Choosing the right investment account is a crucial step in your financial journey. The type of account you open can significantly affect your investment strategy, tax implications, and overall financial goals. With various options available, understanding the differences between them is essential for making an informed decision.

Investment accounts generally fall into three main categories: brokerage accounts, retirement accounts, and specialty accounts. Each type has its own features, benefits, and limitations. This article will guide you through the different types of investment accounts, helping you determine which one aligns best with your financial objectives.

| Account Type | Key Features |

|---|---|

| Brokerage Account | Flexible access to a wide range of investments without tax advantages. |

| Retirement Account | Tax-advantaged savings for retirement with specific contribution limits. |

| Specialty Accounts | Accounts designed for specific purposes like education or disability. |

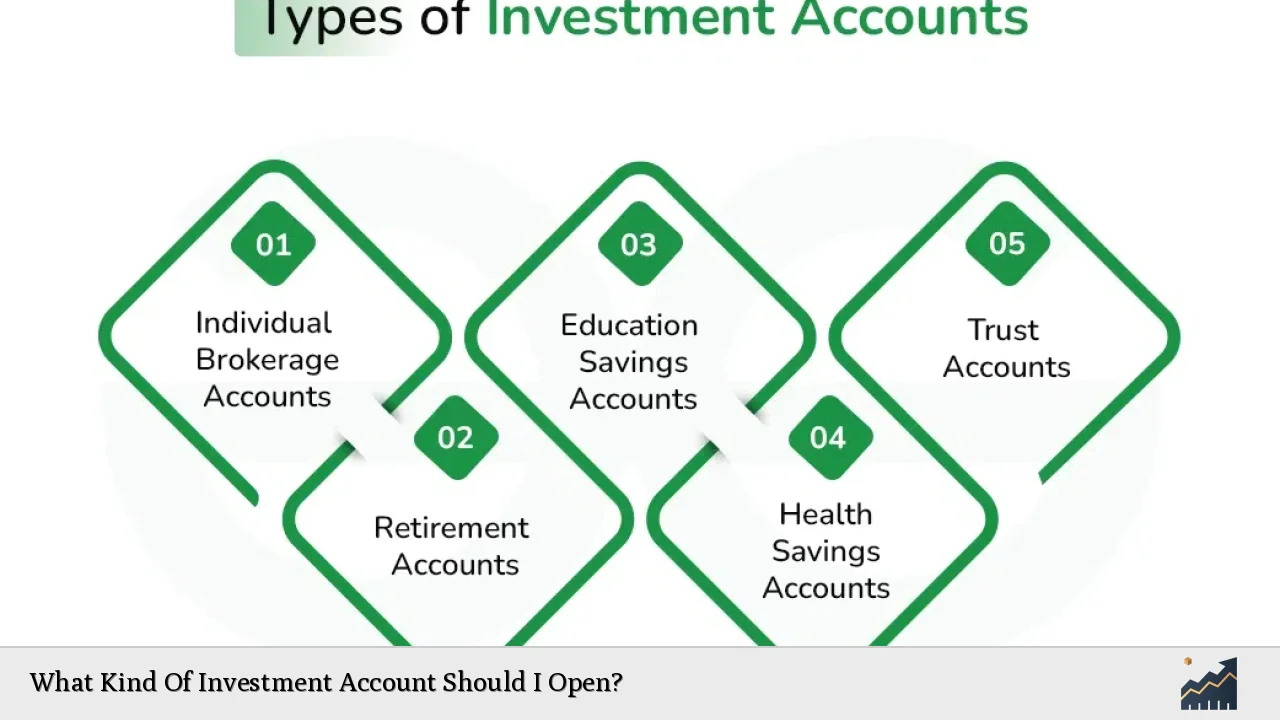

Types of Investment Accounts

Understanding the types of investment accounts available is vital for selecting the one that best suits your needs.

Brokerage Accounts

A brokerage account allows you to buy and sell various types of investments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These accounts come in two main forms: cash accounts and margin accounts.

- Cash Accounts: You pay for securities in full at the time of purchase.

- Margin Accounts: You can borrow money from your broker to purchase securities.

Brokerage accounts are flexible and do not have restrictions on withdrawals or contributions. However, any gains or income generated within these accounts are subject to taxes in the year they are realized.

Retirement Accounts

Retirement accounts offer tax advantages that can help you save for your future. The most common types include:

- Traditional IRA: Contributions may be tax-deductible, but withdrawals during retirement are taxed as income.

- Roth IRA: Contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement.

- 401(k): Offered by employers, these plans often include matching contributions and have higher contribution limits than IRAs.

Retirement accounts come with specific rules regarding contributions and withdrawals, making them suitable for long-term savings.

Specialty Accounts

Specialty accounts cater to specific financial goals or needs. Examples include:

- 529 Plans: Designed for education savings, allowing tax-free withdrawals for qualified educational expenses.

- ABLE Accounts: For individuals with disabilities, enabling tax-free savings for disability-related expenses without affecting eligibility for public benefits.

These accounts provide unique benefits tailored to particular situations but may have restrictions on how funds can be used.

Factors to Consider When Choosing an Investment Account

When deciding which investment account to open, consider several key factors that align with your financial situation and goals.

Investment Goals

Your primary investment goals will dictate the type of account that is best for you. If you’re saving for retirement, a retirement account may be ideal due to its tax advantages. For more immediate investment needs or flexibility, a brokerage account might be more suitable.

Tax Implications

Understanding how different accounts are taxed is crucial. Brokerage accounts are taxed annually on gains and income, while retirement accounts often provide tax deferral or tax-free growth. Assessing your current tax situation and future expectations can help guide your choice.

Risk Tolerance

Your comfort level with risk should influence your decision. If you prefer a hands-on approach to investing in various assets, a brokerage account may be appropriate. Conversely, if you’re looking for a more structured approach to long-term growth with less volatility, consider a retirement account.

Time Horizon

The length of time you plan to invest also plays a significant role. Short-term investors may favor brokerage accounts for their liquidity and flexibility. In contrast, those focused on long-term growth might benefit from the structure of retirement accounts that encourage saving over several years or decades.

Accessibility

Consider how easily you need to access your funds. Brokerage accounts allow for quick access to cash through sales of investments without penalties. In contrast, retirement accounts often impose penalties for early withdrawal before reaching retirement age.

How to Open an Investment Account

Opening an investment account is a straightforward process but requires careful consideration of your options.

Step 1: Determine Your Needs

Identify what you want from your investment account based on your financial goals, risk tolerance, and time horizon.

Step 2: Research Providers

Look into various financial institutions that offer the type of account you’re interested in. Compare fees, services offered, and user reviews to find a provider that meets your needs.

Step 3: Gather Required Documents

Prepare necessary documentation such as identification (e.g., driver’s license), Social Security number, and any financial information required by the institution.

Step 4: Complete the Application

Fill out the application form provided by the institution. This may be done online or in person depending on the provider’s offerings.

Step 5: Fund Your Account

Once approved, fund your account through bank transfers or other means as specified by the provider.

FAQs About Investment Accounts

- What is a brokerage account?

A brokerage account allows you to buy and sell various investments like stocks and bonds. - What are the benefits of a retirement account?

Retirement accounts offer tax advantages that can enhance long-term savings. - Can I withdraw money from my retirement account early?

You can withdraw early but may face penalties unless certain conditions are met. - What is a 529 plan?

A 529 plan is an education savings account offering tax-free withdrawals for qualified expenses. - How do I choose between a traditional IRA and Roth IRA?

Your choice depends on whether you prefer upfront tax deductions (traditional) or tax-free withdrawals (Roth).

Conclusion

Selecting the right investment account is essential for achieving your financial objectives. By understanding the different types of investment accounts—brokerage accounts, retirement accounts, and specialty accounts—you can make an informed decision that aligns with your goals. Consider factors such as your investment objectives, tax implications, risk tolerance, time horizon, and accessibility when choosing an account type. Taking these steps will help set you on a path toward successful investing and financial growth.