Investing can be a daunting task, especially for newcomers who are overwhelmed by the plethora of options available. The Reddit community, particularly subreddits like r/investing and r/stocks, offers a wealth of information and diverse opinions on investment strategies. Whether you are looking to invest in stocks, index funds, or cryptocurrencies, understanding the current market trends and community sentiments can help guide your decisions.

In this article, we will explore various investment avenues that are trending on Reddit, discuss strategies recommended by experienced investors, and provide practical steps to get started. By leveraging insights from the Reddit community, you can make informed decisions tailored to your financial goals.

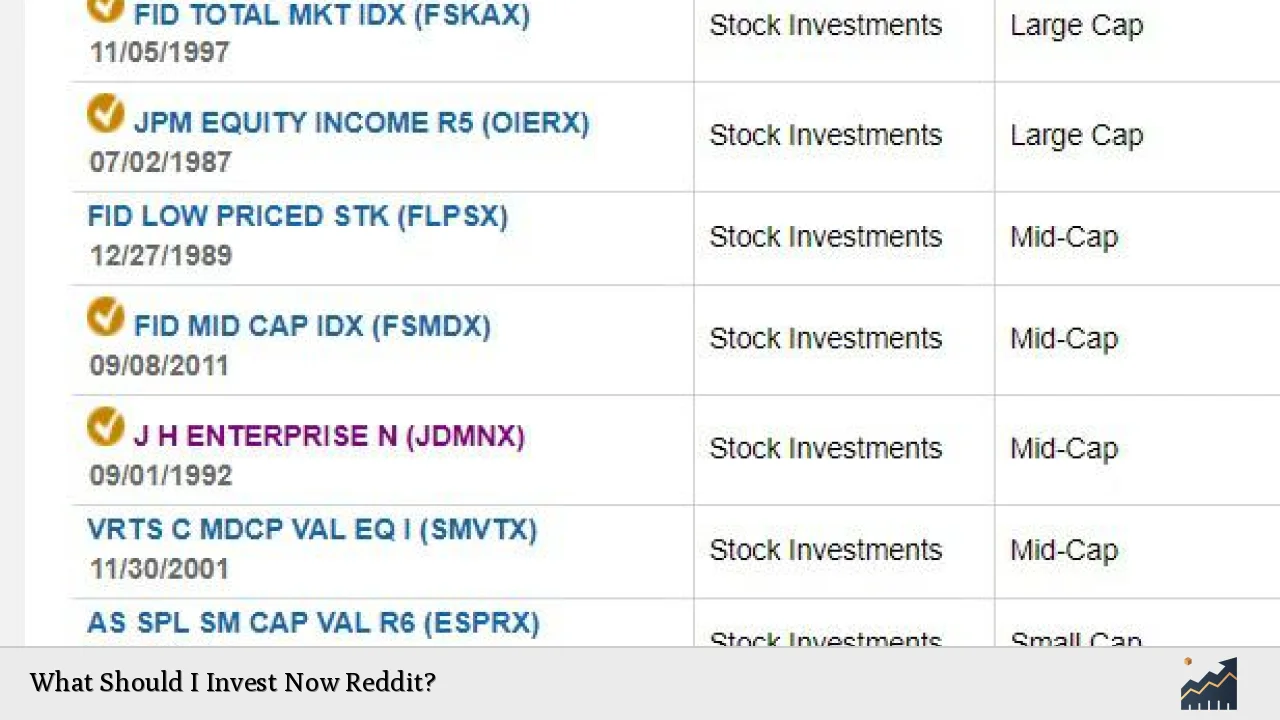

| Investment Type | Description |

|---|---|

| Index Funds | Low-cost funds that track market indices. |

| Cryptocurrencies | Digital currencies like Bitcoin and Ethereum. |

| Real Estate | Investing in properties for rental income. |

| Stocks | Buying shares of individual companies. |

Understanding Investment Options

Investing encompasses a wide range of asset classes. Each class has its own risk profile and potential return on investment. Here are some popular options discussed within the Reddit community:

- Index Funds: These are mutual funds or ETFs that aim to replicate the performance of a specific index, such as the S&P 500. They are favored for their low fees and diversification benefits. Many Reddit users recommend index funds as a reliable way to grow wealth over time without the stress of picking individual stocks.

- Stocks: Investing in individual stocks can offer higher returns but comes with increased risk. The Reddit community often shares insights on trending stocks and sectors. However, it is crucial to conduct thorough research before investing in any specific company.

- Cryptocurrencies: Digital currencies have gained immense popularity, especially among younger investors. Subreddits like r/cryptocurrency discuss various coins and trading strategies. While the potential for high returns exists, the volatility of cryptocurrencies also poses significant risks.

- Real Estate: Investing in real estate is another avenue discussed frequently on Reddit. This can include purchasing rental properties or investing in real estate investment trusts (REITs). Many users advocate for real estate as a way to generate passive income.

- Bonds: Although less frequently mentioned on platforms like Reddit, bonds can provide stability and income through interest payments. They are generally considered safer than stocks but offer lower returns.

Strategies for Successful Investing

Reddit users often share their personal investment strategies that have proven effective over time. Here are some common themes:

- Buy and Hold: Many experienced investors advocate for a buy-and-hold strategy, where investors purchase assets and hold them for the long term regardless of market fluctuations. This approach reduces transaction costs and capitalizes on the market’s overall upward trend.

- Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount of money into an asset over time, regardless of its price. This method helps mitigate the impact of volatility by averaging out the purchase price.

- Diversification: Spreading investments across different asset classes helps reduce risk. The Bogleheads philosophy, popular in many investment discussions on Reddit, emphasizes holding a mix of stocks and bonds to achieve optimal returns while managing risk.

- Research and Education: Continuous learning is crucial for successful investing. Many Redditors recommend utilizing resources like financial news outlets, educational YouTube channels, and investment books to enhance understanding of market dynamics.

Current Market Trends

Staying informed about current market trends is essential for making timely investment decisions. Here are some trends that have been highlighted in recent discussions:

- Growth Stocks: Many investors are focusing on growth stocks—companies expected to grow at an above-average rate compared to their industry peers. These stocks can be volatile but may offer substantial returns if selected wisely.

- Sustainable Investing: There is a growing interest in environmentally sustainable investments. Companies with strong environmental, social, and governance (ESG) practices are becoming increasingly attractive to investors who wish to align their portfolios with their values.

- Tech Sector Dominance: The technology sector continues to attract significant investment due to its rapid innovation and growth potential. Companies involved in artificial intelligence, cloud computing, and cybersecurity are particularly popular among Reddit investors.

Getting Started with Investing

If you are ready to start investing based on insights from Reddit discussions, here are practical steps to follow:

1. Set Clear Goals: Determine your financial objectives—whether it’s saving for retirement, buying a home, or funding education.

2. Build an Emergency Fund: Before investing, ensure you have sufficient savings set aside for emergencies—typically three to six months’ worth of expenses.

3. Choose an Investment Account: Open an investment account with a reputable brokerage that offers low fees and access to various investment options.

4. Start Small: Begin with a modest amount while you learn the ropes of investing. Consider starting with index funds or ETFs as they provide diversification at a lower cost.

5. Stay Informed: Regularly read financial news and participate in online communities like Reddit to stay updated on market trends and strategies.

6. Review Your Portfolio Regularly: Periodically assess your investments to ensure they align with your goals and risk tolerance.

7. Be Patient: Investing is typically a long-term endeavor; avoid making impulsive decisions based on short-term market movements.

FAQs About What Should I Invest Now Reddit

- What are index funds?

Index funds are low-cost mutual funds or ETFs that track specific market indices. - How do I start investing?

Set clear financial goals, build an emergency fund, open an investment account, and start small. - What is dollar-cost averaging?

This strategy involves investing a fixed amount regularly regardless of market conditions. - Why should I diversify my investments?

Diversification reduces risk by spreading investments across different asset classes. - What should I consider when choosing stocks?

Look for companies with strong fundamentals, growth potential, and favorable market conditions.

Investing wisely requires knowledge and patience. By leveraging insights from platforms like Reddit while following sound investment principles, you can build a robust portfolio that aligns with your financial goals over time.