Investing in cryptocurrencies has gained immense popularity, especially with the rise of Bitcoin. As a leading cryptocurrency, Bitcoin has set the stage for numerous investment opportunities, attracting both seasoned investors and newcomers alike. If you are considering investing like Bitcoin, it is essential to understand the various alternatives available in the cryptocurrency market. This article will explore different investment options that can provide similar benefits and risks as Bitcoin, helping you make informed decisions.

| Investment Option | Description |

|---|---|

| Bitcoin (BTC) | The original cryptocurrency, known for its high volatility and potential for significant returns. |

| Ethereum (ETH) | A decentralized platform enabling smart contracts and dApps, often considered the second most popular cryptocurrency. |

| Stablecoins | Cryptocurrencies pegged to stable assets like the US dollar, reducing volatility. |

| Altcoins | Alternative cryptocurrencies to Bitcoin, offering various functionalities and use cases. |

| Crypto ETFs | Exchange-traded funds that provide exposure to a basket of cryptocurrencies. |

Understanding Cryptocurrency Investments

Investing in cryptocurrencies involves purchasing digital assets with the expectation that their value will increase over time. Unlike traditional investments, cryptocurrencies operate on decentralized networks using blockchain technology. This technology ensures transparency and security but also introduces unique risks due to market volatility.

When considering investments similar to Bitcoin, it’s crucial to evaluate your financial goals and risk tolerance. Cryptocurrencies can be highly volatile; thus, understanding market dynamics is essential for successful investing.

Investors should also be aware of security measures when handling cryptocurrencies. Using reputable exchanges and wallets can help protect your investments from theft or loss. Additionally, diversifying your portfolio by investing in multiple cryptocurrencies can mitigate risks associated with individual assets.

Popular Alternatives to Bitcoin

Ethereum (ETH)

Ethereum is often regarded as the leading alternative to Bitcoin. It is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Ethereum’s native cryptocurrency, Ether (ETH), is used to power these applications.

Investing in Ethereum can provide exposure to a more extensive range of functionalities compared to Bitcoin. The platform’s continuous development and upgrades, such as Ethereum 2.0, aim to improve scalability and reduce energy consumption, making it an attractive investment option.

Stablecoins

Stablecoins are designed to minimize price volatility by pegging their value to stable assets like the US dollar or gold. Examples include Tether (USDT) and USD Coin (USDC). These coins offer a safer alternative for investors looking to avoid the extreme fluctuations often seen in other cryptocurrencies.

Investing in stablecoins can be beneficial for those who want to maintain liquidity while earning interest through lending platforms or yield farming. However, it’s essential to understand that while stablecoins reduce volatility, they do not offer the same potential for high returns as more volatile assets like Bitcoin.

Altcoins

Altcoins refer to any cryptocurrency other than Bitcoin. There are thousands of altcoins available in the market, each with unique features and use cases. Some notable examples include:

- Binance Coin (BNB): Used on the Binance exchange for trading fee discounts.

- Cardano (ADA): Focuses on sustainability and scalability through a proof-of-stake consensus mechanism.

- Solana (SOL): Known for its high transaction speed and low fees, making it suitable for decentralized applications.

Investing in altcoins can diversify your portfolio and potentially yield high returns if you choose well-performing projects. However, be cautious as many altcoins may not have the same level of adoption or stability as Bitcoin.

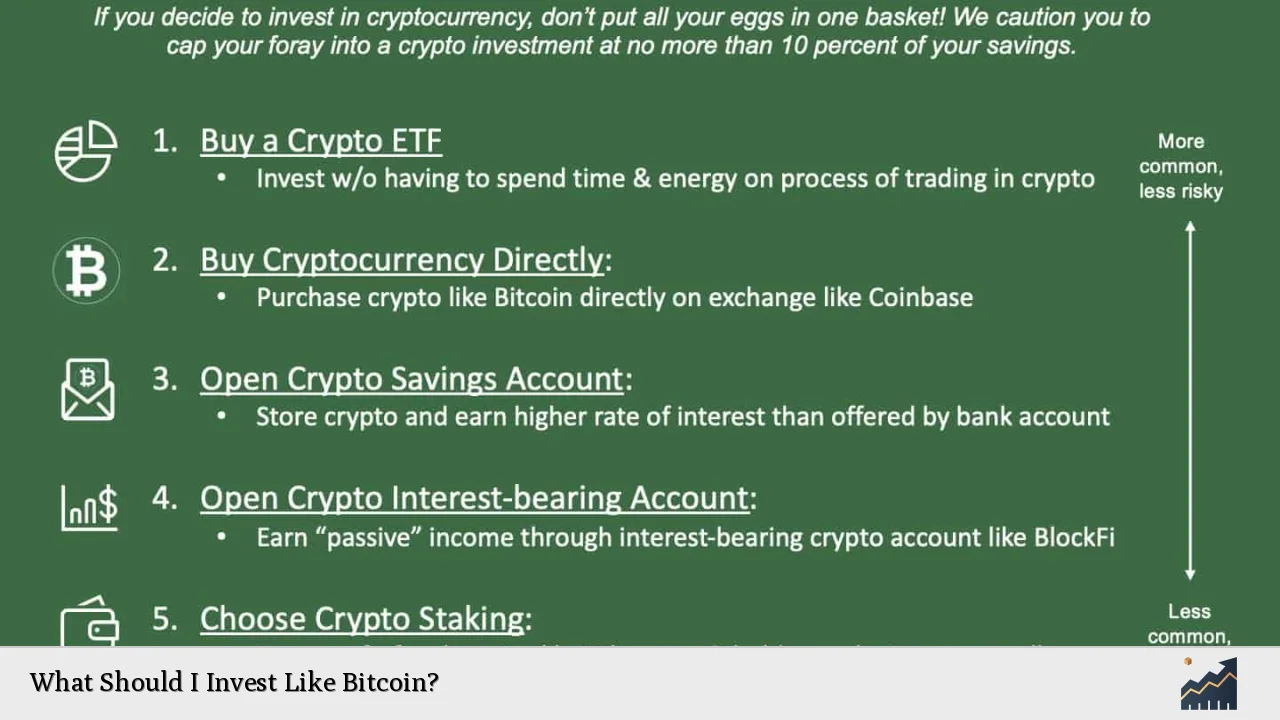

Cryptocurrency ETFs

Cryptocurrency exchange-traded funds (ETFs) allow investors to gain exposure to a basket of cryptocurrencies without directly purchasing them. These funds trade on stock exchanges like traditional stocks, providing an accessible way for investors who may be hesitant about buying cryptocurrencies directly.

Crypto ETFs can be an excellent option for those looking for diversification while avoiding the complexities of managing individual wallets or exchanges. Some popular crypto ETFs focus on major currencies like Bitcoin and Ethereum or track broader indices of multiple cryptocurrencies.

Steps to Invest Like Bitcoin

Research Thoroughly

Before investing in any cryptocurrency, conduct thorough research. Understand the technology behind each asset, its use case, market trends, and potential risks involved. Resources such as white papers and reputable financial news sites can provide valuable information.

Choose a Reliable Exchange

Selecting a trustworthy cryptocurrency exchange is crucial for making secure transactions. Look for platforms with strong security measures, user-friendly interfaces, and favorable fee structures. Popular exchanges include Coinbase, Binance, and Kraken.

Create a Secure Wallet

After purchasing cryptocurrencies, consider transferring them to a secure wallet rather than keeping them on an exchange. Hardware wallets offer enhanced security against hacks compared to software wallets or exchange storage.

Diversify Your Portfolio

To mitigate risks associated with cryptocurrency investments, diversify your portfolio by including various assets such as Bitcoin, Ethereum, stablecoins, and promising altcoins. This strategy helps balance potential losses from one asset with gains from another.

Monitor Market Trends

Stay updated on market trends and news related to cryptocurrencies. This information can help you make informed decisions about when to buy or sell your assets based on market conditions.

Risks Associated with Cryptocurrency Investments

Investing in cryptocurrencies comes with inherent risks that every investor should consider:

- Market Volatility: Cryptocurrencies are known for their price fluctuations; values can change dramatically within short periods.

- Regulatory Risks: Governments worldwide are still developing regulations around cryptocurrencies; changes in laws could impact your investments.

- Security Risks: Cybersecurity threats pose significant risks; exchanges and wallets can be vulnerable to hacks.

- Lack of Consumer Protections: Unlike traditional financial markets, many cryptocurrencies lack regulatory oversight which may expose investors to fraud or scams.

Understanding these risks is vital before committing funds into cryptocurrency markets.

FAQs About What Should I Invest Like Bitcoin

- What are some good alternatives to Bitcoin?

Some good alternatives include Ethereum (ETH), stablecoins like USDT or USDC, and various altcoins. - How do I start investing in cryptocurrencies?

Begin by researching different cryptocurrencies and selecting a reliable exchange where you can create an account. - Are stablecoins safe investments?

Stablecoins are generally safer than volatile cryptocurrencies but still carry risks associated with their underlying assets. - Can I invest in crypto without buying coins directly?

Yes, you can invest indirectly through cryptocurrency ETFs or stocks of companies involved in blockchain technology. - What should I consider before investing in crypto?

You should evaluate your risk tolerance, investment goals, and conduct thorough research on potential investments.

In conclusion, investing like Bitcoin involves exploring various options within the cryptocurrency landscape while understanding associated risks. By researching thoroughly and diversifying your portfolio across different assets such as Ethereum, stablecoins, altcoins, or crypto ETFs, you can position yourself strategically within this dynamic market while aiming for potential growth similar to what Bitcoin has achieved over the years.