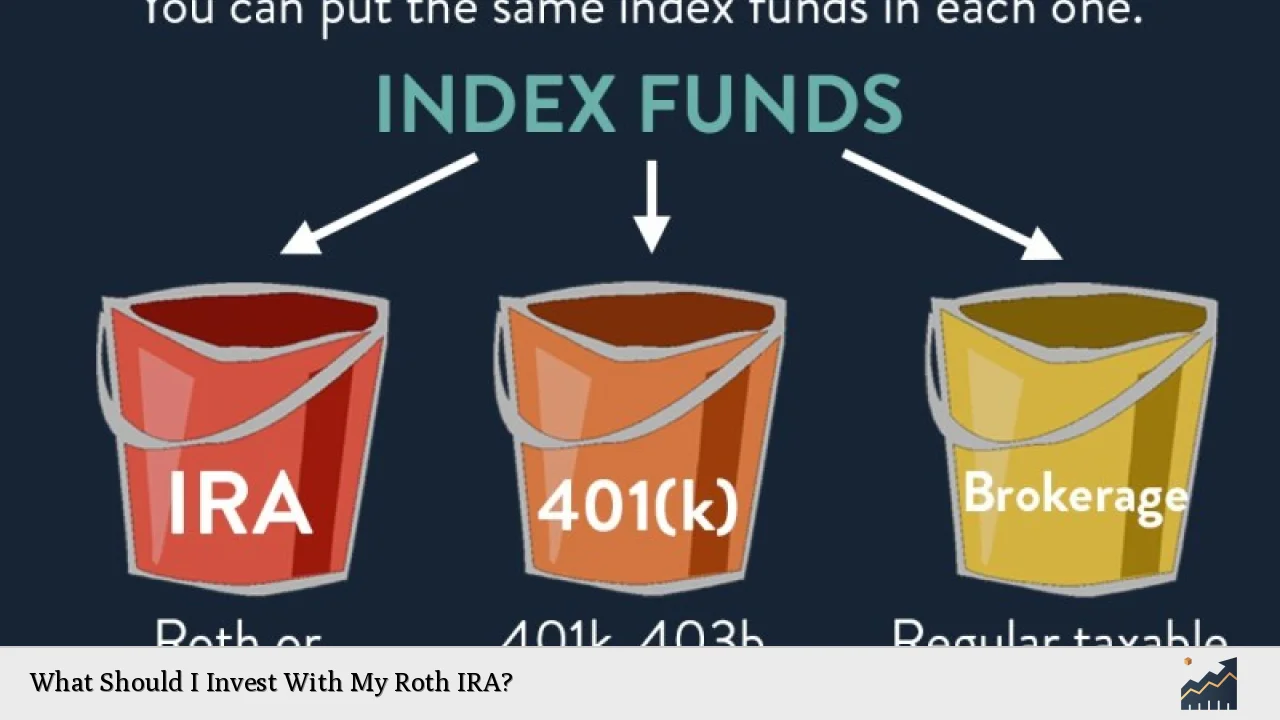

When it comes to choosing investments for your Roth IRA, it’s essential to consider factors such as your investment goals, risk tolerance, and time horizon. A well-diversified portfolio can help mitigate risks while enhancing potential returns. Below is an overview of popular investment options that can be held within a Roth IRA.

| Investment Type | Description |

|---|---|

| Stocks | Equities that can provide growth and dividends. |

| Bonds | Debt securities that offer fixed income. |

| Mutual Funds | Pooled funds that invest in a diversified portfolio. |

| ETFs | Exchange-traded funds that track indices or sectors. |

| REITs | Real estate investment trusts that invest in real estate. |

Understanding the Basics of a Roth IRA

A Roth IRA is a type of individual retirement account (IRA) where contributions are made with after-tax dollars. This means you pay taxes on the money before you deposit it into the account, but your investments grow tax-free. Withdrawals of both contributions and earnings are tax-free in retirement if certain conditions are met, such as being at least 59½ years old and having the account open for at least five years.

One of the significant advantages of a Roth IRA is that it does not have required minimum distributions (RMDs) during the account holder’s lifetime. This allows your investments to continue growing without being forced to withdraw funds at any specific age. Additionally, contributions can be withdrawn at any time without penalties, providing flexibility for investors.

The contribution limits for a Roth IRA in 2024 are $7,000 annually for individuals under age 50 and $8,000 for those aged 50 and older. Income limits may affect eligibility to contribute directly to a Roth IRA, so it’s essential to be aware of these thresholds.

Popular Investment Options for Your Roth IRA

When investing within a Roth IRA, diversification is crucial. Here are some popular investment types:

- U.S. Stock Index Funds: These funds track major stock indices like the S&P 500, offering broad exposure to the U.S. economy with relatively low fees.

- Bond Index Funds: These provide exposure to various bonds, helping stabilize your portfolio against stock market volatility.

- Global Stock Index Funds: Investing in international markets can enhance diversification and potentially increase returns.

- Dividend Stock Funds: These funds focus on companies that pay regular dividends, providing income along with potential capital appreciation.

- Real Estate Investment Trusts (REITs): REITs allow you to invest in real estate without directly owning property, often providing high dividend yields.

- Target-Date Funds: These automatically adjust the asset allocation based on your target retirement date, becoming more conservative as you approach retirement.

Strategies for Building Your Roth IRA Portfolio

Building an effective investment strategy for your Roth IRA involves several steps:

1. Define Your Investment Goals: Determine whether your primary goal is growth, income generation, or capital preservation. This will guide your investment choices.

2. Assess Your Risk Tolerance: Understand how much risk you are willing to take on. Younger investors may opt for more aggressive portfolios with higher stock allocations.

3. Diversify Your Investments: Spread your investments across different asset classes (stocks, bonds, real estate) and sectors (technology, healthcare) to reduce risk.

4. Consider Time Horizon: If you have a long time until retirement, you may choose more volatile investments like stocks. Conversely, if retirement is near, consider shifting towards more stable assets like bonds.

5. Review and Adjust Regularly: Periodically reassess your portfolio to ensure it aligns with your goals and risk tolerance as market conditions change or as you age.

The Importance of Low-Cost Investments

One key factor in successful investing is minimizing costs associated with managing your investments. High fees can significantly erode returns over time. When selecting mutual funds or ETFs for your Roth IRA:

- Look for funds with low expense ratios.

- Consider index funds that typically have lower fees compared to actively managed funds.

- Evaluate trading commissions if you’re using a brokerage platform; many now offer commission-free trades for certain investments.

By focusing on low-cost options, you can maximize the growth potential of your Roth IRA over the long term.

Risks Associated with Investing in a Roth IRA

While a Roth IRA offers many benefits, it’s essential to understand the risks involved:

- Market Risk: The value of stocks and bonds can fluctuate based on market conditions.

- Interest Rate Risk: Bond prices may decline if interest rates rise.

- Inflation Risk: Over time, inflation can erode purchasing power if investment returns do not outpace inflation rates.

- Concentration Risk: Investing too heavily in one asset class or sector can lead to significant losses if that area underperforms.

To mitigate these risks, maintain a diversified portfolio and regularly review your investment strategy based on changing financial goals or market conditions.

FAQs About What Should I Invest With My Roth IRA

- What types of investments can I hold in my Roth IRA?

You can hold stocks, bonds, mutual funds, ETFs, REITs, and more in a Roth IRA. - Are there any prohibited investments in a Roth IRA?

Yes, life insurance and collectibles are prohibited investments in a Roth IRA. - How often should I review my Roth IRA investments?

You should review your investments at least annually or when significant life changes occur. - Can I withdraw my contributions from my Roth IRA anytime?

Yes, you can withdraw contributions without taxes or penalties at any time. - What happens if I exceed the contribution limit?

If you exceed the contribution limit, you may face penalties unless corrected promptly by withdrawing excess contributions.

By understanding these aspects of investing within a Roth IRA and implementing sound strategies tailored to your financial goals and risk tolerance, you can effectively build a robust retirement portfolio that leverages the unique benefits of this tax-advantaged account.