Investing $50,000 can be a significant step toward building wealth and securing financial stability. However, the best investment strategy depends on various factors, including your financial goals, risk tolerance, and investment horizon. This article explores several investment options that can help you make the most of your $50,000, providing a comprehensive overview of potential avenues to consider.

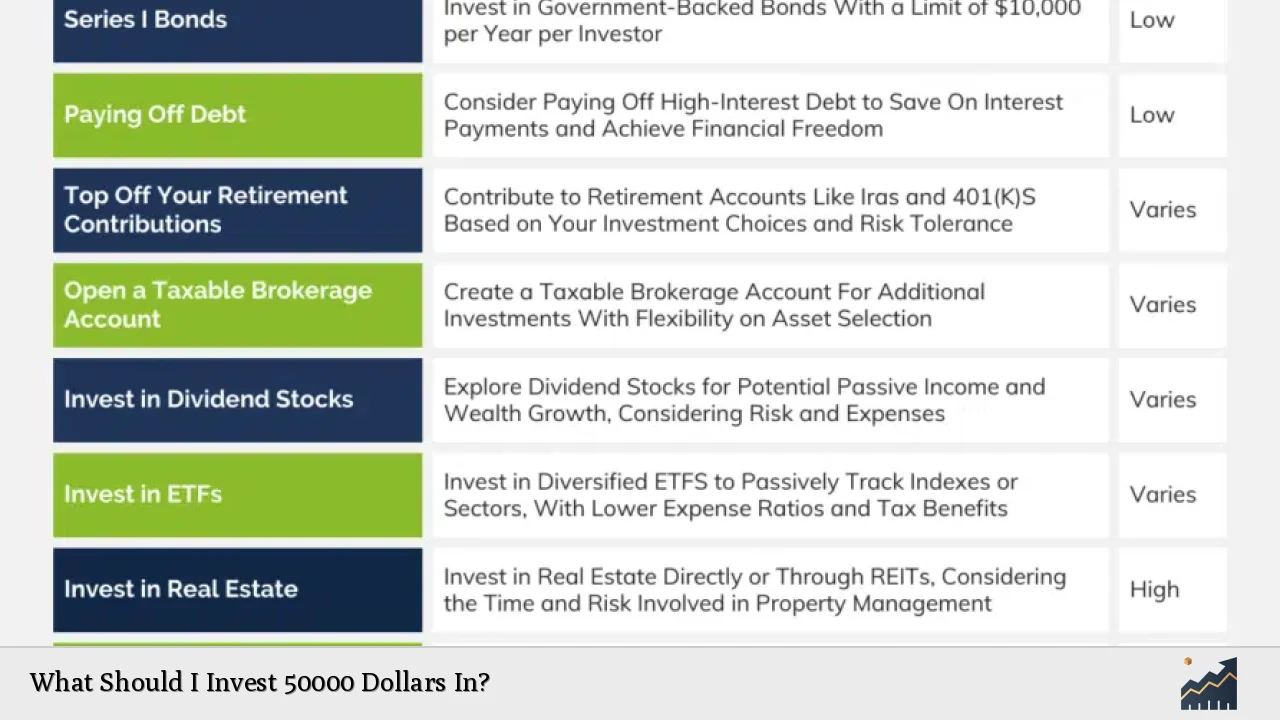

| Investment Option | Description |

|---|---|

| Diversified Portfolio | A mix of stocks, bonds, and other assets to balance risk and return. |

| Real Estate | Investing in properties for rental income or appreciation. |

| Stocks and ETFs | Direct investments in companies or exchange-traded funds for growth. |

| High-Interest Savings Account | A safe place to earn interest while maintaining liquidity. |

| Retirement Accounts | Contributions to accounts like IRAs or 401(k)s for long-term growth. |

Diversified Investment Portfolio

Building a diversified investment portfolio is one of the most effective ways to invest $50,000. A diversified portfolio spreads your investments across various asset classes, such as stocks, bonds, and real estate. This strategy helps to mitigate risk; if one sector underperforms, others may compensate.

When creating a diversified portfolio, consider your risk tolerance. Conservative investors may prefer a higher allocation in bonds and fixed-income securities, while those willing to take on more risk might lean towards equities or alternative investments like real estate or commodities.

A well-balanced portfolio could include:

- 60% in stocks: This can be further divided into U.S. large-cap stocks, small-cap stocks, and international equities.

- 30% in bonds: Including government bonds and corporate bonds can provide steady income.

- 10% in alternative investments: Such as real estate investment trusts (REITs) or commodities.

This approach allows you to capture growth while also having a safety net through fixed-income investments.

Real Estate Investment

Investing in real estate is another compelling option for your $50,000. Real estate can provide both rental income and long-term appreciation. You can choose to invest directly by purchasing properties or indirectly through real estate investment trusts (REITs).

If you opt for direct investment:

- Residential properties: Buying single-family homes or multi-family units can yield rental income.

- Commercial properties: Investing in office buildings or retail spaces may offer higher returns but often comes with increased risk.

Alternatively, if managing property isn’t appealing, consider investing in REITs. They allow you to invest in real estate without the need to manage properties directly while still providing dividends from rental income.

Stocks and Exchange-Traded Funds (ETFs)

Investing directly in stocks or through exchange-traded funds (ETFs) is a popular choice for many investors. With $50,000, you can build a robust portfolio of individual stocks or select ETFs that track specific indices.

When investing in stocks:

- Focus on companies with strong fundamentals and growth potential.

- Consider diversifying across sectors such as technology, healthcare, and consumer goods.

ETFs offer an excellent way to gain exposure to a broad market with lower fees compared to mutual funds. For example:

- S&P 500 ETFs: These track the performance of the 500 largest U.S. companies.

- Sector-specific ETFs: Such as technology or healthcare-focused funds can provide targeted exposure.

Investing in stocks and ETFs can lead to significant capital appreciation over time but requires careful selection and monitoring.

High-Interest Savings Accounts

For those who prefer a more conservative approach, placing your $50,000 in a high-interest savings account is an option worth considering. This method offers liquidity and safety while earning interest on your funds.

High-interest savings accounts typically offer better rates than traditional savings accounts. They are ideal for short-term goals or as an emergency fund while still allowing you easy access to your money when needed.

However, keep in mind that while these accounts are safe, they generally provide lower returns compared to other investment options over the long term.

Retirement Accounts

Contributing to retirement accounts such as a 401(k) or an IRA is another strategic way to invest your $50,000. These accounts often come with tax advantages that can enhance your overall returns.

- 401(k): If your employer offers a matching contribution, make sure to take full advantage of it as it represents free money toward your retirement.

- IRA: An Individual Retirement Account allows you to invest pre-tax dollars (traditional IRA) or post-tax dollars (Roth IRA), depending on your preference for tax treatment.

These accounts are designed for long-term growth and can significantly impact your financial future if you start investing early.

Alternative Investments

If you’re open to exploring beyond traditional investments, consider alternative investments such as:

- Cryptocurrency: Investing in digital currencies like Bitcoin or Ethereum can be highly volatile but may offer substantial returns.

- Art and collectibles: Investing in high-end artwork or collectibles can yield significant appreciation over time but requires expertise in valuation.

Alternative investments often carry higher risks but can diversify your portfolio further if managed wisely.

FAQs About Investing $50000

- What is the best way to invest $50K?

The best way depends on your financial goals; consider a diversified portfolio combining stocks, bonds, and real estate. - Can I invest all $50K in stocks?

Yes, but it’s advisable to diversify across asset classes to mitigate risk. - Is real estate a good investment for $50K?

Yes, investing in real estate can provide rental income and appreciation opportunities. - What are the risks of investing $50K?

The main risks include market volatility and potential loss of capital depending on the investment type. - How long should I invest my $50K?

Your investment horizon should align with your financial goals; longer horizons typically allow for more aggressive strategies.

In conclusion, investing $50,000 offers numerous opportunities tailored to various financial goals and risk tolerances. Whether you choose a diversified portfolio of stocks and bonds, venture into real estate, or explore alternative investments like cryptocurrency or art, it’s essential to conduct thorough research and possibly consult with a financial advisor before making decisions. Each option has its own set of risks and rewards that must align with your personal financial situation.