Gold has long been considered a valuable asset and a reliable investment option. Its unique properties as a tangible asset, coupled with its historical significance as a store of value, make it an attractive choice for many investors. Investing in gold can take various forms, each with its own advantages and disadvantages. This article will explore the different types of gold investments, their characteristics, and the factors to consider when investing in gold.

| Type of Gold Investment | Description |

|---|---|

| Physical Gold | Includes gold bars, coins, and jewelry that investors can hold directly. |

| Gold ETFs | Exchange-traded funds that track the price of gold without physical ownership. |

| Gold Mutual Funds | Funds that invest in gold-related assets and mining companies. |

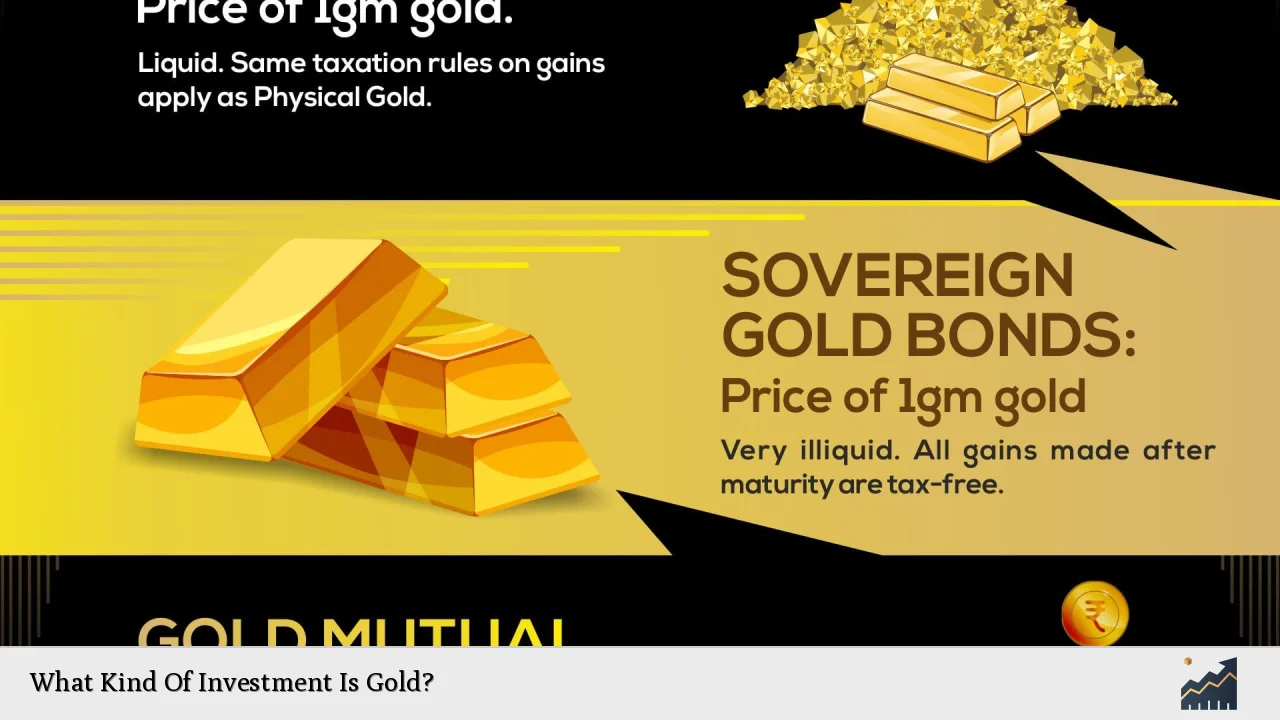

| Sovereign Gold Bonds | Government-backed bonds that offer interest along with gold price appreciation. |

Understanding Gold as an Investment

Gold is often viewed as a safe haven investment, especially during times of economic uncertainty. Its value tends to rise when other investments, such as stocks, are underperforming. This characteristic makes gold an essential part of a diversified investment portfolio. Investors typically seek gold for several reasons:

- Hedge Against Inflation: Gold has historically maintained its value during inflationary periods, making it a reliable hedge against currency devaluation.

- Portfolio Diversification: Including gold in an investment portfolio can reduce overall risk due to its low correlation with other asset classes like stocks and bonds.

- Liquidity: Gold is highly liquid; it can be easily bought or sold in various forms.

Investors should be aware that while gold can provide stability, it does not generate income like dividends or interest from other investments. Therefore, it is essential to consider how much of your portfolio should be allocated to gold based on your financial goals and risk tolerance.

Types of Gold Investments

Investors can choose from several types of gold investments, each with unique features and benefits. Understanding these options is crucial for making informed decisions.

Physical Gold

Investing in physical gold involves purchasing tangible items such as coins, bars, or jewelry. This form of investment allows investors to possess the actual metal.

- Advantages:

- Tangible asset that has intrinsic value.

- No counterparty risk; you own the asset outright.

- Disadvantages:

- Storage and insurance costs.

- Potential for theft or loss.

Gold ETFs

Gold Exchange-Traded Funds (ETFs) are investment funds that hold physical gold bullion or track the price of gold. They are traded on stock exchanges like shares.

- Advantages:

- Easy to buy and sell through brokerage accounts.

- Lower storage costs compared to physical gold.

- Disadvantages:

- Management fees may apply.

- You do not own the physical asset.

Gold Mutual Funds

Gold mutual funds invest primarily in companies involved in the mining and production of gold. They provide indirect exposure to gold prices without holding physical gold.

- Advantages:

- Professional management by fund managers.

- Diversification across multiple companies.

- Disadvantages:

- Higher fees compared to ETFs.

- Performance may not correlate directly with gold prices.

Sovereign Gold Bonds

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold. They offer investors both capital appreciation linked to the price of gold and interest payments.

- Advantages:

- Interest income along with potential capital gains.

- Tax benefits if held until maturity.

- Disadvantages:

- Lock-in period; you cannot redeem before a specified time.

- Market fluctuations affect redemption value.

Factors Influencing Gold Prices

Several factors influence the price of gold, making it essential for investors to stay informed about market dynamics:

- Economic Indicators: Economic instability often drives demand for gold as a safe-haven asset.

- Interest Rates: Lower interest rates tend to increase demand for non-yielding assets like gold.

- Currency Strength: A weaker U.S. dollar typically boosts gold prices since it becomes cheaper for foreign investors.

- Geopolitical Events: Political tensions and conflicts can lead to increased demand for gold as a secure investment.

Understanding these factors can help investors make better decisions regarding when to buy or sell their gold holdings.

Risks Associated with Gold Investment

While investing in gold has its benefits, there are also risks involved:

- Price Volatility: Gold prices can fluctuate significantly based on market conditions and investor sentiment.

- Storage Risks: Physical gold requires secure storage solutions to mitigate theft or loss risks.

- Market Manipulation: The gold market can be susceptible to manipulation by large players or geopolitical events affecting supply and demand dynamics.

Investors should carefully assess these risks before committing capital to gold investments.

Strategies for Investing in Gold

When investing in gold, it is essential to develop a strategy that aligns with your financial goals:

- Long-Term Holding: Consider holding onto your investment during market fluctuations to benefit from long-term price appreciation.

- Dollar-Cost Averaging: Invest fixed amounts regularly regardless of price fluctuations to reduce the impact of volatility on your overall investment cost.

- Diversification: Combine different forms of gold investments (physical, ETFs, mutual funds) to spread risk across various assets.

By employing these strategies, investors can enhance their chances of achieving favorable returns while managing risks effectively.

FAQs About Gold Investment

- What is the best way to invest in gold?

The best way depends on individual preferences; options include physical gold, ETFs, mutual funds, and sovereign bonds. - Is investing in physical gold safe?

While physical gold is tangible and valuable, it carries risks related to storage and potential theft. - How does inflation affect gold prices?

Gold often rises during inflationary periods as investors seek protection against currency devaluation. - Can I invest in gold through my retirement account?

Yes, many retirement accounts allow investments in certain types of precious metals including ETFs and mutual funds. - What are the tax implications of selling gold?

Capital gains taxes apply when selling physical gold or securities based on profit made from the sale.

In conclusion, investing in gold can be a prudent choice for those looking to diversify their portfolios and protect against economic uncertainties. By understanding the different types of investments available and their associated risks and benefits, investors can make informed decisions that align with their financial goals. Whether through physical assets or financial instruments like ETFs and mutual funds, incorporating gold into an investment strategy can provide stability and potential growth over time.