Investing in low-risk options is a prudent strategy for those who prioritize capital preservation and seek to minimize the potential for loss. Low-risk investments are typically characterized by their stability, liquidity, and relatively lower returns compared to higher-risk alternatives. This approach is particularly appealing to conservative investors, retirees, or anyone looking to safeguard their financial future while still earning modest returns.

Low-risk investments can include a variety of financial instruments, such as high-yield savings accounts, government bonds, and certificates of deposit (CDs). These options provide a safe haven for your funds, ensuring that your principal amount remains intact while offering some level of income generation. Understanding the different types of low-risk investments available can help you make informed decisions that align with your financial goals and risk tolerance.

| Investment Type | Description |

|---|---|

| High-Yield Savings Accounts | Safe accounts with higher interest rates than traditional savings. |

| Government Bonds | Debt securities issued by the government, considered very safe. |

| Certificates of Deposit (CDs) | Time deposits with fixed interest rates and terms. |

Understanding Low-Risk Investments

Low-risk investments are designed to provide a stable return with minimal risk of losing the principal amount. They are often backed by reliable institutions or government entities, which contributes to their stability. While these investments typically yield lower returns compared to higher-risk options, they are ideal for those who prioritize capital preservation over aggressive growth.

The appeal of low-risk investments lies in their ability to offer predictable income streams. Many of these options provide regular interest payments or dividends, which can be particularly valuable for retirees or individuals who rely on investment income to cover living expenses. Additionally, low-risk investments can serve as a buffer against market volatility, making them an essential component of a well-rounded investment portfolio.

Investors should consider their risk tolerance, financial goals, and investment horizon when selecting low-risk investment options. For instance, if you prefer minimal risk and can accept lower returns, you should focus on highly secure investments like Treasury securities or CDs. Conversely, if you have a longer investment horizon and seek slightly higher returns while still maintaining a low-risk profile, options like municipal bonds may be suitable.

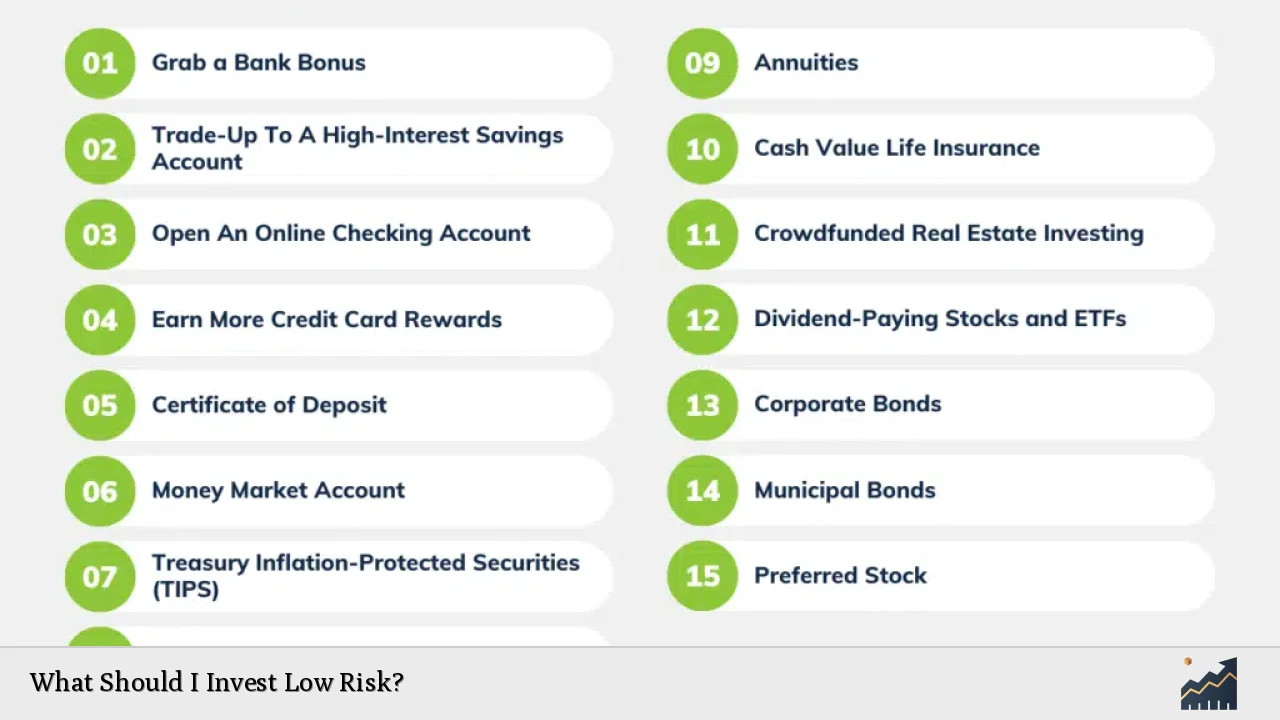

Types of Low-Risk Investments

There are several types of low-risk investments that cater to different financial goals and risk appetites. Here are some common options:

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts and are often FDIC-insured up to $250,000 per depositor per bank. They provide easy access to funds while earning interest.

- Money Market Funds: These funds invest in short-term debt instruments and aim to offer high liquidity with low risk. They are not FDIC-insured but typically maintain a stable value around $1 per share.

- Certificates of Deposit (CDs): CDs are time deposits offered by banks with fixed interest rates and terms ranging from a few months to several years. They are insured by the FDIC up to applicable limits.

- Government Bonds: Issued by national governments, these bonds are considered very safe due to the backing of the government. U.S. Treasury securities are an example and include Treasury bills (T-bills), Treasury notes (T-notes), and Treasury Inflation-Protected Securities (TIPS).

- Corporate Bonds: These are debt securities issued by corporations. While they carry more risk than government bonds, investment-grade corporate bonds from reputable companies can still be considered low-risk.

- Fixed Annuities: These insurance products offer guaranteed returns over a specified period. They can provide steady income but may have limited liquidity.

- Dividend-Paying Stocks: While stocks generally carry more risk than fixed-income securities, investing in established companies that pay regular dividends can provide a balance between risk and reward.

Understanding the characteristics of each type of investment can help you choose the right mix for your portfolio based on your financial situation and goals.

Evaluating Risks and Returns

While low-risk investments offer greater security than their high-risk counterparts, it is essential to recognize that no investment is entirely without risk. Factors such as inflation can erode purchasing power over time, making it crucial for investors to evaluate potential returns against inflation rates.

When assessing low-risk investments, consider the following factors:

- Safety: Look for investments backed by reputable institutions or government guarantees.

- Liquidity: Ensure that you can access your funds when needed without incurring significant penalties.

- Returns: Understand that lower risk typically correlates with lower returns; thus, set realistic expectations regarding potential earnings.

By balancing these factors, investors can create a diversified portfolio that aligns with their financial objectives while minimizing exposure to market volatility.

Strategies for Investing in Low-Risk Options

To effectively invest in low-risk options, consider these strategies:

- Diversification: Spread your investments across various asset classes to reduce overall risk. A mix of high-yield savings accounts, CDs, and bonds can provide stability while generating income.

- Regular Monitoring: Keep track of your investments’ performance relative to inflation and market conditions. Adjust your portfolio as needed to maintain alignment with your goals.

- Long-Term Focus: Low-risk investments often yield slower growth compared to high-risk alternatives. Adopting a long-term perspective allows you to benefit from compounding returns over time.

- Consulting Professionals: If you’re unsure about which low-risk options suit your needs best, consider seeking advice from financial advisors who can tailor recommendations based on your unique situation.

Implementing these strategies can enhance your investment experience while ensuring that you remain within your comfort zone regarding risk tolerance.

FAQs About Low-Risk Investments

- What is the safest low-risk investment?

Treasury securities are considered the safest due to their backing by the U.S. government. - Can I get higher returns from low-risk investments?

While low-risk investments provide stability, they usually offer lower returns compared to high-risk alternatives. - How can I start investing with low-risk options?

You can begin by exploring high-yield savings accounts or CDs through banks or online brokerage platforms. - Are municipal bonds always tax-free?

Municipal bonds may be tax-free at the federal level; consult a tax advisor for specific implications. - How often should I review my low-risk investments?

Regularly monitor your investments at least annually or whenever significant market changes occur.

In conclusion, investing in low-risk options is an effective way to preserve capital while generating modest returns. By understanding the various types of low-risk investments available and employing sound strategies for evaluation and management, investors can build a secure financial future tailored to their individual goals and risk tolerance.