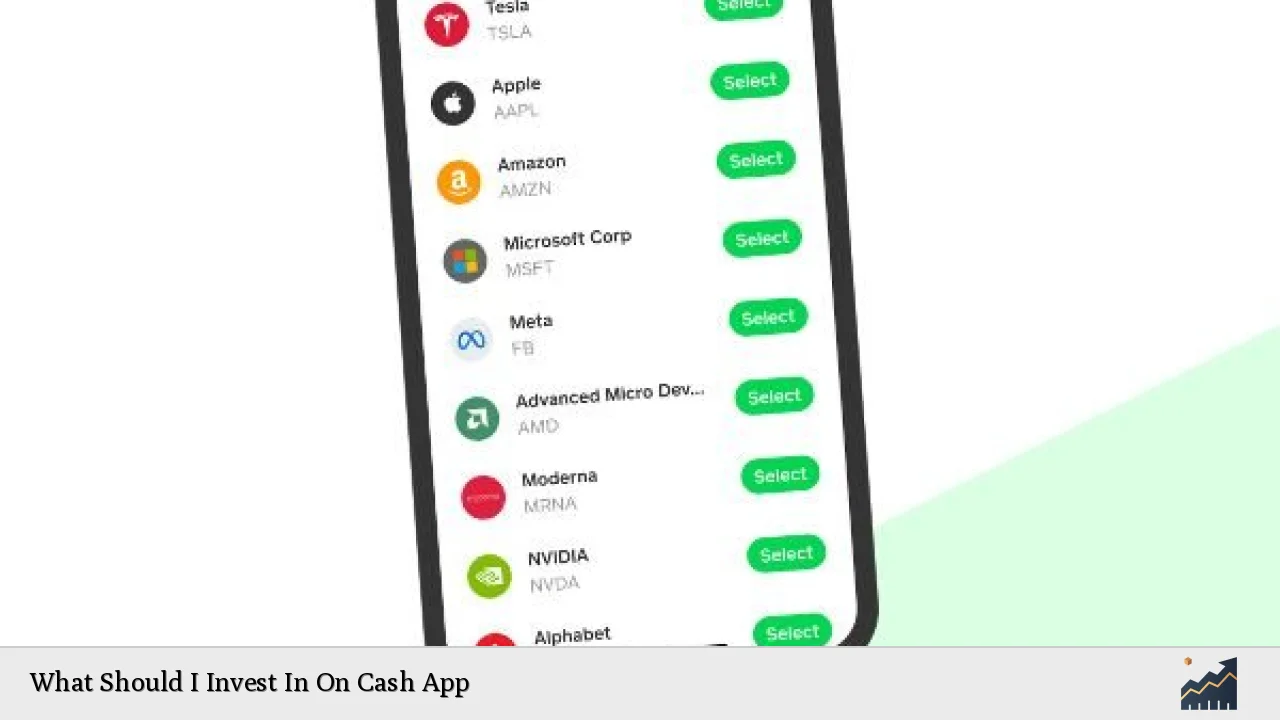

Cash App has emerged as a popular platform for individual investors looking to dip their toes into the world of investing. With features that allow users to buy stocks, exchange-traded funds (ETFs), and Bitcoin, it provides a user-friendly interface for those new to investing. However, understanding what to invest in and how to maximize the potential of Cash App requires a thorough analysis of market trends, investment strategies, and risk considerations. This article delves into the various investment options available on Cash App, offering insights into market dynamics, implementation strategies, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Fractional Shares | Allows users to invest in portions of shares, making high-value stocks accessible with minimal capital. |

| Commission-Free Trading | No fees for buying and selling stocks or ETFs, which is beneficial for cost-conscious investors. |

| Bitcoin Investments | Cash App supports Bitcoin trading, appealing to those interested in cryptocurrencies. |

| Limited Investment Options | Cash App primarily offers stocks and ETFs; lacks options like mutual funds or advanced trading tools. |

| User-Friendly Interface | The app is designed for beginners, with straightforward navigation and educational resources. |

| Market Trend Alerts | Users can set alerts for market movements, helping them make informed investment decisions. |

Market Analysis and Trends

The investment landscape has evolved significantly in recent years, with mobile platforms like Cash App democratizing access to financial markets. As of late 2023, the global stock market has shown resilience despite economic challenges, with indices like the S&P 500 experiencing fluctuations but maintaining an upward trajectory over the long term. The rise of fractional share investing has made it easier for individuals to invest in high-value companies without needing substantial capital.

Current Market Statistics

- S&P 500 Performance: The index has returned approximately 15% year-to-date as of December 2023.

- Bitcoin Trends: Bitcoin prices have shown volatility but have regained interest following institutional investments; currently trading around $40,000.

- ETFs Popularity: ETFs have seen a surge in popularity due to their diversification benefits and lower expense ratios compared to mutual funds.

Investors using Cash App can take advantage of these trends by focusing on high-performing sectors such as technology and renewable energy. The ability to invest in fractional shares allows users to diversify their portfolios without significant financial commitment.

Implementation Strategies

To effectively utilize Cash App for investing, individuals should consider several strategies:

- Start Small with Fractional Shares: Begin by purchasing fractional shares of well-established companies like Apple or Microsoft. This approach allows investors to build confidence without risking large amounts of money.

- Diversify with ETFs: Investing in ETFs can provide exposure to various sectors without needing to select individual stocks. This strategy mitigates risk while allowing for potential growth.

- Regular Contributions: Set up a routine for investing small amounts regularly (e.g., weekly or monthly). This dollar-cost averaging strategy can help reduce the impact of market volatility.

- Utilize Market Alerts: Take advantage of Cash App’s market trend alerts to stay informed about significant price movements or news affecting your investments.

- Educate Yourself: Leverage educational resources available within the app to understand market fundamentals and investment principles better.

Risk Considerations

While Cash App offers an accessible entry point into investing, it is essential to be aware of the associated risks:

- Market Volatility: The stock market can be unpredictable; prices may fluctuate significantly based on economic news or changes in investor sentiment.

- Limited Research Tools: Cash App lacks advanced analytical tools that more established brokerages provide, which could hinder informed decision-making.

- Security Risks: As with any digital platform, there are risks related to account security; users should enable two-factor authentication and monitor their accounts regularly.

Investors should assess their risk tolerance before diving into investments on Cash App. It may be wise to consult financial advisors or conduct thorough research before making significant investment decisions.

Regulatory Aspects

Investing through Cash App is subject to regulatory oversight by bodies such as the Securities and Exchange Commission (SEC). Users should be aware of the following:

- Account Types: Cash App primarily offers taxable brokerage accounts; it does not support tax-advantaged accounts like IRAs.

- Compliance Requirements: Users must comply with Know Your Customer (KYC) regulations when opening an account.

- Transaction Fees: While trading stocks and ETFs is commission-free, Bitcoin transactions may incur fees depending on market conditions.

Staying informed about regulatory changes is crucial for investors using Cash App as their primary investment platform.

Future Outlook

The future landscape of investing through platforms like Cash App appears promising. As more individuals seek convenient ways to manage their finances and investments via mobile apps, Cash App is likely to enhance its features further:

- Expansion of Investment Options: There is potential for Cash App to introduce new asset classes beyond stocks and Bitcoin, such as mutual funds or options trading.

- Enhanced Educational Resources: As novice investors continue using the app, there will likely be an increased focus on educational content tailored to different experience levels.

- Integration with Other Financial Services: The seamless integration of banking services with investing features positions Cash App as a one-stop solution for personal finance management.

Investors should keep an eye on these developments as they could significantly impact how they utilize Cash App for their investment needs.

Frequently Asked Questions About What Should I Invest In On Cash App

- What types of investments can I make on Cash App?

You can invest in stocks, ETFs, and Bitcoin through Cash App. - Is there a minimum investment amount?

You can start investing with as little as $1 due to fractional share options. - Are there any fees associated with trading?

Cashing trading stocks and ETFs is commission-free; however, Bitcoin transactions may incur fees. - Can I withdraw my funds easily?

Yes, after selling investments, funds are transferred back into your Cash App balance for easy access. - Is Cash App suitable for experienced investors?

While it offers basic trading features, more experienced investors may find its tools limited compared to traditional brokerages. - How secure is my investment on Cash App?

Cash App employs security measures like two-factor authentication but remains susceptible to online risks; regular monitoring is advised. - Can I use Cash App for retirement accounts?

No, currently Cash App only offers standard taxable brokerage accounts without retirement account options. - What is dollar-cost averaging?

This strategy involves regularly investing a fixed amount over time regardless of market conditions, helping mitigate volatility risks.

In conclusion, while Cash App presents a viable option for beginner investors seeking simplicity and accessibility in their investment journey, it is crucial to approach it with a well-informed strategy that considers current market trends and personal financial goals.