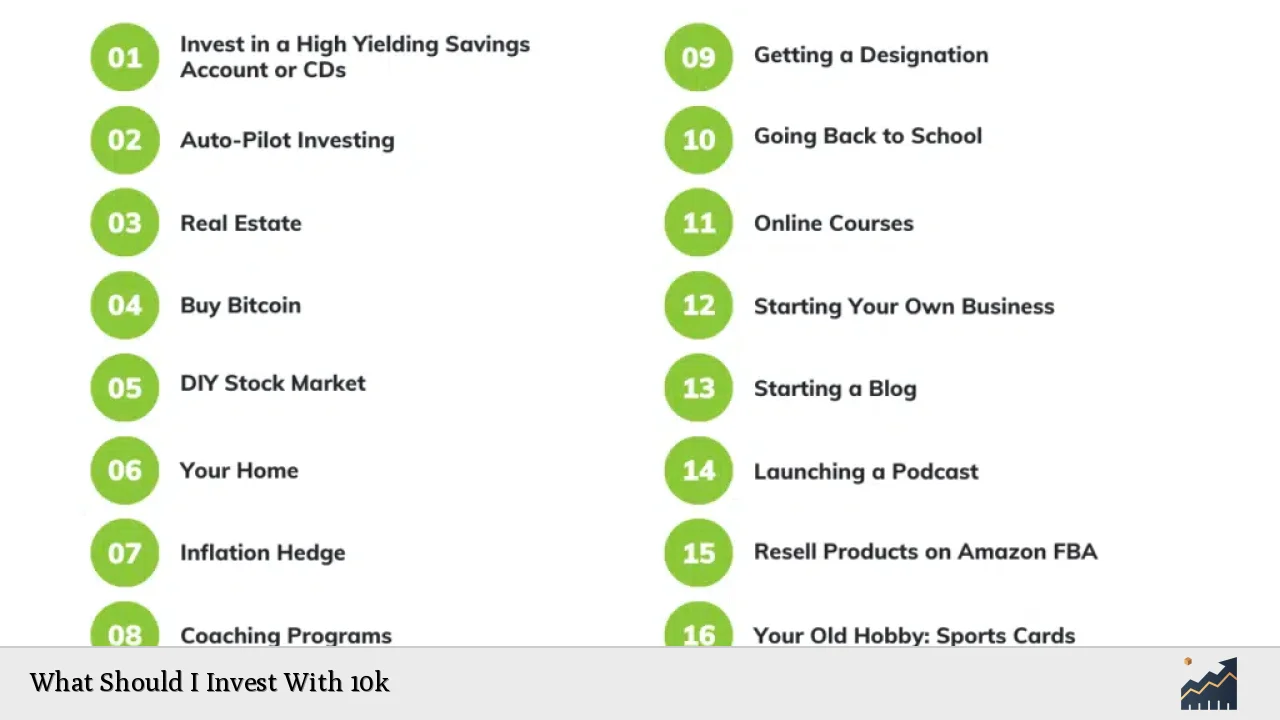

Investing $10,000 can be a pivotal step toward building wealth and securing your financial future. The right investment strategy will depend on your financial goals, risk tolerance, and investment timeline. Whether you are looking for short-term gains or long-term growth, there are various avenues to explore. This article will guide you through the best options for investing $10,000, helping you make informed decisions that align with your financial aspirations.

| Investment Option | Description |

|---|---|

| Stock Market | Investing in individual stocks or ETFs for potential high returns. |

| Mutual Funds | Professionally managed funds that pool money from multiple investors. |

| Real Estate Investment Trusts (REITs) | Investing in real estate without owning property directly. |

| Bonds | Debt securities that provide fixed interest over time. |

| High-Yield Savings Accounts | Safe accounts that offer higher interest rates than traditional savings. |

Understanding Your Investment Goals

Before diving into specific investment strategies, it’s crucial to define your investment goals. Ask yourself what you want to achieve with your $10,000. Are you saving for retirement, a major purchase, or simply looking to grow your wealth?

Setting clear objectives will help shape your investment choices. For instance, if your goal is long-term growth, you might lean towards stocks or mutual funds. Conversely, if you need access to your money within a few years, safer options like high-yield savings accounts or bonds may be more suitable.

Your risk tolerance is another essential factor. If you are comfortable with market fluctuations and can withstand potential losses, investing in the stock market could yield significant returns. However, if you prefer stability and lower risk, consider options like bonds or high-yield savings accounts.

Stock Market Investments

Investing in the stock market is one of the most popular ways to grow your money. With $10,000, you can purchase shares in individual companies or invest in exchange-traded funds (ETFs) and mutual funds.

- Individual Stocks: Buying shares of companies can be rewarding if you choose wisely. Look for companies with strong fundamentals and growth potential.

- ETFs and Mutual Funds: These funds allow you to invest in a diversified portfolio without having to pick individual stocks. They are managed by professionals and can be a great option for beginners.

Investing in the stock market carries risks but also offers the potential for high returns over time. Historically, the stock market has averaged annual returns of about 7-10%, making it an attractive option for long-term investors.

Real Estate Investments

While $10,000 may not be enough for direct real estate purchases, it can still be effectively used through Real Estate Investment Trusts (REITs). REITs allow you to invest in real estate markets without the need to buy physical properties.

- Benefits of REITs: They provide exposure to real estate markets and often pay dividends. This can be an excellent way to generate passive income while diversifying your investment portfolio.

You could also consider crowdfunding platforms that allow you to invest in real estate projects with smaller amounts of capital. This approach provides access to potential profits from property investments without the responsibilities of being a landlord.

Bonds and Fixed-Income Investments

If you’re looking for stability and lower risk, consider investing in bonds or fixed-income securities. Bonds are essentially loans made to governments or corporations that pay interest over time.

- Types of Bonds: Government bonds are generally considered safer than corporate bonds but may offer lower returns. Corporate bonds can provide higher yields but come with increased risk.

Bonds can balance out a portfolio heavily weighted in stocks by providing steady income and reducing overall volatility. They are particularly suitable for conservative investors or those nearing retirement who prioritize capital preservation.

High-Yield Savings Accounts

For those who prioritize safety and liquidity over growth, a high-yield savings account is an excellent choice. These accounts typically offer higher interest rates than traditional savings accounts while maintaining easy access to your funds.

- Benefits: High-yield savings accounts are FDIC-insured up to $250,000 per depositor, making them a safe place to store cash while earning interest.

This option is ideal if you’re building an emergency fund or saving for short-term goals like a vacation or home down payment. While the returns may not match those of stocks or real estate investments, they provide peace of mind knowing your principal is secure.

Diversification Strategies

One of the most effective ways to manage risk when investing $10,000 is through diversification. Spreading your investments across different asset classes—such as stocks, bonds, real estate, and cash—can help mitigate losses during market downturns.

- How to Diversify: Consider allocating portions of your $10,000 into various investments based on your risk tolerance and goals. For example:

- $4,000 in stocks (individual stocks or ETFs)

- $3,000 in REITs

- $2,000 in bonds

- $1,000 in a high-yield savings account

This balanced approach allows you to benefit from growth opportunities while reducing exposure to any single investment’s risks.

Investment Accounts

To invest your $10,000 effectively, you’ll need an appropriate investment account. Options include:

- Brokerage Accounts: These accounts allow you to buy and sell stocks, ETFs, mutual funds, and more without restrictions on withdrawals.

- Retirement Accounts: If you’re investing for retirement, consider maxing out contributions to an IRA or 401(k). These accounts offer tax advantages that can significantly enhance long-term growth.

Opening an account with a reputable brokerage firm is straightforward and often comes with educational resources that can help guide your investment decisions.

Conclusion

Investing $10,000 can open doors to numerous financial opportunities if approached thoughtfully. By defining your goals and understanding your risk tolerance, you can select suitable investments that align with your financial aspirations. Whether you choose stocks for growth potential or bonds for stability, remember that diversification is key to managing risk effectively.

As you embark on this investment journey, stay informed about market trends and continuously evaluate your portfolio’s performance against your goals. With patience and strategic planning, your initial investment can pave the way toward significant financial growth over time.

FAQs About Investing $10k

- What is the best way to invest $10k?

The best way depends on your financial goals; consider stocks for growth or bonds for stability. - Can I invest $10k in real estate?

You can invest in REITs or crowdfunding platforms instead of purchasing property directly. - What are some low-risk investment options?

High-yield savings accounts and bonds are considered low-risk investments. - How should I diversify my investments?

A balanced mix of stocks, bonds, REITs, and cash helps reduce overall risk. - Is it wise to invest all my money at once?

Dollar-cost averaging by investing over time can mitigate risks associated with market volatility.