An annuity is a financial product that serves as a contract between an individual and an insurance company, designed primarily to provide a steady income stream, often during retirement. Individuals purchase annuities by making either a lump sum payment or a series of payments over time. In return, the insurance company agrees to make periodic payments to the annuitant, either immediately or at some point in the future.

Annuities are particularly appealing for those looking to manage their retirement income and mitigate the risk of outliving their savings. They can be structured in various ways, offering different benefits and features tailored to individual needs. Understanding the types of annuities and their specific characteristics is crucial for potential investors.

| Feature | Description |

|---|---|

| Income Stream | Provides periodic payments for a specified duration or for life. |

| Tax Benefits | Offers tax-deferred growth until withdrawals are made. |

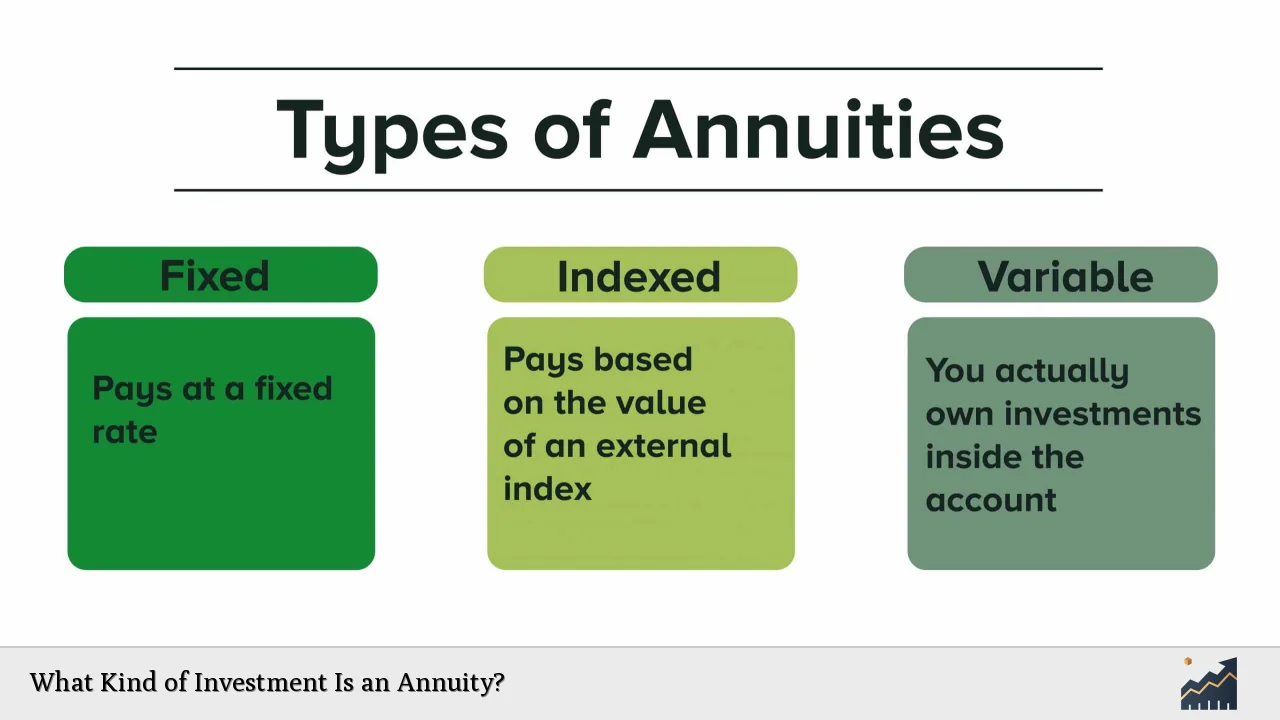

Types of Annuities

Annuities can be categorized into several types based on their structure and payout options. The main types include immediate, deferred, fixed, variable, and indexed annuities. Each type has unique features that cater to different financial goals and risk tolerances.

Immediate Annuities

Immediate annuities begin payments almost immediately after a lump sum payment is made. They are ideal for individuals nearing retirement who need immediate income.

- Payments can be structured monthly, quarterly, or annually.

- They provide a guaranteed income stream for the rest of the annuitant’s life or for a specified period.

Deferred Annuities

Deferred annuities involve an accumulation phase where the investment grows before payouts begin at a future date. This type is suitable for those who do not require immediate income.

- The accumulation phase allows funds to grow on a tax-deferred basis.

- Payments start at a predetermined date, which can be years after the initial investment.

Fixed Annuities

Fixed annuities guarantee a specific rate of return on the investment, providing predictable income. They are favored by conservative investors seeking stability.

- The insurer invests premiums in low-risk securities.

- Payments remain constant throughout the payout period.

Variable Annuities

Variable annuities allow the owner to invest in various subaccounts, similar to mutual funds. This type offers the potential for higher returns but comes with increased risk.

- Payments fluctuate based on market performance.

- Investors can choose from multiple investment options within the annuity.

Indexed Annuities

Indexed annuities combine features of fixed and variable annuities. They provide returns based on a specific market index while offering some level of protection against losses.

- They typically offer a guaranteed minimum return.

- Returns can increase based on the performance of an underlying index, such as the S&P 500.

How Annuities Work

Annuities operate through two main phases: the accumulation phase and the annuitization phase.

Accumulation Phase

During this phase, individuals contribute funds to their annuity through either lump-sum payments or regular contributions. The money grows tax-deferred until withdrawals begin.

- This phase allows investors to build up their retirement savings.

- The longer funds remain in the account, the more they can potentially grow due to compounding interest.

Annuitization Phase

Once the accumulation phase ends, the annuitant enters the annuitization phase, where they begin receiving regular payments from the insurance company.

- Payments can be structured for a fixed period or for life.

- The amount received depends on factors such as age, investment amount, and chosen payout structure.

Benefits of Annuities

Annuities offer several advantages that make them appealing as investment vehicles:

- Guaranteed Income: Annuities provide reliable income streams, making them suitable for retirees concerned about outliving their savings.

- Tax Advantages: Earnings on annuities grow tax-deferred until withdrawal, allowing for potentially greater accumulation over time.

- Customization Options: Many annuities come with features like death benefits or inflation protection that can be tailored to individual needs.

Drawbacks of Annuities

Despite their benefits, there are also disadvantages associated with investing in annuities:

- Limited Liquidity: Once invested in an annuity, accessing funds can be challenging due to surrender charges and penalties associated with early withdrawals.

- Complexity: Annuity contracts can be intricate and difficult to understand fully without professional guidance.

- Fees: Many annuities come with high fees that can erode overall returns over time.

Choosing an Annuity

When considering an annuity as an investment option, it’s crucial to evaluate personal financial goals and circumstances. Here are some key factors to consider:

- Investment Horizon: Determine how long you plan to keep your money invested before needing access to it.

- Income Needs: Assess how much guaranteed income you will require during retirement.

- Risk Tolerance: Understand your comfort level with market fluctuations and potential losses associated with variable or indexed annuities.

FAQs About Annuities

- What is an annuity?

An annuity is a financial contract that provides periodic payments in exchange for an upfront investment. - How do I purchase an annuity?

You can purchase an annuity through insurance companies or financial advisors by making either a lump sum payment or regular contributions. - What are the tax implications of an annuity?

Annuity growth is tax-deferred until withdrawals begin; then it is taxed as ordinary income. - Can I withdraw money from my annuity early?

Yes, but early withdrawals may incur penalties and surrender charges. - Are there different types of annuities?

Yes, common types include immediate, deferred, fixed, variable, and indexed annuities.

In conclusion, understanding what kind of investment an annuity represents is essential for anyone considering it as part of their retirement strategy. With their ability to provide guaranteed income and various customization options, they can play a significant role in ensuring financial security during retirement years. However, potential investors should carefully weigh both benefits and drawbacks before committing to an annuity contract.