As we enter 2025, the investment landscape is evolving rapidly, influenced by technological advancements, economic shifts, and changing investor preferences. Understanding where to allocate your resources can lead to significant returns. This article will explore various investment opportunities and strategies that are poised to thrive in the current environment.

| Investment Category | Key Features |

|---|---|

| Tech Stocks | High growth potential, particularly in AI and renewable energy sectors. |

| Private Markets | Increasing interest in private equity and hedge funds for diversification. |

| Sustainable Investments | Focus on ESG criteria and impact investing. |

| Emerging Markets | Potential for high returns, especially in Asia and Africa. |

| Infrastructure | Government investments driving growth in construction and related sectors. |

Tech Stocks: The Future of Investment

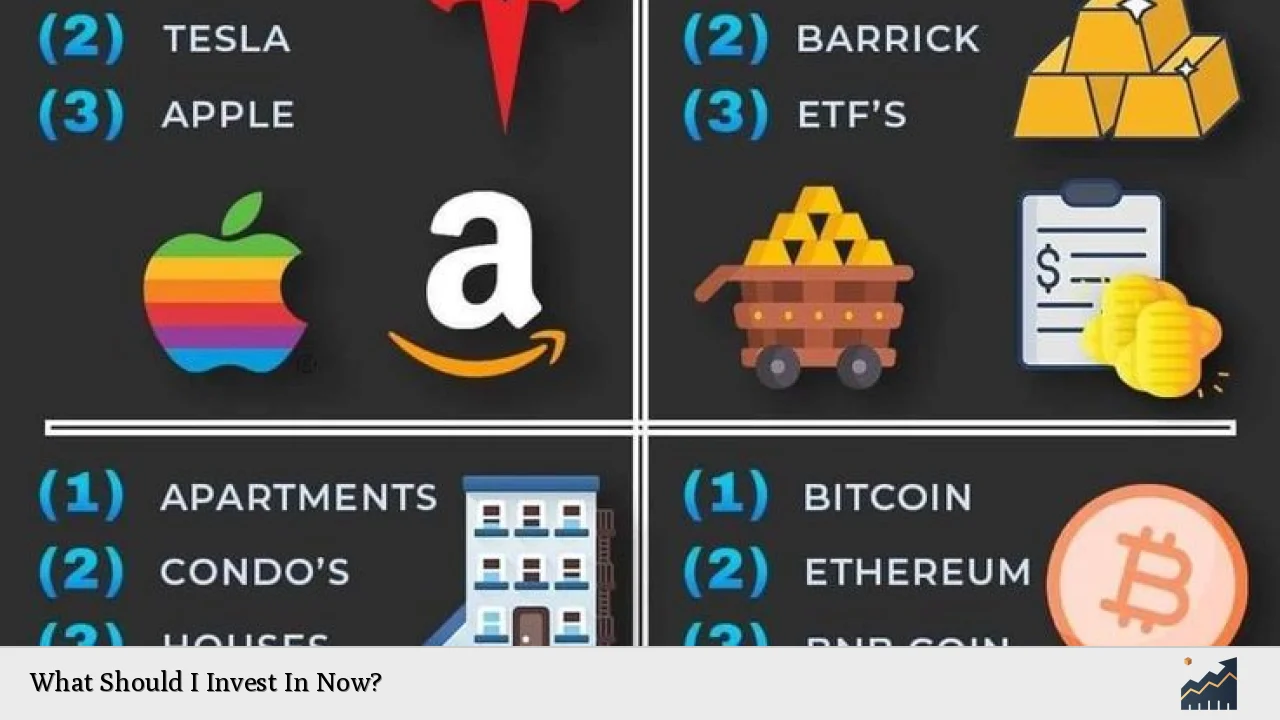

Investing in technology stocks remains one of the most promising strategies for 2025. With the rapid advancement of artificial intelligence (AI) and digital transformation across industries, companies like Nvidia, Google, and Amazon are expected to lead the charge. These firms are not only innovating but also adapting to market demands, positioning themselves for robust growth.

The AI sector is particularly noteworthy. Companies leveraging AI technology are anticipated to experience exponential growth as businesses increasingly rely on data-driven decision-making. Investing in ETFs or mutual funds focused on tech stocks can provide exposure to this dynamic sector while mitigating risks associated with individual stock investments.

Moreover, as the world transitions towards renewable energy, tech firms involved in clean energy solutions are likely to benefit significantly. This includes companies that develop technologies for solar power, wind energy, and electric vehicles. The intersection of technology and sustainability presents a unique opportunity for investors looking to align their portfolios with future trends.

Private Markets: A Growing Interest

The rise of private markets is reshaping investment strategies. Investors are increasingly turning to private equity and hedge funds, seeking alternatives that offer less correlation with traditional equities. This shift is driven by a desire for diversification and higher returns.

Private equity investments have shown resilience amid market volatility, attracting significant capital from institutional investors. Hedge funds are also becoming popular due to their ability to capitalize on market fluctuations while providing a range of investment options that can lower risk.

Additionally, innovative fund structures are emerging to provide liquidity solutions for investors. The popularity of semi-liquid funds and continuation vehicles reflects a growing demand for flexible investment options in private markets. As these trends continue, investors should consider allocating a portion of their portfolios to private market assets.

Sustainable Investments: Aligning Values with Returns

Sustainable investing is gaining momentum as more investors prioritize Environmental, Social, and Governance (ESG) factors in their decision-making processes. This trend is expected to accelerate in 2025 as climate change and social responsibility become central themes in investment strategies.

Investors can explore opportunities in impact investing, which focuses on generating positive social or environmental outcomes alongside financial returns. This includes sectors such as renewable energy, affordable housing, and healthcare infrastructure. By aligning investments with personal values, investors can contribute to meaningful change while pursuing financial growth.

Furthermore, the issuance of sustainable bonds is projected to exceed USD 1 trillion in 2025, driven by increasing demand for green financing solutions. Investors should consider integrating sustainable bonds into their portfolios as part of a broader strategy focused on long-term impact.

Emerging Markets: High Growth Potential

Emerging markets present an exciting opportunity for investors seeking high returns. Regions like Asia, Africa, and Latin America are poised for significant growth as global supply chains diversify and economies recover from past disruptions.

Countries such as India and Indonesia are expected to benefit from strong domestic demand and supportive fiscal policies. Investing in emerging market funds or ETFs can provide exposure to these regions while spreading risk across multiple economies.

However, it’s essential to approach emerging markets with caution due to inherent risks such as political instability and currency fluctuations. A well-researched investment strategy focused on long-term growth can help mitigate these challenges while capitalizing on the potential rewards.

Infrastructure: Capitalizing on Government Initiatives

Infrastructure development is a cornerstone of economic growth in many countries. Governments worldwide are increasing investments in infrastructure projects such as roads, railways, ports, and urban development. This trend presents a prime opportunity for investors focused on sectors related to construction and engineering.

In India alone, the government plans to invest over ₹100 trillion (approximately USD 1.2 trillion) in infrastructure projects over the coming years. Companies involved in these projects are likely to see substantial returns as demand for improved infrastructure continues to rise.

Investors should consider focusing on construction firms or materials suppliers that stand to benefit from government spending initiatives. Additionally, infrastructure-focused ETFs can provide diversified exposure to this growing sector.

FAQs About What Should I Invest In Now

- What are the top sectors to invest in for 2025?

The top sectors include technology, private markets, sustainable investments, emerging markets, and infrastructure. - How can I invest in technology stocks?

You can invest through individual stocks or by purchasing ETFs that focus on technology companies. - What is impact investing?

Impact investing focuses on generating positive social or environmental outcomes alongside financial returns. - Are emerging markets worth the risk?

While they carry higher risks, emerging markets offer significant growth potential that can lead to substantial returns. - How do I start investing sustainably?

You can start by researching ESG funds or sustainable bonds that align with your values and financial goals.

In conclusion, navigating the investment landscape in 2025 requires an understanding of key trends and opportunities across various sectors. By focusing on technology stocks, private markets, sustainable investments, emerging markets, and infrastructure development, investors can build a diversified portfolio poised for growth amidst evolving economic conditions. Staying informed about market dynamics will be crucial for making sound investment decisions that align with your financial objectives.