Planning for retirement is a critical financial step that requires careful consideration of various investment options. As individuals approach their retirement years, they often seek to ensure their financial security and maintain their desired lifestyle. The type of investment needed for retirement can vary significantly based on individual goals, risk tolerance, and the time remaining until retirement.

To successfully navigate retirement investing, one must understand the different types of accounts available, the importance of starting early, and the need for a diversified portfolio. This article will provide a comprehensive overview of the essential investments for retirement, helping you make informed decisions about your financial future.

| Investment Type | Description |

|---|---|

| 401(k) | Employer-sponsored retirement plan with tax advantages. |

| IRA | Individual Retirement Account allowing tax-deferred growth. |

| Roth IRA | Tax-free withdrawals in retirement; contributions are made with after-tax dollars. |

| Stocks | Equity investments offering potential for high returns but higher risk. |

| Bonds | Fixed-income investments providing regular interest payments with lower risk. |

| Mutual Funds | Pooled investments managed by professionals; can include stocks and bonds. |

| ETFs | Exchange-traded funds that track indices; traded like stocks on exchanges. |

| Annuities | Insurance products providing guaranteed income streams in retirement. |

Understanding Retirement Accounts

When planning for retirement, it is crucial to understand the various retirement accounts available. Each type has its own benefits and tax implications that can significantly impact your savings.

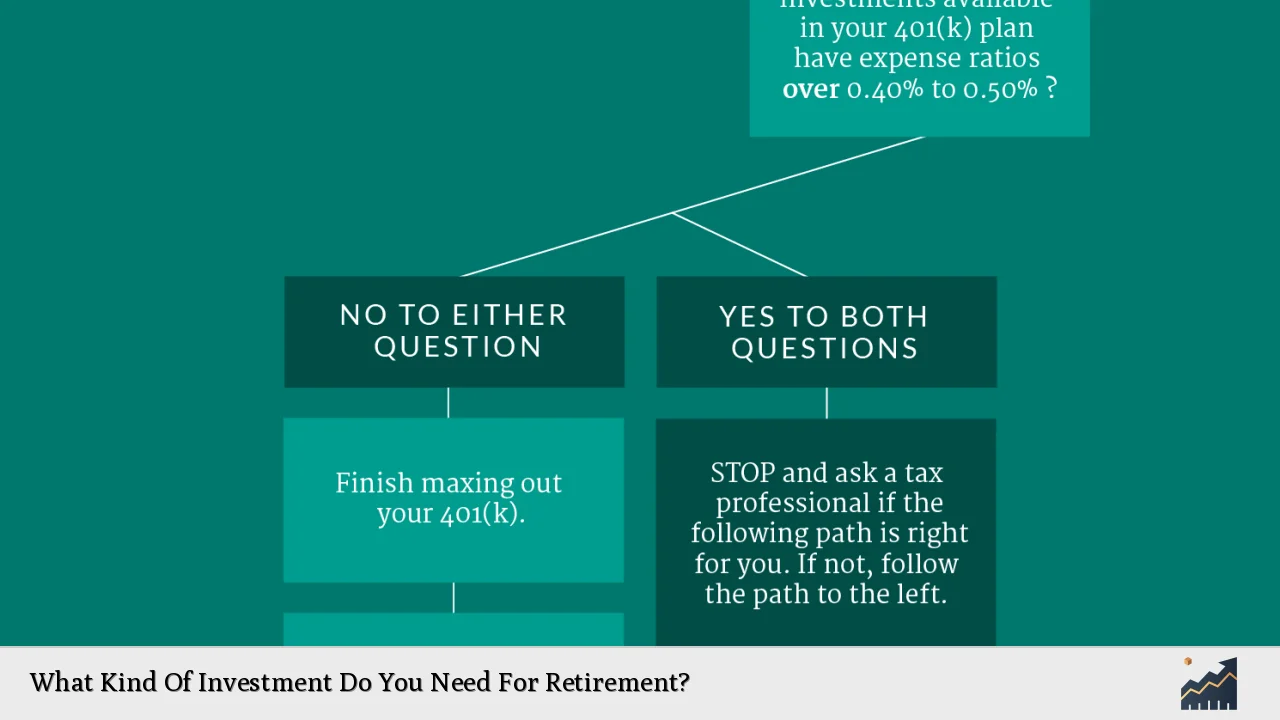

- 401(k) Plans: These employer-sponsored plans allow employees to save a portion of their paycheck before taxes are taken out. Many employers offer matching contributions, which can significantly boost your savings. The funds grow tax-deferred until withdrawal during retirement.

- Individual Retirement Accounts (IRAs): An IRA allows individuals to contribute a certain amount each year, with tax advantages similar to a 401(k). Traditional IRAs offer tax-deductible contributions, while Roth IRAs allow for tax-free withdrawals in retirement.

- Health Savings Accounts (HSAs): While primarily intended for medical expenses, HSAs can also serve as a supplementary retirement account. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Understanding these accounts is essential as they form the foundation of your retirement investment strategy.

The Importance of Starting Early

One of the most critical aspects of retirement investing is the principle of compounding. The earlier you start saving and investing, the more time your money has to grow.

- Compounding Growth: For example, if you invest $10,000 at an average annual return of 5%, after 30 years, it could grow to approximately $43,000 due to compounding interest. Waiting just ten years can significantly reduce this growth potential.

- Habit Formation: Starting early also helps establish a habit of saving and investing regularly. This consistency can lead to greater financial security in retirement.

- Risk Tolerance: Younger investors typically have a higher risk tolerance because they have more time to recover from market fluctuations. This allows them to invest more heavily in equities, which historically offer higher returns than bonds or cash equivalents.

By beginning your investment journey early, you maximize your potential returns and create a solid foundation for your retirement savings.

Diversification Strategies

Diversification is a key strategy in building a resilient investment portfolio for retirement. By spreading investments across various asset classes, you can reduce risk while aiming for steady growth.

- Equities vs. Bonds: A balanced portfolio typically includes both stocks and bonds. Stocks provide growth potential but come with higher volatility. Bonds offer stability and income but generally lower returns.

- Mutual Funds and ETFs: These investment vehicles allow you to diversify easily by pooling money from multiple investors to purchase a variety of stocks or bonds. They are managed by professionals who make investment decisions on behalf of the investors.

- Rebalancing: Over time, the performance of different assets will vary. Regularly rebalancing your portfolio ensures that you maintain your desired asset allocation according to your risk tolerance and investment goals.

Diversification not only mitigates risks but also enhances the potential for returns over time.

Assessing Your Risk Tolerance

Understanding your risk tolerance is vital when selecting investments for retirement. Risk tolerance varies among individuals based on factors such as age, income level, financial goals, and personal comfort with market fluctuations.

- Age Considerations: Younger investors can afford to take more risks since they have time to recover from potential losses. Conversely, those nearing retirement should focus on preserving capital and generating income.

- Investment Goals: If your goal is aggressive growth, you may lean towards stocks or high-yield mutual funds. If stability is more important, consider bonds or fixed-income investments.

- Market Conditions: Be aware that economic conditions can influence market performance. Staying informed about market trends can help you adjust your portfolio accordingly.

By aligning your investments with your risk tolerance, you enhance the likelihood of achieving your financial goals while minimizing stress during market downturns.

Creating an Income Strategy

As you approach retirement age, transitioning from accumulating wealth to generating income becomes crucial. Developing an effective income strategy ensures that you have sufficient funds throughout your retirement years.

- Withdrawal Strategies: Determine how much money you will withdraw annually from your retirement accounts. A common rule is the 4% rule, which suggests withdrawing 4% of your total savings each year to maintain financial stability.

- Annuities: Consider purchasing annuities as part of your income strategy. Annuities provide guaranteed monthly payments for a specified period or even for life, offering peace of mind regarding income stability.

- Social Security Benefits: Factor in Social Security benefits as part of your overall income strategy. Delaying benefits until full retirement age or beyond can increase monthly payouts significantly.

Creating a comprehensive income strategy will help ensure that you do not outlive your savings during retirement.

Conclusion

In summary, planning for retirement requires careful consideration of various investment options tailored to individual needs and circumstances. Understanding different types of accounts, starting early, diversifying investments, assessing risk tolerance, and creating an effective income strategy are all essential components of successful retirement planning.

By taking proactive steps today and making informed decisions about investments, individuals can work towards achieving their desired lifestyle in retirement while ensuring financial security for years to come.

FAQs About Investment For Retirement

- What is the best age to start investing for retirement?

The earlier you start investing for retirement, ideally in your 20s or 30s, the more time your money has to grow through compounding. - How much should I save each month for retirement?

A common recommendation is to save at least 15% of your gross income each month towards retirement. - What types of investments should I consider?

You should consider a mix of stocks, bonds, mutual funds, ETFs, and possibly annuities based on your risk tolerance. - How do I know my risk tolerance?

Your risk tolerance depends on factors like age, financial goals, income level, and comfort with market fluctuations. - What is the 4% rule?

The 4% rule suggests that retirees withdraw 4% of their initial portfolio balance annually adjusted for inflation without running out of money over a typical 30-year retirement.