Investing is a crucial aspect of financial planning that can significantly impact your long-term wealth. When considering what to invest in, many people often weigh the options between various asset classes, including stocks. The decision on where to allocate funds can depend on multiple factors such as risk tolerance, investment goals, and market conditions. This article aims to provide a comprehensive overview of the differences between investing in stocks and other investment options, helping you make informed decisions.

| Investment Type | Key Characteristics |

|---|---|

| Stocks | Ownership in a company, potential for high returns, subject to market volatility |

| Bonds | Debt investment, lower risk than stocks, fixed interest payments |

| Real Estate | Tangible asset, potential for rental income, less liquid than stocks |

| Mutual Funds | Diversified portfolio managed by professionals, lower risk through diversification |

| Cryptocurrencies | Digital assets, high volatility, potential for significant returns or losses |

Understanding Stocks as an Investment

Investing in stocks involves purchasing shares of a company, which represents a claim on its assets and earnings. Stocks are categorized into two main types: common stocks and preferred stocks. Common stockholders have voting rights and may receive dividends, while preferred stockholders typically receive fixed dividends but do not have voting rights.

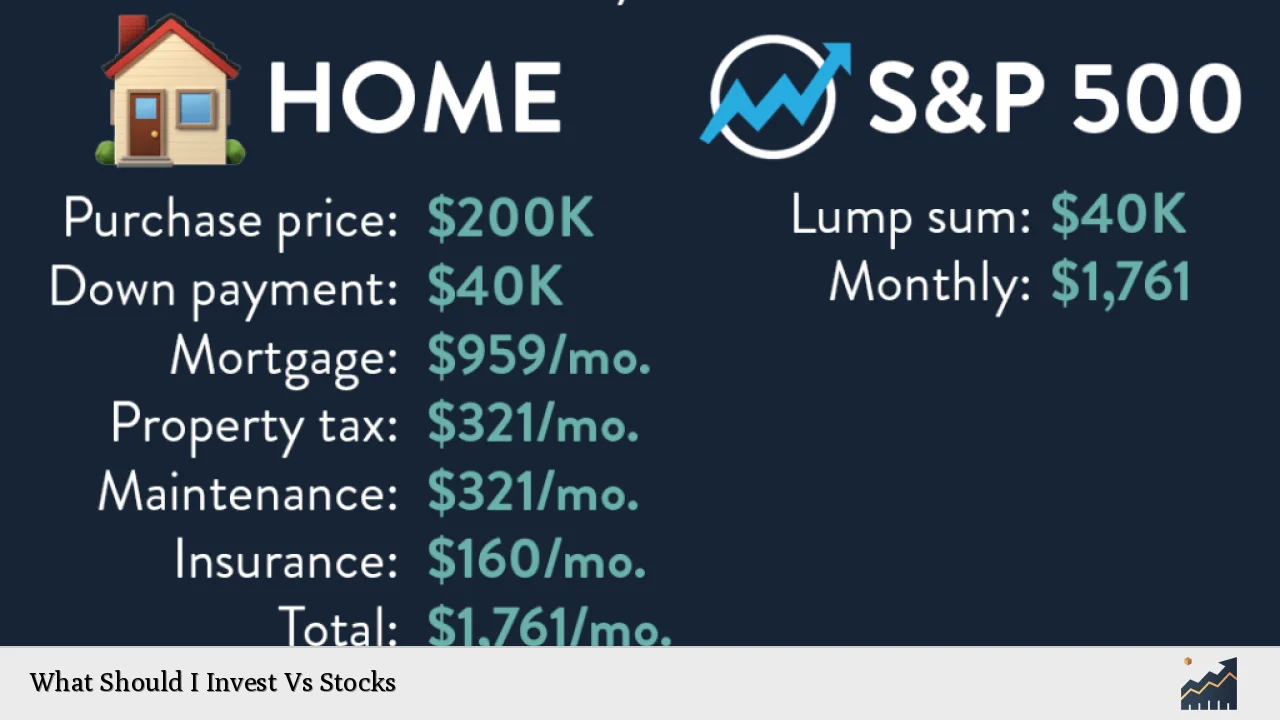

One of the primary attractions of investing in stocks is the potential for high returns. Historically, the stock market has outperformed other asset classes over the long term. For instance, investing in a diversified index fund like the S&P 500 has yielded average annual returns of about 10% over several decades.

However, investing in stocks comes with inherent risks. The value of stocks can fluctuate significantly due to market conditions, economic factors, and company performance. Investors need to be prepared for potential losses and understand that past performance does not guarantee future results.

Additionally, stocks offer liquidity, meaning they can be bought and sold quickly compared to other investments like real estate. This feature makes them appealing for investors who may need access to cash in the short term.

Comparing Stocks with Other Investment Options

When deciding whether to invest in stocks or other assets, it’s essential to compare their characteristics. Below is a detailed comparison of stocks with other common investment types:

| Investment Type | Risk Level |

|---|---|

| Stocks | High risk with potential for high returns |

| Bonds | Low to moderate risk with fixed returns |

| Real Estate | Moderate risk; depends on market conditions |

| Mutual Funds | Varies; generally lower risk due to diversification |

| Cryptocurrencies | Very high risk; highly volatile market |

Investing in bonds is often considered safer than stocks. Bonds provide fixed interest payments and are less susceptible to market volatility. However, their returns are typically lower than those of stocks.

Real estate investments involve purchasing physical properties that can generate rental income and appreciate over time. While real estate can provide stable cash flow and tax benefits, it is less liquid than stocks and requires more management effort.

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks and bonds. This diversification reduces risk compared to investing in individual stocks but may come with management fees that can eat into returns.

Lastly, cryptocurrencies represent a new asset class with significant potential for high returns but also come with extreme volatility and regulatory uncertainty.

Factors Influencing Your Investment Decision

When deciding between investing in stocks or other assets, several factors should be considered:

- Risk Tolerance: Assess your comfort level with risk. If you prefer stability and lower volatility, bonds or mutual funds may be more suitable.

- Investment Goals: Define your financial objectives clearly. Are you looking for long-term growth (stocks) or steady income (bonds)?

- Time Horizon: Consider how long you plan to invest. Stocks are generally better suited for long-term investments due to their potential for higher growth over time.

- Market Conditions: Stay informed about current economic trends and market conditions that could affect your investments.

- Diversification: Avoid putting all your eggs in one basket. A diversified portfolio can help mitigate risks associated with individual investments.

Strategies for Investing in Stocks

If you choose to invest in stocks, consider implementing some effective strategies:

- Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount regardless of stock prices. It helps reduce the impact of volatility over time.

- Value Investing: Focus on undervalued companies with strong fundamentals that have the potential for price appreciation over time.

- Growth Investing: Look for companies expected to grow at an above-average rate compared to others in the industry.

- Dividend Investing: Invest in companies that pay regular dividends as they can provide a steady income stream while also allowing for capital appreciation.

- Index Fund Investing: Consider investing in index funds or ETFs that track major indices like the S&P 500 for broad market exposure at lower costs.

The Importance of Research

Regardless of where you decide to invest—stocks or otherwise—conducting thorough research is critical. Understand the fundamentals of any investment you consider:

- Analyze financial statements and performance metrics.

- Keep abreast of industry trends and economic indicators.

- Review analyst reports and expert opinions.

- Evaluate management teams and company strategies.

Being well-informed will help you make better investment decisions and reduce risks associated with investing.

FAQs About What Should I Invest Vs Stocks

- What are the main benefits of investing in stocks?

The main benefits include high return potential, liquidity, and ownership stakes in companies. - Are bonds safer than stocks?

Bonds are generally considered safer than stocks due to fixed interest payments and lower volatility. - How do I determine my risk tolerance?

Your risk tolerance can be assessed by considering your financial goals, investment horizon, and comfort level with fluctuations. - What is dollar-cost averaging?

Dollar-cost averaging is an investment strategy where you regularly invest a fixed amount regardless of market conditions. - What should I look for when researching stocks?

You should analyze financial health, industry position, growth potential, and management effectiveness.

In conclusion, deciding what to invest in versus focusing solely on stocks involves understanding various asset classes’ characteristics and aligning them with your financial goals. By weighing these factors carefully and conducting thorough research, you can make informed decisions that will help you achieve your investment objectives effectively.