As we navigate the complex financial landscape of 2023, many investors are seeking guidance on where to allocate their funds for optimal returns. The investment climate has shifted significantly, with rising interest rates, ongoing geopolitical tensions, and evolving market dynamics presenting both challenges and opportunities. This article will explore some of the most promising investment options for early 2023, providing insights to help you make informed decisions about your financial future.

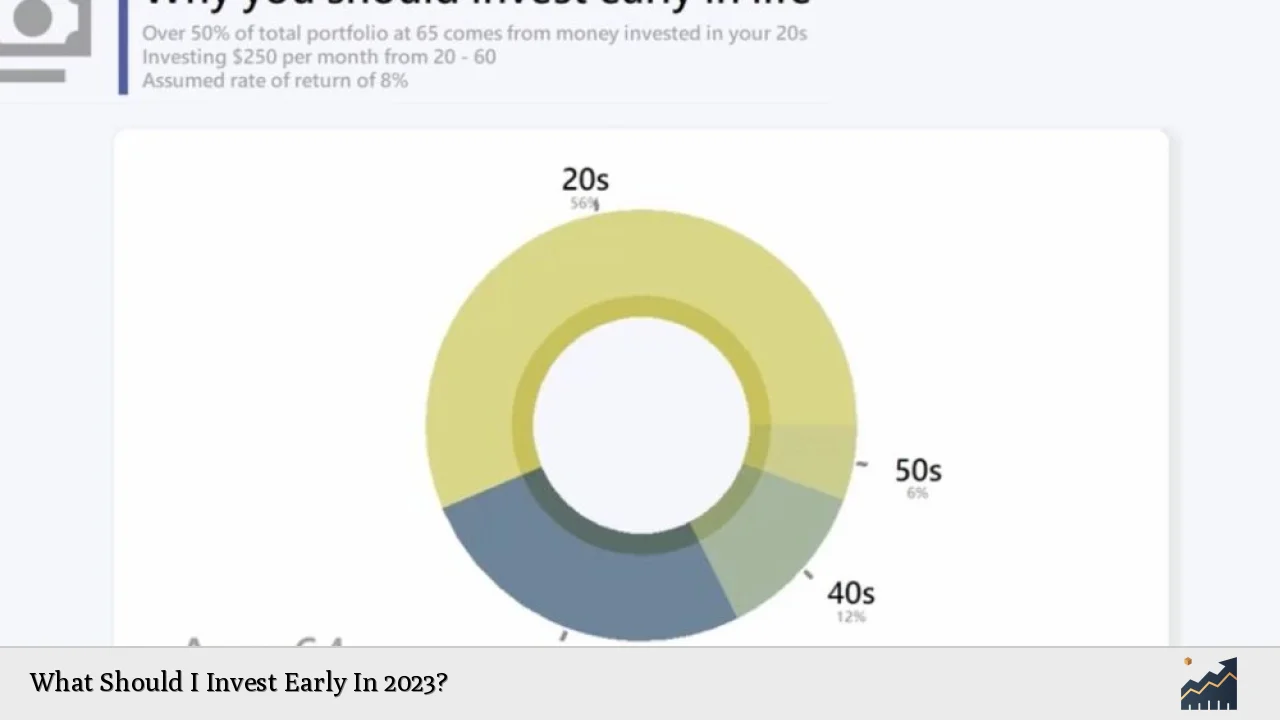

Investing early in the year can be advantageous, allowing you to capitalize on market trends and potentially benefit from compound growth over time. However, it’s crucial to approach investing with a clear strategy, taking into account your financial goals, risk tolerance, and the current economic environment. Let’s examine some of the key investment areas that experts are recommending for early 2023.

| Investment Type | Potential Benefits |

|---|---|

| Bonds | Steady income, portfolio stabilization |

| Technology Stocks | High growth potential, innovation exposure |

| Real Estate Investment Trusts (REITs) | Diversification, passive income |

| Clean Energy | Long-term growth, sustainability impact |

Bonds: A Resurgence in Fixed Income

After years of low yields, bonds are making a comeback as an attractive investment option in early 2023. The rising interest rate environment has reinvigorated the bond market, offering investors the potential for steady income and portfolio stabilization. Government bonds, corporate bonds, and municipal bonds are all worth considering, depending on your risk appetite and investment goals.

Investing in bonds can provide a reliable income stream, especially for those nearing retirement or seeking to balance riskier investments. Treasury Inflation-Protected Securities (TIPS) are particularly appealing in the current inflationary climate, as they offer protection against rising prices. For those looking to diversify their bond holdings, consider bond ETFs or mutual funds, which can provide exposure to a broad range of fixed-income securities.

However, it’s important to note that bond prices typically move inversely to interest rates. If rates continue to rise, existing bond prices may fall. To mitigate this risk, consider a laddered bond strategy, where you invest in bonds with staggered maturity dates. This approach can help balance yield and interest rate risk while providing regular income.

Technology Stocks: Riding the Wave of Innovation

Despite some volatility in the tech sector, technology stocks remain a compelling investment option for early 2023. The ongoing digital transformation across industries continues to drive growth and innovation in areas such as artificial intelligence, cloud computing, and cybersecurity. While some tech giants may face regulatory challenges, many smaller and mid-sized tech companies offer significant growth potential.

When investing in tech stocks, focus on companies with strong fundamentals, sustainable business models, and competitive advantages in their respective niches. Look for firms that are at the forefront of emerging technologies like 5G, Internet of Things (IoT), and quantum computing. These areas are poised for substantial growth in the coming years and could offer attractive returns for early investors.

Consider diversifying your tech investments across different subsectors to spread risk. A mix of established tech giants and promising startups can provide a balance of stability and growth potential. Tech-focused ETFs can also offer a convenient way to gain broad exposure to the sector without the need to pick individual stocks.

Real Estate Investment Trusts (REITs): Diversification and Income

Real Estate Investment Trusts (REITs) present an attractive investment opportunity in early 2023, offering a way to invest in real estate without the need to directly own and manage properties. REITs can provide portfolio diversification, passive income, and potential long-term appreciation. As the real estate market continues to evolve post-pandemic, certain REIT sectors show promising growth prospects.

Focus on REITs that operate in resilient sectors such as:

- Industrial REITs (benefiting from e-commerce growth)

- Data center REITs (supporting digital infrastructure)

- Healthcare REITs (catering to an aging population)

- Residential REITs (addressing housing demand)

These sectors have demonstrated strength and adaptability in the face of economic challenges. When selecting REITs, look for those with strong balance sheets, consistent dividend growth, and properties in prime locations. Dividend yields for quality REITs can be attractive, especially in comparison to traditional fixed-income investments.

Consider both equity REITs (which own and operate income-producing real estate) and mortgage REITs (which finance real estate and often offer higher yields but with more risk). A mix of both types can provide a balanced approach to real estate investing.

Clean Energy: Investing in a Sustainable Future

The clean energy sector continues to gain momentum, driven by global efforts to combat climate change and transition to sustainable energy sources. Investing in clean energy early in 2023 not only aligns with environmental, social, and governance (ESG) principles but also offers significant growth potential as the world moves towards a low-carbon economy.

Key areas within the clean energy sector include:

- Solar and wind power companies

- Energy storage solutions

- Electric vehicle (EV) manufacturers and suppliers

- Green hydrogen technologies

- Energy efficiency and smart grid companies

When investing in clean energy, consider both pure-play companies focused solely on renewable energy and established energy companies transitioning towards cleaner technologies. Clean energy ETFs can provide diversified exposure to the sector, reducing the risk associated with individual stock selection.

Keep an eye on government policies and incentives, as these can significantly impact the growth of clean energy companies. The Inflation Reduction Act in the United States, for example, provides substantial support for clean energy initiatives, potentially boosting companies in this sector.

Diversification: The Key to a Robust Portfolio

While focusing on specific sectors can be beneficial, it’s crucial to maintain a well-diversified portfolio to manage risk effectively. Consider spreading your investments across different asset classes, sectors, and geographic regions. This approach can help cushion your portfolio against market volatility and provide more stable returns over time.

In addition to the investments mentioned above, consider allocating a portion of your portfolio to:

- International stocks: To gain exposure to global growth opportunities

- Commodities: As a potential hedge against inflation

- Defensive stocks: In sectors like healthcare and consumer staples for stability

- Emerging market assets: For higher growth potential, albeit with higher risk

Remember that diversification doesn’t guarantee profits or protect against losses, but it can help manage risk and potentially improve your overall investment returns.

FAQs About What to Invest Early In 2023

- How much should I invest in bonds versus stocks in 2023?

The ideal allocation depends on your risk tolerance and financial goals, but a common starting point is the 60/40 rule: 60% stocks and 40% bonds. - Are cryptocurrencies a good investment for 2023?

Cryptocurrencies remain highly volatile; only invest what you can afford to lose and consider them a small part of a diversified portfolio. - Should I invest in gold as a hedge against inflation?

Gold can be a good inflation hedge, but limit it to a small portion (5-10%) of your overall portfolio for diversification. - How can I invest in clean energy if I’m new to the sector?

Consider clean energy ETFs or mutual funds for broad exposure without the need to pick individual stocks. - Is it too late to invest in tech stocks in 2023?

No, but be selective and focus on companies with strong fundamentals and innovative technologies rather than chasing trends.