As we enter July 2024, investors face a complex landscape shaped by technological advancements, geopolitical shifts, and evolving economic conditions. The investment world continues to be dominated by themes such as artificial intelligence, renewable energy, and the ongoing recovery from global economic challenges. For those looking to make informed investment decisions, it’s crucial to consider a mix of traditional and emerging opportunities while keeping a close eye on market trends and potential risks.

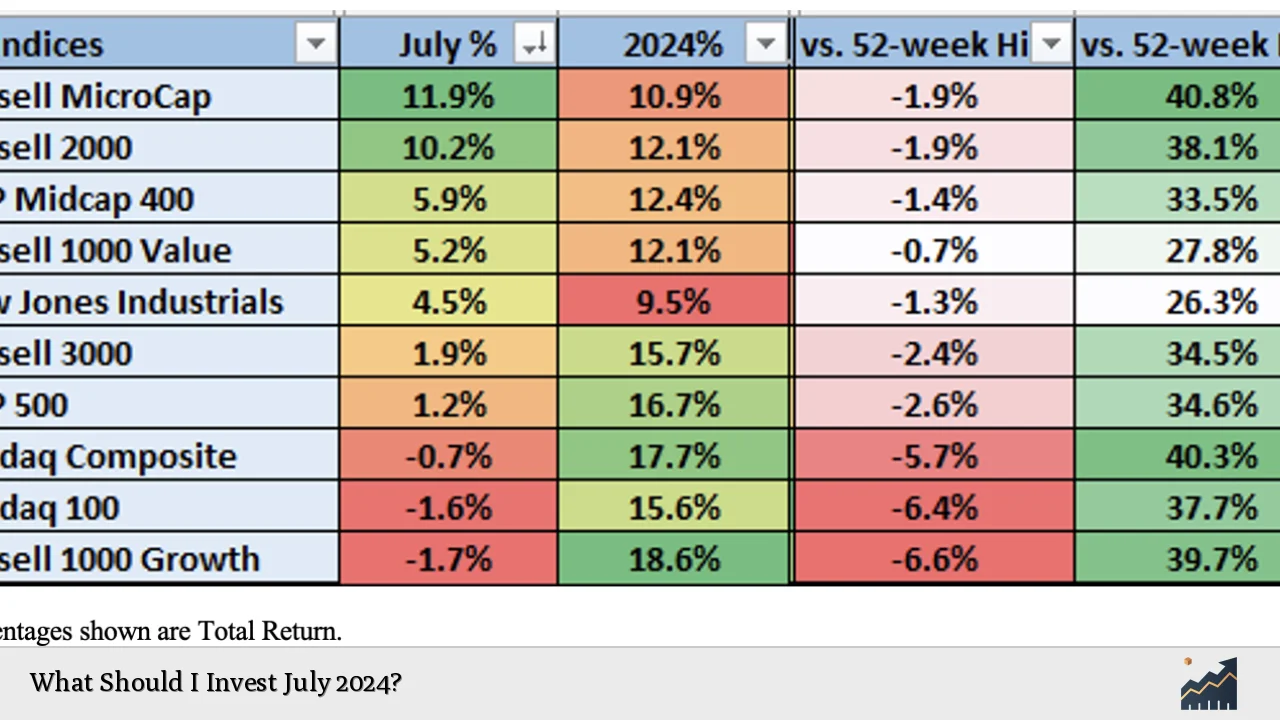

To provide a snapshot of current investment opportunities, let’s look at some of the top-performing sectors and assets:

| Asset/Sector | YTD Performance (as of July 2024) |

|---|---|

| Technology | +15.4% |

| Renewable Energy | +12.7% |

| Healthcare | +9.3% |

| US Large-Cap Stocks | +8.6% |

| Global Bonds | +3.2% |

Technology and AI Investments

The technology sector continues to be a powerhouse for investors, with artificial intelligence (AI) leading the charge. Companies at the forefront of AI development and implementation are seeing substantial growth. The L&G Global Technology Index fund has been a top performer, with impressive returns of 32.3% over the past year. This fund provides broad exposure to the tech sector, including giants like Apple, Microsoft, and Nvidia.

For those looking to capitalize on the AI boom specifically, consider these options:

- Invest in AI-focused ETFs like the VanEck Semiconductor ETF

- Look into individual stocks of AI leaders such as Nvidia or Google’s parent company Alphabet

- Explore AI-adjacent sectors like cybersecurity and cloud computing

However, it’s important to note that the tech sector’s high valuations could pose risks. Diversification is key to mitigating potential downturns in this volatile sector.

Renewable Energy and Sustainability

The push towards clean energy and sustainability continues to gain momentum. Investors are increasingly looking at renewable energy as both a profitable venture and a way to support environmental goals. Some attractive options in this space include:

- Greencoat UK Wind and NextEnergy Solar Fund, which offer high yields of 7% and 10% respectively

- ETFs focusing on clean energy, such as those tracking solar or wind power companies

- Stocks of established utilities transitioning to renewable sources, like NextEra Energy

The renewable energy sector benefits from government support and growing consumer demand, making it a potentially stable long-term investment. However, be aware that regulatory changes can significantly impact this sector.

Healthcare and Biotechnology

Healthcare remains a resilient sector, driven by aging populations in developed countries and increasing healthcare access globally. The COVID-19 pandemic has also highlighted the importance of robust healthcare systems and innovative biotechnology.

Consider these investment options:

- Broad healthcare ETFs for diversified exposure to the sector

- Biotechnology stocks focusing on emerging treatments and technologies

- Healthcare REITs that invest in medical facilities and senior living centers

While healthcare can provide stable returns, it’s important to stay informed about regulatory changes that can affect the sector.

Emerging Markets

Emerging markets, particularly India, are attracting investor attention. The Jupiter India fund has shown impressive performance, with a 51.2% return over the past year. India’s growing middle class, technological advancements, and economic reforms make it an attractive long-term investment destination.

Other emerging market opportunities to consider:

- Brazil, as it benefits from commodity exports and economic reforms

- Vietnam, with its growing manufacturing sector and young population

- Indonesia, Southeast Asia’s largest economy with a burgeoning tech scene

Investing in emerging markets comes with higher risks, including currency fluctuations and political instability. It’s advisable to limit exposure to a small portion of your portfolio.

Fixed Income and Cash Equivalents

With interest rates at historical highs, fixed income investments are becoming more attractive. The Royal London Short Term Money Market fund, for instance, offers a yield of 5.29%. As central banks begin to cut rates, these yields may decrease, but they still offer a stable income stream.

Consider these fixed income options:

- Short-term government bonds for low-risk, steady returns

- Corporate bond funds for slightly higher yields

- High-yield savings accounts or money market funds for cash management

Fixed income investments can provide portfolio stability, but be aware that their value may decrease as interest rates fall.

Diversification Strategies

Diversification remains a crucial strategy for managing risk. Multi-asset funds like the Vanguard LifeStrategy series offer a simple way to achieve diversification. These funds come in different risk profiles, from 20% equity to 100% equity, allowing investors to choose based on their risk tolerance.

For those preferring to build their own diversified portfolio, consider:

- A mix of domestic and international stocks

- Bonds of varying durations and credit qualities

- Real estate investment trusts (REITs)

- Commodities or commodity-linked securities

Remember, the key to successful diversification is regular rebalancing to maintain your desired asset allocation.

Responsible Investing

Environmental, Social, and Governance (ESG) factors are increasingly important to investors. Many funds now incorporate ESG criteria, allowing investors to align their portfolios with their values while seeking financial returns.

Options for responsible investing include:

- ESG-focused ETFs and mutual funds

- Green bonds that fund environmental projects

- Stocks of companies with strong sustainability practices

While ESG investing is growing in popularity, it’s important to research thoroughly as definitions of “responsible” can vary between fund managers.

FAQs About Investing in July 2024

- Is it a good time to invest in AI stocks?

AI stocks offer growth potential but come with high valuations. Diversify and invest cautiously. - How can I protect my portfolio against inflation?

Consider TIPS, real estate, and stocks of companies with pricing power. - Are emerging markets a safe investment?

Emerging markets offer growth potential but with higher risk. Limit exposure to a small portion of your portfolio. - Should I invest in cryptocurrencies?

Cryptocurrencies are highly speculative. Only invest what you can afford to lose. - How often should I rebalance my portfolio?

Rebalance at least annually or when your asset allocation significantly deviates from your target.

In conclusion, the investment landscape in July 2024 offers a mix of opportunities across various sectors and asset classes. While technology and AI continue to dominate headlines, it’s crucial to maintain a balanced approach to investing. Consider your personal financial goals, risk tolerance, and investment horizon when making decisions. Always do thorough research or consult with a financial advisor before making significant investment choices. Remember, diversification and regular portfolio reviews are key to navigating the ever-changing financial markets successfully.