Investing for your child’s future is a crucial step in ensuring their financial security and success. Starting early not only helps in building a substantial financial foundation but also instills valuable lessons about money management and investing. Parents have various options to consider, each with its own benefits and risks. This article will explore different investment avenues, providing insights into how to effectively invest for your child.

| Investment Option | Description |

|---|---|

| Cash Junior ISA | A tax-free savings account for children, allowing up to £9,000 per year. |

| Stocks and Shares Junior ISA | An investment account that allows parents to invest on behalf of their children. |

Understanding the Importance of Investing for Children

Investing for children is not just about accumulating wealth; it’s about teaching them the value of money and how to manage it wisely. Starting early gives children a head start in understanding financial concepts such as compound interest, which can significantly enhance their savings over time. By investing small amounts regularly, you can show them how money can grow through smart decisions.

Moreover, investing provides an opportunity for children to learn about risk versus reward. They can see firsthand how markets fluctuate and how patience can lead to greater rewards in the long run. This experience is invaluable as they transition into adulthood, where financial literacy becomes essential.

In addition to financial benefits, investing helps cultivate a sense of responsibility in children. They learn to set goals, make informed decisions, and understand the importance of saving for future needs. These lessons will serve them well throughout their lives.

Types of Investment Accounts for Children

When considering how to invest for your child, there are several types of accounts available:

- Cash Junior ISAs: These accounts offer a safe place for savings with tax-free interest. You can contribute up to £9,000 each tax year, and the funds cannot be accessed until the child turns 18.

- Stocks and Shares Junior ISAs: This option allows parents to invest in various assets on behalf of their children. The potential for higher returns exists here compared to cash ISAs, but it comes with increased risk.

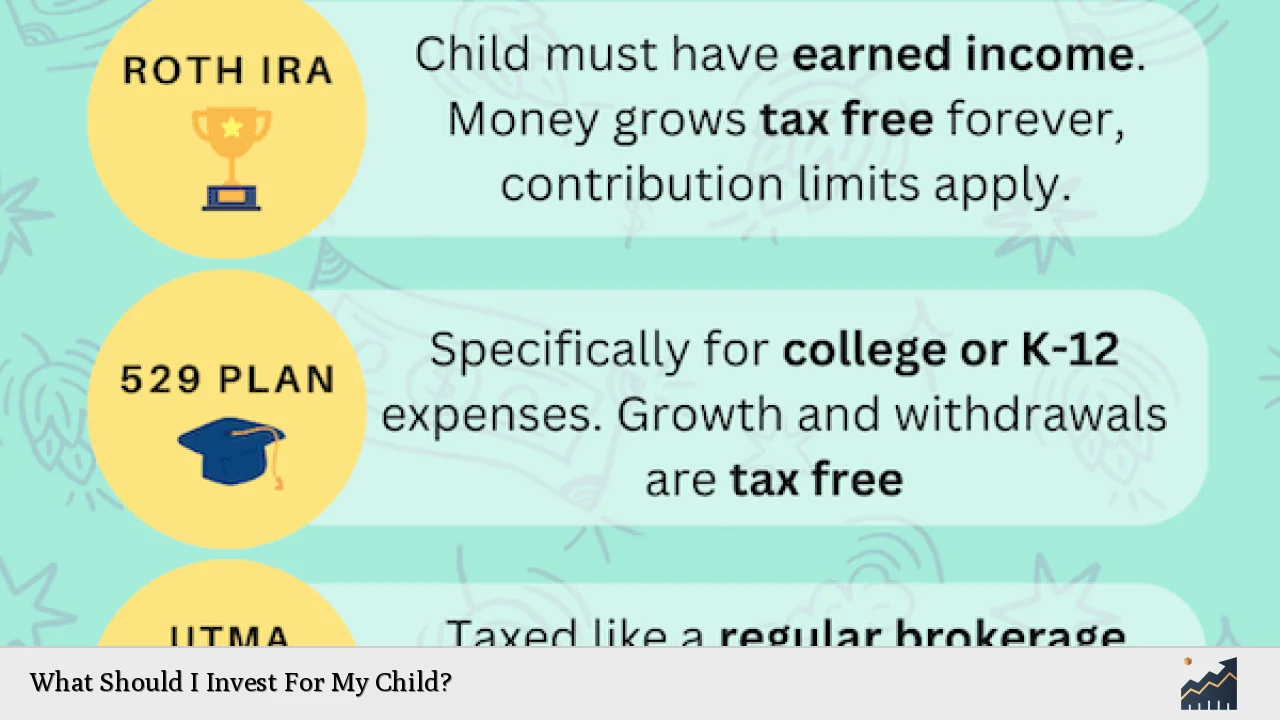

- Custodial Accounts: Under laws like UGMA/UTMA, parents can open custodial accounts that transfer control to the child when they reach adulthood. This option allows for a broader range of investments.

- Roth IRA: If your child has earned income from part-time work, a custodial Roth IRA can be a great option. Contributions grow tax-free and can be withdrawn without penalty under certain conditions.

- High-Yield Savings Accounts: While not technically an investment account, these accounts earn higher interest rates than traditional savings accounts and are excellent for short-term savings goals.

Each of these options has unique features that cater to different financial goals and risk tolerances.

Teaching Your Child About Investing

Engaging your child in the investment process is crucial. Start by explaining basic concepts such as saving, budgeting, and the importance of investing. Use relatable examples from their everyday life—such as discussing companies they know and love—to make investing more tangible.

Encourage them to think about what brands they enjoy or products they use regularly. This could include popular tech companies like Apple or entertainment platforms like Netflix. Allowing them to choose some investments based on their interests can increase their enthusiasm and understanding of the market.

Additionally, consider setting up regular discussions about their investments. This could involve reviewing performance together or discussing news related to companies they are invested in. Such practices help reinforce the lessons learned and keep them engaged over time.

The Benefits of Starting Early

Investing early has numerous advantages that compound over time:

- Time Value of Money: The earlier you start investing, the more time your money has to grow through compounding interest.

- Financial Literacy: Children who learn about investing at a young age are more likely to develop healthy financial habits as adults.

- Goal Setting: Investing teaches children how to set financial goals and work towards achieving them.

- Risk Management: Understanding market fluctuations from an early age helps children learn how to manage risks effectively.

By introducing these concepts early on, you empower your child with knowledge that will benefit them throughout their life.

Choosing the Right Investments

When it comes to selecting specific investments for your child, consider diversifying their portfolio:

- Individual Stocks: Start with companies your child is familiar with or interested in. Owning shares in companies like Disney or Nike can make investing exciting for them.

- Exchange-Traded Funds (ETFs): These funds pool money from multiple investors to buy a diversified portfolio of stocks or bonds. They are generally lower risk than individual stocks and provide exposure to various sectors.

- Mutual Funds: Similar to ETFs but actively managed by professionals, mutual funds can offer diversification without requiring extensive knowledge from your child.

- Index Funds: These funds track a specific index (like the S&P 500) and typically have lower fees than actively managed funds. They are an excellent choice for long-term growth with minimal management effort.

Choosing a mix of these investment types allows you to balance potential risks while still aiming for growth.

Monitoring and Adjusting Investments

Once you have set up an investment plan for your child, it’s important to monitor its performance regularly:

- Review the portfolio at least once a year.

- Discuss any changes in market conditions or personal interests that might affect investment choices.

- Adjust allocations based on performance or changing financial goals.

Encouraging your child to participate in these discussions fosters responsibility and helps them understand the importance of staying informed about their investments.

FAQs About What Should I Invest For My Child

- What is a Junior ISA?

A Junior ISA is a tax-free savings account specifically designed for children under 18. - How much can I contribute to my child’s investment account?

You can contribute up to £9,000 per tax year into a Junior ISA. - What types of investments should I choose?

Consider a mix of individual stocks, ETFs, mutual funds, and index funds based on your child’s interests. - Can my child access their investments before turning 18?

No, funds in a Junior ISA cannot be accessed until the child turns 18. - How do I teach my child about investing?

Use relatable examples from their life and encourage discussions about their investments.

Investing for your child is an enriching experience that offers both immediate benefits and long-term rewards. By starting early and engaging them in the process, you can help build a solid financial foundation that will serve them well into adulthood.