Investing can be a daunting task, especially for newcomers who are unsure where to start. Reddit has become a popular platform for discussions about investing, where users share their experiences, strategies, and advice. This article will explore various investment options discussed on Reddit, focusing on practical strategies and insights from seasoned investors. By leveraging the collective wisdom of the Reddit community, you can make informed decisions about your investment journey.

| Investment Type | Description |

|---|---|

| Index Funds | Low-cost funds that track a specific market index. |

| ETFs | Exchange-traded funds that offer diversification and liquidity. |

| Real Estate | Investing in property for rental income or appreciation. |

| Cryptocurrency | Digital currencies that can offer high returns but come with significant risk. |

Understanding Investment Basics

Before diving into specific investment options, it’s crucial to understand some basic principles of investing. The primary goal is to grow your wealth over time while managing risk. Here are some fundamental concepts to consider:

- Risk Tolerance: Assess how much risk you are willing to take. Higher potential returns often come with higher risks.

- Time Horizon: Determine how long you plan to invest. Longer time horizons typically allow for more aggressive investments.

- Diversification: Spread your investments across different asset classes to reduce risk. This can include stocks, bonds, real estate, and more.

Understanding these concepts will help you make better investment decisions tailored to your financial goals.

Popular Investment Options on Reddit

The Reddit community frequently discusses various investment options. Here are some of the most commonly recommended choices:

- Index Funds: These funds track a specific market index, such as the S&P 500. They are praised for their low fees and broad market exposure.

- ETFs (Exchange-Traded Funds): Similar to index funds but traded like stocks on exchanges. They offer flexibility and diversification.

- Mutual Funds: Actively managed funds that pool money from multiple investors to purchase a diversified portfolio of stocks or bonds.

- Real Estate: Investing in property can provide rental income and potential appreciation over time.

- Cryptocurrency: Digital currencies like Bitcoin and Ethereum have gained popularity for their high-risk, high-reward potential.

- Bonds: Fixed-income securities that provide regular interest payments and are generally considered safer than stocks.

Each of these options has its pros and cons, which should be weighed based on your individual circumstances.

Strategies for Successful Investing

To maximize your investment success, consider the following strategies often discussed by Reddit users:

- Start Early: The earlier you begin investing, the more time your money has to grow through compounding interest.

- Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market conditions. This strategy helps reduce the impact of volatility.

- Focus on Low Fees: Choose investments with low expense ratios to keep more of your returns.

- Stay Informed: Keep up with market trends and news related to your investments. Knowledge is key in making informed decisions.

- Avoid Emotional Decisions: Stick to your investment plan and avoid making impulsive decisions based on market fluctuations.

Implementing these strategies can help you navigate the complexities of investing more effectively.

Building a Diversified Portfolio

A well-diversified portfolio is essential for managing risk while aiming for growth. Here’s how you can build one:

1. Asset Allocation: Decide how much of your portfolio will be allocated to different asset classes (stocks, bonds, real estate, etc.).

2. Choose Investment Vehicles: Select specific funds or securities within each asset class based on your research and risk tolerance.

3. Regular Rebalancing: Periodically review and adjust your portfolio to maintain your desired asset allocation as market conditions change.

4. Consider Tax Implications: Be aware of how taxes can affect your investment returns, especially when selling assets or receiving dividends.

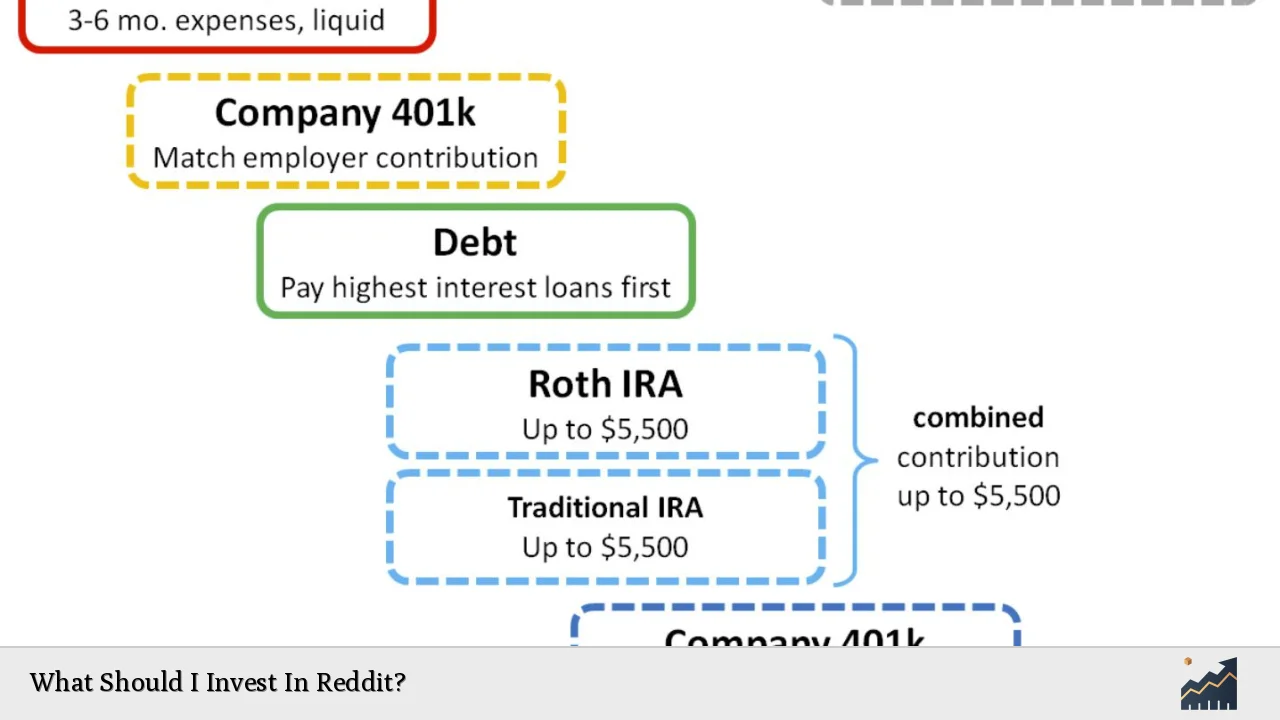

5. Use Retirement Accounts: Take advantage of tax-advantaged accounts like IRAs or 401(k)s for long-term investments.

By following these steps, you can create a diversified portfolio that aligns with your financial objectives.

Investment Tools and Resources

Utilizing various tools and resources can enhance your investment experience:

- Brokerage Accounts: Choose a reputable brokerage that offers low fees and a user-friendly platform for trading stocks, ETFs, and mutual funds.

- Investment Apps: Apps like Robinhood or Acorns allow for easy investing with minimal fees, making them suitable for beginners.

- Financial News Outlets: Stay updated with financial news through platforms like Bloomberg or CNBC to keep abreast of market developments.

- Online Communities: Engage with communities on Reddit or other forums where investors share insights and experiences.

These resources can provide valuable support as you navigate the investment landscape.

Risks Associated with Investing

While investing offers opportunities for growth, it also comes with inherent risks:

- Market Risk: The value of investments may fluctuate due to changes in market conditions or economic factors.

- Credit Risk: The possibility that a bond issuer may default on payments affects bond investments specifically.

- Liquidity Risk: Some investments may not be easily sold without incurring significant losses or delays.

Understanding these risks is crucial for developing effective risk management strategies in your investment approach.

FAQs About What Should I Invest In Reddit

- What are the best investment options for beginners?

Index funds and ETFs are often recommended due to their diversification and low fees. - How much should I invest initially?

Start with an amount you are comfortable with; even small contributions can grow over time. - Is cryptocurrency a good investment?

It can offer high returns but comes with significant risks; invest only what you can afford to lose. - How often should I rebalance my portfolio?

Aim to rebalance at least once a year or whenever your asset allocation drifts significantly. - What is dollar-cost averaging?

This strategy involves investing a fixed amount regularly regardless of market conditions.

Investing is not just about picking stocks; it encompasses understanding various asset classes, strategies, and personal financial goals. By leveraging insights from the Reddit community and employing sound investment principles, you can build a robust portfolio that aligns with your financial aspirations. Remember that successful investing requires patience, discipline, and continuous learning.