A high-yield savings account (HYSA) is an attractive option for individuals looking to maximize their savings while maintaining easy access to their funds. These accounts typically offer significantly higher interest rates compared to traditional savings accounts, making them a popular choice for both short-term savings goals and emergency funds. By understanding how HYSAs work and the benefits they provide, you can make informed decisions about where to invest your savings.

High-yield savings accounts are offered by various financial institutions, including banks and credit unions, often with rates that can be 10 to 20 times greater than the national average for standard savings accounts. The appeal lies in their combination of safety, liquidity, and higher returns. Importantly, HYSAs are usually insured by the FDIC (up to $250,000), ensuring that your money is protected.

Investing in a high-yield savings account is especially beneficial in a fluctuating interest rate environment. As rates rise, these accounts typically adjust accordingly, allowing savers to benefit from increased returns without the risk associated with more volatile investment options like stocks or bonds.

| Feature | Description |

|---|---|

| Higher Interest Rates | APYs often between 4% to 5% or more |

| Safety | FDIC insured up to $250,000 |

| Liquidity | Easy access to funds with limited withdrawal restrictions |

Understanding High-Yield Savings Accounts

High-yield savings accounts function similarly to traditional savings accounts but with the added benefit of higher interest rates. They allow account holders to deposit and withdraw money while earning interest on their balance. The key difference lies in the interest rate offered; HYSAs often provide rates that are substantially higher than those found at conventional banks.

When considering a HYSA, it is important to evaluate the annual percentage yield (APY) offered by different institutions. This figure represents the total amount of interest you can earn over a year based on your account balance. Many online banks offer competitive APYs because they have lower overhead costs compared to brick-and-mortar institutions.

Additionally, while HYSAs provide flexibility, they may come with certain conditions such as minimum balance requirements or limits on monthly withdrawals. Understanding these terms is crucial for maximizing your investment and ensuring that you do not incur any unnecessary fees.

Benefits of High-Yield Savings Accounts

Investing in a high-yield savings account offers several advantages:

- Higher Returns: The primary benefit of HYSAs is their ability to generate more interest on your deposits compared to traditional savings accounts.

- Safety: HYSAs are insured by the FDIC, which protects your deposits up to $250,000 per depositor per bank.

- Liquidity: These accounts allow you to access your funds easily without penalties, making them ideal for emergency savings or short-term goals.

- No Risk of Principal Loss: Unlike stock investments or other market-based options, HYSAs do not carry the risk of losing principal.

- Compounding Interest: Many high-yield accounts compound interest daily or monthly, enhancing your overall earnings potential.

By leveraging these benefits, you can effectively grow your savings while maintaining peace of mind regarding the safety of your funds.

Choosing the Right High-Yield Savings Account

When selecting a high-yield savings account, it’s essential to consider several factors that can influence your overall experience:

- Interest Rates: Compare APYs across different banks and credit unions to find the best rate available.

- Fees: Look for accounts with minimal fees or no monthly maintenance fees that could eat into your earnings.

- Minimum Balance Requirements: Some accounts may require a minimum balance to earn the advertised APY; choose one that aligns with your financial situation.

- Withdrawal Limits: Understand any restrictions on monthly withdrawals to avoid potential fees and ensure you can access your funds when needed.

- Account Access: Consider whether you prefer online banking features or if you need access to physical branches for transactions.

By carefully evaluating these aspects, you can select an account that meets your financial needs and helps you achieve your savings goals efficiently.

Opening a High-Yield Savings Account

The process of opening a high-yield savings account is straightforward and typically involves several key steps:

1. Research Options: Start by comparing different banks and credit unions online. Look for institutions offering competitive APYs and favorable terms.

2. Gather Required Information: Prepare necessary documentation such as identification (driver’s license or passport), Social Security number, and contact information.

3. Complete the Application: Most applications can be completed online in just a few minutes. Ensure all information is accurate before submission.

4. Fund Your Account: You may need to make an initial deposit, which can often be done through electronic transfer from another bank account or via check.

5. Set Up Online Banking Features: Enroll in online banking services for easy access and management of your account. Download any mobile apps provided by the bank for added convenience.

By following these steps, you can quickly establish a high-yield savings account and start earning interest on your deposits.

Strategies for Maximizing Your High-Yield Savings Account

To get the most out of your high-yield savings account, consider implementing these strategies:

- Automate Deposits: Set up automatic transfers from your checking account into your HYSA each month. This ensures consistent contributions toward your savings goals without requiring manual intervention.

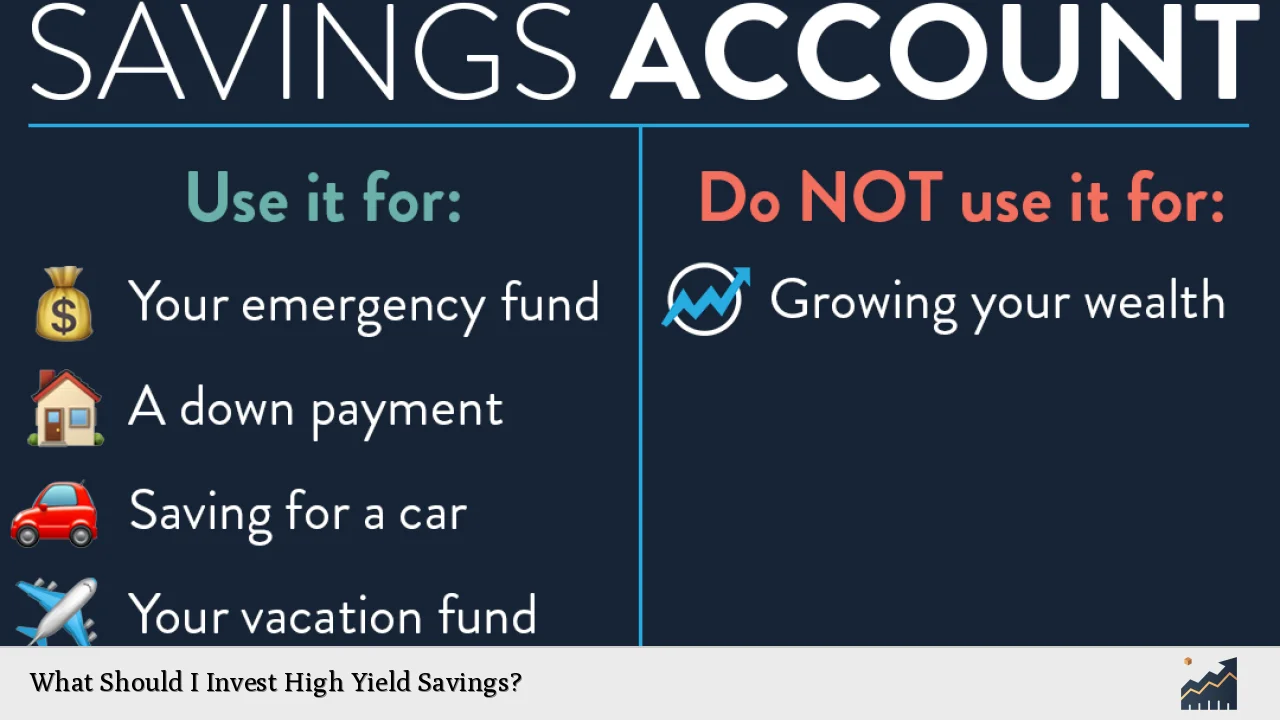

- Use as an Emergency Fund: Keep three to six months’ worth of living expenses in this account as a safety net against unexpected financial challenges.

- Separate Savings Goals: Consider opening multiple HYSAs dedicated to specific goals like vacations, home purchases, or education expenses. This helps keep your finances organized and focused on achieving individual objectives.

- Monitor Interest Rates Regularly: Stay informed about changes in APYs across various institutions. If better rates become available elsewhere, consider switching accounts to maximize returns.

By employing these strategies, you can enhance the effectiveness of your high-yield savings account as part of a broader financial plan.

FAQs About What Should I Invest High Yield Savings

- What is a high-yield savings account?

A high-yield savings account is a type of bank account that offers significantly higher interest rates than traditional savings accounts. - How do I choose the best high-yield savings account?

Compare APYs, fees, minimum balance requirements, withdrawal limits, and accessibility options before selecting an account. - Are high-yield savings accounts safe?

Yes, most high-yield savings accounts are insured by the FDIC up to $250,000 per depositor per bank. - Can I access my money easily from a high-yield savings account?

Yes, these accounts allow easy access to funds with limited withdrawal restrictions. - What are some common uses for high-yield savings accounts?

They are ideal for emergency funds, saving for short-term goals like vacations or major purchases.

Investing in a high-yield savings account can be an effective way to grow your money while keeping it safe and accessible. By understanding how these accounts work and implementing smart strategies for managing them, you can achieve greater financial stability and reach your saving objectives more efficiently.