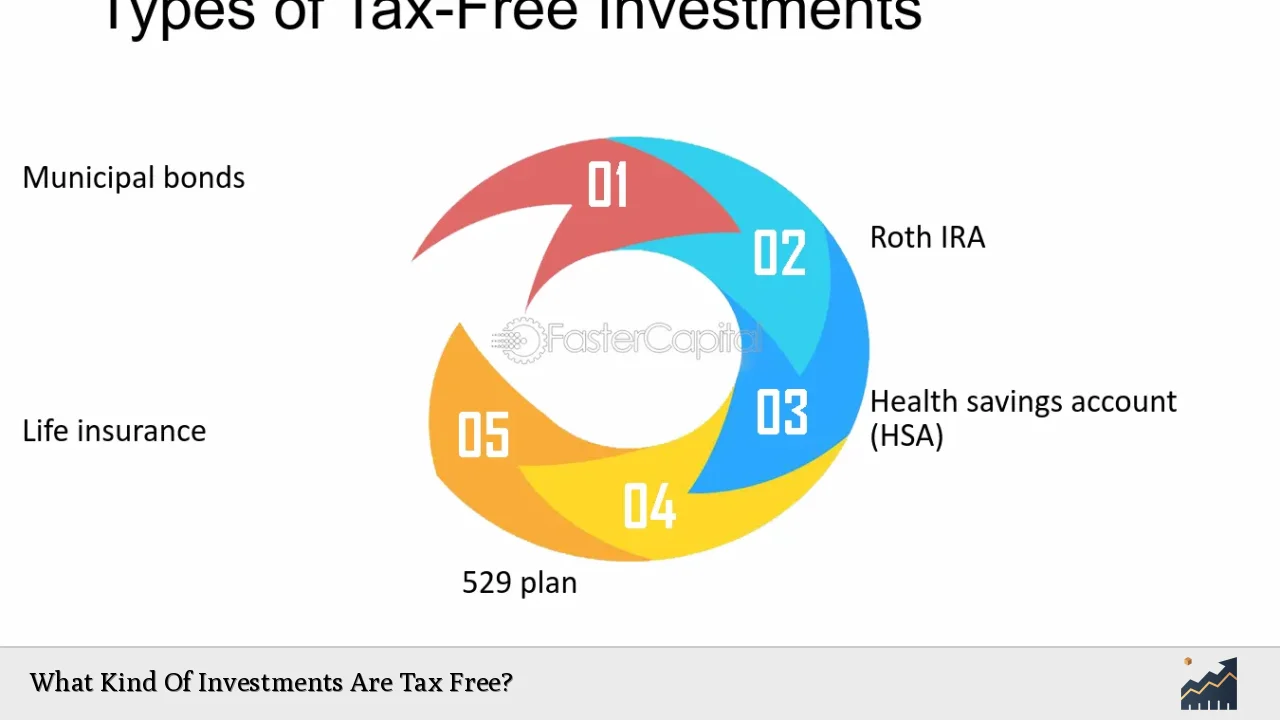

Tax-free investments are financial instruments that allow individuals to earn returns without incurring taxes on the income generated, including interest, dividends, and capital gains. These investment options are particularly appealing for those looking to maximize their savings and grow their wealth without the burden of tax liabilities. Understanding which investments qualify as tax-free can significantly enhance your financial planning and investment strategy.

Tax-free investments are generally regulated by government policies that set specific limits on contributions and withdrawals. For example, many countries have introduced tax-free investment accounts with annual contribution limits to encourage savings among citizens. The benefits of these accounts can lead to substantial long-term financial growth, especially when compounded over time.

| Type of Investment | Key Features |

|---|---|

| Tax-Free Savings Accounts (TFSAs) | Tax-free growth on investments; annual contribution limits. |

| Municipal Bonds | Interest income is often exempt from federal taxes. |

Tax-Free Savings Accounts (TFSAs)

Tax-Free Savings Accounts (TFSAs) are popular in countries like Canada. They allow individuals to save and invest money without paying taxes on the income or capital gains earned within the account. TFSAs have become a cornerstone of personal finance strategies due to their flexibility and tax advantages.

The key features of TFSAs include:

- Tax-Free Growth: All income generated within a TFSA is completely tax-free, including interest, dividends, and capital gains.

- Contribution Limits: There are annual contribution limits set by the government. For instance, in Canada, the limit is CAD 6,500 for 2023.

- Withdrawals: Funds can be withdrawn at any time without penalty, and withdrawals do not affect future contribution limits.

- Investment Options: TFSAs can hold a variety of investments such as stocks, bonds, mutual funds, and ETFs.

These accounts encourage individuals to save for various goals, from retirement to purchasing a home, without the worry of tax implications on their earnings.

Municipal Bonds

Municipal bonds represent another significant category of tax-free investments. Issued by state or local governments, these bonds are primarily used to fund public projects. The interest earned on municipal bonds is often exempt from federal income tax and may also be exempt from state and local taxes if you reside in the state where the bond was issued.

Key features of municipal bonds include:

- Tax Exemption: The interest income is typically exempt from federal taxes, making them attractive for investors in higher tax brackets.

- Safety: Municipal bonds are generally considered safe investments since they are backed by government entities.

- Variety: There are different types of municipal bonds, including general obligation bonds and revenue bonds, each serving different funding purposes.

Investors often choose municipal bonds to achieve tax efficiency while supporting local infrastructure development.

Tax-Exempt Mutual Funds

Tax-exempt mutual funds invest primarily in municipal bonds or other tax-exempt securities. These funds allow investors to pool their money together to purchase a diversified portfolio of tax-free investments.

Key advantages include:

- Diversification: By investing in a mutual fund, individuals can achieve diversification across various municipal bonds without needing substantial capital.

- Professional Management: These funds are managed by professionals who make investment decisions on behalf of shareholders.

- Income Generation: Investors benefit from regular interest payments that are free from federal taxes.

While these funds provide tax advantages, it is essential to consider management fees and expenses that can affect overall returns.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) offer a unique form of tax-free investment specifically designed for medical expenses. Individuals who have high-deductible health plans can contribute pre-tax dollars into an HSA, which can then be invested in various assets.

Key features include:

- Triple Tax Advantage: Contributions are made pre-tax, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

- Investment Flexibility: Funds in an HSA can be invested in stocks, bonds, or mutual funds once a certain balance is reached.

- Long-Term Savings: Unused funds roll over year after year, allowing for significant growth potential over time.

HSAs serve as both a savings tool for current medical expenses and a long-term investment vehicle for future healthcare costs.

Roth IRAs

Roth Individual Retirement Accounts (IRAs) provide another avenue for tax-free investing. Contributions to Roth IRAs are made with after-tax dollars; however, qualified withdrawals during retirement are entirely tax-free.

Key benefits include:

- Tax-Free Withdrawals: Once you reach retirement age and meet specific conditions, you can withdraw funds without incurring any taxes on earnings.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not require minimum distributions during the account holder’s lifetime.

- Flexible Contributions: Contributions can be withdrawn at any time without penalty since they are made with after-tax dollars.

Roth IRAs appeal to those who anticipate being in a higher tax bracket during retirement than they currently are.

Tax-Free Exchange-Traded Funds (ETFs)

Tax-exempt ETFs function similarly to mutual funds but trade like stocks on exchanges. Many ETFs focus on municipal bonds or other tax-exempt securities.

Key characteristics include:

- Low Costs: ETFs typically have lower expense ratios compared to mutual funds due to their passive management style.

- Liquidity: Being traded on exchanges allows investors to buy and sell shares throughout the trading day at market prices.

- Diverse Holdings: Tax-exempt ETFs offer exposure to a diversified portfolio of municipal securities or other exempt assets without requiring significant capital investment upfront.

Investors seeking efficiency and flexibility often find tax-exempt ETFs an attractive option for their portfolios.

Indexed Universal Life Insurance (IUL)

Indexed Universal Life Insurance (IUL) policies combine life insurance with an investment component that grows cash value based on a stock market index’s performance.

Notable features include:

- Tax-Free Growth: Cash value accumulates on a tax-deferred basis; policyholders can access this cash value through loans or withdrawals without incurring taxes if structured correctly.

- Death Benefit: Provides a death benefit to beneficiaries that is generally not subject to income taxes.

- Flexible Premiums: Policyholders can adjust premium payments and death benefits according to their financial needs over time.

IULs appeal to those looking for both life insurance protection and an investment vehicle with potential for growth while enjoying favorable tax treatment.

FAQs About Tax-Free Investments

- What is a tax-free investment?

A tax-free investment allows individuals to earn returns without incurring taxes on income generated. - Are all investments in TFSAs tax-free?

Yes, all income generated within TFSAs is completely tax-free. - What types of accounts offer tax-free growth?

Accounts like TFSAs, Roth IRAs, HSAs, and certain mutual funds provide tax-free growth. - How do municipal bonds work?

Municipal bonds offer interest income that is often exempt from federal taxes. - Can I withdraw money from my HSA anytime?

You can withdraw from your HSA anytime; however, only qualified medical expenses will be tax-free.

In conclusion, understanding various types of tax-free investments allows investors to strategically plan their finances while minimizing their overall tax burden. From TFSAs and municipal bonds to HSAs and Roth IRAs, there are numerous options available that cater to different financial goals and risk tolerances. By leveraging these instruments effectively, individuals can enhance their wealth-building strategies while enjoying significant long-term benefits.