Cash and deposits represent a fundamental category of investments that individuals and businesses often utilize. These types of investments are typically characterized by their low risk and high liquidity, making them appealing for those looking to preserve capital while earning a modest return. Cash investments generally include savings accounts, money market accounts, and certificates of deposit (CDs). While they may not offer the high returns associated with stocks or real estate, they provide a secure place for funds, often insured by the Federal Deposit Insurance Corporation (FDIC) in the United States.

Cash investments are particularly attractive for short-term financial goals or as a safe haven during market volatility. Investors often use these vehicles to maintain liquidity while they explore other investment opportunities. Understanding the nuances of cash investments can help individuals make informed decisions about where to allocate their funds.

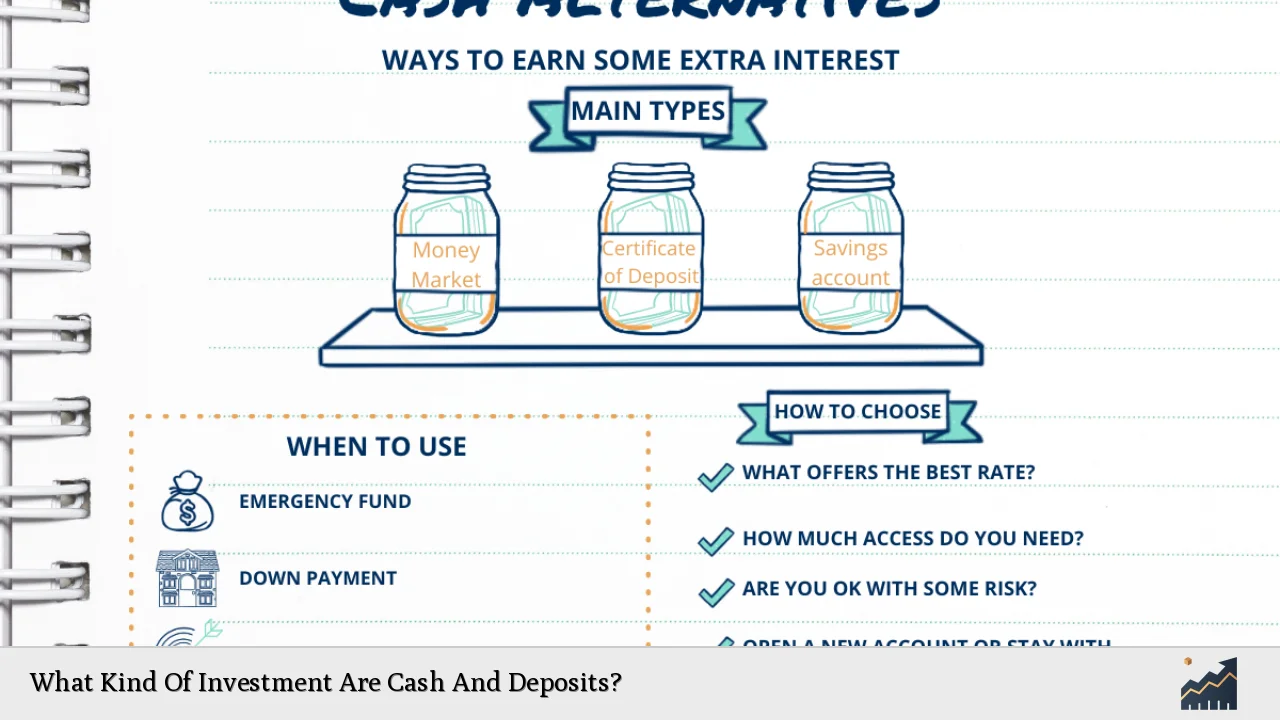

| Type of Cash Investment | Description |

|---|---|

| Savings Accounts | Traditional accounts offering low interest rates with high liquidity. |

| Money Market Accounts | Accounts providing higher interest rates than savings accounts with limited check-writing capabilities. |

| Certificates of Deposit (CDs) | Time deposits with fixed interest rates and penalties for early withdrawal. |

Understanding Cash Investments

Cash investments are typically defined as low-risk financial instruments that provide a return in the form of interest payments. These investments are favored by those who prioritize capital preservation over aggressive growth. The primary types of cash investments include savings accounts, money market accounts, and certificates of deposit.

Savings accounts are one of the most common forms of cash investment. They are offered by banks and credit unions, providing easy access to funds while earning minimal interest. Although the returns are low, these accounts are insured by the FDIC, ensuring that deposits up to a certain limit are protected.

Money market accounts offer slightly higher interest rates compared to traditional savings accounts. They typically require a higher minimum balance and may allow limited check-writing capabilities. This makes them suitable for individuals who want to earn more interest while retaining some level of liquidity.

Certificates of deposit (CDs) represent another popular cash investment option. These are time deposits where funds are locked in for a specified term, ranging from a few months to several years. In exchange for this commitment, banks offer higher interest rates compared to savings accounts. However, withdrawing funds before maturity usually incurs penalties, making them less liquid than other cash investments.

Overall, cash investments serve as a stable foundation within an investment portfolio, providing safety and liquidity even if the returns are limited.

Advantages of Cash Investments

Investing in cash offers several advantages that make it an appealing choice for many individuals and businesses. One of the most significant benefits is capital preservation. Cash investments typically carry very low risk, which means that investors can safeguard their principal amount while still earning some interest.

Another advantage is liquidity. Most cash investments allow easy access to funds without significant delays or penalties. For example, savings accounts enable immediate withdrawals, while money market accounts may offer check-writing features for added convenience.

Additionally, cash investments can serve as a buffer during periods of market volatility. When stock markets experience downturns, having liquid assets can provide peace of mind and financial flexibility. Investors can quickly access cash when needed without having to sell off other investments at unfavorable prices.

Moreover, cash investments can be strategically used for short-term financial goals. If an individual is saving for a vacation or home purchase within the next year or two, keeping money in cash investments can help ensure those funds remain intact while potentially earning some interest.

In summary, the advantages of cash investments include:

- Capital preservation

- High liquidity

- Protection during market volatility

- Suitability for short-term financial goals

Disadvantages of Cash Investments

While cash investments have their merits, they also come with notable disadvantages that investors should consider carefully. One primary drawback is low returns compared to other investment options such as stocks or real estate. The interest earned on savings accounts and CDs often fails to keep pace with inflation, resulting in diminished purchasing power over time.

Another concern is inflation risk. If inflation rates exceed the interest earned on cash investments, the real value of money decreases. This means that while the nominal amount may remain stable or grow slightly due to interest payments, its actual purchasing power could decline significantly.

Furthermore, relying heavily on cash investments can hinder long-term wealth growth. Individuals who allocate too much capital into low-yielding assets may miss out on opportunities for higher returns available through diversified portfolios that include equities or alternative investments.

Lastly, there is also a risk associated with bank failures. Although FDIC insurance protects deposits up to a certain limit, there is still a chance that an investor could lose funds if they exceed this threshold or if they invest in non-FDIC insured products.

In conclusion, the disadvantages of cash investments include:

- Low returns compared to other assets

- Inflation risk eroding purchasing power

- Potential hindrance to long-term wealth growth

- Risk associated with bank failures

Types of Cash Investments

Understanding the different types of cash investments available is crucial for making informed financial decisions. Each type offers unique features that cater to various investor needs and objectives.

Savings Accounts

Savings accounts are basic banking products that allow individuals to deposit money while earning interest on their balance. They typically have no minimum balance requirements and provide easy access to funds through ATMs or online banking platforms. However, the interest rates offered on savings accounts are generally low compared to other investment vehicles.

Money Market Accounts

Money market accounts combine features of both savings accounts and checking accounts. They usually offer higher interest rates than traditional savings accounts but require higher minimum balances. These accounts may also provide limited check-writing capabilities and debit card access, making them more versatile for managing finances.

Certificates of Deposit (CDs)

Certificates of deposit are time-bound deposits where investors commit their funds for a specified period in exchange for higher interest rates than standard savings accounts. The terms can range from a few months to several years, with penalties imposed for early withdrawals. CDs are ideal for those who do not need immediate access to their funds and seek guaranteed returns over time.

Other Cash Investment Options

In addition to traditional bank products, investors may also consider options like cash management accounts offered by brokerage firms or high-yield savings accounts provided by online banks. These alternatives often feature competitive interest rates while maintaining liquidity.

In summary, common types of cash investments include:

- Savings Accounts

- Money Market Accounts

- Certificates of Deposit (CDs)

- Cash Management Accounts

FAQs About Cash And Deposits

- What are cash investments?

Cash investments refer to low-risk financial instruments such as savings accounts, money market accounts, and certificates of deposit. - Are cash investments safe?

Yes, cash investments are generally considered safe due to FDIC insurance protecting deposits up to certain limits. - What is the main disadvantage of cash investments?

The main disadvantage is low returns compared to other investment options like stocks or real estate. - How do I choose between different cash investment options?

Consider factors such as liquidity needs, minimum balance requirements, and desired returns when choosing among options. - Can I lose money in cash investments?

While unlikely with insured products like savings accounts and CDs, there is still risk associated with exceeding insurance limits or investing in non-insured products.

Cash and deposits play an essential role in personal finance and investment strategies. By understanding their characteristics—advantages and disadvantages—investors can make informed choices that align with their financial goals.