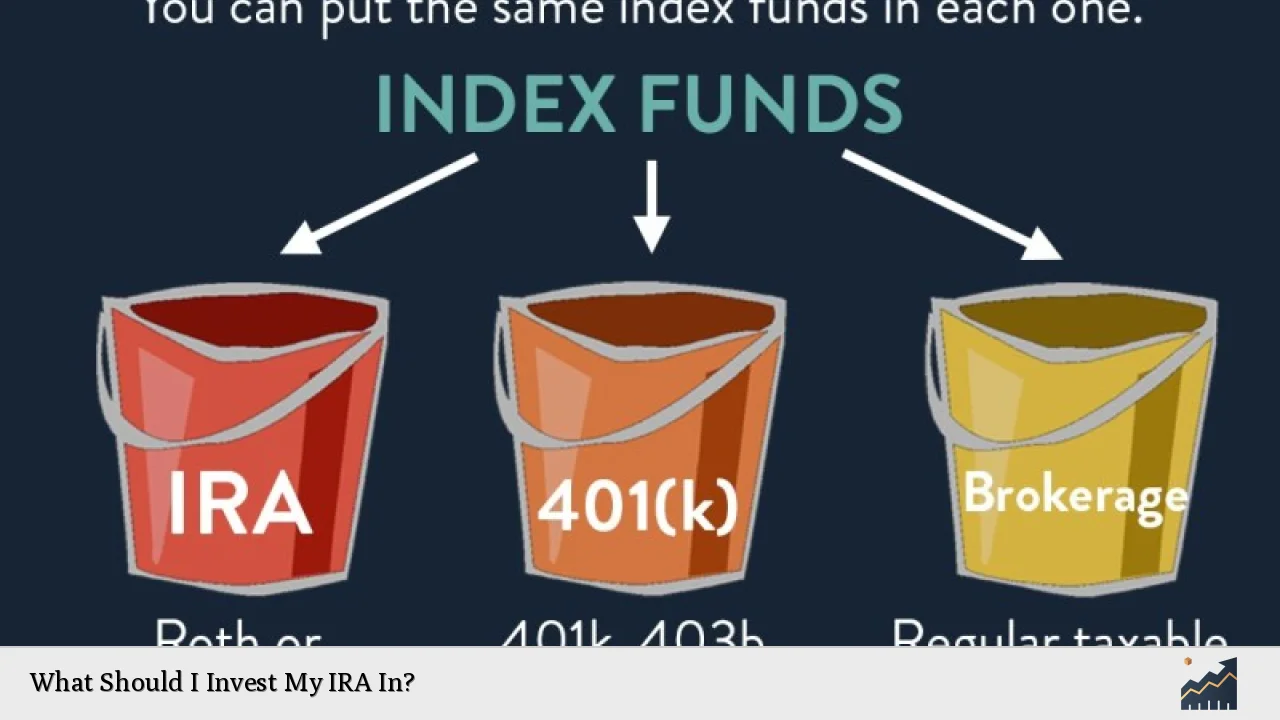

Investing in an Individual Retirement Account (IRA) is a crucial step for securing your financial future. With the right investments, you can maximize your returns while enjoying tax advantages. The choice of investments can significantly influence your retirement savings, making it essential to understand your options and how they align with your financial goals.

When considering what to invest in, it’s important to recognize that IRAs can hold a variety of assets, including stocks, bonds, mutual funds, and real estate. Each investment type has its own risk and return profile. Therefore, understanding these options will help you make informed decisions tailored to your risk tolerance and investment horizon.

| Investment Type | Description |

|---|---|

| Stocks | Equities that represent ownership in a company. |

| Bonds | Debt securities issued by corporations or governments. |

| Mutual Funds | Pooled investment vehicles that invest in diversified portfolios. |

| ETFs | Exchange-traded funds that track an index or sector. |

| Real Estate | Physical property or real estate investment trusts (REITs). |

Understanding Different Types of Investments

Investing in an IRA allows for a wide range of asset classes. Here’s a closer look at some common investment types:

Stocks

Stocks represent shares of ownership in a company. Investing in individual stocks can yield high returns but also comes with higher risk. Stocks are typically more volatile than other investments, making them suitable for investors with a longer time horizon who can withstand market fluctuations.

Bonds

Bonds are fixed-income securities that pay interest over time. They are generally considered safer than stocks and can provide steady income. Bonds can be an excellent choice for those looking to balance their portfolio and reduce overall risk.

Mutual Funds

Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. This diversification reduces the risk associated with individual securities. Mutual funds are managed by professionals, making them suitable for those who prefer a hands-off approach.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They often have lower fees than mutual funds and provide flexibility in trading throughout the day. ETFs can be an efficient way to gain exposure to various asset classes without needing to buy individual securities.

Real Estate

Investing in real estate, either directly or through Real Estate Investment Trusts (REITs), can provide diversification and potential income through rental yields. However, real estate investments may require more management and come with unique risks compared to traditional securities.

Factors Influencing Your Investment Choices

When deciding what to invest your IRA in, consider the following factors:

Risk Tolerance

Your risk tolerance is crucial in determining your investment strategy. If you are comfortable with market fluctuations and potential losses, you might lean towards stocks or aggressive mutual funds. Conversely, if you prefer stability and income, bonds or conservative mutual funds may be more appropriate.

Time Horizon

Your time horizon is the period until you plan to retire and start withdrawing from your IRA. A longer time horizon allows for riskier investments since you have time to recover from market downturns. If retirement is approaching, it may be wise to shift towards more conservative investments.

Investment Goals

Define your investment goals clearly. Are you looking for growth, income, or capital preservation? Understanding what you want to achieve will guide your investment choices within your IRA.

Popular Investment Options for Your IRA

Here are some popular investment options that many individuals consider for their IRAs:

S&P 500 Index Funds

Investing in S&P 500 index funds is a popular choice due to their historical performance and diversification across large-cap U.S. companies. These funds typically offer lower fees and have shown average annual returns of about 10% over the long term.

Dividend Stock Funds

Dividend stock funds invest in companies that pay regular dividends. These investments can provide income while also offering potential for capital appreciation. The dividends earned within an IRA are not taxed until withdrawal, allowing for greater compounding over time.

Target-Date Funds

Target-date funds automatically adjust their asset allocation based on a specified retirement date. They start with a higher allocation in stocks when you’re younger and gradually shift toward bonds as retirement approaches, providing a hands-off approach for investors.

REIT Funds

Investing in Real Estate Investment Trusts (REITs) allows individuals to gain exposure to real estate without directly purchasing properties. REITs must distribute at least 90% of their taxable income as dividends, making them attractive for generating income within an IRA.

Strategies for Maximizing Your IRA Investments

To make the most of your IRA investments, consider the following strategies:

Start Early

The earlier you start investing in your IRA, the more time your money has to grow through compounding. Even small contributions can lead to significant growth over time due to the exponential nature of compound interest.

Diversify Your Portfolio

Diversification is key to managing risk within your IRA. By spreading investments across various asset classes—such as stocks, bonds, and real estate—you can mitigate losses during market downturns while still participating in market gains.

Regular Contributions

Make regular contributions to your IRA rather than waiting until tax season. This practice allows you to take advantage of dollar-cost averaging by buying more shares when prices are low and fewer when prices are high.

Rebalance Periodically

Rebalancing involves adjusting your portfolio back to its original asset allocation after significant market movements. This strategy helps ensure that you maintain your desired level of risk as some investments may grow faster than others over time.

FAQs About What Should I Invest My IRA In

- What types of investments can I hold in my IRA?

You can hold stocks, bonds, mutual funds, ETFs, REITs, and even certain alternative assets like real estate. - Are there any restrictions on what I can invest in?

Yes, certain assets like collectibles and life insurance cannot be held in an IRA. - Can I change my investments within my IRA?

Yes, you can buy and sell investments within your IRA without tax consequences. - What is the contribution limit for IRAs?

The contribution limit for 2024 is $7,000 per year or $8,000 if you’re age 50 or older. - Is it better to invest aggressively or conservatively in an IRA?

This depends on your individual risk tolerance and time horizon; younger investors often benefit from aggressive strategies.

In conclusion, investing wisely within your IRA is essential for building a secure financial future. By understanding the various investment options available and considering factors such as risk tolerance and time horizon, you can tailor your investment strategy effectively. Regular contributions and diversification will further enhance your potential for growth while minimizing risks associated with market volatility.