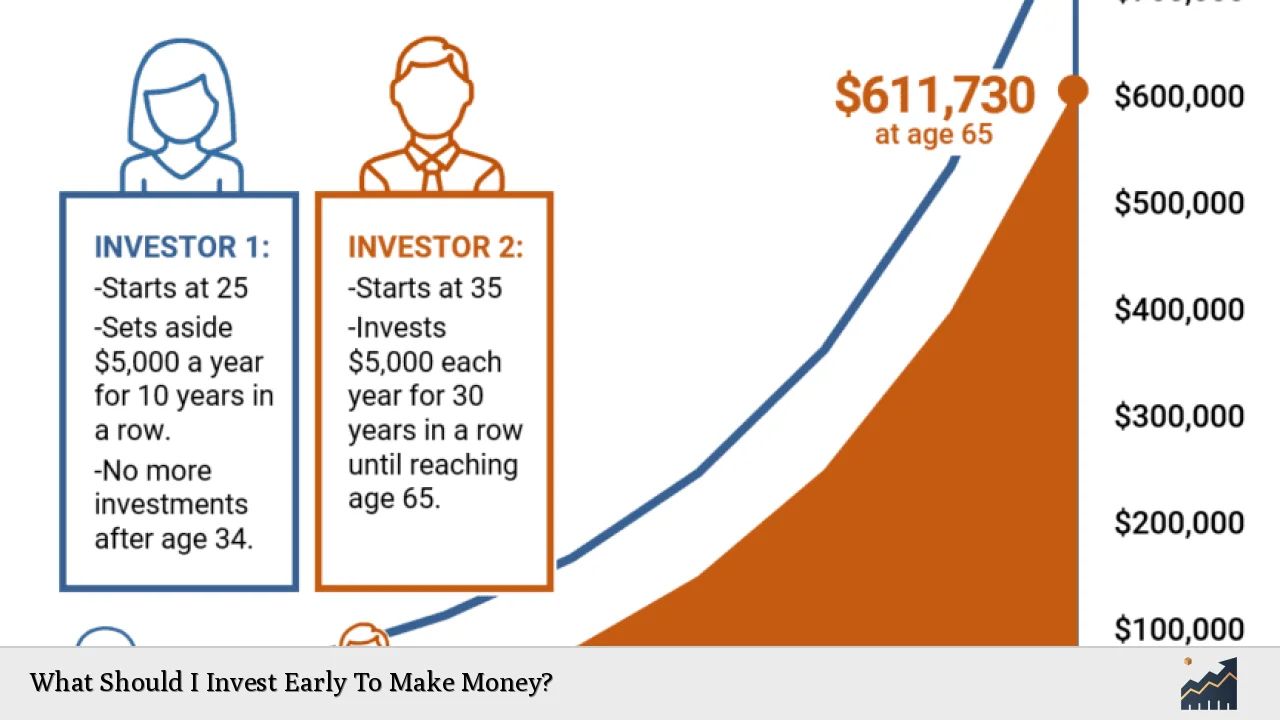

Investing early is a crucial step toward building wealth and achieving financial independence. The earlier you start investing, the more time your money has to grow through the power of compound interest. This means that not only does your initial investment earn returns, but those returns also earn additional returns over time. Knowing where to invest can be overwhelming, especially for beginners. Here, we will explore various investment options suitable for early investors, their potential returns, risks, and how to get started.

| Investment Type | Description |

|---|---|

| Stocks | Shares of ownership in a company that can provide high returns but come with higher risk. |

| ETFs | Exchange-Traded Funds that track indexes and offer diversification at lower costs. |

| Mutual Funds | Investment vehicles pooling money from many investors to buy a diversified portfolio of stocks or bonds. |

| Real Estate | Investing in property can provide rental income and appreciation over time. |

| Cryptocurrency | Digital currencies that can offer high returns but are highly volatile. |

Understanding Different Investment Options

When considering where to invest early, it’s essential to understand the various options available. Each investment type comes with its own set of characteristics, risks, and potential rewards.

Stocks are one of the most popular investment choices. By purchasing shares in a company, you become a part-owner and can benefit from its growth. Historically, stocks have provided some of the highest returns over long periods. However, they also come with significant risks due to market volatility. It’s crucial to perform thorough research before investing in individual stocks.

Exchange-Traded Funds (ETFs) are another excellent option for beginners. ETFs are similar to mutual funds but trade like stocks on exchanges. They typically track an index and provide instant diversification by holding a variety of assets within one fund. This diversification helps reduce risk while still offering the potential for growth.

Mutual Funds are professionally managed investment funds that pool money from multiple investors to purchase a diversified portfolio of stocks and bonds. They are ideal for those who prefer a hands-off approach to investing. While mutual funds often come with management fees, they can be beneficial for those looking for expert guidance.

Real Estate investing involves purchasing property for rental income or appreciation. While it requires more capital upfront compared to stocks or ETFs, real estate can provide steady cash flow and long-term growth potential. It’s essential to understand the local market conditions and property management before diving into real estate investments.

Cryptocurrency has gained popularity in recent years as a high-risk, high-reward investment option. Digital currencies like Bitcoin and Ethereum can experience extreme price fluctuations, making them suitable only for those willing to accept significant risks. If you choose to invest in cryptocurrency, it’s important to do so cautiously and only allocate a small portion of your portfolio.

The Importance of Diversification

Diversification is a critical strategy in investing that involves spreading your investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can protect your portfolio from significant losses if one investment performs poorly.

- Stocks: Invest in a mix of large-cap, mid-cap, and small-cap stocks.

- ETFs and Mutual Funds: Consider funds that track different sectors or indices.

- Bonds: Include government or corporate bonds for stability.

- Real Estate: Explore different types of properties or real estate investment trusts (REITs).

- Alternative Investments: Look into commodities or peer-to-peer lending platforms.

By diversifying your investments, you can achieve more stable returns over time and reduce the impact of market volatility on your overall portfolio.

Starting Your Investment Journey

Beginning your investment journey requires careful planning and consideration of your financial goals. Here are some steps to help you get started:

1. Set Clear Financial Goals: Determine what you want to achieve with your investments—whether it’s saving for retirement, buying a home, or funding education.

2. Establish an Emergency Fund: Before investing, ensure you have savings set aside for emergencies—ideally three to six months’ worth of living expenses.

3. Choose an Investment Account: Open an investment account through a brokerage firm or an online platform that suits your needs. Look for accounts with low fees and user-friendly interfaces.

4. Start Small: You don’t need large sums of money to begin investing. Many platforms allow you to start with as little as $1 through fractional shares or robo-advisors.

5. Educate Yourself: Take advantage of educational resources available online—many platforms offer webinars, articles, and tutorials on investing basics.

6. Monitor Your Investments: Regularly review your portfolio’s performance and make adjustments as needed based on market conditions and personal financial goals.

Utilizing Technology in Investing

With advancements in technology, investing has become more accessible than ever before. Various apps and online platforms cater specifically to beginners:

- Robo-Advisors: Automated platforms like Betterment or Wealthfront create personalized portfolios based on your risk tolerance and goals without requiring extensive knowledge of investing.

- Investment Apps: Apps like SoFi Invest and Robinhood allow users to trade stocks and ETFs commission-free while providing educational resources tailored for beginners.

- Social Media Influencers (Finfluencers): Many individuals turn to social media platforms for financial advice from influencers who share tips on investing strategies and market trends.

While technology offers convenience and access to information, it’s important to remain cautious about the sources you trust for financial advice.

Common Mistakes Early Investors Make

As you embark on your investment journey, be aware of common pitfalls that many new investors encounter:

- Emotional Investing: Making decisions based on fear or greed can lead to poor investment choices; stick to your strategy.

- Timing the Market: Trying to predict market movements is challenging; focus on long-term growth instead.

- Neglecting Research: Always perform due diligence before making any investment; understand what you’re investing in.

- Overlooking Fees: Be mindful of management fees associated with mutual funds or ETFs; high fees can eat into your returns over time.

- Ignoring Diversification: Failing to diversify can expose you to unnecessary risk; spread investments across various asset classes.

By avoiding these mistakes, you can increase your chances of achieving financial success through investing.

FAQs About What Should I Invest Early To Make Money?

- What is the best investment for beginners?

Exchange-Traded Funds (ETFs) are often recommended due to their diversification and lower costs. - How much money do I need to start investing?

You can start investing with as little as $1 using platforms that offer fractional shares. - Is it better to invest in stocks or bonds?

Stocks typically offer higher potential returns but come with greater risk compared to bonds. - How often should I review my investments?

Regularly review your portfolio at least once every six months or when significant life changes occur. - Can I lose all my money in investments?

Yes, all investments carry risks; however, diversifying your portfolio can help mitigate potential losses.

Investing early is one of the most effective ways to build wealth over time. By understanding different investment options, diversifying your portfolio, using technology effectively, and avoiding common mistakes, you can set yourself up for financial success in the future. Start today by taking small steps toward achieving your financial goals!