Investment accounts are essential tools for individuals looking to grow their wealth, save for retirement, or fund education. They allow investors to buy and sell various financial assets such as stocks, bonds, and mutual funds. Understanding the different types of investment accounts available is crucial for making informed financial decisions. Each account type serves distinct purposes and comes with specific tax implications, investment options, and rules regarding withdrawals.

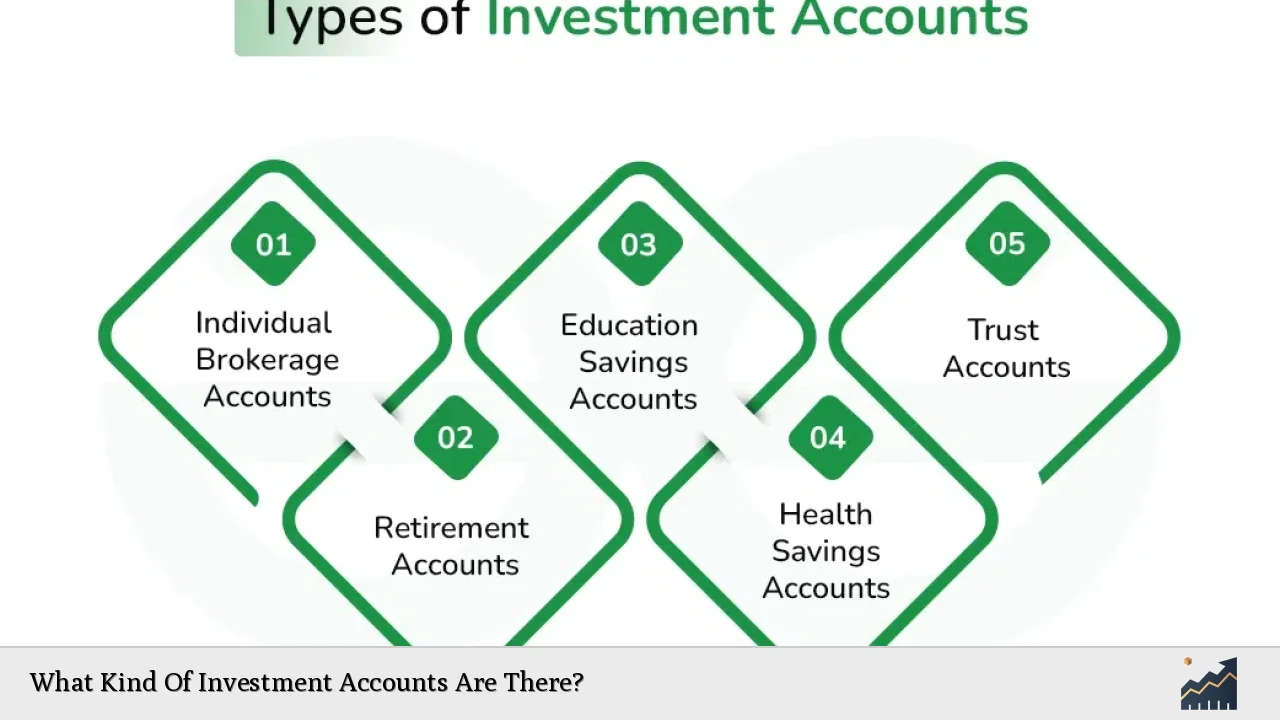

Investment accounts can be broadly categorized into two main types: brokerage accounts and retirement accounts. Brokerage accounts are typically used for general investing, while retirement accounts are designed to help individuals save for their future. Additionally, there are specialized accounts for education savings and individuals with disabilities. Below is a concise overview of the various types of investment accounts.

| Type of Account | Description |

|---|---|

| Brokerage Accounts | Used for buying and selling a variety of investments; taxable on gains. |

| Retirement Accounts | Tax-advantaged accounts for retirement savings; includes IRAs and 401(k)s. |

| Education Savings Accounts | Tax-advantaged accounts for education expenses; includes 529 plans. |

| ABLE Accounts | Designed for individuals with disabilities; tax benefits on disability-related expenses. |

Brokerage Accounts

Brokerage accounts are versatile investment vehicles that allow individuals to buy and sell a wide range of securities, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These accounts can be classified into two main types: cash accounts and margin accounts.

A cash account requires that all transactions be made using the available cash in the account. This means investors must deposit funds before purchasing securities. In contrast, a margin account allows investors to borrow money from the brokerage to purchase additional securities, which can amplify both potential gains and losses.

One of the significant advantages of brokerage accounts is their flexibility. Investors can trade at any time during market hours, providing opportunities to respond quickly to market changes. However, any profits realized from these trades are subject to capital gains taxes in the year they are earned.

Key Features of Brokerage Accounts

- Investment Options: Stocks, bonds, mutual funds, ETFs.

- Tax Implications: Taxable on dividends and capital gains.

- Ownership Structure: Can be individual or joint accounts.

- Accessibility: Funds can be withdrawn at any time (subject to brokerage policies).

Retirement Accounts

Retirement accounts are specifically designed to help individuals save for their retirement while providing tax advantages. The most common types include Traditional IRAs, Roth IRAs, and 401(k) plans.

A Traditional IRA allows individuals to contribute pre-tax income, reducing their taxable income in the contribution year. Taxes are then paid upon withdrawal during retirement. Conversely, a Roth IRA is funded with after-tax dollars, allowing tax-free withdrawals in retirement.

401(k) plans are employer-sponsored retirement savings plans that often come with matching contributions from employers. This feature makes them an attractive option for employees looking to maximize their retirement savings.

Key Features of Retirement Accounts

- Tax Benefits: Contributions may be tax-deductible (Traditional IRA) or tax-free upon withdrawal (Roth IRA).

- Contribution Limits: Annual limits apply; currently $6,500 for IRAs and $22,500 for 401(k)s (2023 limits).

- Withdrawal Rules: Penalties may apply for early withdrawals before age 59½.

- Investment Choices: Typically similar to brokerage accounts but may have additional restrictions.

Education Savings Accounts

Education savings accounts are designed specifically to help families save for educational expenses. The most popular type is the 529 plan, which offers tax advantages when used for qualified education costs.

Contributions to a 529 plan grow tax-free, and withdrawals used for eligible educational expenses—such as tuition, fees, books, and room and board—are also tax-free. Some states offer tax deductions or credits for contributions made to a 529 plan.

Key Features of Education Savings Accounts

- Tax Advantages: Tax-free growth and withdrawals for qualified expenses.

- Contribution Limits: Varies by state; some states allow high contribution limits.

- Use of Funds: Must be used for qualified education expenses.

- Flexibility: Can be transferred between beneficiaries if not used by the original beneficiary.

ABLE Accounts

ABLE (Achieving a Better Life Experience) accounts were created to help individuals with disabilities save money without jeopardizing their eligibility for public assistance programs like Medicaid or Supplemental Security Income (SSI). These tax-advantaged accounts allow contributions from various sources while maintaining certain eligibility criteria.

Funds in an ABLE account can be used for qualified disability-related expenses such as education, housing, transportation, health care, and more. The account allows individuals with disabilities to save without facing penalties that typically accompany asset accumulation under government assistance programs.

Key Features of ABLE Accounts

- Eligibility Requirements: Must have a qualifying disability occurring before age 26.

- Tax Benefits: Contributions grow tax-deferred; withdrawals for qualified expenses are tax-free.

- Contribution Limits: Annual contribution limit is $17,000 (2023 limit).

- Impact on Benefits: Funds do not affect eligibility for means-tested benefits up to certain limits.

FAQs About Investment Accounts

- What is the most common type of investment account?

The most common types are brokerage accounts and retirement accounts like IRAs. - Can I have multiple investment accounts?

Yes, many investors use multiple account types to meet different financial goals. - What are the benefits of using a retirement account?

Retirement accounts offer tax advantages that can significantly enhance savings over time. - How do I choose the right investment account?

Your choice should depend on your financial goals, time horizon, and risk tolerance. - Are there penalties for withdrawing from retirement accounts early?

Yes, early withdrawals from retirement accounts often incur penalties unless certain conditions are met.

Understanding the various types of investment accounts is crucial in crafting an effective financial strategy. Each account type has unique features that cater to different financial goals and circumstances. By selecting the appropriate investment account(s), individuals can optimize their savings potential while effectively managing risks associated with investing.